Quick Navigation

Overview

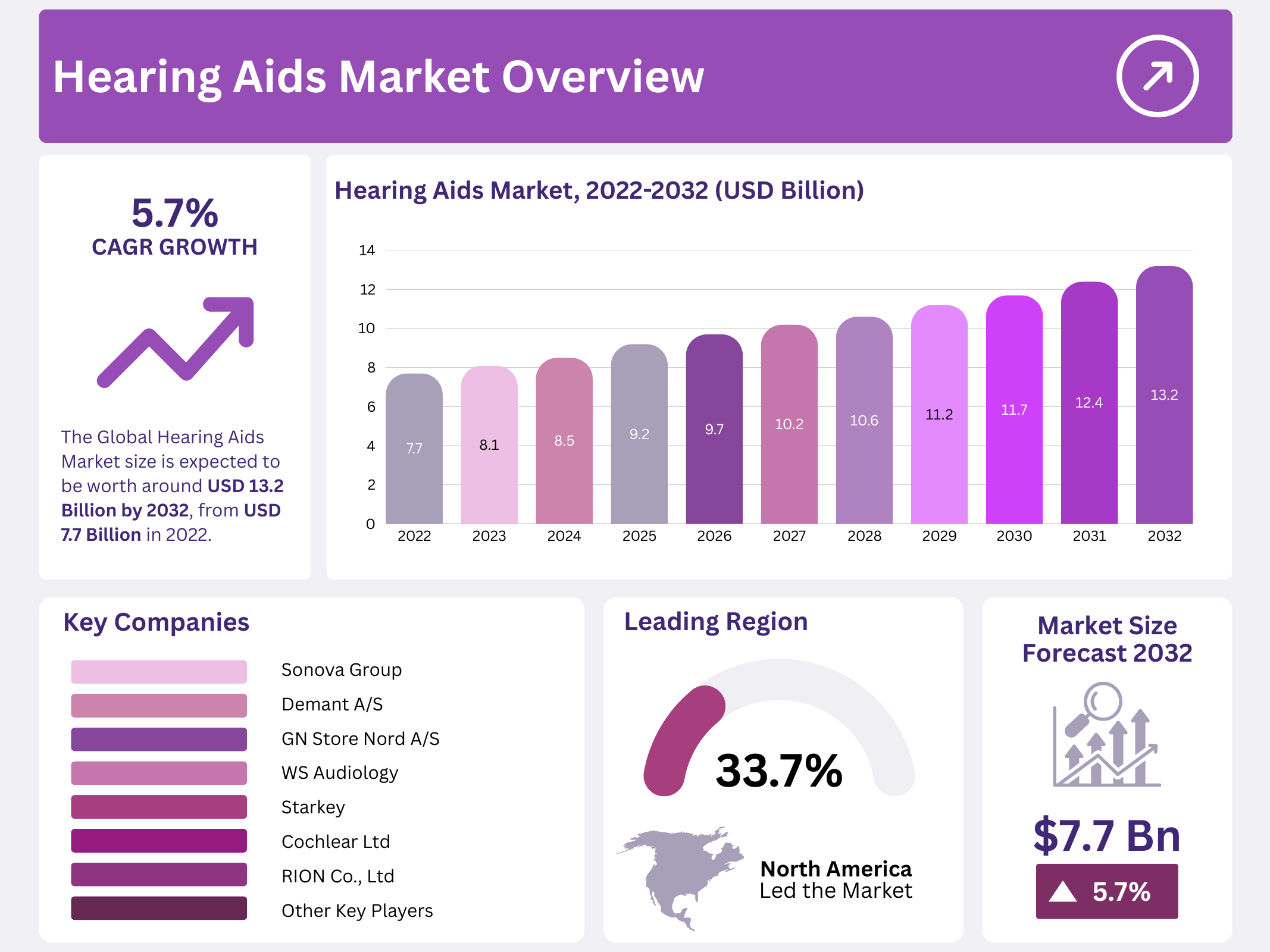

The Global Hearing Aids Market is projected to grow from USD 7.7 billion in 2022 to USD 13.2 billion by 2032, expanding at a CAGR of 5.7%. This growth is largely attributed to the increasing prevalence of hearing loss. According to the World Health Organization (WHO), 466 million individuals currently suffer from disabling hearing loss, a number expected to double by 2050. Meanwhile, over 1.5 billion people are affected by some form of hearing loss. However, global hearing aid production satisfies less than 10% of this demand, indicating a significant unmet need and strong growth potential.

Despite public health measures capable of preventing nearly 50% of hearing loss cases—such as immunization, noise control, and maternal care—these strategies remain unevenly adopted. The challenge is especially evident in low‑ and middle‑income countries, where only 3% of hearing aid requirements are fulfilled. This underlines the need for wider preventive programs and provides scope for market expansion in underserved regions. Limited access to audiology services and low public awareness also restrict adoption in these regions.

Regulatory reforms are enhancing accessibility in key markets. The U.S. Food and Drug Administration (FDA) has approved over-the-counter (OTC) hearing aids for adults with perceived mild-to-moderate hearing loss. These devices, available without a prescription, are helping reduce barriers for rural and cost-sensitive populations. This regulatory shift is expected to significantly broaden the market base by offering affordable and accessible solutions.

Technological innovation remains a major growth driver. New hearing aids incorporate artificial intelligence, real-time sound adjustments, and activity tracking. For example, Starkey’s advanced models conduct over 80 million sound adjustments per hour. AI-powered noise cancellation is also improving sound clarity in real time. These innovations enhance user experience and differentiate products, encouraging higher adoption rates across age groups.

Social inclusion and cognitive health benefits are reinforcing adoption. Greater access to hearing aids enhances participation in family, social, and economic life. Moreover, hearing aids have been linked to slower cognitive decline among older adults at risk of dementia. However, affordability remains a concern. Studies show adoption is higher among individuals with middle incomes and health insurance. Addressing income and awareness barriers—particularly in low-resource settings—is essential for achieving broader market penetration.

Key Takeaways

- The global hearing aids market is projected to reach USD 13.2 billion by 2032, growing at a CAGR of 5.7% from 2022.

- Expansion of the elderly population, who are particularly susceptible to hearing loss, continues to drive consistent growth across the global hearing aids market.

- Financial constraints and a general unwillingness among individuals to take hearing tests remain significant barriers to broader hearing aid adoption.

- The COVID-19 pandemic negatively impacted sales, with postponed cochlear implant procedures significantly contributing to the temporary market decline.

- Behind-the-ear (BTE) hearing aids held the largest share in 2022, accounting for over 40% of global market revenue due to their wide usability.

- Canal hearing aids are expected to grow swiftly, supported by their discreet design and growing preference among young, tech-savvy adults.

- Retail channels, including over-the-counter hearing aid sales, contributed more than 70% of total revenue in 2022, highlighting accessibility and ease of purchase.

- Emerging markets offer strong growth potential, driven by competitive pricing, improved healthcare infrastructure, and rising trends in medical tourism.

- Recent trends show manufacturers securing raw materials at favorable prices and increasingly collaborating with third-party suppliers to optimize production.

Segmentation Analysis

Type Analysis

The Behind-the-Ear (BTE) hearing aids segment accounted for over 40% of revenue share in 2022. These devices consist of a curved case positioned behind the ear and are widely preferred due to their adaptability. They can be connected to external audio devices like infrared systems and auditory training tools. The growing demand is supported by Bluetooth-enabled BTE models that allow wireless connectivity. In addition, hearing implants—such as cochlear and bone-anchored implants—contribute to growth, driven by newborn screening initiatives and continuous product innovation.

The canal hearing aids segment is projected to experience the fastest revenue growth throughout the forecast period. These devices offer a discreet design, which appeals to image-conscious users, particularly younger adults. Their ability to reduce tinnitus and cancel environmental noise also supports their adoption. The stigma surrounding visible hearing aids drives the preference for more concealed solutions. As a result, advancements in miniaturization and sound quality enhancement are expected to contribute significantly to this segment’s expansion in the coming years.

Distribution Channel

In 2022, retail sales held over 70% of total market revenue and are projected to expand rapidly over the forecast period. This dominance is mainly due to the increasing availability of over-the-counter (OTC) hearing aids. The entry of new manufacturers into the retail market has accelerated supply. A higher sales margin and broader access points further support retail segment growth. Company-owned and independent stores comprise this category, enabling wide consumer reach. Product accessibility and local availability are important factors influencing consumer purchases.

Independent retail stores continue to dominate the market due to low entry barriers and direct customer engagement. These stores benefit from high profitability and personalized service, which contribute to sustained demand. Major players such as Walmart, Costco, and CVS play a vital role in expanding reach. Their retail presence strengthens consumer trust and convenience. The expansion of these independent outlets aligns with rising consumer preference for in-person consultation and instant product access. These factors reinforce their leading position in the overall distribution landscape.

Regional Analysis

North America accounted for the largest share of the global hearing aids market in 2022, with over 33.7% share, valued at approximately US$ 2.6 billion. This dominance can be attributed to strong consumer demand for compact and aesthetically appealing devices. Additionally, government support, advanced R&D activities, and rapid adoption of innovative hearing solutions have driven growth. The U.S. remains a key contributor in the region. The availability of technologically advanced products and high awareness further reinforce North America’s leading position in the global landscape.

Europe emerged as the second-largest regional market in 2022. The presence of globally recognized companies such as GN Store Nord A/S, Senovo, Demant A/S, and WS Audiology enhances the region’s competitive edge. These companies play a key role in product innovation and distribution strength across Western and Eastern Europe. Countries like Germany, the UK, and France are leading contributors. Furthermore, supportive reimbursement policies and an aging population have further propelled market growth across European countries during the historical period.

Key Players Analysis

Sonova Holding AG holds a dominant position in the global hearing aid market, with a market share exceeding 80%. The company strengthened its portfolio through the acquisition of Sennheiser Electronic GmbH & Co. KG’s Consumer Division in March 2022. This move is expected to expand Sonova’s customer base and enhance its product offerings. GN Store Nord A/S launched the ReSound Key in February 2021. This product introduction allows broader access to advanced hearing solutions and supports global outreach to hearing-impaired individuals.

Prominent companies operating in the hearing aid industry include Sonova Group, Demant A/S, and GN Store Nord A/S. Other notable players are WS Audiology, Starkey, and MED-EL. Cochlear Ltd, RION Co., Ltd, and SeboTek Hearing System LLC also play significant roles. Widex USA, Inc and Sivantos Pte LTD contribute with innovative hearing technologies. Additionally, Phonak Hearing Systems and several other key players actively shape the competitive landscape. These firms continue to invest in research and global expansion strategies.

Market Key Players

- Sonova Group

- Demant A/S

- GN Store Nord A/S

- WS Audiology

- Starkey

- MED-EL (Medical Electronics)

- Cochlear Ltd

- RION Co., Ltd

- SeboTek Hearing System LLC

- Widex USA, Inc

- Sivantos Pte LTD

- Phonak Hearing Systems

- Other Key Players

Conclusion

The hearing aids market is expected to grow steadily in the coming years. This growth is mainly driven by the rising number of people with hearing loss and the increasing awareness about hearing health. New technologies such as AI-based sound adjustment and wireless connectivity are making hearing aids more user-friendly and effective. Government support, including over-the-counter availability, is helping more people access these devices. However, challenges like high costs and limited access in low-income areas still exist. To unlock full market potential, companies must focus on affordable solutions and raise awareness in underserved regions. Overall, the market outlook remains strong, supported by innovation, policy changes, and global healthcare improvements.

Get in Touch with Us:

Contact Person: Lawrence John.

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]