Quick Navigation

Overview

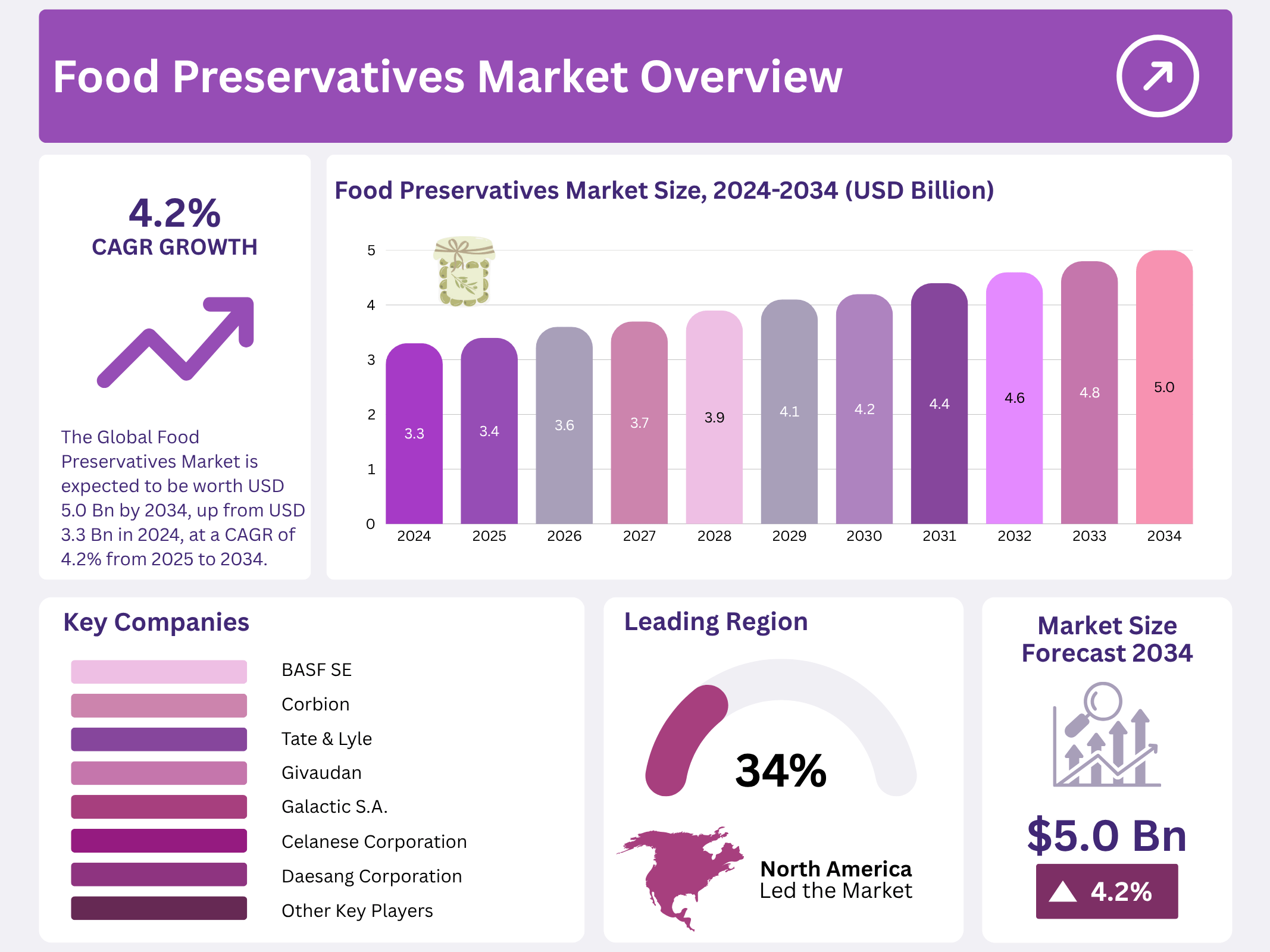

New York, NY – November 12, 2025 – The Global Food Preservatives Market is projected to reach USD 5.0 billion by 2034, rising from USD 3.3 billion in 2024, growing at a CAGR of 4.2% from 2025 to 2034. North America leads with a 34.3% share, reflecting its high usage in packaged and processed food products. Food preservatives—both natural, such as salt, sugar, and vinegar, and synthetic, like sorbates and benzoates—play a crucial role in extending shelf life, preventing microbial spoilage, and ensuring food safety across bakery, dairy, meat, and ready-to-eat segments.

The market represents the global trade and application of natural and chemical agents used to preserve food quality and freshness. It is influenced by consumer preferences for clean-label ingredients, evolving food safety regulations, and technological advances in food processing. Growing urbanization and busy lifestyles have boosted reliance on convenience and packaged food, driving the demand for preservatives that maintain product stability during storage and transportation. Moreover, efforts to reduce food waste and ensure longer shelf life are fueling steady adoption across both industrial and artisanal production.

The sector is also witnessing notable investments and innovation in natural preservation solutions. For instance, Health-first food startup Troovy raised Rs 20 crore to develop safe, nutrient-rich products, while Chinova Bioworks secured USD 6 million to advance its clean-label preservative technology. Such developments reflect a global shift toward sustainable, health-conscious, and transparent food systems, ensuring growth opportunities for both established manufacturers and emerging biotech innovators in the food preservatives market.

Key Takeaways

- The Global Food Preservatives Market is expected to be worth around USD 5.0 billion by 2034, up from USD 3.3 billion in 2024, and grow at a CAGR of 4.2% from 2025 to 2034.

- In the food preservatives market, synthetic preservatives accounted for a 72.2% share due to cost-effectiveness.

- Powder form dominated the market with a 63.4% share, offering easy mixing and a longer shelf life.

- Antimicrobials held a 68.7% share, driven by their strong role in preventing bacterial and fungal contamination.

- The food segment led application use with a 59.3% share, reflecting growing packaged food and safety needs.

- Strong demand for packaged foods boosted North America’s USD 1.1 Bn market value.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.3 Billion |

| Forecast Revenue (2034) | USD 5.0 Billion |

| CAGR (2025-2034) | 4.2% |

| Segments Covered | By Type (Natural (Salt, Sugar, Vinegar, Edible Oil, Rosemary Extracts, Natamycin, Others), Synthetic (Propionates, Sorbates, Benzoates, Others)), By Form (Powder, Liquid), By Function (Antimicrobials, Antioxidants, Others), By Application (Food (Bakery and Confectionery, Dairy and Dairy Products, Meat, Poultry, and Seafood, Animal Feed and Pet Food, Savory and Snacks, Others), Beverage (Carbonated Soft Drinks, Fruit Beverages, Sports Drinks, Alcoholic Beverages, Others)) |

| Competitive Landscape | Cargill, Incorporated, BASF SE, Archer Daniels Midland Company, Kerry Group, Kemin Industries, Inc., Tate & Lyle, Corbion, International Flavors & Fragrances Inc., Givaudan, Celanese Corporation, Galactic S.A., Daesang Corporation, KWANGIL CO., LTD. CO., LTD., Ingredion Incorporated, Stepan Company, Other Key Players |

Key Market Segments

By Type Analysis

Synthetic preservatives command the market with a 72.2% global share.

In 2024, the Synthetic segment dominated the By Type category of the Food Preservatives Market, capturing 72.2% of the share. Food manufacturers continue to favor synthetics for their reliable, cost-effective performance in preserving product quality. Key compounds—benzoates, sorbates, and nitrites—excel at inhibiting bacteria and fungi, extending shelf life across diverse processed foods.

Regulatory approvals in most countries permit controlled use under strict safety guidelines. Synthetics deliver potent preservation at minimal doses, keeping costs low while ensuring scalability and uniformity. Though natural alternatives gain attention, synthetics remain the go-to for high-risk categories like meats, baked goods, and beverages, where microbial control is non-negotiable.

By Form Analysis

Powdered preservatives dominate with 63.4%, valued for versatility and efficiency.

In 2024, the Powder segment led the By Form category, holding 63.4% of the market. Its widespread adoption stems from superior handling, dosing precision, and stability in transit and storage. Powders dissolve and disperse evenly, integrating seamlessly into dry blends, seasonings, and processed items. They align with automated production systems, requiring no special equipment. Their resistance to degradation guarantees sustained antimicrobial or antioxidant activity. Economically, powders reduce shipping costs through compact, lightweight packaging—an advantage in global logistics.

By Function Analysis

Antimicrobial agents lead with 68.7%, essential for spoilage prevention.

In 2024, the Antimicrobials segment captured 68.7% of the By Function market, underscoring their vital role in blocking bacteria, yeasts, and molds—the main culprits behind spoilage and foodborne illness. These agents provide dependable safety over extended storage and distribution, especially in meats, dairy, and bakery products. They comply with regulations without compromising taste or texture. Rising demand for packaged and ready-to-eat foods amplifies their importance, making antimicrobials the foundation of modern preservation strategies worldwide.

By Application Analysis

Food applications hold 59.3%, fueled by packaged and processed goods.

In 2024, the Food segment dominated the By Application category with 59.3%, encompassing baked goods, dairy, confectionery, and ready meals, where freshness and safety are paramount. Preservatives curb spoilage and contamination throughout supply chains, ensuring consistency in high-volume production. They minimize waste, support inventory control, and meet global safety standards—critical as food networks expand internationally.

Regional Analysis

North America leads with 34.3% share, valued at USD 1.1 Bn.

In 2024, North America commanded 34.3% of the global Food Preservatives Market, generating USD 1.1 billion. Demand surges from packaged, frozen, and convenience foods, bolstered by hectic lifestyles, food-safety awareness, and clear regulations. Europe maintains steady growth via mature processing industries and quality-focused consumers. Asia Pacific emerges rapidly, driven by urbanization, expanding production, and shifting diets in India and China. Latin America and the Middle East & Africa adopt preservation technologies amid rising processed-food demand in cities, though their shares lag behind North America.

Top Use Cases

- Extending Shelf Life in Bakery Products: Food preservatives play a key role in bakery items like bread and pastries by stopping mold and yeast growth. This keeps the texture soft and flavor fresh for longer, helping bakers reduce waste and meet demand for convenient snacks. In a busy market, this use case supports steady supply chains, ensuring products reach stores without spoiling quickly and delighting customers with reliable quality every time.

- Preventing Spoilage in Dairy Goods: In cheeses and yogurts, preservatives fight off bacteria and fungi that cause quick souring or off smells. They maintain the creamy taste and smooth feel, making dairy safe for longer storage at home or in shops. This application boosts producer confidence in wider distribution, cutting down on returns and keeping fresh dairy accessible to families everywhere without health worries.

- Protecting Meat and Poultry from Oxidation: Preservatives act as shields in sausages and chicken cuts, blocking air and light that turn meat brown or rancid. They preserve the juicy color and natural taste, vital for ready-to-cook meals. This use helps meat packers handle longer transport routes safely, meeting the rise in grab-and-go proteins while ensuring every bite stays appealing and trustworthy for everyday eaters.

- Inhibiting Microbial Growth in Beverages: For juices and soft drinks, preservatives halt yeast and bacteria that lead to fizz loss or cloudiness over time. They keep the crisp, fruity notes intact, ideal for shelf-stable bottles. This case aids bottlers in serving remote areas without quality dips, aligning with trends for portable hydration options that stay vibrant and enjoyable from factory to fridge.

- Maintaining Freshness in Snacks and Confectionery: In chips and candies, preservatives curb oil breakdown and bug invasions, holding crunch and sweetness steady. They prevent sticky messes or stale bites, perfect for impulse buys. This supports snack makers in creating fun, long-lasting treats that fit active lifestyles, minimizing toss-outs and keeping variety high on store aisles for quick consumer picks.

Recent Developments

1. Cargill, Incorporated

Cargill is expanding its portfolio of natural preservation solutions, focusing on vinegar and cultured celery powders to replace synthetic options. A key development is their investment in fermentation capabilities to produce bio-preservatives like lactics, enabling cleaner labels in meat and poultry. They are also leveraging their global supply chain to ensure consistent availability of these natural alternatives for manufacturers seeking to meet clean-label demand.

2. BASF SE

BASF is advancing natural antioxidant solutions to combat food spoilage. Their recent focus includes expanding the production and application scope of plant-derived vitamin E (tocopherols). They emphasize sustainability by offering mass balance-certified ingredients, allowing customers to reduce the carbon footprint of their products. BASF’s research also explores synergistic blends of tocopherols with rosemary extracts to provide high-performance, natural preservation for oils and fatty products.

3. Archer Daniels Midland Company (ADM)

ADM is strengthening its position through acquisitions, such as Flavor Infusion International, to enhance its natural preservation systems. They are developing integrated solutions that combine plant-based extracts, antioxidants, and fermentation-derived ingredients. A key initiative is their Clean & Simple portfolio, which includes acerola-based vitamin C blends and rosemary extracts, helping brands remove artificial preservatives while maintaining shelf life and food safety.

4. Kerry Group

Kerry is a leader in developing bio-protective cultures for natural preservation, especially in dairy and meat. Their recent developments include new shelf-life extension solutions for plant-based products, which are particularly susceptible to spoilage. Kerry’s SureShield portfolio combines cultured sugar, vinegar, and botanical extracts to inhibit mold and yeast growth, allowing for significant reductions or complete removal of chemical preservatives like sorbates and benzoates.

5. Kemin Industries, Inc.

Kemin continues to innovate with its proprietary rosemary extracts under the FORTIUM brand for oxidation control. A key recent development is their Neo series of extracts, designed to offer superior water solubility and efficacy in a wider range of applications, including dressings and beverages. Kemin also heavily invests in research to validate the efficacy of its natural preservatives in challenging matrices, providing data-driven solutions to formulators.

Conclusion

Food Preservatives as a cornerstone of modern eating, quietly enabling the fresh, safe foods we rely on daily. With shoppers craving easy, healthy options, the shift to natural choices like plant extracts is reshaping how we protect flavors and nutrients without harm. This evolution promises less waste and bolder tastes ahead, blending old wisdom with smart innovation to feed a world on the move.