Quick Navigation

Introduction

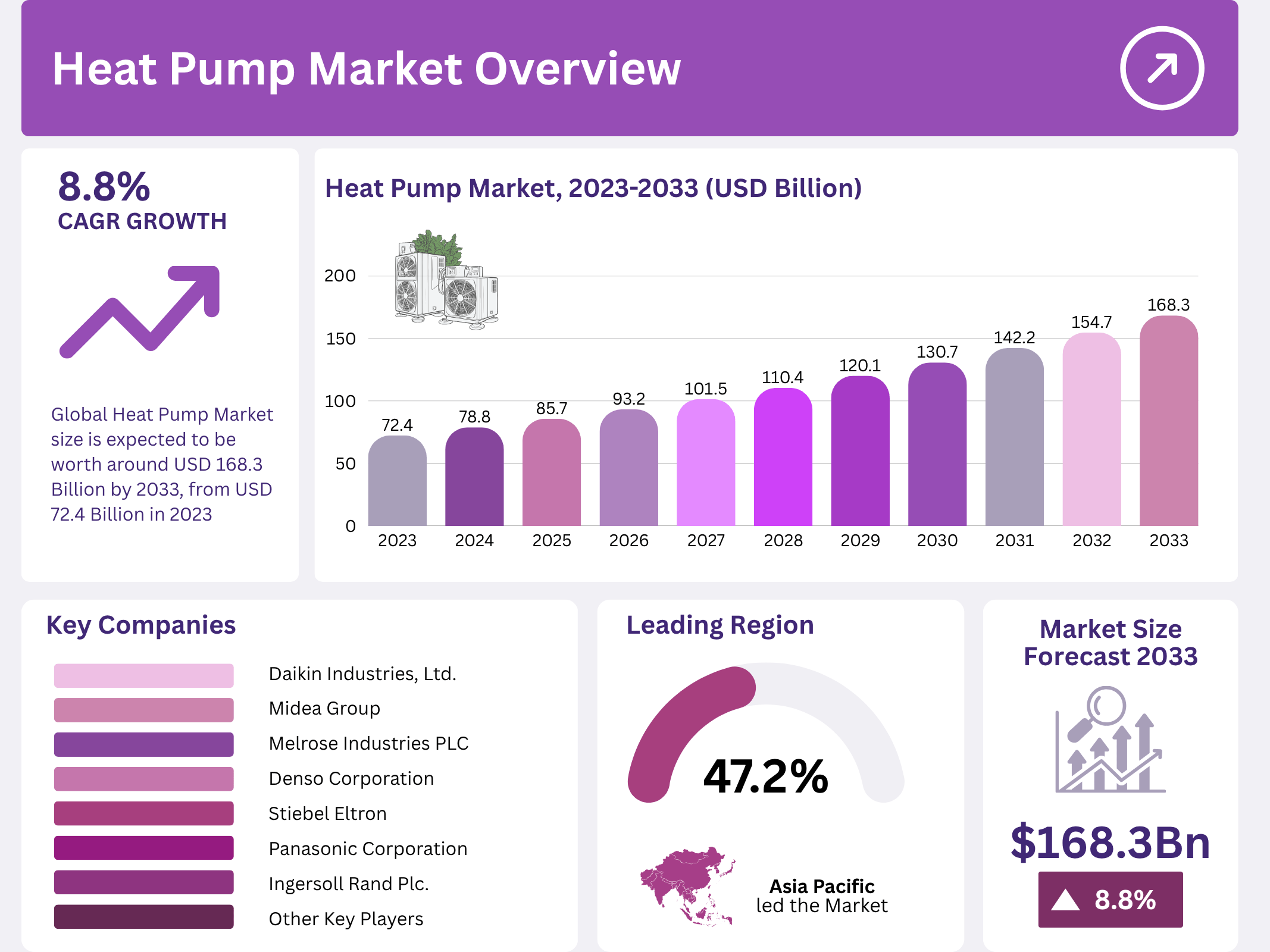

The Global Heat Pump Market is projected to grow significantly, reaching USD 168.3 Billion by 2033, up from USD 72.4 Billion in 2023, registering a CAGR of 8.8% from 2024 to 2033. The market’s robust expansion is fueled by rising environmental awareness and demand for sustainable heating solutions.

Moreover, escalating energy prices and the need to reduce carbon emissions are accelerating adoption. Governments worldwide are introducing incentives and rebates, supporting consumers in transitioning to efficient technologies. As a result, the heat pump industry is evolving rapidly to meet stringent sustainability goals.

Additionally, technological advancements—such as smart home integration and hybrid systems—are enhancing performance and accessibility. These innovations, alongside strong policy backing, are transforming the landscape of global heating and cooling solutions.

Key Takeaways

- The Global Heat Pump Market size is expected to reach USD 168.3 Billion by 2033, from USD 72.4 Billion in 2023, growing at a CAGR of 8.8%.

- In 2023, Air Source held a 78% market share in the technology segment.

- In 2023, Residential applications dominated with an 80% share.

- Asia Pacific led the market with a 47.2% share and USD 34.17 Billion revenue.

Market Segmentation Overview

Based on Technology

In 2023, Air Source Heat Pumps captured 78% of the market, attributed to their affordability and installation ease. Ground Source models followed, valued for efficiency and reliability. Water Source, Solar-assisted, Absorption, and Exhaust Air technologies also grew steadily, catering to specialized applications across diverse climates.

Based on Application

The Residential segment dominated with an 80% share in 2023, driven by rising energy costs and consumer awareness. Commercial spaces, including schools and hospitals, showed notable growth. Meanwhile, industrial users began adopting heat pumps for process heating, capitalizing on waste heat utilization.

Drivers

1. Government Initiatives Propel Global Heat Pump Adoption

Worldwide, government programs are accelerating heat pump adoption. In the EU, the Heat Pump Accelerator Platform fosters collaboration for deployment, while Australia offers rebates in states like Victoria and Queensland. Similarly, the U.S. High-efficiency Electric Home Rebate Program funds energy-efficient home upgrades, boosting market accessibility and growth.

2. Rising Energy Costs and Climate Commitments

As energy prices surge, consumers seek efficient, low-emission alternatives. Heat pumps, being 3–5 times more efficient than traditional boilers, significantly reduce operating costs and carbon footprints. Global climate pledges further reinforce adoption, aligning with emission reduction goals and renewable energy integration.

Use Cases

1. Residential Energy Efficiency

Homeowners increasingly install heat pumps to minimize utility expenses and greenhouse gas emissions. Modern systems, often paired with smart thermostats, optimize energy usage automatically, ensuring comfort and sustainability. Residential demand remains the primary market driver amid rising global environmental consciousness.

2. Commercial and Institutional Applications

Commercial buildings, including hospitals, schools, and offices, leverage heat pumps for scalable, cost-effective climate control. By replacing conventional HVAC systems, these institutions achieve substantial long-term savings, enhanced energy ratings, and compliance with green building certifications, reinforcing corporate sustainability objectives.

Major Challenges

1. High Initial Installation Costs

Despite efficiency advantages, upfront installation remains a hurdle. In the UK, air-source systems cost around £10,000, while ground-source units reach £20,000, far exceeding £3,000 gas boilers. Labor costs, inflation, and limited price reductions hinder broader consumer adoption, especially without strong incentives.

2. Limited Skilled Workforce

The industry faces a growing skills gap. With projections of 1.3 million additional workers needed by 2030, training and certification programs must expand rapidly. Insufficient skilled technicians may slow installation rates and hinder policy-driven deployment targets.

Business Opportunities

1. Technological Advancements and Smart Integration

Emerging innovations—such as smart connectivity, AI-driven controls, and hybrid systems—are enhancing heat pump functionality. These upgrades enable remote monitoring, predictive maintenance, and energy optimization, making heat pumps integral to smart homes and green infrastructure worldwide.

2. Expansion in Cold Climate Applications

Advances in cold climate performance have opened new markets in northern regions. Modern systems operate efficiently at sub-zero temperatures, unlocking demand across Europe, Canada, and Northern Asia, where reliable winter heating is essential.

Regional Analysis

1. Asia Pacific Dominance

Asia Pacific leads with a 47.2% market share, valued at USD 34.17 Billion in 2023. Rapid industrialization, urban growth, and sustainability mandates in China, Japan, and India drive expansion. Strong policy support and large-scale residential adoption underpin the region’s continued leadership.

2. Europe and North America’s Sustainable Shift

Europe benefits from stringent environmental laws and incentives promoting heat pumps, while North America experiences growth from rising energy costs and electrification policies. Together, these regions exemplify mature adoption models transitioning toward carbon-neutral heating systems.

Recent Developments

- July 2024 – Denso Corporation: Secured $50 million to enhance R&D for eco-friendly heat pump technologies.

- March 2024 – Midea Group: Introduced a high-efficiency series cutting energy use by 30% versus conventional systems.

- May 2023 – Melrose Industries PLC: Acquired a regional heat pump manufacturer to expand European presence.

Conclusion

The Global Heat Pump Market is undergoing a transformative phase, propelled by regulatory incentives, consumer awareness, and cutting-edge innovations. As governments prioritize emission reduction and energy efficiency, heat pumps stand out as a cornerstone of sustainable climate control.

With the market expected to reach USD 168.3 Billion by 2033, industry players must focus on cost optimization, workforce development, and smart integration. This strategic approach will ensure long-term competitiveness and accelerate the transition to a low-carbon global economy.