Quick Navigation

Introduction

The global home fragrance market continues to gain steady momentum as consumers increasingly prioritize comfort, wellness, and ambiance within residential spaces. In recent years, changing lifestyles and extended time spent indoors have reshaped purchasing behavior, encouraging demand for scented candles, diffusers, sprays, and essential oils. This shift reflects evolving preferences toward emotional well-being and personalized living environments.

Moreover, home fragrance products are no longer viewed as simple air fresheners. Instead, they are positioned as lifestyle-enhancing solutions associated with relaxation, mood improvement, and aesthetic appeal. As disposable incomes rise and self-care becomes mainstream, households are allocating more spending toward premium and wellness-oriented home products that create inviting atmospheres. Consequently, manufacturers are expanding portfolios to meet diverse scent preferences.

At the same time, the market benefits from innovation in natural ingredients, sustainable packaging, and product design. Brands are responding to health-conscious consumers by reducing synthetic components and emphasizing eco-friendly formulations. Additionally, growing awareness of aromatherapy has strengthened demand across both mature and emerging economies. Together, these dynamics position home fragrance as a resilient and expanding consumer segment globally.

Furthermore, retail accessibility and digital commerce have reshaped how consumers discover and purchase home fragrance products. While physical stores continue to dominate due to sensory evaluation advantages, online platforms are accelerating reach and personalization. As a result, the market demonstrates balanced growth supported by innovation, lifestyle trends, and evolving distribution strategies worldwide.

Key Takeaways

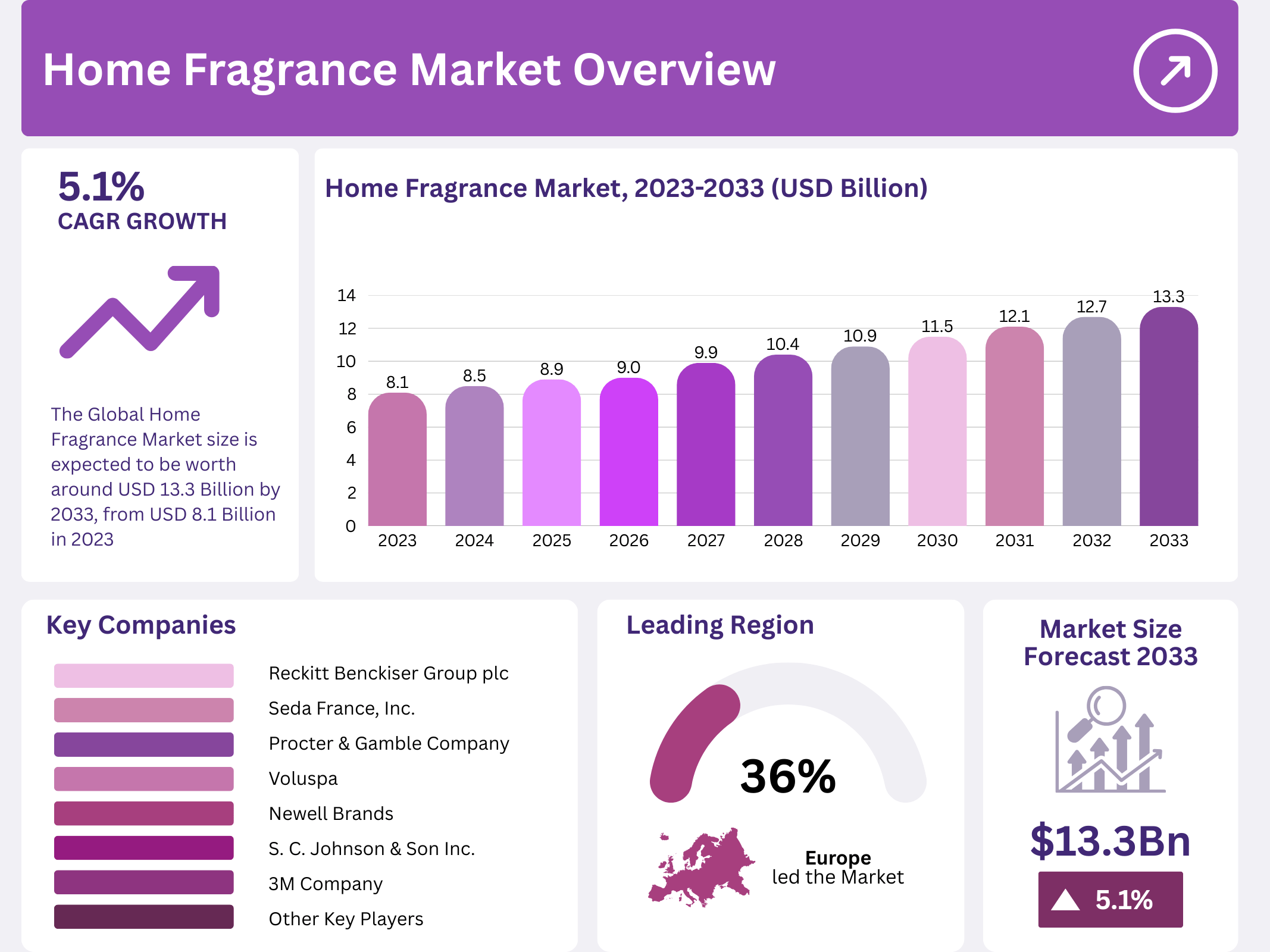

- The home fragrance market was valued at USD 8.1 billion in 2023 and is projected to reach USD 13.3 billion by 2033.

- The market is expected to grow at a CAGR of 5.1% during the forecast period.

- Candles accounted for the largest product share at 34.2% in 2023.

- Supermarkets and hypermarkets led distribution with a 47.3% market share.

- Europe dominated globally with 36% share, generating over USD 2.92 billion in 2023.

Market Segmentation Overview

By product type, candles represent the leading segment, driven by their decorative appeal, fragrance variety, and emotional connection with relaxation and ambiance. Consumers increasingly prefer candles for both functional and aesthetic purposes. Consequently, innovation in scent blends, packaging, and burn performance continues to strengthen this segment’s competitive position within the market.

Meanwhile, sprays and diffusers serve complementary consumer needs. Sprays provide instant odor control, while diffusers offer long-lasting fragrance dispersion with minimal maintenance. Additionally, essential oils and niche products address wellness-driven and traditional preferences. Together, these segments enhance market diversity and support steady adoption across different household usage patterns.

By distribution channel, supermarkets and hypermarkets remain dominant due to their accessibility, product variety, and consumer trust. Shoppers prefer physical retail for scent evaluation before purchase. However, convenience stores play a critical role in impulse buying, while online platforms are expanding rapidly by offering broader assortments and home delivery services.

Drivers

Rising consumer interest in home ambiance is a primary growth driver. As living spaces increasingly reflect personal identity and comfort, home fragrances have become essential lifestyle products. This trend is reinforced by increased home renovation activity and decorative spending across urban households globally.

Additionally, the growing wellness and self-care movement supports market expansion. Aromatherapy-based products are widely adopted for stress relief, mood enhancement, and relaxation. As awareness of mental well-being rises, consumers actively seek fragrance solutions that align with holistic lifestyle practices.

Use Cases

Residential usage remains the dominant application, with consumers integrating home fragrances into daily routines for relaxation, entertainment, and seasonal décor. Products such as candles and diffusers enhance living rooms, bedrooms, and bathrooms, creating personalized sensory experiences.

Commercial usage is also expanding, particularly across hospitality, wellness centers, and luxury retail environments. Hotels, spas, and boutiques use signature scents to strengthen brand identity, improve customer experience, and create memorable atmospheres that support customer retention.

Major Challenges

High costs associated with premium and natural fragrance products present affordability challenges in price-sensitive markets. While demand for luxury offerings is strong, elevated pricing can limit broader adoption, particularly in developing economies.

Concerns over synthetic ingredients and allergies also restrain growth. Increasing consumer scrutiny regarding health and safety requires manufacturers to reformulate products, comply with regulations, and invest in transparent labeling, which may increase operational complexity.

Business Opportunities

Development of eco-friendly and sustainable home fragrance products presents significant growth potential. Brands that adopt biodegradable packaging, natural ingredients, and low-emission formulations can attract environmentally conscious consumers and strengthen brand loyalty.

Expansion into emerging markets offers additional opportunities. Rising disposable incomes and urbanization across Asia-Pacific, Latin America, and Africa are increasing interest in lifestyle-enhancing products, creating long-term demand for affordable and premium fragrance offerings.

Regional Analysis

Europe leads the global home fragrance market with a 36% share, supported by strong demand for luxury, natural, and sustainable products. Established fragrance traditions, advanced retail infrastructure, and high wellness awareness contribute to regional dominance.

Asia Pacific is the fastest-growing region, driven by urban expansion and rising middle-class populations. North America maintains a strong presence through premiumization and seasonal fragrance demand, while Latin America and the Middle East show steady growth supported by lifestyle changes.

Recent Developments

- In August 2024, SFERRA Fine Linens acquired Antica Farmacista to strengthen its premium home fragrance portfolio.

- In January 2024, L’Occitane Group acquired Dr. Vranjes Firenze to expand its global luxury fragrance footprint.

- In August 2024, K三 launched a new unisex fragrance collection inspired by multicultural aesthetics.

Conclusion

The global home fragrance market demonstrates resilient growth supported by lifestyle shifts, wellness trends, and product innovation. While mature markets drive premium demand, emerging regions offer long-term expansion potential. As sustainability, personalization, and digital commerce gain importance, brands that adapt strategically are well-positioned to capture future market value and consumer loyalty.