Quick Navigation

Overview

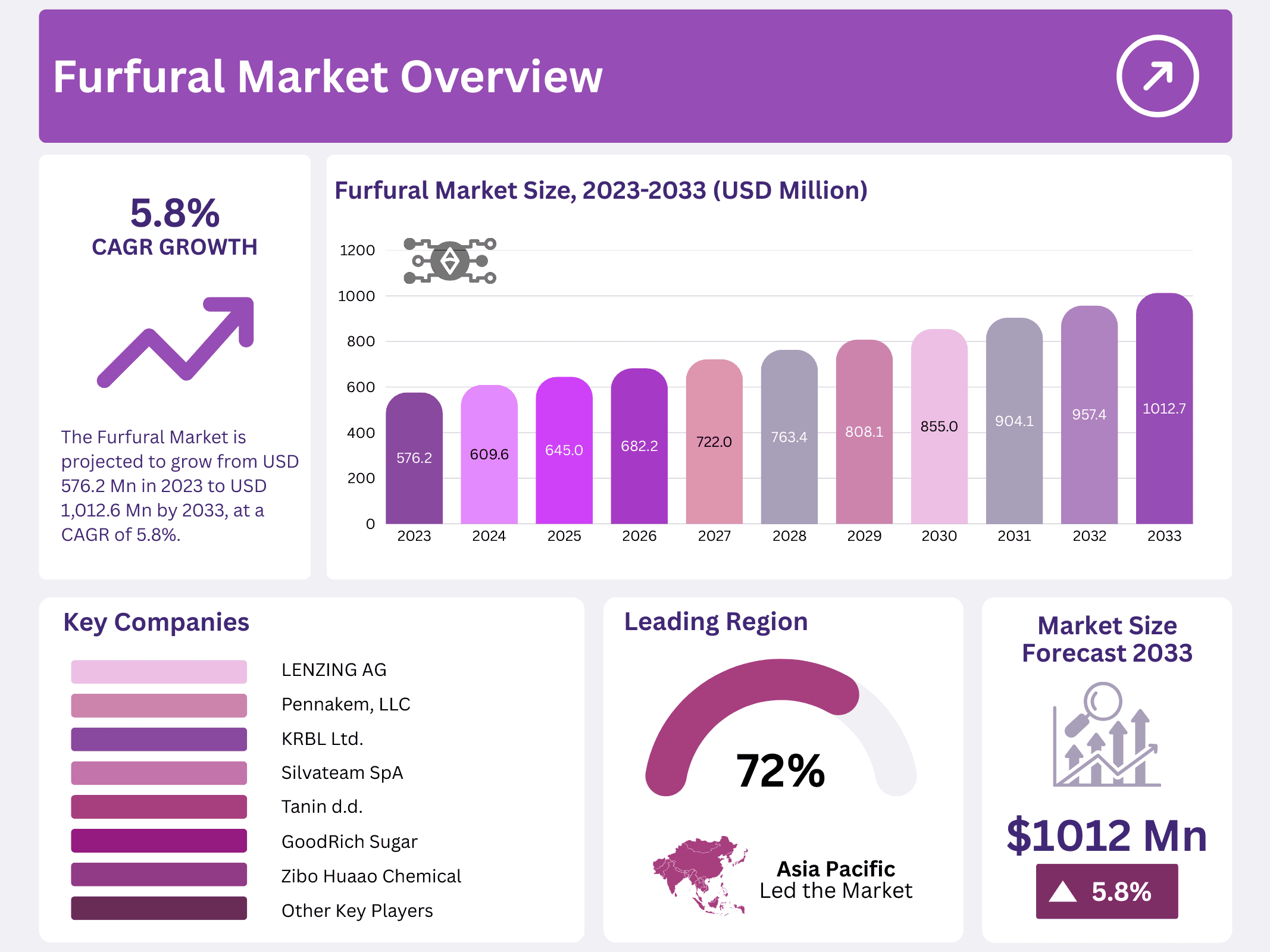

New York, NY – January 16, 2026 – The Global Furfural Market is projected to reach a value of around USD 1,012.6 million by 2033, rising from USD 576.2 million in 2023. This growth reflects a steady CAGR of 5.8% over the forecast period from 2023 to 2033, supported by increasing adoption across chemical, refining, and agricultural applications.

Rising environmental concerns are playing a key role in shaping market demand. Furfural, being bio-based and derived from agricultural residues, is increasingly preferred as a green solvent and intermediate. Growing regulatory pressure to reduce reliance on petroleum-based chemicals is further accelerating its use in solvent extraction, resins, and sustainable chemical processes.

The market experienced a temporary setback during 2020 due to the COVID-19 pandemic. Lockdowns, social distancing measures, and reduced industrial activity led to lower production levels. In addition, disruptions in supply chains and logistics affected the availability of raw materials and the distribution of furfural, slowing overall market momentum during that period.

Key Takeaways

- The Global Furfural Market is projected to grow from USD 576.2 million in 2023 to approximately USD 1,012.6 million by 2033, at a CAGR of 5.8% during the forecast period 2023–2033.

- The Chinese batch process dominates production, accounting for about 80.3% of global furfural revenue.

- Corncob is the primary raw material, holding over 68.5% market share in 2023 because of its high furfural yield and wide availability.

- Furfuryl alcohol is the leading application, representing more than 82.1% of total furfural demand.

- Asia Pacific region dominated the global furfural market, accounting for over 72.3% market share in 2023.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 576.2 Million |

| Forecast Revenue (2033) | USD 1,012.6 Million |

| CAGR (2024-2033) | 5.8% |

| Segments Covered | By Process (Chinese Batch Process, Quaker Batch Process, and Rosenlew Continuous Process), By Raw Material (Sugarcane bagasse, Corn cob, Rice husk, and Sunflower hull), By Application(Furfuryl Alcohol, Solvent, Intermediate, Others), By End-use (Pharmaceuticals, Agriculture, Food & Beverage, Paints & Coatings, and Refineries) |

| Competitive Landscape | Central Romana Corporation, ILLOVO SUGAR AFRICA (PTY) LTD, KRBL Ltd., LENZING AG, Pennakem, LLC, Hongye Holding Group Corporation Limited, Silvateam SpA, Tanin d.d., TransFurans Chemicals bvba, Xingtai Chunlei Furfuryl Alcohol Co. Ltd (hebeichem), Zibo Xinye Chemical Co. Ltd, Arcoy Industries Pvt. Ltd., GoodRich Sugar, Zibo Huaao Chemical, Tieling North Furfural (Group) Co. Ltd. |

Key Market Segments

Process Analysis

The global furfural market is segmented by process into Quaker batch, Chinese batch, Rosenlew continuous, and other Chinese batch variations. The Chinese batch process dominated, accounting for approximately 80.3% of global revenue. This process forms the backbone of China’s furfural manufacturing industry due to its low capital cost and operational flexibility.

While the Quaker batch process is the oldest method, most modern systems are modified versions designed to improve efficiency. A key difference between the Rosenlew continuous process and the Quaker batch process lies in catalyst usage—Rosenlew relies on sulfuric acid, whereas the Quaker process does not require it.

The Rosenlew continuous process is known for its simplicity, reliability, and low maintenance needs. It is less suitable for small and medium-sized producers because it consumes large amounts of steam and delivers relatively low yields, resulting in higher production costs. Manufacturers, especially in China, continue to favor the cost-effective Chinese batch process.

Raw Material Analysis

Based on raw materials, the global furfural market is segmented into corncob and sugarcane bagasse. In 2023, the corncob segment led the market, capturing over 68.5% share. Corncobs remain the preferred feedstock due to their high furfural yield and wide availability. Their efficiency makes them the most economical choice for producers, supporting their continued dominance in the coming years. In addition, corncobs can also be used as biomass feedstock for renewable energy generation, further enhancing their value.

Sugarcane bagasse is another important raw material, primarily sourced as a byproduct of sugar processing. It is widely available at low cost in sugar mills and distilleries, particularly in Brazil, India, China, Thailand, and Pakistan. However, bagasse storage is complex and costly, requiring furfural units to be located close to sugar mills. While gas-fired boilers can increase bagasse availability, logistical challenges limit its broader adoption.

Application Analysis

Furfuryl Alcohol dominated the furfural market, accounting for over 82.1% of total demand. It is extensively used in the production of resins, foundry sand binders, and corrosion-resistant materials. Strong demand from the automotive, construction, and electronics industries continues to drive growth due to its durability and versatility.

Solvents represent another important application, particularly in paints, coatings, and cleaning products. Their strong dissolving properties support consistent demand across manufacturing and construction sectors. Intermediates play a critical supporting role, serving as building blocks for chemicals used in pharmaceuticals and agrochemicals. Although less visible, they are essential to downstream chemical production.

End-Use Analysis

The Furfural Market is segmented into refineries, agriculture, paints & coatings, pharmaceuticals, and food & beverages. In 2023, refineries held a dominant revenue share of over 48.9%. This dominance is driven by furfural’s extensive use as a selective solvent in petroleum refining, specialty lubricants, and adhesive formulations.

In agriculture, furfural is widely applied as an insecticide, nematicide, fungicide, and weed control agent, often used at low concentrations with minimal environmental impact. Furfural is also used as a pharmaceutical intermediate, supporting the synthesis of key drug components. It is listed in the Drug Products Database as an active ingredient in veterinary medicines. Rising healthcare investments and expanding pharmaceutical production are expected to further increase demand across medical and agrochemical applications.

Regional Analysis

The Asia Pacific region dominated the global furfural market, accounting for over 72.3% market share in 2023. This leadership is supported by strong production capacity across the region, particularly in China, along with rising demand from key end-use sectors such as agriculture, food & beverages, pharmaceuticals, and petroleum refining.

The chemical and foundry industries. China remained the largest contributor within the region in 2023, supported by high consumption of furfuryl alcohol and growing domestic production capacity. The market structure in China is highly fragmented, with a large number of small-scale producers operating across agricultural and industrial hubs.

Corncobs are widely used as the primary feedstock in China due to their high yield and cost efficiency, while the Chinese batch process remains the preferred production method. As a result, China accounts for over 81.1% of global furfural production, reinforcing its strategic position in the global supply chain.

In Europe, market growth has been supported by steady expansion in the pharmaceutical and food industries over the past decade. Furfural production in the region is concentrated in countries such as Austria, Slovenia, and Italy, with additional volumes imported from other regional suppliers.

Top Use Cases

- Selective solvent in oil refining: Furfural is widely used in solvent extraction units to clean up petroleum streams. Refineries use it to pull out unwanted aromatic and unstable compounds from lubricating oil cuts, which improves viscosity stability and oxidation resistance. This helps produce better base oils for engine oils, industrial lubricants, and specialty lube formulations.

- Building block for foundry resins: A major industrial use of furfural is as a feedstock to make furfuryl alcohol, which then goes into furan resins. These resins are popular binders for foundry sand molds and cores because they handle heat well and give strong, precise cast shapes. They also support fast production cycles in metal casting.

- Intermediate for pharma and agrochemicals: Furfural is a versatile chemical intermediate that can be converted into several higher-value molecules, such as furoic acid and furfurylamine-type derivatives used in synthesis pathways. Because it is reactive and easy to functionalize, it supports routes used by manufacturers of pharmaceutical intermediates, crop-protection chemistry, and other fine-chemical applications needing furan-based structures.

- Route to green solvents and specialty chemicals: Furfural is used to produce downstream solvents like tetrahydrofurfuryl alcohol and furan-based solvent systems. These materials are valued for strong solvency, good wetting behavior, and usefulness in coatings, inks, cleaners, and specialty formulations. For suppliers, this pathway links biomass-derived furfural to performance solvents that can replace harsher petro-based options.

- Flavor and aroma ingredient in foods: In controlled, low-use applications, furfural is used as a flavoring ingredient that adds warm, baked, nutty, or caramel-like notes. It can support flavor profiles in bakery-style products, beverages, and cooked or roasted taste systems. It helps recreate familiar “heated sugar” and “toasted” sensory cues in formulated foods.

Recent Developments

1. Central Romana Corporation

- Central Romana, a major Dominican sugar producer, has expanded its focus to furfural derived from bagasse. Recent developments highlight its commitment to circular economy principles, utilizing this agricultural by-product for chemical production. This supports both waste valorization and diversification within its biorefinery operations. Their annual sustainability reports detail progress in by-product utilization.

2. ILLOVO SUGAR AFRICA (PTY) LTD

- Illovo Sugar Africa, part of the Associated British Foods group, actively researches furfural production from sugarcane bagasse and maize residues. Recent developments are integrated into its broader biorefinery strategy to enhance value from waste streams. The company’s focus is on developing sustainable biochemical platforms, with technical insights often shared through its parent company’s sustainability and R&D channels.

3. KRBL Ltd.

- KRBL, primarily known for rice, produces furfural from rice husk—a major by-product of its milling operations. Recent developments involve process optimization to increase yield and purity for the export market. The company emphasizes sustainable processing, turning agricultural waste into a valuable chemical for industries like pharmaceuticals and resins, aligning with its circular economy initiatives.

4. LENZING AG

- Lenzing, a leader in bio-based fibers, explores furfural as a potential bio-based feedstock within its circular TENCEL model. Recent R&D focuses on converting wood-derived hemicellulose from pulp production into value-added chemicals like furfural. This work is part of its “Naturally Positive” strategy to maximize resource efficiency and develop new sustainable material streams beyond fibers.

5. Pennakem, LLC

- Pennakem, a Minova Solutions company, is a key global supplier of furfural and derivatives like furfuryl alcohol. Recent developments center on securing sustainable, non-food biomass sources and promoting furan chemistry for green solvents and resins. The company actively markets furfural’s role in producing renewable alternatives to petroleum-based chemicals, emphasizing its ECO³ product line.

Conclusion

Furfural is a practical, multi-industry platform chemical because it can act both as a working solvent and as a stepping-stone to many downstream products. Demand tends to track refining activity, foundry output, and growth in bio-based intermediates. Commercially, its value is strongest where buyers need reliable performance and flexible chemistry from a renewable-linked feedstock.