Quick Navigation

Overview

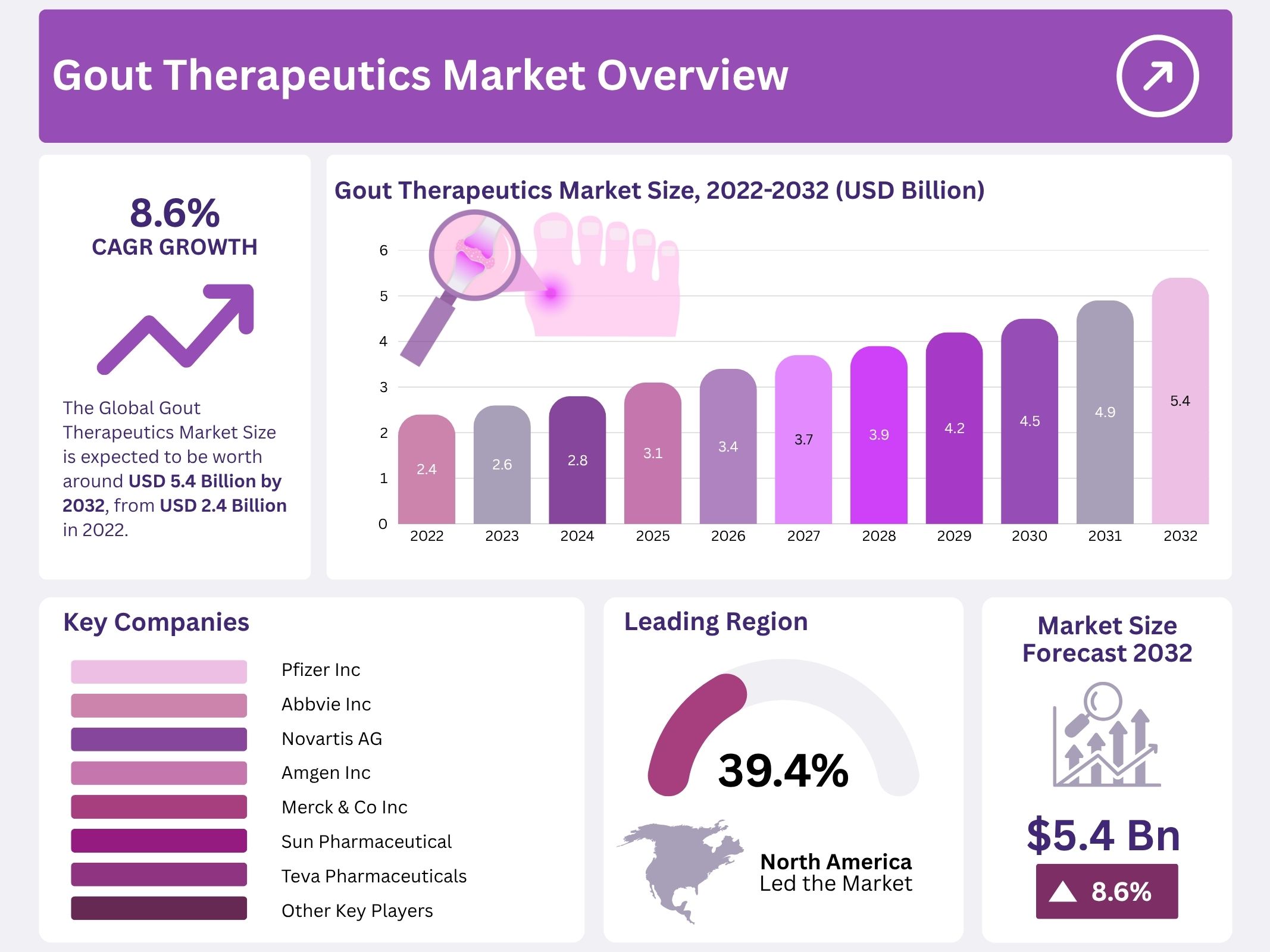

The Gout Therapeutics Market is projected to reach USD 5.4 billion by 2032, from USD 2.4 billion in 2022, at an 8.6% CAGR. Growth is supported by rising gout prevalence driven by aging, obesity, metabolic syndrome, and chronic kidney disease. Many patients remain undertreated due to gaps in diagnosis, urate monitoring, and adherence. Increasing treat-to-target adoption, with serum urate goals below established thresholds, has strengthened continuous monitoring and optimized urate-lowering therapy use.

Therapy initiation is occurring earlier, especially for patients with recurrent flares or kidney impairment. This trend extends treatment duration and expands the eligible patient pool. Innovation in uricase biologics, IL-1 inhibitors for severe flares, and next-generation urate-lowering agents is improving outcomes. Precision approaches, including pharmacogenomic screening and renal-based dosing, enhance safety and expand access to therapy for high-risk and previously undertreated individuals.

Comorbidity clustering with hypertension, diabetes, dyslipidemia, obesity, and kidney disease increases hospital interactions and detection rates. Integrated care models through nephrology, primary care, and rheumatology support treatment referrals and therapy escalation. Prevention of flare-related hospital visits, surgeries, and productivity losses creates measurable cost savings, encouraging payer support. Step-therapy frameworks and real-world data demonstrating target achievement reinforce coverage and predictable market uptake pathways.

Renal-safe dosing strategies and improving cardiovascular safety clarity have increased physician confidence. Digital health tools, nurse-led titration programs, and pharmacist-managed pathways support adherence, early titration, and long-term persistence. Point-of-care serum urate testing and advanced imaging enable faster diagnosis and severity staging. These diagnostic advances help clinicians justify advanced therapies for complex patients and accelerate treatment optimization across settings.

Emerging markets are contributing to expansion as awareness rises and access to generic therapies improves. Urbanization and lifestyle changes are increasing hyperuricemia rates in developing regions. Combination formulations, once-daily dosing, titration-friendly packs, and label expansions are improving convenience and supporting brand differentiation. Patient support services and co-pay programs help maintain therapy continuity. Overall, market progress is driven by rising disease burden, structured treat-to-target protocols, therapeutic innovation, and payer recognition of long-term cost savings linked to reduced flare frequency and sustained disease control.

Key Takeaways

- The gout therapeutics market is projected to expand at an 8.6% CAGR, increasing from USD 2.4 billion in 2022 to USD 5.4 billion by 2032.

- NSAIDs currently retain the largest share of the drug class segment, accounting for 46% of usage due to strong efficacy in managing acute gout symptoms.

- Chronic gout represents 67% of total market share, supported by expanding treatment options and a continued emphasis on long-term disease management strategies.

- Hospitals remain the primary end-user segment, reflecting their central role in delivering acute gout care and comprehensive treatment support for severe cases.

- North America leads the global gout therapeutics market with a 39.4% share, driven by higher disease prevalence and advanced healthcare infrastructure.

- Asia Pacific is emerging as the fastest-growing regional market, supported by rising patient numbers and strengthening healthcare systems across Japan, China, and India.

- Biologic therapies continue gaining traction, supported by their ability to improve outcomes in severe gout cases and enhance treatment effectiveness.

- Combination therapy approaches are becoming more prominent, designed to target multiple disease mechanisms and deliver improved long-term gout control.

- Increasing global aging population contributes significantly to gout prevalence, strengthening demand for advanced therapeutics and sustained care solutions.

- Growing disease awareness and earlier diagnostic practices are leading to improved identification of gout cases and rising adoption of targeted treatment regimens.

Regional Analysis

North America is projected to remain the most lucrative market for gout therapeutics, accounting for an estimated 39.4% share. The high disease burden and rising diagnosis rates support this dominance. The region benefits from strong healthcare systems and advanced treatment facilities. Increasing awareness of gout and its complications has encouraged early medical intervention. Both the United States and Canada are showing consistent demand growth. Favorable reimbursement policies and access to innovative drugs continue to strengthen market penetration and therapy adoption.

The United States leads the regional landscape due to a growing patient pool and established treatment guidelines. High healthcare expenditure has supported access to novel therapies and specialist consultations. Advancements in biologics and expanding clinical research pipelines are supporting product availability. Public and private initiatives are improving disease awareness and management programs. Increasing obesity and chronic kidney disease prevalence are raising gout incidence rates in the country. These factors are enabling sustained market expansion within the U.S. healthcare ecosystem.

Canada represents another key contributor within North America. The country is reporting rising gout prevalence, driven by aging demographics and lifestyle-related conditions. Improved patient education and early diagnosis are encouraging timely treatment. The availability of specialist care and streamlined reimbursement procedures supports therapy uptake. Canada’s healthcare infrastructure facilitates effective management of chronic inflammatory diseases. Increasing adoption of urate-lowering therapies and anti-inflammatory agents is strengthening market performance. The national focus on preventive healthcare initiatives continues to complement market growth prospects.

The Asia Pacific region is emerging as the fastest-growing market for gout therapeutics. Rapid urbanization and lifestyle shifts are contributing to higher incidence rates. Countries such as Japan, China, and India are experiencing increasing gout-related healthcare visits. Rising disposable income has expanded access to advanced treatment options. Healthcare infrastructure modernization is supporting better disease management. Greater awareness of complications associated with untreated gout is encouraging pharmaceutical adoption. Favorable regulatory reforms and expanding healthcare coverage are expected to sustain strong regional growth momentum.

Segmentation Analysis

The market has been segmented by drug class into NSAIDs, urate-lowering agents, corticosteroids, and colchicine. NSAIDs accounted for around 46% share, driven by strong accessibility, affordability, and effective pain relief during severe attacks. Their established use supported dominant penetration across treatment settings. Urate-lowering agents, including xanthine oxidase inhibitors and uricosurics, are projected to record the fastest growth. Rising adoption and new product introductions are expected to support expansion. Corticosteroids are used when NSAIDs or colchicine cannot be tolerated, yet rebound flares may restrict wider uptake.

Colchicine held a notable position due to its mechanism of reducing neutrophil adhesion and moderating acute inflammation. Disease segmentation includes chronic gout and acute gout. Chronic gout led with approximately 67% share. Its growth has been driven by wider commercialization of therapies for long-term management. Xanthine oxidase inhibitors and uricosurics are commonly prescribed in this category. Increasing emphasis on continuous urate control and long-term disease management supported strong demand.

Acute gout treatment relies on colchicine, NSAIDs, and corticosteroids. These therapies provide pain and inflammation reduction; however, shorter symptom-relief duration, lower costs, and inconsistent adherence contribute to a smaller market share versus chronic treatments. Acute gout occurs when uric acid crystals build in joints, leading to intense pain, redness, and swelling. Treatment in this phase focuses on rapid inflammation control. Adoption remains steady, yet chronic therapy preference continues to rise as long-term disease burden and recurrence risks become more visible across healthcare systems.

End users include hospitals, clinics, and home care settings. Hospitals held the highest share, due to their role in managing severe gout attacks and providing specialized rheumatology services. Clinics, including primary care and rheumatology centers, also contribute significantly by managing both acute episodes and long-term disease. Collaboration across multidisciplinary care teams enhances treatment continuity. Home care settings serve stable patients requiring ongoing medication adherence and lifestyle support. Hospital-based care remains essential, yet outpatient management options are expanding with growing chronic gout prevalence.

Key Market Segments

Based on Drug Class

- NSAIDs

- Corticosteroids

- Colchicine

- Urate-Lowering Agents

Based on Disease Condition

- Acute Gout

- Chronic Gout

Based on End-User

- Hospital

- Clinics

- Home Care Setting

Key Players Analysis

The market is led by global pharmaceutical companies with strong capabilities in drug development and commercialization. Their dominance has been supported by heavy investment in R&D and established distribution networks. These organizations focus on enhancing urate-lowering therapies and launching advanced biologics for severe cases. Pfizer Inc, AbbVie Inc, Novartis AG, Amgen Inc, and Merck & Co Inc are recognized for strategic portfolios. Their scale and research focus have resulted in consistent product innovation and strong physician engagement across major markets.

Expansion strategies have been reinforced by licensing agreements, product approvals, and clinical trials in refractory gout treatment. Companies are investing in biologics and combination therapies to reduce flare frequency and improve long-term disease control. Sun Pharmaceutical Industries Ltd, Teva Pharmaceuticals Industries Ltd, AstraZeneca, and Boehringer Ingelheim International GmbH maintain active development pipelines. These players also concentrate on market penetration in regions with rising incidence, supported by growing access to specialty gout therapies and improved diagnostic coverage.

Diversification of treatment mechanisms remains central to competitive positioning. Firms are exploring xanthine oxidase inhibitors, anti-inflammatory biologics, and uricosuric agents. Collaborations with academic institutions and biotechnology firms have been utilized to accelerate clinical development. GSK plc, Antares Pharma, Astellas Pharma Inc, and JW Pharmaceutical Corporation have expanded their therapeutic offerings to include targeted options. Their strategies have strengthened product differentiation. Greater emphasis on patient-specific therapy adoption and reduced adverse reactions has resulted in enhanced therapeutic acceptance.

Emerging innovators are strengthening the competitive landscape by advancing next-generation therapies and personalized medicine approaches. Addex Therapeutics, Takeda Pharmaceutical Company Limited, TEIJIN LIMITED, and Lilly focus on novel delivery mechanisms and niche formulations. Their objective is to address unmet needs among patients with difficult-to-treat gout or comorbid conditions. The entry of such firms is expected to support treatment advancements. However, market growth remains led by established participants with strong regulatory capabilities and manufacturing expertise worldwide.

Market Key Players

- Pfizer Inc

- Abbvie Inc

- Novartis AG

- Amgen Inc

- Merck & Co Inc

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceuticals Industries Ltd

- AstraZeneca

- Boehringer Ingelheim International GmbH

- GSK plc

- Antares Pharma

- Astellas Pharma Inc

- JW Pharmaceutical Corporation

- Addex Therapeutics

- Takeda Pharmaceutical Company Limited

- TEIJIN LIMITED

- Lilly

Conclusion

The gout therapeutics market is expected to grow steadily, supported by rising disease cases, better diagnosis, and wider access to treatment options. Adoption of early and long-term therapy is increasing as patients and clinicians focus on preventing repeated flare-ups and joint damage. Progress in biologics, urate-lowering medicines, and personalized dosing is improving outcomes for difficult-to-treat patients. Strong support from healthcare providers and insurers is encouraging timely treatment and adherence. Growing awareness, expanding access in emerging regions, and improved monitoring tools are helping more patients receive effective care. The market outlook remains positive as new therapies, supportive care programs, and integrated treatment models boost long-term disease control.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]