Quick Navigation

Overview

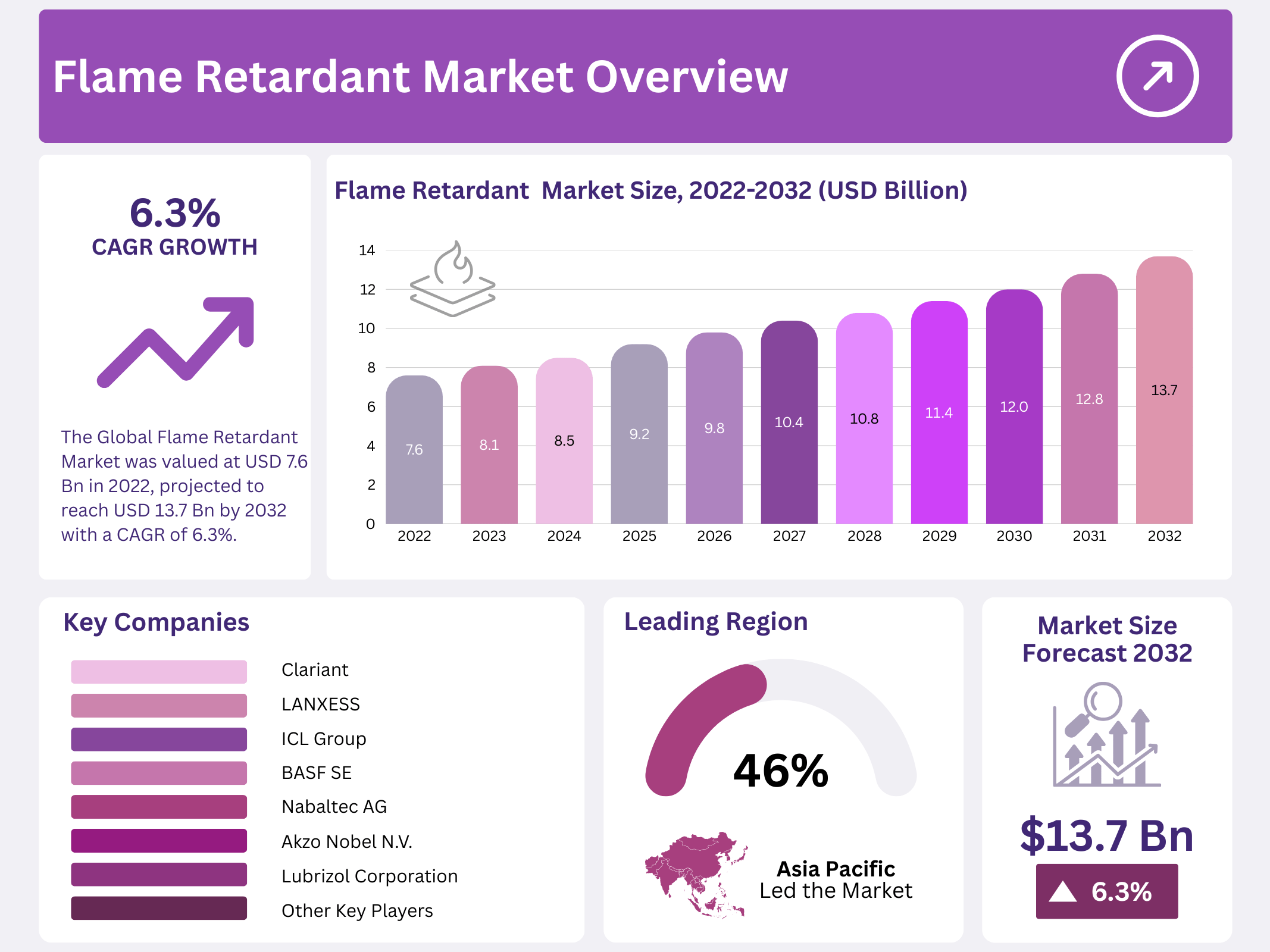

New York, NY – December 08, 2025 – The Global Flame Retardant Market was valued at USD 7.6 billion in 2022 and is projected to reach USD 13.7 billion by 2032, expanding at a CAGR of 6.3% from 2023 to 2032. Flame retardants are chemical additives added to combustible materials such as textiles, plastics, and coatings to prevent or slow the spread of fire. These chemicals include a wide range of compounds with different molecular structures and performance characteristics, designed to improve fire resistance across multiple applications.

Flame retardants are introduced during the polymerization stage either as additives mixed into materials or as reactive components integrated into the polymer structure. They are widely used in products such as foams, mattresses, electronic devices, electric wires, insulation materials, and automotive components. Organohalogen and organophosphorus compounds can act as either additives or reactive flame retardants, while mineral-based flame retardants are mainly used as additives due to their stability and cost-effectiveness.

Market growth is strongly supported by strict government fire safety regulations and standards across major industries. Sectors such as construction, transportation, electrical and electronics, and consumer goods increasingly rely on flame-retardant materials to meet safety compliance requirements. Rising consumer awareness about household and workplace fire safety is also boosting demand, as flame retardants help reduce fire risks in modern electrical appliances and everyday consumer products.

Key Takeaways

- The Global Flame Retardant Market was valued at USD 7.6 Bn in 2022, projected to reach USD 13.7 Bn by 2032 with a CAGR of 6.3%.

- Non-halogenated flame retardants dominated in 2022, capturing over 59% of total market revenue due to environmental and health advantages.

- The polyolefins segment led with 26.3% revenue share in 2022, widely used in construction, automotive, and aerospace applications.

- Electrical & electronics was the top end-use segment, contributing 38.1% of revenue in 2022, driven by safety needs in device housings.

- Asia Pacific held the largest share 46% in 2022 and is expected to grow fastest, fueled by construction, automotive, and electronics demand, plus strict fire regulations.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 7.6 Billion |

| Forecast Revenue (2032) | USD 13.7 Billion |

| CAGR (2023-2032) | 6.3% |

| Segments Covered | Based on Type: Halogenated (Brominated, Chlorinated Phosphates, Antimony Trioxide, and Others) and Non-Halogenated (Aluminum Hydroxide, Magnesium Dihydroxide, and Phosphorus Based); Based on Application: Polyolefins, Epoxy Resins, UPE (Unsaturated Polyester), PVC (Polyvinyl Chloride), ETP (Engineering Thermoplastics), Styrenics, and Other Applications; Based on End-User: Construction, Transportation, Electrical & Electronics, and Other End-Users |

| Competitive Landscape | Clariant, ICL Group, LANXESS, Lubrizol Corporation, BASF SE, Albemarle Corporation, Akzo Nobel N.V., Nabaltec AG, Italmatch Chemicals S.p.A., Kisuma Chemicals, Huber Engineered Materials, and Other Key Players |

Key Market Segments

By Type Analysis

In 2022, non-halogenated flame retardants held more than 59% of total market revenue. This growth reflects rising demand for products that are safer for people and have a lower impact on the environment. Industries are gradually moving away from traditional halogen-based chemicals due to health and environmental concerns. As regulations become stricter, non-halogen alternatives are increasingly preferred across multiple applications.

Antimony trioxide combined with brominated organic compounds has long been used in molding compounds to improve fire resistance. However, these formulations are known to pose environmental risks. To address this, manufacturers are increasingly blending antimony trioxide with hydromagnesite fillers, which also deliver flame-retardant properties while reducing overall environmental harm. Growing awareness of antimony trioxide’s effects is expected to accelerate the shift toward safer and more sustainable flame-retardant solutions in the coming years.

By Application Analysis

The polyolefins segment dominated the market in 2022, accounting for a 26.3% revenue share. This dominance is driven by the widespread use of polyolefins in plastic products, where flame retardants help limit flame spread, reduce dripping, and control smoke formation. These materials are commonly used in construction fabrics, roofing, siding, mattress covers, carpet backing, automotive components, and parts used in rail and aerospace applications.

Polyvinyl chloride (PVC) is another major polymer due to its natural resistance to ignition. It is widely used in insulation, communication cables, doors, window frames, and exterior construction products. However, PVC releases dense smoke and toxic gases under fire conditions, raising safety concerns. To improve performance, PVC formulations are stabilized and modified with impact modifiers and processing aids, enhancing flame resistance while maintaining usability.

Epoxy resins are also gaining traction because of their high fire resistance and mechanical strength. They are widely used in construction, civil engineering, aerospace, rail, and marine applications. Flame-retardant epoxy systems often include additives such as fillers, curing agents, and accelerators, supporting compliance with strict fire safety standards across multiple industries.

By End-User Analysis

The electrical and electronics segment led the market in 2022, accounting for 38.1% of revenue. This strong position is driven by the extensive use of flame retardants in plastic housings for electrical devices, where fire safety and consumer protection are critical.

Construction followed as the second-largest end-use segment, contributing 28.1% of total revenue. Growth in infrastructure projects and rising awareness of fire safety in buildings are key factors supporting demand. Additionally, the rapid expansion of the transportation and automotive sectors is increasing the need for fire-resistant materials.

Regional Analysis

Asia Pacific is projected to record the fastest growth rate from 2022 to 2032 and led the global market with a revenue share of over 46% in 2022. This strong position is supported by high demand from key end-use industries such as construction, automotive, and electrical and electronics, along with the implementation of strict fire safety regulations across the region.

The region also hosts a large share of global flame-retardant production facilities, with China and India playing a dominant role. Market expansion is further supported by increasing awareness of safety standards and ongoing infrastructure development in emerging economies, including India, China, and Japan. Rapid urbanization and industrial growth continue to fuel long-term demand.

North America is primarily driven by rising demand for electrical components used in power cables, wiring, and connectors across construction, transportation, and electronic applications. The United States leads the regional market, followed by Canada, due to large-scale manufacturing activity and steady growth in the electrical and electronics, automotive, and construction sectors.

In the United States, expanding automotive and construction industries are closely linked to increased investments in electric vehicles and private construction projects. These trends are strengthening demand for flame-retardant materials designed to meet modern fire safety and performance requirements.

Top Use Cases

- Electronics and Appliances: Flame retardants are added to plastics and coatings in devices like computers, phones, and TVs to prevent electrical sparks from causing fires. This keeps users safe by slowing fire spread and giving more time to escape or shut down equipment, especially in homes and offices where gadgets are everywhere.

- Building and Construction: In walls, insulation, and wiring, these materials help stop fires from spreading quickly through structures like homes and offices. They protect lives and property by meeting safety rules, allowing firefighters extra time to respond while reducing smoke and heat buildup in crowded buildings.

- Automotive and Transportation: Cars, trains, and planes use flame retardants in seats, dashboards, and cables to handle crashes or electrical faults without igniting. This boosts passenger safety on the road or in the air, cutting risks from fuel or battery fires and supporting stricter vehicle fire standards worldwide.

- Furnishings and Textiles: Sofas, curtains, carpets, and work uniforms get treated with these chemicals to resist open flames from candles or sparks. They limit fire growth in homes or factories, helping families and workers avoid burns and smoke inhalation during everyday accidents or emergencies.

- Protective Gear for Firefighters: Special fabrics in suits and gloves incorporate flame retardants to shield against direct heat and flames during rescues. This gear lets heroes stay in hot zones longer, saving more lives without quick clothing burnout, and meets tough standards for comfort and breathability in tough jobs.

Recent Developments

1. Clariant

Clariant launched its Exolit OP 1400 series, halogen-free flame retardants for epoxy resins in e-mobility and electronics. These products offer high efficiency with low dosage, enhancing sustainability. The development supports stricter fire safety standards and meets demand for eco-friendly solutions in growing markets like electric vehicle batteries.

2. ICL Group

ICL introduced EcoFlam NR, a bio-based, halogen-free flame retardant for polyamide textiles. Derived from renewable feedstocks, it reduces environmental impact while maintaining performance. This aligns with ICL’s sustainability goals and responds to regulations restricting halogenated retardants in consumer goods.

3. LANXESS

LANXESS expanded its Emerald Innovation 3000 range with a polymeric brominated flame retardant for expanded polystyrene (EPS) insulation. It provides long-term thermal stability and fire safety, targeting the construction industry’s need for energy-efficient, safe materials.

4. Lubrizol Corporation

Lubrizol developed its latest Estane TPU grades with inherently flame-retardant properties, eliminating the need for additives. These materials target wire and cable applications, offering improved safety, flexibility, and durability for automotive and industrial markets.

5. BASF SE

BASF launched Flamestab NOR 116, a halogen-free solution for polyolefin films in agriculture and construction. It provides long-term UV stability and fire protection, addressing demand for durable, sustainable materials that meet high safety standards.

Conclusion

Flame Retardants are a cornerstone of modern safety, quietly woven into everyday items to shield us from fire’s hidden dangers. With growing worries about urban fires and gadget overloads, these smart additives are evolving toward greener options that dodge health pitfalls while keeping performance strong. Expect a boom in demand as builders, makers, and regulators team up for safer worlds—proving that a little prevention truly sparks big protection for communities everywhere.