Quick Navigation

Introduction

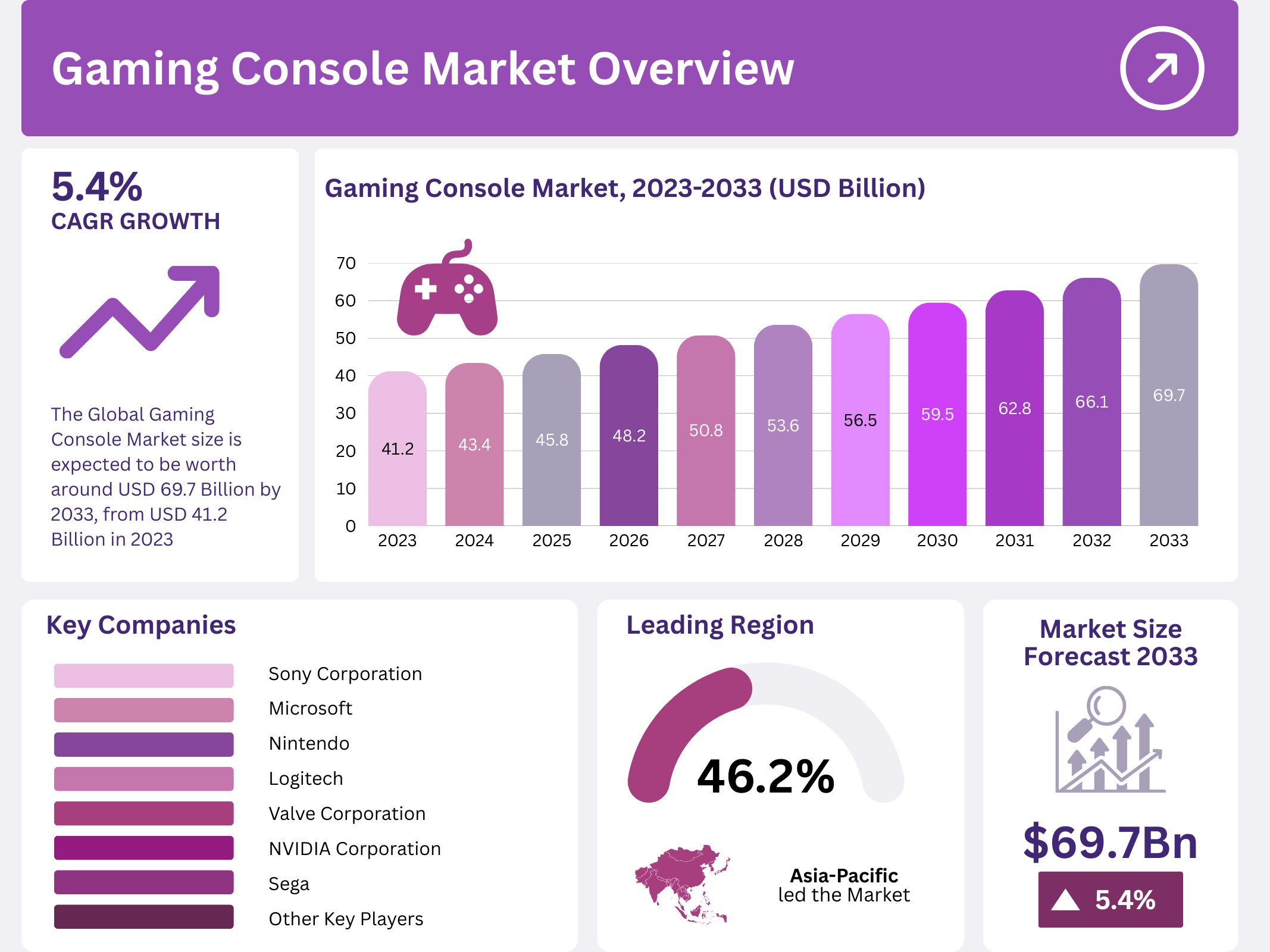

The Global Gaming Console Market is poised for significant growth, with a projected value of USD 69.7 Billion by 2033, up from USD 41.2 Billion in 2023, marking a CAGR of 5.4% from 2024 to 2033. The gaming console market, driven by ongoing technological advancements and an expanding consumer base, is set to evolve with increasing demand for immersive gaming experiences, cloud gaming solutions, and portable gaming devices.

As the gaming industry continues to innovate and integrate new features such as virtual reality (VR), cross-platform play, and subscription-based models, the market is expected to grow dynamically. In 2023, Asia Pacific dominated the market with a 46.2% share, generating USD 19.0 Billion in revenue.

Key Takeaways

- The Global Gaming Console Market is projected to reach USD 69.7 Billion by 2033, from USD 41.2 Billion in 2023, growing at a CAGR of 5.4%.

- PlayStation holds the largest share in the By Product segment, with 25.3% of the market in 2023.

- The Gaming Application segment dominates with a 56.6% share in 2023.

- The Online Distribution Channel segment accounted for 46.1% of the market share in 2023.

- The Handheld Game Console segment led the By Type category with 31.3% share in 2023.

- Console Unit remains the dominant component segment with 36.4% of the market share.

Market Segmentation Overview

The gaming console market can be segmented by product, application, distribution channel, type, and component.

- By Product: PlayStation led the market with 25.3% of the share, owing to its superior gaming library and brand loyalty.

- By Application: Gaming dominates the market, holding 56.6% of the share, driven by technological advancements and immersive gaming experiences.

- By Distribution Channel: Online Distribution Channel takes the lead with 46.1%, offering ease of access and global reach to consumers.

- By Type: Handheld Game Console was the most popular type, accounting for 31.3% of the market share.

- By Component: Console Unit remains dominant with 36.4% market share, offering a comprehensive and integrated gaming experience.

Drivers

- Technological Advancements: Continuous innovations in graphics, processing power, and virtual reality integration are enhancing the gaming experience and attracting more players.

- Consumer Demand for Immersive Gaming: As gaming evolves from a niche to mainstream entertainment, consumers are seeking more immersive experiences with enhanced graphics and VR capabilities.

- Cloud Gaming: The rise of cloud gaming is reducing the need for costly hardware and allowing consumers to stream high-quality games directly to their consoles, widening the market.

- Esports Growth: The increasing popularity of esports and online gaming competitions has led to higher demand for gaming consoles, as these devices are central to professional gaming.

Use Cases

- Home Entertainment: Consoles are increasingly integrated with streaming services, social media, and other entertainment functions, positioning them as all-in-one entertainment hubs.

- Educational and Fitness Applications: Consoles are being adapted for non-traditional uses, such as educational games and fitness applications, targeting new demographics like children and health-conscious adults.

- Cloud Gaming Services: Companies are now offering game streaming services that allow users to access games without needing to invest in expensive hardware, making gaming more accessible.

Major Challenges

- High Initial Costs: The latest gaming consoles come with significant upfront costs, making them less accessible to price-sensitive consumers, particularly in emerging markets.

- Technological Obsolescence: Rapid technological advancements can render new consoles obsolete in a short period, leading to higher consumer expectations and shorter product life cycles.

- Competition from Mobile Gaming: Mobile gaming continues to grow as a more affordable and portable alternative, posing a threat to traditional gaming consoles, especially as mobile devices become increasingly powerful.

- Environmental Impact: The significant energy consumption of gaming consoles has led to rising concerns about their environmental impact, with gaming consoles in the U.S. consuming around 34 terawatt-hours annually, contributing to 24 million metric tons of CO2 emissions.

Business Opportunities

- Cloud Gaming: With the rise of cloud gaming, companies can tap into the growing demand for subscription-based models and offer high-quality gaming without the need for expensive hardware upgrades.

- Subscription Services: The growth of subscription-based services like Xbox Game Pass and PlayStation Now presents an opportunity for steady revenue streams and greater customer loyalty.

- Emerging Markets: Rising disposable incomes in regions like Asia Pacific, Latin America, and the Middle East provide significant growth potential as more consumers gain access to gaming consoles and services.

- Sustainable Technologies: Companies can explore eco-friendly, energy-efficient gaming consoles to address environmental concerns and meet increasing consumer demand for greener products.

Regional Analysis

In 2023, Asia Pacific dominated the global gaming console market with 46.2% market share, contributing USD 19.0 Billion in revenue. Countries like Japan, South Korea, and China are major contributors, driven by robust gaming cultures and rapidly growing middle-class populations. The region’s tech-savvy consumer base, coupled with increased internet penetration and mobile gaming adoption, offers significant growth potential.

North America follows closely, driven by a high level of consumer spending on entertainment and the presence of major gaming companies. Europe also represents a significant market, fueled by a strong economy and high consumer purchasing power.

Meanwhile, Latin America and Middle East & Africa are emerging markets where gaming is rapidly gaining popularity, but they still account for smaller portions of the global market. The expansion of internet access and mobile devices is expected to further boost growth in these regions.

Recent Developments

- August 2023: NVIDIA entered the gaming console market, collaborating with game developers to optimize AI-driven graphics technology, which is expected to enhance game visuals and performance.

- July 2023: Logitech launched a new gaming console accessory that offers ergonomic improvements, enhancing comfort for gamers during extended sessions.

- May 2023: Valve Corporation introduced an updated version of the Steam Deck, boasting larger storage and improved battery life to enhance mobile gaming experiences.

Conclusion

The Global Gaming Console Market is positioned for continued growth, fueled by technological advancements, the rise of cloud gaming, and expanding market opportunities in emerging regions. Despite facing challenges such as high costs, environmental concerns, and mobile gaming competition, the market remains vibrant, offering multiple avenues for innovation and growth. With the increasing integration of gaming consoles into broader entertainment ecosystems and the ongoing evolution of gaming experiences, the future looks bright for both established and new entrants in the gaming console industry.