Quick Navigation

Introduction

The global fitness tracker market is witnessing accelerated expansion as consumers increasingly adopt wearable technology to monitor health. Additionally, rising digital health trends continue to influence buyer behavior. Moreover, manufacturers are rapidly innovating to meet evolving user expectations. Consequently, the market is positioned for sustained long-term growth.

The increasing integration of smart features into fitness devices is transforming how users track wellness. Furthermore, seamless connectivity with smartphones enhances overall usability. Likewise, greater accuracy in biometric data strengthens consumer trust. Therefore, demand for technologically advanced trackers continues to surge across regions.

At the same time, growing awareness of chronic disease prevention is encouraging individuals to use wearables proactively. Besides, governments and healthcare systems are promoting digital monitoring as part of preventive care. Similarly, younger demographics are driving adoption due to lifestyle preferences. As a result, fitness trackers have become mainstream health tools.

In addition, affordability of entry-level devices is widening market reach worldwide. Similarly, online distribution channels are making products easily accessible. Meanwhile, emerging markets show rising interest due to increasing urbanization. Thus, the global industry is benefiting from broad demographic appeal and rapidly improving technologies.

Overall, the fitness tracker market continues evolving as innovation reshapes functionality. Moreover, enhanced data accuracy and AI-based analytics elevate product value. Also, collaborations with healthcare and corporate wellness ecosystems strengthen adoption. Consequently, the industry is forecast to experience robust expansion through 2033.

Key Takeaways

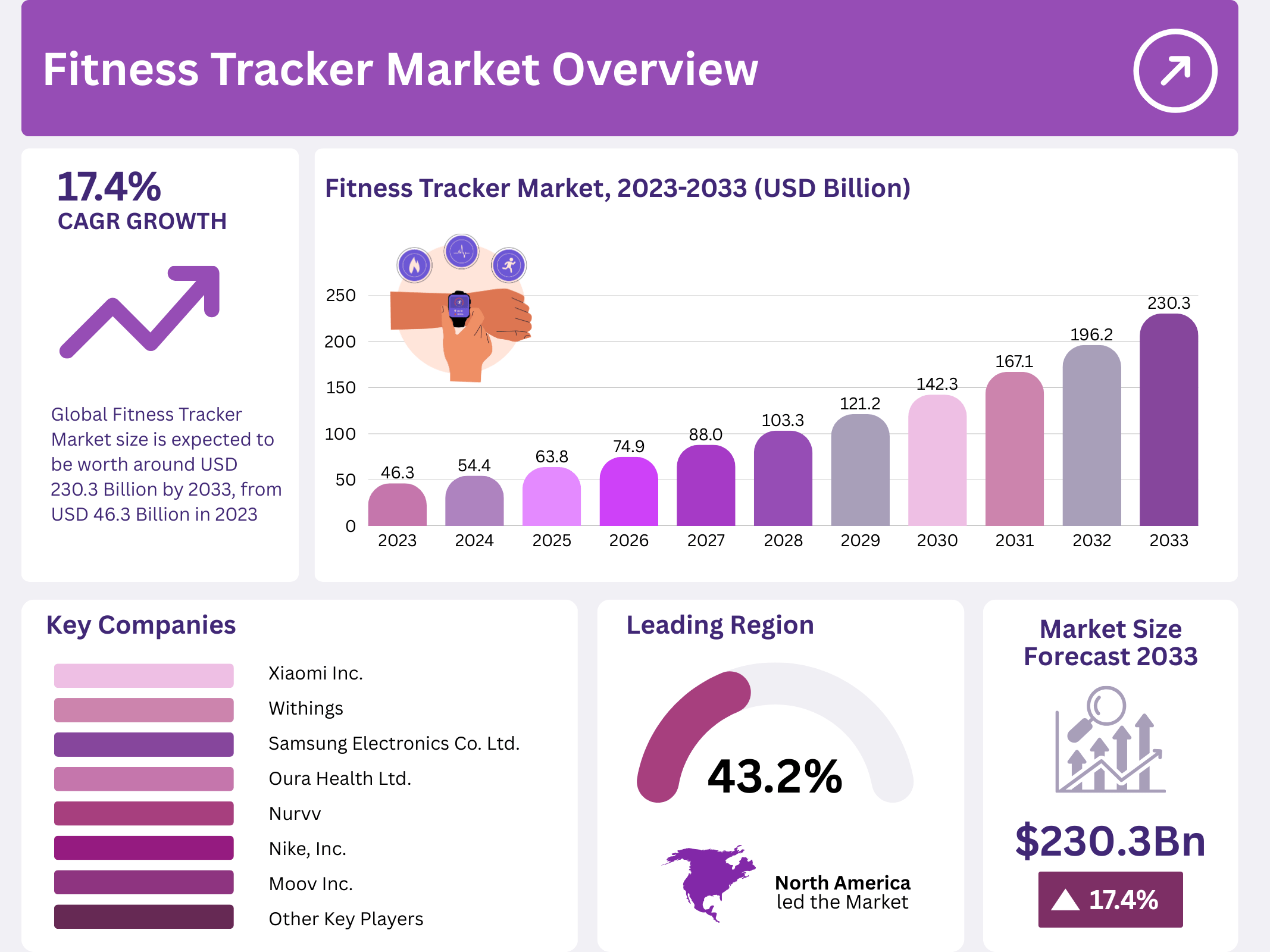

- The Global Fitness Tracker Market size is expected to be worth around USD 230.3 Billion by 2033, from USD 46.3 Billion in 2023, growing at a CAGR of 17.4% from 2024 to 2033.

- In 2023, Smart Watches held a dominant market position with a 49.3% share.

- In 2023, Running Tracking led the application segment with a 23.5% share.

- In 2023, Online distribution held a commanding 65.2% share.

- North America dominated with a 43.2% market share and USD 20.0 Billion revenue in 2023.

Market Segmentation Overview

By Type

Smart Watches dominated the segment in 2023 due to advanced features such as heart rate monitoring, GPS, and smartphone synchronization. Additionally, consumers prefer multifunctional wearables that combine convenience and performance.

Smart Bands remained popular for being cost-effective and user-friendly. Furthermore, Smart Clothing gained traction as biometric textiles evolved. The Others category reflected niche innovations contributing to market diversity.

By Application

Running Tracking led the market with a strong focus on step count, distance metrics, and route mapping. Moreover, the popularity of running among global consumers elevated demand for performance-oriented wearables.

Heart Rate and Sleep Monitoring followed closely as health-conscious users sought holistic wellness insights. Additionally, categories such as Glucose and Cycling Tracking addressed specialized needs across diverse user groups.

By Distribution Channel

Online channels commanded the majority share due to convenience, competitive pricing, and broader product availability. Furthermore, digital platforms empowered consumers with detailed comparisons and reviews.

Offline stores remained relevant as they enabled hands-on product testing and guided consultations. As a result, traditional retail continued supporting buyers seeking personalized service.

Drivers

Rising health awareness and lifestyle monitoring: Growing global focus on wellness is driving fitness tracker adoption as consumers proactively monitor activity, heart rate, and sleep patterns. Increased cases of obesity and chronic diseases also motivate users to rely on wearables for daily health management.

Technological advancements and smart integration: Enhanced sensor accuracy, AI-driven analytics, and IoT connectivity significantly improve device performance. Seamless integration with smartphones and health apps further elevates user engagement and supports long-term market growth.

Use Cases

Personal wellness and preventive care: Fitness trackers assist users in monitoring vital metrics, encouraging healthier habits, and reducing long-term health risks. Consumers utilize insights to modify exercise routines, sleep cycles, and nutrition plans for holistic well-being.

Chronic disease management: Healthcare providers increasingly incorporate trackers into patient care programs. Continuous monitoring of heart rate, glucose, and activity supports early intervention, improving outcomes for individuals with conditions like diabetes or cardiovascular disorders.

Major Challenges

Data security and privacy concerns: As trackers collect sensitive health information, users remain cautious about data storage and sharing practices. High-profile breaches in related industries intensify hesitation, creating adoption barriers.

Rapid technological obsolescence: Continuous innovation shortens product lifecycles. Consumers may delay purchases fearing newer models will quickly replace existing devices, affecting upgrade rates and market growth.

Business Opportunities

Integration with healthcare and insurance ecosystems: Partnerships with medical institutions, insurers, and corporate wellness programs present major expansion avenues. Fitness trackers can support preventive health initiatives and incentivized wellness plans.

Growth in emerging markets: Rising disposable incomes, urbanization, and an expanding tech-savvy population create substantial opportunities in Asia Pacific, Latin America, and Africa. Affordable devices are particularly positioned to benefit.

Regional Analysis

North America leads due to high health awareness: Strong consumer demand, advanced digital infrastructure, and established brands contribute to regional dominance. Integration of trackers in corporate and insurance wellness programs enhances adoption further.

Asia Pacific experiences rapid expansion: Urban lifestyles, growing incomes, and an increasing population of young users fuel demand. Countries like China and India are emerging as major hubs for manufacturing and consumption.

Recent Developments

- In July 2023, Moov Inc. secured USD 5 million to advance AI-powered fitness devices offering real-time motion-based coaching.

- In March 2023, Nike collaborated with Apple to launch a fitness tracker designed for athletes seeking advanced performance analytics.

- In January 2023, Nurvv released upgraded smart insoles providing biomechanical running insights to improve technique and reduce injury risks.

Conclusion

The global fitness tracker market continues gaining momentum as technology, health awareness, and preventive care converge. With rising adoption across consumer and medical ecosystems, the industry is positioned for substantial long-term growth. Advancements in AI, sensors, and smart connectivity will further enhance device capabilities, solidifying fitness trackers as essential health companions worldwide.