Quick Navigation

Overview

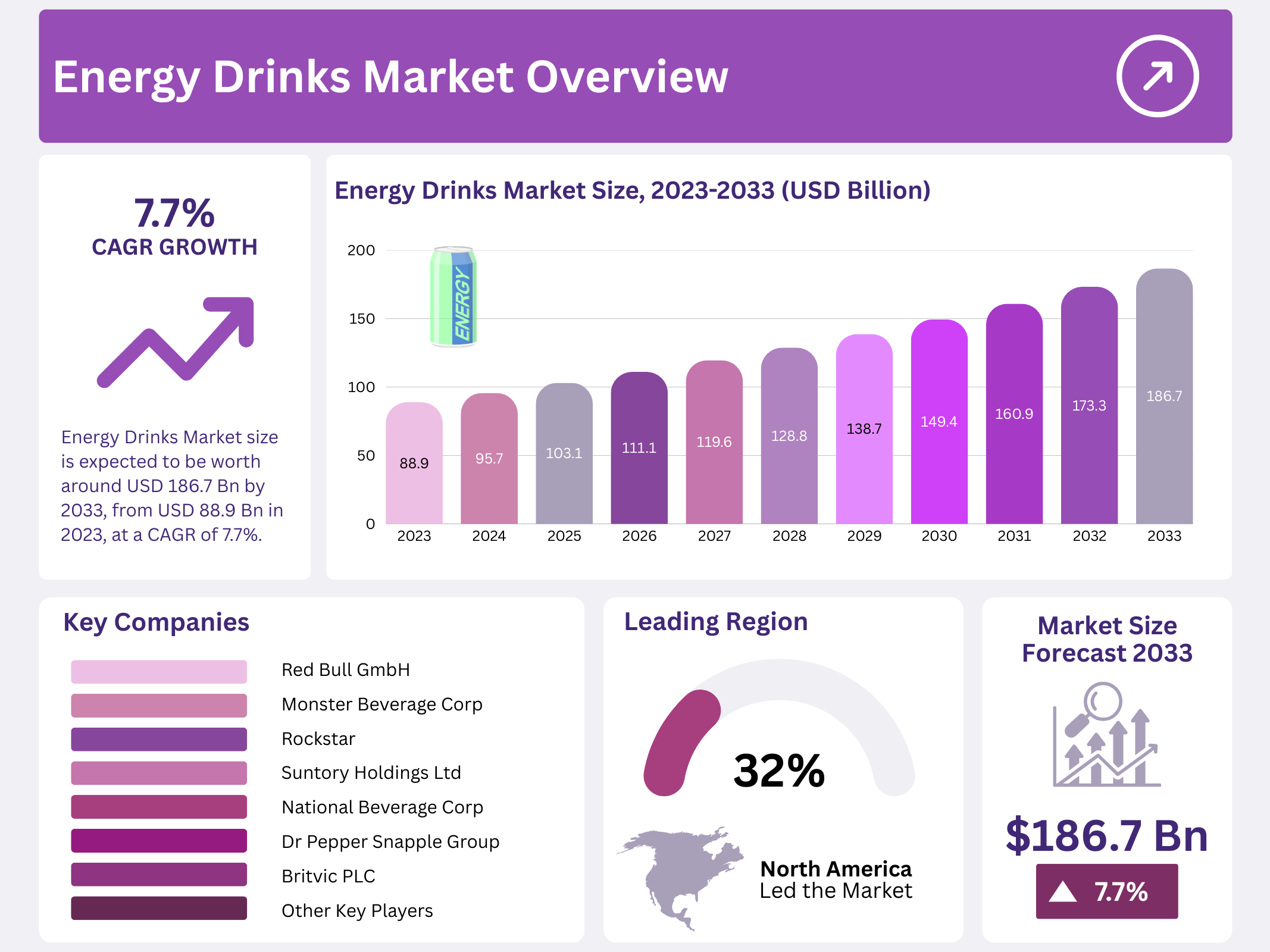

New York, NY – September 03, 2025 – The Global Energy Drinks Market is projected to reach USD 186.7 billion by 2033, up from USD 88.9 billion in 2023, registering a CAGR of 7.7% between 2023 and 2033. Growth is driven by rising consumer demand for beverages that boost both physical and cognitive performance. With increasing preference for sugar-free options over drinks containing glucose or high fructose corn syrup, companies are positioning energy drinks as functional beverages designed to enhance alertness and provide a physical energy lift.

In Australia, energy drinks fall under Food Standards Australia New Zealand (FSANZ) regulations, which limit caffeine content to 80 mg per 250 ml. This restriction, comparable to a standard cup of coffee, ensures consumer safety by preventing excessive intake. Health Canada has set a maximum of 180 mg of caffeine per single-serving can and 400 mg per liter for larger containers. These measures aim to protect sensitive groups such as children and pregnant women from the risks of high caffeine consumption.

From January 1, 2024, Poland will prohibit the sale of energy drinks containing caffeine or taurine to individuals under 18 years of age. Products must display clear labeling about their high caffeine content, with penalties for violations reaching up to 200,000 zloty (€44,677). Retailers selling to minors may face fines of 2,000 zloty (€447). This initiative reflects growing concerns over youth health.

In the UK, the government has committed £289 million to the Industrial Energy Transformation Fund (IETF), supporting energy-intensive sectors, including beverage production. As part of this initiative, Britvic Soft Drinks received £4.4 million to install heat recovery systems at its manufacturing facility, aligning with broader goals to decarbonize operations and improve competitiveness.

Key Takeaways

- The Global Energy Drinks Market is projected to reach USD 186.7 billion by 2033, growing at a CAGR of 7.7% from USD 88.9 billion in 2023.

- Cans held over 44.8% revenue share in 2023, favored for portability, while bottling is expected to grow due to aluminum shortages.

- Conventional energy drinks dominated with a 50.9% revenue share in 2023, but organic drinks are expected to grow faster, driven by health-conscious consumers.

- Off-trade channels contributed to 68.9% of total revenue in 2023, as consumers prefer evaluating quality, brands, and ingredients.

- North America led in revenue share in 2023, with over 32.3% 2023 driven by increased disposable income, local brand promotion, and marketing activities.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 88.9 Billion |

| Forecast Revenue (2033) | USD 186.7 Billion |

| CAGR (2024-2033) | 7.7% |

| Segments Covered | By Product(Drinks, Shots, Mixers), By Packaging(Cans, Bottles), By Type(Conventional, Organic), By Distribution channel(On-trade, Off-trade) |

| Competitive Landscape | Red Bull GmbH, Monster Beverage Corp, Rockstar, TC Pharmaceutical Industry Co Ltd, Shenzhen Eastroc Beverage Co Ltd, Fujian Dali Food Co Ltd, Suntory Holdings Ltd, National Beverage Corp, Dr Pepper Snapple Group, Living Essentials Marketing LLC, Vital Pharmaceuticals Inc, Britvic PLC, Other Key Players |

Key Market Segments

Product Overview

In 2023, energy drinks held a commanding 48.6% market share, driven by their high caffeine content and stimulating effects, which boost energy and focus.

- Drinks Segment: This category led revenue generation in 2023 and is expected to maintain dominance through 2032. Consumers favor energy drinks for their instant hydration and nutritional benefits, appealing to health-conscious individuals. Their diverse flavors and formulations attract a broad consumer base.

- Mixers Segment: Forecasted to grow significantly, mixers are gaining traction for their role in crafting premium cocktails and alcoholic beverages. Brands are introducing innovative flavors to attract new customers. Mixing alcohol with caffeinated beverages like energy drinks or cola can reduce alcohol’s negative effects compared to consuming it alone, further boosting demand.

Packaging Insights

- Cans: In 2023, cans captured a 44.8% revenue share and are projected to maintain their lead. Their portability, durability, and appeal to younger consumers make them a preferred choice over fragile glass bottles. The closure of bars and restaurants during the coronavirus pandemic significantly increased canned energy drink sales, a trend expected to persist.

- Bottles: This segment is anticipated to see the second-highest growth rate through 2032. Plastic bottles popularized the ready-to-drink concept, while aluminum shortages in countries like the U.S. have driven a shift to glass bottles in some markets.

Type Analysis

- Conventional Drinks: Dominating with a 50.9% revenue share in 2023, conventional energy drinks are expected to lead due to their affordability and widespread availability. Limited consumer awareness of organic alternatives supports this segment’s growth.

- Organic Drinks: Expected to grow at a faster CAGR through 2032, organic energy drinks are gaining popularity among health-conscious consumers for their perceived higher nutrient and antioxidant content. However, higher costs and lower awareness currently limit their market penetration.

Distribution Channels

- Off-Trade: Accounting for 68.9% of revenue in 2023, off-trade channels like hypermarkets, supermarkets, and pharmacies (e.g., Walmart, Walgreens, CVS, Kroger, Safeway) dominate due to their large customer bases and extensive product offerings. Consumers prioritize quality, brand, and ingredients, driving sales through these channels.

- On-Trade: Expected to grow rapidly through 2032, the on-trade segment benefits from the increasing availability of bars offering diverse energy drink options, fueling product sales.

Regional Analysis

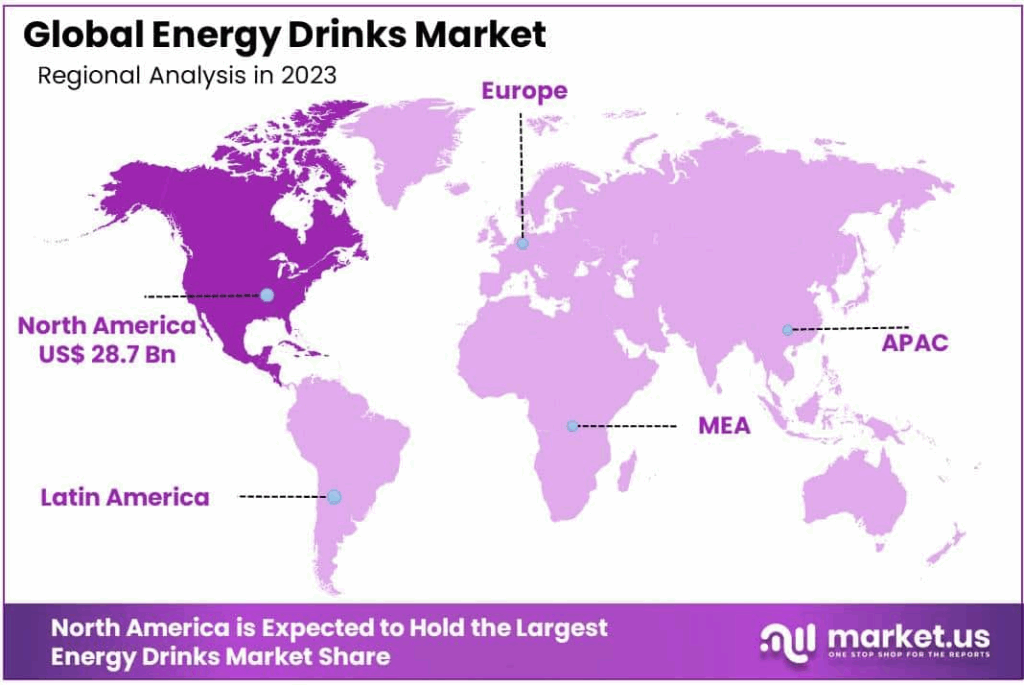

North America leads with a 32.3% share and a USD 28.7 Billion market value.

In 2023, North America led with a 32.3% revenue share in the energy drinks market. Growth is driven by rising disposable incomes, the emergence of local brands, and robust marketing efforts. Changing demographics, globalization, and evolving consumer preferences have made North America the largest consumer of energy drinks globally. These factors have prompted key market players to diversify their portfolios with a wide range of beverage options.

Projected to be the fastest-growing region from 2023 to 2032, the Asia Pacific is experiencing strong demand, particularly in China, India, and Japan. Consumers’ openness to new flavors and the influence of immigrant populations seeking diverse beverages are key drivers. Frequent product launches tailored to regional tastes further fuel market expansion.

Top Use Cases

- Boosting Athletic Performance: Energy drinks are popular among athletes for a quick energy surge during workouts or competitions. Packed with caffeine and ingredients like taurine, they enhance stamina and focus. Young adults and fitness enthusiasts consume them before or during exercise to push physical limits, making them a go-to for sports and gym activities.

- Enhancing Mental Alertness: Students and professionals use energy drinks to stay sharp during long study sessions or work hours. The caffeine and vitamins help improve concentration and reduce mental fatigue. These drinks are especially popular among teens and young adults needing a quick boost for exams or demanding tasks.

- Supporting Social and Nightlife Activities: Energy drinks are a favorite in social settings like parties or clubs. Often mixed with alcohol, they create energizing cocktails that keep consumers active. Their vibrant packaging and bold flavors appeal to younger crowds, driving demand in bars and social events.

- Aiding Esports and Gaming: Gamers, especially in competitive esports, rely on energy drinks for sustained focus and reaction speed. Brands target this growing market with specialized formulas, offering mental clarity and energy for long gaming sessions. This trend is strong among young males aged 18-34.

- Promoting Health-Conscious Lifestyles: Organic and sugar-free energy drinks are gaining traction among health-focused consumers. With natural ingredients like green tea or stevia, these drinks appeal to those seeking hydration and energy without artificial additives. They cater to active lifestyles, especially among millennials, prioritizing wellness.

Recent Developments

1. Red Bull GmbH

- Red Bull continues to dominate through extreme sports marketing and F1, but faces significant headwinds. An ongoing Austrian investigation into alleged improper commercial practices has created market uncertainty. Concurrently, the brand is expanding its organics line with a new Juneberry edition, aiming to capture the growing demand for slightly alternative energy options within its iconic portfolio.

2. Monster Beverage Corp

- Monster is aggressively expanding its product portfolio beyond traditional energy drinks. A key recent development is the nationwide rollout of The Beast Unleashed, a flavored malt beverage that leverages brand recognition to compete in the alcohol segment. This move diversifies revenue streams and directly challenges competitors like Boston Beer Company and Constellation Brands in the hard soda and seltzer space.

3. Rockstar

- Following its full acquisition by PepsiCo in 2020, Rockstar’s strategy is now tightly integrated with its parent’s distribution. Recent efforts focus on a brand refresh and international market expansion, particularly in Europe, leveraging PepsiCo’s massive network. The focus is on competing directly with Monster and Red Bull by improving shelf presence and introducing new flavors to revitalize the brand under its new ownership.

4. TC Pharmaceutical Industry Co Ltd

- The core recent development for TC Pharmaceutical is its ongoing global legal dispute with Red Bull GmbH over trademark rights. This conflict, concerning the original Thai formula’s international distribution, continues to create a parallel Red Bull brand in certain markets. The company remains focused on its stronghold in Asia while navigating these complex intellectual property challenges.

5. Shenzhen Eastroc Beverage Co Ltd

- As a major Chinese player, Eastroc is capitalizing on the domestic functional beverage boom. Its strategy involves heavy investment in R&D for new products like sugar-free and herbal-based energy drinks tailored to local tastes. The company is also expanding its manufacturing capacity and distribution network within China to solidify its market position against international giants and local competitors.

Conclusion

The Energy Drinks Market is growing fast, driven by people wanting quick energy boosts and better mental focus. Younger consumers, like teenagers and young adults, are the main buyers, but the market is also reaching new groups with healthier options like sugar-free and organic drinks. New flavors and ingredients are keeping consumers interested, while online shopping makes these drinks easy to buy. However, concerns about too much caffeine and health risks are pushing brands to create safer, more natural products.