Quick Navigation

Overview

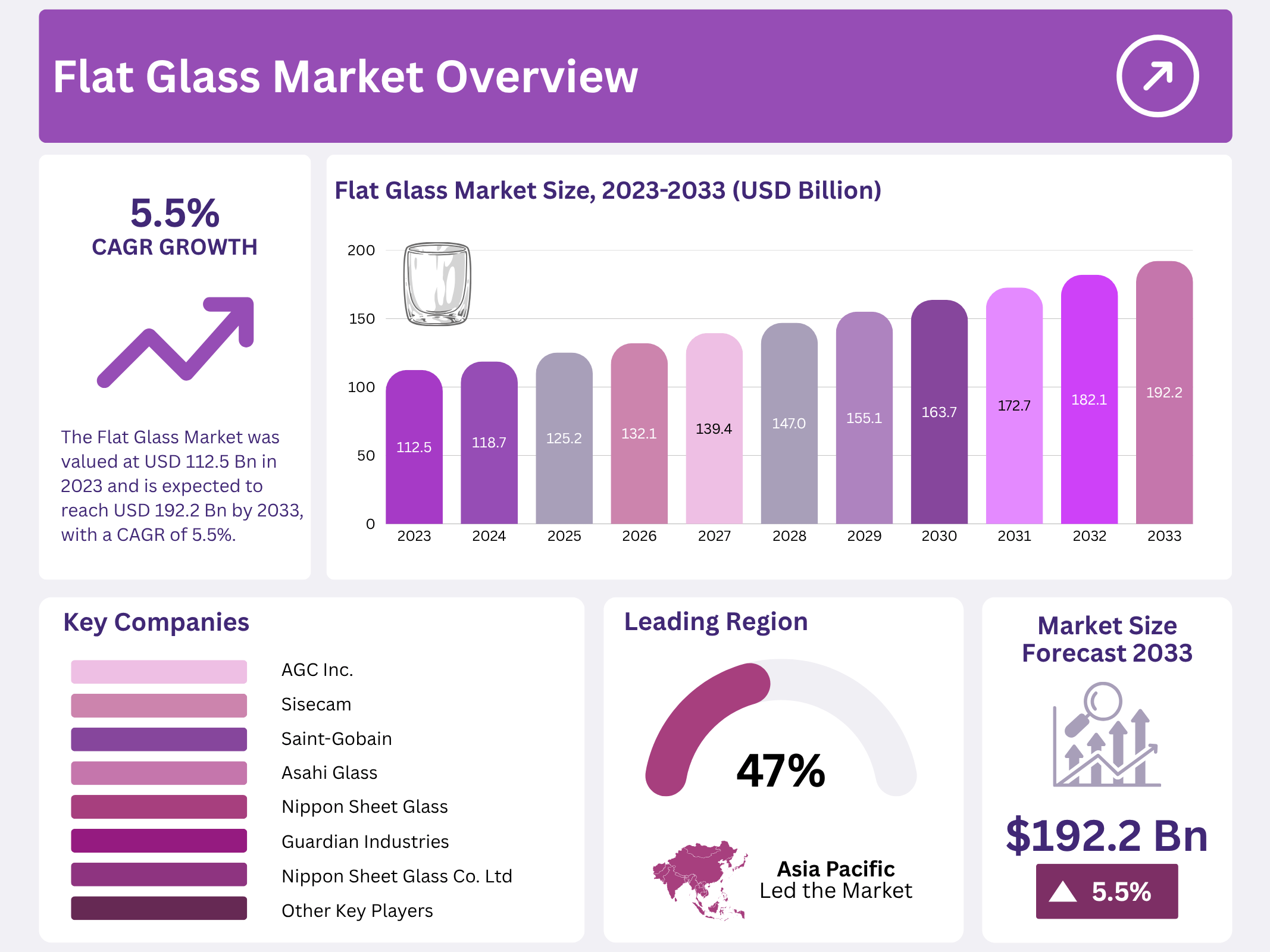

New York, NY – November 20, 2025 – The Flat Glass Market is set for steady expansion, projected to reach USD 192.2 billion by 2033, up from USD 112.5 billion in 2023, with a 5.5% CAGR from 2024 to 2033. Flat glass serves key sectors such as construction, automotive, and solar energy, produced through processes like floating, rolling, and drawing. Its usage spans windows, facades, windshields, and photovoltaic panels, reflecting its importance across multiple industries.

A major growth driver is the strong momentum in the global construction sector. The U.S. construction market alone reached USD 1.6 trillion, accounting for 4.3% of national GDP, underscoring its influence on economic activity and material demand. Residential construction saw a notable upswing, with 1,337,800 new housing units built, a 4% rise from 2020, demonstrating sustained demand for living spaces and associated building materials like flat glass.

As urban development accelerates and construction standards evolve, demand for flat glass continues to rise, especially for energy-efficient and smart building solutions. Market participants stand to benefit by investing in sustainable production methods, recycling technologies, and advanced performance glass. With trends shifting toward eco-friendly construction and high-performance materials, the flat glass market is positioned for a significant long-term opportunity.

Key Takeaways

- The Flat Glass Market was valued at USD 112.5 billion in 2023 and is expected to reach USD 192.2 billion by 2033, with a CAGR of 5.5%.

- Toughened Glass dominated with 36.3%; it is critical for safety and durability in various applications.

- Sheet technology led with 42.8%; it is preferred due to its versatility and cost-effectiveness in production.

- Building & Construction held 40.5%; it is a major consumer of flat glass due to urbanization and infrastructure growth.

- APAC dominated with 47.8%; its significance is driven by rapid industrialization and construction activities in the region.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 112.5 Billion |

| Forecast Revenue (2033) | USD 192.2 Billion |

| CAGR (2024-2033) | 5.5% |

| Segments Covered | By Product Type (Toughened Glass, Laminated Glass, Coated Glass, Extra Clear Glass, Others), By Technology (Sheet, Float, Rolled), By Application (Building & Construction, Automotive, Solar Glass, Others) |

| Competitive Landscape | Asahi Glass, Nippon Sheet Glass, Guardian Industries, Saint-Gobain, AGC Inc., Cardinal Glass Industries Inc., Nippon Sheet Glass Co. Ltd, China Glass Holdings Limited, Fuyao Glass Industry Group Co., Ltd., Guardian Industries, Sisecam, Other Key Players |

Key Market Segments

Product Analysis

Toughened (tempered) glass commands the largest share of the flat glass market at 36.3%, owing to its exceptional mechanical strength and safety characteristics. Produced through a controlled thermal tempering process, toughened glass is approximately four times stronger than annealed glass and, when broken, fractures into small, blunt pieces rather than sharp shards. This inherent safety feature makes it the material of choice in applications where human safety and impact resistance are critical.

In the construction sector, toughened glass is extensively used in windows, doors, curtain walls, balustrades, and partitions—particularly in high-rise buildings and public spaces. The global shift toward sleek, glass-intensive modern architecture, combined with increasingly strict building codes that mandate safety glass in high-risk areas, continues to fuel its dominance. The automotive industry also contributes significantly, relying on toughened glass for side and rear windows due to regulatory safety standards.

Technology Analysis

Sheet Glass Technology Dominates with 42.8% Share, Powered by Cost-Effectiveness and Scalability. From a technology perspective, the sheet glass segment (primarily the float process and drawn sheet methods) holds the leading position with 42.8% of the market. The float glass process—in which molten glass is floated on a bed of molten tin to produce uniform, high-quality sheets—remains the most cost-effective and scalable method for mass production.

Its affordability, consistent optical quality, and ease of further processing (cutting, tempering, laminating, coating) make sheet glass the backbone of the industry. Rapid urbanization and infrastructure expansion, especially in emerging markets across Asia-Pacific and Latin America, have created massive demand for economical glazing solutions. Sheet glass perfectly matches these needs, serving as the primary raw material for windows, mirrors, and basic architectural applications where advanced performance is not required.

Application Analysis

Building & Construction Segment Captures 40.5% Share, Fueled by Urbanization and Energy-Efficiency Mandates

The building and construction sector remains the largest end-use application, accounting for 40.5% of global flat glass consumption. Flat glass is indispensable in modern construction for windows, façades, roofing, interior partitions, and structural glazing systems that define contemporary architectural aesthetics. Demand is propelled by ongoing urbanization, population growth, and large-scale infrastructure projects worldwide.

Equally important is the rising focus on green building standards and energy efficiency. Advanced flat glass products—such as low-emissivity (Low-E) coatings, double- and triple-glazed insulating units, and solar-control glass—play a pivotal role in reducing building energy consumption for heating and cooling. Stricter energy-performance regulations in Europe, North America, and parts of Asia, along with voluntary green certification programs (LEED, BREEAM, etc.), continue to drive adoption of these high-performance glazing solutions, solidifying construction as the dominant application segment.

Regional Analysis

Asia-Pacific Commands 47.8% Global Market Share, Powered by Unmatched Construction and Industrial Expansion

Asia-Pacific (APAC) solidly leads the global flat glass market with a dominant 47.8% share, propelled by explosive urbanization, large-scale infrastructure development, and vigorous industrial growth. India’s construction market is projected to reach USD 640 billion. These mega-economies, alongside fast-growing nations such as Indonesia, Vietnam, and Bangladesh, are driving unprecedented demand for residential, commercial, and public infrastructure projects, all heavily reliant on flat glass.

The region’s booming automotive industry further amplifies consumption, with China remaining the world’s largest vehicle producer and India rapidly climbing the ranks. A burgeoning middle class and a population exceeding 4.5 billion continue to fuel housing and commercial building needs, while government-led mega-projects, high-speed rail networks, airports, smart cities, and industrial parks create sustained, multi-year demand.

Increasing regulatory focus on energy efficiency and green building standards is accelerating the adoption of advanced glazing solutions, including low-E glass, double glazing, and solar-control products. National initiatives such as China’s carbon neutrality goals and India’s Smart Cities Mission are channeling significant investment into high-performance, sustainable flat glass technologies.

Top Use Cases

- Architectural Glazing: Flat glass brings modern buildings to life by creating stunning windows, sleek facades, and open interior partitions that let in natural light. Its clear, smooth surface enhances aesthetic appeal while offering thermal insulation to keep spaces comfortable. Builders love it for easy installation and customization, making everyday structures feel brighter and more inviting for residents and workers alike.

- Automotive Windshields and Windows: In cars and trucks, flat glass forms safe, durable windshields and side windows that protect drivers from wind and debris. Toughened versions shatter into harmless pieces during crashes, boosting safety. As vehicles grow smarter with features like heads-up displays, this glass supports clear visibility and lightweight designs for better fuel efficiency.

- Solar Panel Covers: Flat glass shields solar panels from the weather while allowing sunlight to generate clean energy efficiently. Its anti-reflective coatings maximize light capture, helping homes and farms harness renewable power. With the push for green tech, this use helps cut energy bills and supports eco-friendly living without compromising on strength or clarity.

- Furniture and Decor Elements: Flat glass adds a touch of elegance to tables, shelves, and display cases in homes and stores. Polished edges and tempered strength make it ideal for heavy-use items that resist scratches and breaks. Designers use it to blend functionality with style, creating airy, modern spaces that feel spacious and contemporary.

Recent Developments

1. Asahi Glass (AGC Inc.)

AGC is aggressively developing eco-friendly glass products. Recent launches include “Fluon+ ETFE,” a durable, lightweight fluoropolymer film for façades, and advancements in low-emissivity (Low-E) glass for energy-efficient buildings. They are also integrating glass components for the global semiconductor market, emphasizing thermal stability and purity. A significant focus remains on reducing the carbon footprint of their manufacturing processes through innovative furnace technologies and increased use of recycled materials.

2. Nippon Sheet Glass (NSG Group)

NSG Group, under the Pilkington brand, is expanding its product range for automotive and architectural glass. A key development is the production of larger, high-quality glass substrates for the growing OLED display market. In architecture, they are promoting “Pilkington Activ,” a self-cleaning glass, and enhancing their solar control glass range to help buildings achieve better energy ratings and occupant comfort in varying climates.

3. Guardian Industries

Guardian Glass has been investing in new production lines and technology upgrades, such as their “Sputter Coating” process in Europe, to enhance the performance of coated glass products. They are launching new solar control and acoustic glass solutions for the architectural sector. A major strategic development is their increased focus on the residential segment in North America, offering a broader range of high-performance, coated glass products directly to homeowners and builders.

4. Saint-Gobain

Saint-Gobain is a leader in sustainable construction, recently launching “COOL-LITE XTREME,” an advanced solar control glass. They are heavily investing in decarbonization, aiming for carbon neutrality, with projects like a new furnace in Norway running on over 50% renewable electricity. Their acquisition of French startup “Glassdome” also highlights a push into smart glass that dynamically controls light and heat, integrating with building management systems.

5. AGC Inc.

AGC (recently unified under this brand from Asahi Glass) is pioneering in multiple fields. They are developing “anti-fogging” glass for automotive cameras and sensors essential for ADAS. In architecture, they offer the “FireLite” series of fire-resistant glass. A significant recent move is their strategic partnership to supply large-sized, high-performance glass for next-generation televisions and high-end monitors, focusing on the premium display market.

Conclusion

Flat Glass as a cornerstone material shaping our built world, blending timeless reliability with fresh innovations. Urban growth worldwide fuels its role in crafting energy-smart homes and offices that save resources and welcome light. The shift toward greener living amplifies demand for advanced types that insulate better and support solar power, while the rise of electric cars calls for lighter, safer sheets.