Quick Navigation

Introduction

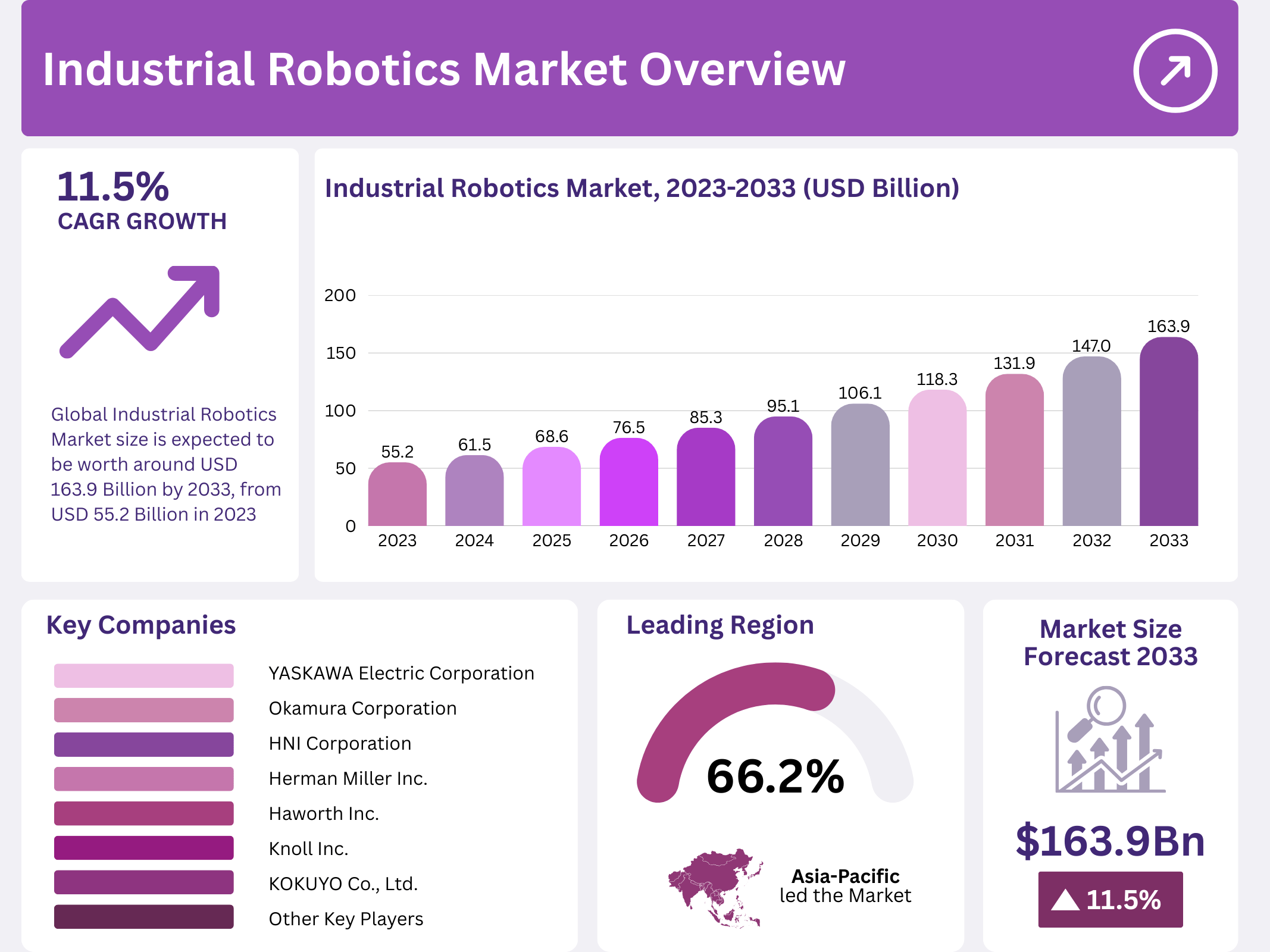

The global industrial robotics market is accelerating rapidly, projected to reach USD 163.9 Billion by 2033, rising from USD 55.2 Billion in 2023. As industries adopt automation to boost efficiency, precision, and safety, the demand for intelligent robotic systems continues to expand across manufacturing processes.

Furthermore, the market is expected to grow at a strong CAGR of 11.5% from 2024 to 2033, driven by innovation, digital transformation initiatives, and rising automation investments globally. Asia Pacific continues to dominate adoption with a commanding 66.2% market share recorded in 2023.

Key Takeaways

• The Global Industrial Robotics Market size is expected to reach USD 163.9 Billion by 2033 from USD 55.2 Billion in 2023, growing at a CAGR of 11.5% from 2024 to 2033.

• In 2023, Handling held a dominant market position in the By Application segment with a 41.3% share.

• In 2023, Electrical/Electronics held a dominant position in the end-use segment with a 26.3% share.

• Asia Pacific dominated the global market with a 66.2% share and revenue of USD 36.5 Billion in 2023.

Market Segmentation Overview

Handling applications remained the top segment with a 41.3% share in 2023, as manufacturers increasingly adopt robots for material transfer, machine feeding, and packaging. This shift continues to reduce operational costs while improving productivity and consistency across high-volume production environments.

In the end-use market, the Electrical/Electronics sector dominated with a 26.3% share due to extensive use of robotics for precision assembly, micro-handling, and electronic component testing. The growing consumer demand for smart devices continues to shape the segment’s expansion.

Drivers

A major driver is the need for automation to boost efficiency and productivity across manufacturing operations. Robots significantly minimize human error, reduce material wastage, and accelerate production cycles, enabling companies to achieve consistent quality standards while saving labor costs.

Another strong driver is the integration of AI and machine learning into robotic systems. Intelligent robots now perform complex, adaptive tasks and operate safely in dynamic industrial environments, expediting the shift toward smart factories and Industry 4.0 frameworks.

Use Cases

In the automotive industry, robots are widely deployed for welding, painting, and high-precision assembly, delivering predictable output and improved safety. These applications have streamlined manufacturing workflows while reducing downtime from manual processes.

In the electronics sector, robots are utilized for micro-component assembly, soldering, and high-speed inspection. Their precision and repeatability support the production of compact, high-performance devices and ensure uniformity across millions of units.

Major Challenges

High initial investment remains a core restraint for small and mid-sized companies, involving costs for robots, software integration, and facility reconfiguration. These upfront expenditures often delay adoption despite promising long-term returns.

The shortage of skilled technicians to operate and maintain advanced robotic systems is another challenge. Without trained personnel, companies risk increased downtime, higher maintenance expenses, and slower implementation timelines.

Business Opportunities

Emerging economies such as China, India, and Brazil represent vast opportunities as industries accelerate factory automation. Manufacturers in these regions are investing in robotics to expand production capacity and improve global competitiveness.

The rise of AI-powered robotics opens new opportunities beyond traditional manufacturing, including pharmaceuticals, food processing, and logistics. Smart, adaptable robots are enabling automation in tasks previously too delicate or variable for mechanized workflows.

Regional Analysis

Asia Pacific continues to lead global adoption with a 66.2% share thanks to rapid industrialization and major automation programs in China, Japan, and South Korea. Heavy investments in electronics, automotive, and hardware production continue to sustain regional market dominance.

North America and Europe also remain critical markets, driven by the focus on collaborative robots, AI-integrated automation, and worker safety. Both regions are investing heavily in robotics to strengthen manufacturing resilience and address skilled labor shortages.

Recent Developments

• In August 2024, KUKA launched a next-generation precision robot for electronics manufacturing, enabling a 30% faster production rate.

• In July 2024, Comau SpA partnered with a major automotive manufacturer to integrate advanced robotics in production, targeting a 20% efficiency increase by year-end.

• In February 2024, FANUC introduced a new robotic system for the food and beverage industry, projected to reduce downtime by 25% through advanced diagnostics.

Conclusion

The industrial robotics market is undergoing transformative growth backed by technological innovation, global automation demand, and rising investments across manufacturing ecosystems. As AI-enabled robots evolve to become more adaptive, efficient, and collaborative, industries worldwide are positioned to unlock new productivity benchmarks, reduce operational risks, and elevate manufacturing precision in the decade ahead.