Quick Navigation

Introduction

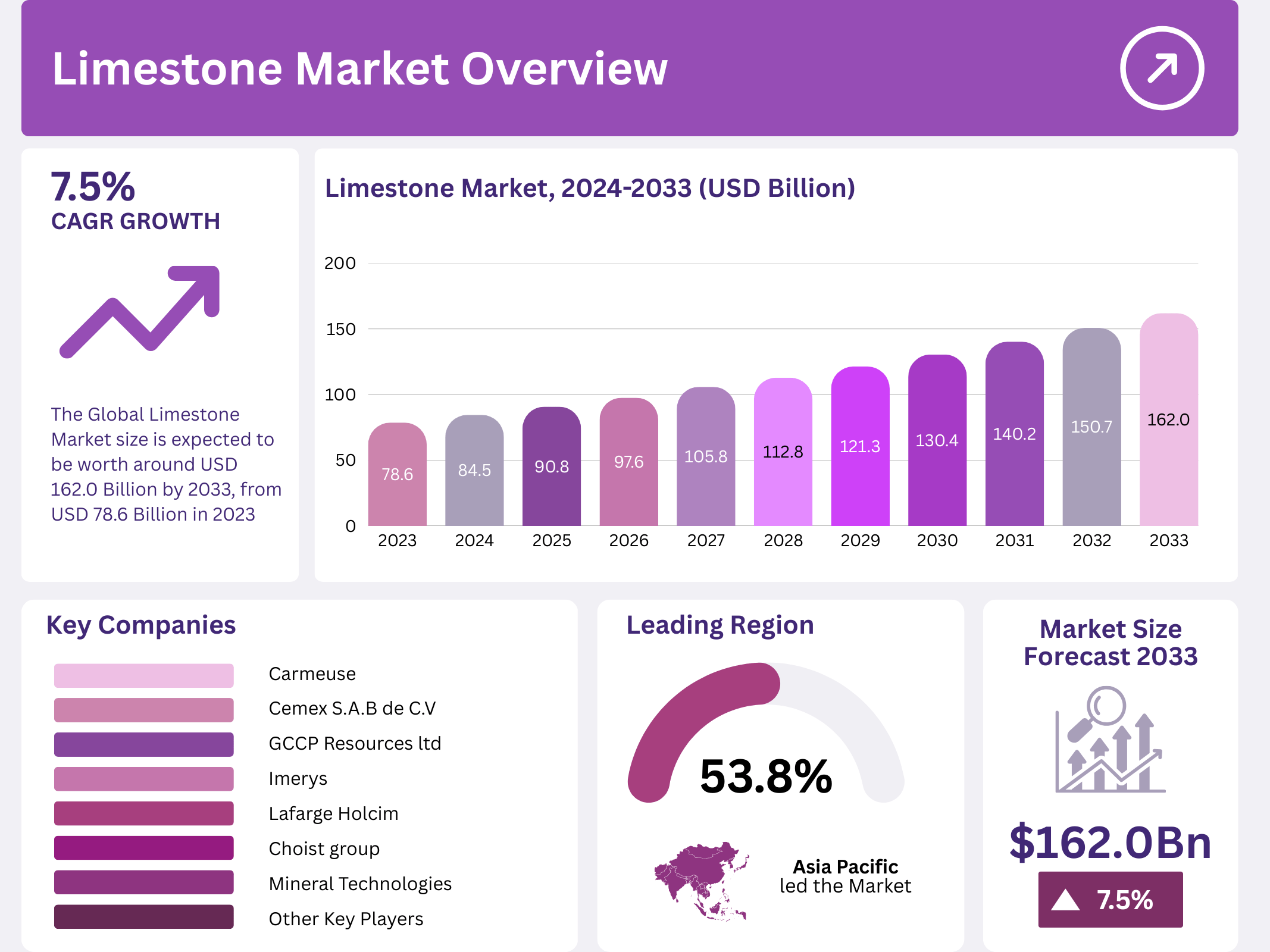

The global limestone market is projected to reach USD 162.0 Billion by 2033, growing from USD 78.6 Billion in 2023, at a CAGR of 7.5% during the forecast period from 2024 to 2033. Limestone, primarily composed of calcium carbonate (CaCO3), is used in various industries, including construction, agriculture, and steel manufacturing. The demand for limestone is driven by the increasing need for cement and steel production, as well as the growing emphasis on environmental applications.

In 2023, Asia Pacific dominated the limestone market, holding a 53.8% share with USD 42.28 Billion in revenue. The limestone market’s growth is closely linked to the booming construction sector, industrial activities, and agriculture. As global urbanization accelerates, the demand for limestone products such as cement, aggregates, and environmental solutions is expected to rise steadily.

Key Takeaways

- The global limestone market size is expected to reach USD 162.0 Billion by 2033, from USD 78.6 Billion in 2023, growing at a CAGR of 7.5%.

- In 2023, High Calcium Limestone held a 69.5% market share in the By Type segment.

- Industry Lime dominated the By Application segment in 2023, with a 46.7% share.

- The Building & Construction sector held a dominant market position in the By End User segment with an 82.6% share in 2023.

- Asia Pacific led the market in 2023, holding a 53.8% market share, valued at USD 42.28 Billion in revenue.

Market Segmentation Overview

By Type

In 2023, High Calcium Limestone led the market with a 69.5% share, mainly due to its broad applications in construction, agriculture, and industrial sectors. This segment’s growth is fueled by its superior chemical properties, including its use in environmental applications like water purification. Magnesian Limestone accounted for the remaining 30.5%, with its applications more limited due to the need for specialized quarrying techniques.

By Application

The Industry Lime segment dominated the limestone market in 2023, capturing 46.7% of the market share. This segment’s strength lies in its widespread use across industries like steel, paper, and plastics, where it is integral in purification and metallurgical processes. Additionally, Chemical Lime, with applications in water treatment and flue gas desulfurization, remains a key market player.

By End User

The Building & Construction sector led the By End User segment, accounting for 82.6% of the market share in 2023. The demand for limestone in cement production, concrete, and building materials drives this dominance. Despite its smaller share, the Iron and Steel industry also significantly contributes to limestone demand, primarily for use as a flux agent in steel production.

Drivers

- Construction Growth:

The expanding construction industry, particularly in emerging markets, is a primary driver for the limestone market. As infrastructure development and urbanization continue to accelerate globally, the demand for limestone products like cement and aggregates grows steadily. The need for building materials remains high in both residential and commercial sectors. - Agriculture Demand:

Limestone’s role in agriculture, particularly in soil conditioning, is another key factor contributing to the market’s growth. As global food demand rises, limestone’s application as a soil amendment to neutralize acidic soils and enhance crop yields becomes increasingly critical. This sector is expected to see continued growth, especially in regions experiencing agricultural expansion.

Use Cases

- Cement and Concrete Production:

Limestone is a crucial raw material in cement production, which is essential for the construction industry. As urbanization and industrialization rise globally, the demand for cement and concrete products, which rely heavily on limestone, continues to increase, especially in emerging economies. - Steel Manufacturing:

Limestone is vital in the steel production process, where it serves as a flux agent to remove impurities from iron ore. As the demand for steel increases, particularly in rapidly industrializing regions, the need for limestone in steelmaking is projected to grow significantly, contributing to the overall market expansion.

Major Challenges

- Environmental Regulations:

Stringent environmental regulations related to limestone quarrying and extraction can hinder market growth. The processes involved in limestone mining often lead to landscape disruption, dust pollution, and noise, requiring companies to comply with stringent guidelines that may slow down production. - Transportation Costs:

Limestone is a heavy material, and its transportation costs can be substantial, especially when shipped over long distances. The weight and bulkiness of limestone contribute to high shipping expenses, which may limit its market reach and elevate overall costs for manufacturers and consumers.

Business Opportunities

- Sustainability Initiatives:

With increasing emphasis on environmental sustainability, there are opportunities for innovation in limestone extraction and processing. Companies that adopt eco-friendly quarrying practices and focus on recycling limestone materials can differentiate themselves in the market, aligning with global sustainability goals. - Emerging Markets:

As industrialization and urbanization continue to rise in emerging markets, particularly in Asia Pacific and Latin America, limestone demand is expected to soar. Companies have opportunities to expand their operations in these regions, tapping into growing construction, agricultural, and industrial needs.

Regional Analysis

- Asia Pacific:

Asia Pacific remains the dominant market for limestone, holding 53.8% of the global market share in 2023. The region’s rapid urbanization and industrialization, particularly in countries like China and India, drive the high demand for limestone products, especially for construction and steel production. - North America:

North America, particularly the United States, continues to show steady growth in the limestone market. The region’s recovery in construction activities and its stringent environmental regulations favor limestone’s use in waste treatment and environmental applications, creating a stable market demand.

Recent Developments

- In June 2023, Imerys expanded its operations in Asia, investing $30 million to enhance limestone processing capacity.

- In March 2023, Lafarge Holcim acquired a smaller competitor in Brazil, adding 10 million tons to its annual limestone output.

- In January 2023, Choist Group launched a new eco-friendly limestone product line, aiming to reduce carbon emissions in production by 25% by 2025.

Conclusion

The global limestone market is set for robust growth, driven by the increasing demand from key industries such as construction, steel manufacturing, and agriculture. As infrastructure development and industrialization continue, especially in emerging markets, the need for limestone will remain strong. Companies are also presented with opportunities in sustainability and technological advancements to meet growing demand. Despite challenges such as environmental regulations and transportation costs, the market shows promising potential for strategic growth, particularly in Asia Pacific and North America. With innovations in mining processes and environmental management, the limestone market is poised to thrive in the coming years.