Quick Navigation

Overview

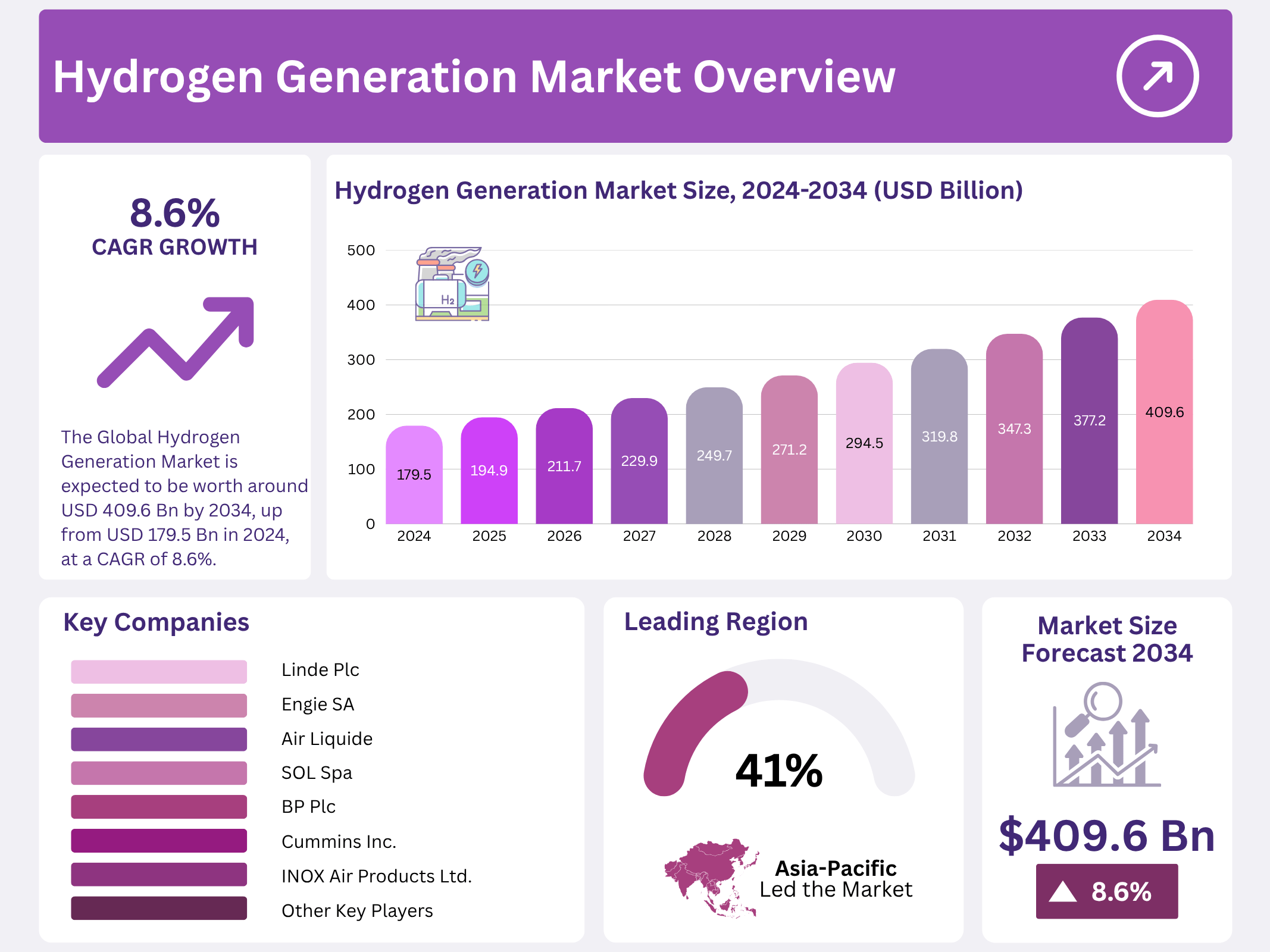

New York, NY – October 17, 2025 – The Global Hydrogen Generation Market is projected to reach USD 409.6 billion by 2034, rising from USD 179.5 billion in 2024, at a CAGR of 8.6% (2025–2034). Hydrogen investments in Asia-Pacific reached USD 74.1 billion, representing 41.3% of the global share, underscoring the region’s leadership in clean-energy expansion.

Hydrogen generation refers to the production of hydrogen gas, mainly through steam methane reforming (SMR), electrolysis, and other methods used as a fuel and industrial feedstock. It plays a key role in decarbonizing hard-to-abate sectors such as transportation, steelmaking, and chemicals, making it a cornerstone of the global clean-energy transition. Growing emphasis on low-carbon and renewable energy has accelerated hydrogen’s adoption.

Governments worldwide are tightening emission regulations and providing financial support for green-hydrogen projects—such as the EU’s Hydrogen Strategy and the U.S. Department of Energy’s H2Hubs program to encourage industrial and mobility applications. These initiatives aim to reduce carbon intensity and diversify national energy portfolios. Technological progress in electrolysis efficiency and cost reduction has further boosted hydrogen’s competitiveness.

The transport sector, particularly fuel-cell vehicles (FCVs), is emerging as a key consumer due to hydrogen’s high energy density and fast refueling time compared with battery systems. According to the International Energy Agency (IEA), global demand for low-emission hydrogen could exceed 35 million tons by 2030, driven by industrial decarbonization and clean-fuel mandates. Emerging economies present notable growth opportunities as industrialization combines with rising environmental awareness.

Key Takeaways

- The Global Hydrogen Generation Market is expected to be worth around USD 409.6 billion by 2034, up from USD 179.5 billion in 2024, and grow at a CAGR of 8.6% from 2025 to 2034.

- Natural gas dominates the hydrogen generation market source, holding a significant 66.4% share globally.

- Grey hydrogen leads in type within the hydrogen market, accounting for 58.3% of production methods.

- Steam methane reforming is the preferred technology, making up 67.4% of hydrogen generation techniques.

- Captive delivery mode is predominant in hydrogen supply, with a substantial market share of 73.4%.

- In the application segment, the chemical and refinery industries utilize 64.6% of the generated hydrogen.

- Strong industrial demand helped the Asia-Pacific reach 41.3% in the Hydrogen Generation Market value.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 179.5 Billion |

| Forecast Revenue (2034) | USD 409.6 Billion |

| CAGR (2025-2034) | 8.6% |

| Segments Covered | By Source (Natural Gas, Coal, Biomass, Water), By Type (Grey Hydrogen, Blue Hydrogen, Green Hydrogen), By Technology (Steam Methane Reforming, Coal Gasification, Electrolysis, Partial Oxidation, Autothermal Reforming), By Delivery Mode (Captive, Merchant), By Application (Chemical and Refinery(Petroleum Refinery, Ammonia Production, Methanol Production, Others), Energy (Power Generation, CHP), Mobility) |

| Competitive Landscape | Linde Plc, Engie SA, Air Products and Chemicals, Inc., Air Liquide, INOX Air Products Ltd., Messer Group GmbH, Matheson Tri-Gas, Inc., SOL Spa, Tokyo Gas Chemicals Co., Ltd., Iwatani Corporation, FuelCell Energy, Inc., Chevron Corporation, Cummins Inc., BP Plc, Other Key Players |

Key Market Segments

By Source Analysis

Natural Gas leads the Hydrogen Generation Market, commanding a 66.4% share in 2024. Its dominance stems from widespread infrastructure, lower costs, and compatibility with steam methane reforming (SMR) technology. The established SMR process ensures efficient, low-risk hydrogen production, making natural gas the preferred choice for large-scale applications in refineries and chemical manufacturing. Its economic benefits and reliability drive adoption, particularly in industries not yet fully transitioning to renewables.

By Type Analysis

Grey Hydrogen holds a 58.3% market share in 2024, driven by its cost-effectiveness and mature production infrastructure. Produced via SMR from natural gas without carbon capture, grey hydrogen remains the most economical option for industries like chemicals, petroleum refining, and fertilizers. Its widespread availability, especially in natural gas-rich regions, reinforces its lead. Despite stricter environmental regulations, grey hydrogen’s affordability ensures its dominance until blue and green hydrogen become more scalable and cost-competitive.

By Technology Analysis

Steam Methane Reforming (SMR) dominates with a 67.4% adoption rate in 2024. Its efficiency, scalability, and integration with existing infrastructure make it the cornerstone of industrial hydrogen production. SMR’s reliability and cost-effectiveness, particularly for grey hydrogen, meet the high demand from petrochemicals, refineries, and ammonia production. The abundant availability of natural gas further solidifies SMR’s position across both developed and developing markets.

By Delivery Mode Analysis

Captive delivery mode leads with a 73.4% share in 2024, reflecting the preference for on-site hydrogen production. Industries like petroleum refining, ammonia, and methanol production favor captive systems for their reliability, reduced dependence on external suppliers, and lower transportation costs. Tailored to specific pressure and purity needs, captive systems, often paired with SMR, offer cost-effective, high-volume hydrogen production, enhancing operational efficiency for large-scale users.

By Application Analysis

Chemical and refinery applications dominate with a 64.6% share in 2024, driven by hydrogen’s critical role in hydrocracking, desulfurization, and ammonia production. Refineries rely on hydrogen to meet clean fuel standards, while chemical industries, particularly ammonia and methanol production, depend on it as a feedstock. Captive hydrogen generation ensures a steady, cost-effective supply, reinforcing these sectors’ lead in the market.

Regional Analysis

Asia-Pacific leads the Hydrogen Generation Market in 2024 with a 41.3% share, valued at USD 74.1 billion. High demand from refining, chemical, and energy sectors in China, Japan, and South Korea fuels this dominance. North America follows, driven by clean energy initiatives and government support. Europe advances with sustainability goals under the EU Hydrogen Strategy. The Middle East & Africa explores hydrogen for energy diversification, while Latin America, led by Brazil and Chile, grows modestly with pilot projects.

Top Use Cases

- Industrial Processes: Hydrogen generation powers key manufacturing steps, like refining petroleum to create cleaner fuels and chemicals. It acts as a building block for making ammonia used in fertilizers, boosting crop yields worldwide. This reliable supply supports heavy industries shifting toward greener methods, reducing waste and improving product quality without halting production lines.

- Transportation Fuels: Generating hydrogen fuel vehicles such as trucks, buses, and trains that run on fuel cells, offering long-range travel with zero tailpipe emissions. It powers heavy-duty fleets in logistics and public transit, easing urban air pollution. As infrastructure grows, this use case promises smoother commutes and cuts reliance on dirty diesel engines for daily operations.

- Power Generation: Hydrogen from generation plants blends with natural gas in turbines to produce electricity with lower carbon output, stabilizing grids during peak demand. It stores excess renewable energy for later use, ensuring a steady power supply. This flexible approach helps utilities meet rising energy needs while transitioning to sustainable sources without blackouts.

- Energy Storage: By generating hydrogen during sunny or windy periods via electrolysis, it stores surplus renewable power as gas for later conversion back to electricity. This bridges gaps in solar and wind availability, supporting off-grid homes and remote sites. It enhances grid resilience, allowing communities to rely more on clean sources year-round.

- Chemical Production: Hydrogen generation enables efficient synthesis of materials like methanol for plastics and solvents, vital for everyday goods. It drives hydrogenation in food processing to refine oils into healthier products. This core role in chemistry sustains innovation in pharmaceuticals and materials, fostering safer, more durable items for global markets.

Recent Developments

1. Linde Plc

Linde is advancing the clean hydrogen economy through major projects like its electrolyzer in Leuna, Germany, one of the world’s largest. The company is also expanding its liquid hydrogen capacity in North America and has signed a long-term agreement with Evonik to supply green hydrogen. These efforts solidify its position in building the infrastructure for low-carbon energy.

2. Engie SA

Engie is focusing on large-scale renewable hydrogen projects to decarbonize industry and mobility. A flagship initiative is the Yuri project in Australia, integrating an electrolyzer powered by solar and wind to produce green hydrogen for the Yara Pilbara Fertiliser plant. The company is also developing a major hydrogen pipeline network in Europe, H2BE, to facilitate future transport and distribution.

3. Air Products and Chemicals, Inc.

Air Products is committing billions to mega-scale hydrogen projects. It’s a landmark joint venture in NEOM, Saudi Arabia. In Louisiana, USA, the company is developing the world’s largest blue hydrogen facility, targeting cubic feet per day with carbon capture, showcasing its dual approach to clean hydrogen.

4. Air Liquide

Air Liquide is accelerating its electrolyzer manufacturing and project deployment. The company inaugurated a large-scale electrolyzer in Bécancour, Canada, and is constructing a unit in Normandy, France. It also launched a joint venture for a Europe-wide network of hydrogen stations for heavy-duty vehicles. Furthermore, Air Liquide committed to investing in the low-carbon hydrogen value chain.

5. INOX Air Products Ltd.

INOX Air Products, a key Indian industrial gas player, is actively expanding into the green hydrogen space. The company has announced plans to manufacture electrolyzers in India and is developing green hydrogen projects for industrial clients. A significant recent development includes commissioning a green hydrogen plant for India’s largest single-site coffee plantation, demonstrating the application of green hydrogen in the agricultural processing industry.

Conclusion

Hydrogen Generation stands at the heart of a transformative energy era, bridging today’s industrial needs with tomorrow’s green ambitions. Cleaner production methods are gaining traction, driven by global pushes for lower emissions and smarter resource use. This shift promises resilient supply chains, innovative fuels, and broader access to sustainable power, positioning hydrogen as a key player in building a low-carbon world that benefits economies and communities alike.