Quick Navigation

Introduction

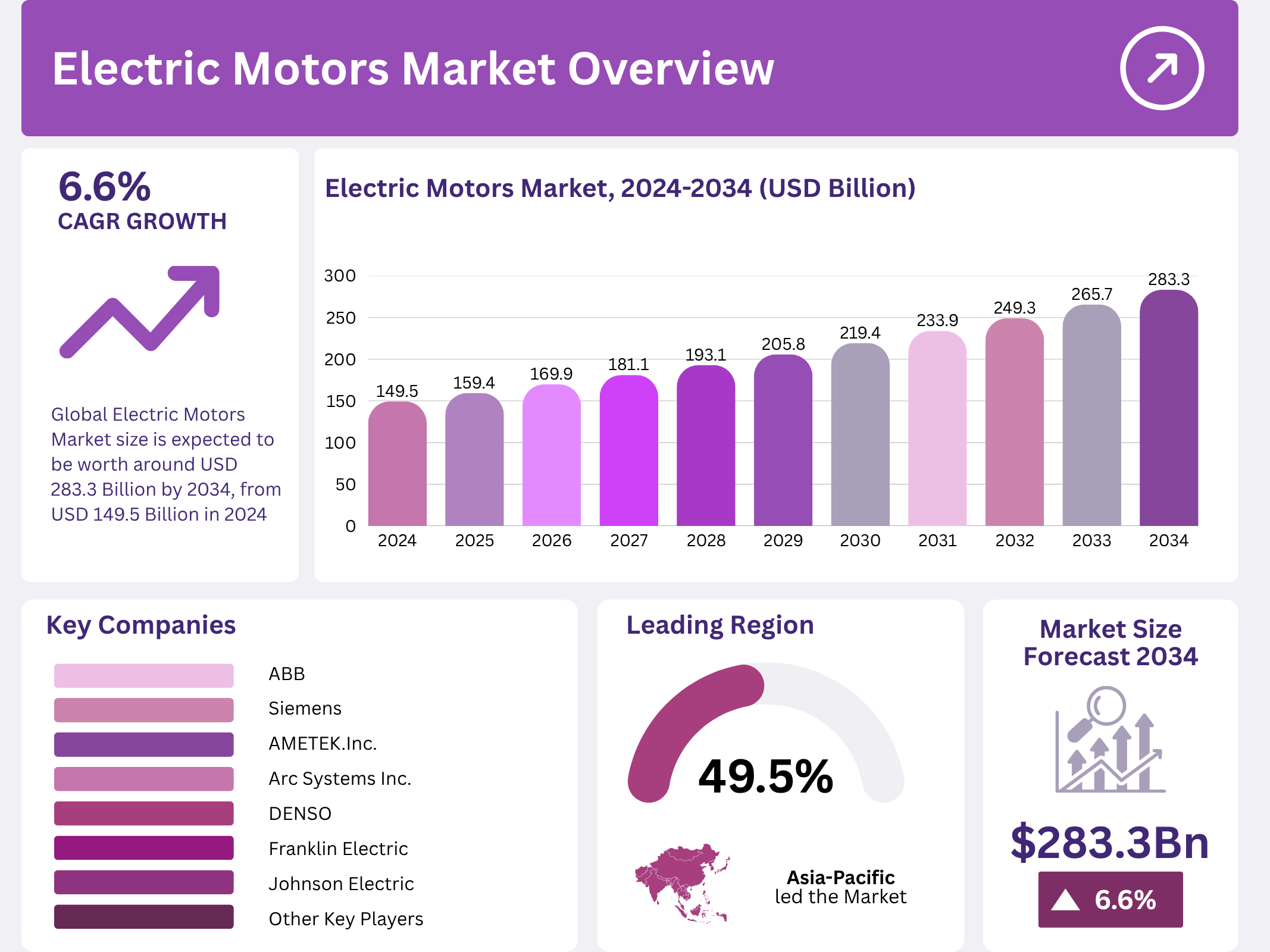

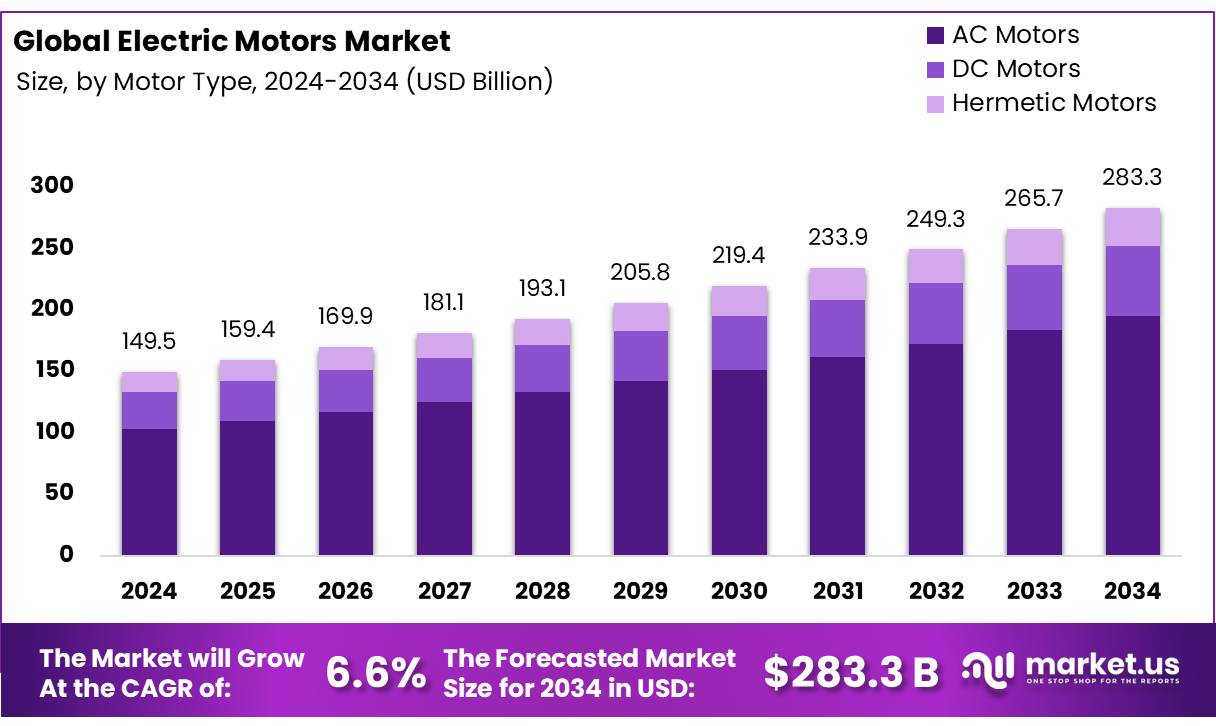

Global demand for high-efficiency motion is accelerating, and the Electric Motors Market is surging in step. Valued at USD 149.5 Billion in 2024, it is projected to reach USD 283.3 Billion by 2034, advancing at a CAGR of 6.6% from 2025 to 2034. As sustainability mandates tighten, adoption quickens.

Moreover, industrial automation, electrified transport, and smarter HVAC are reshaping specifications and procurement. Consequently, AC architectures, fractional horsepower classes, and sub-1-kV systems dominate shipments. Meanwhile, APAC’s manufacturing base anchors nearly half of consumption, while Europe and North America scale via policy-backed efficiency upgrades.

Key Takeaways

- The Global Electric Motors Market is projected to grow from USD 149.5 billion in 2024 to USD 283.3 billion by 2034, with a CAGR of 6.6% during the forecast period 2025 to 2034.

- AC motors lead the market with a 69.3% share, valued for their efficiency, reliability, and versatility across industries like household appliances and industrial machinery.

- Motors with output up to 1 HP hold a 58.2% share, widely used in compact, high-efficiency applications such as household appliances, HVAC systems, and automotive uses.

- Motors operating at up to 1 KV dominate with a 59.3% share, favored for their safety, efficiency, and compatibility with standard electrical systems in commercial and residential settings.

- Industrial machinery accounts for a 39.2% share, relying on electric motors for automation and precision in manufacturing processes like conveyors and assembly lines.

- The industrial sector holds a 48.1% share, driven by demand for robust, high-performance motors in manufacturing, processing, and automation.

- The APAC region commands 49.5% of the global market, valued at USD 73.8 billion, fueled by rapid industrialization and urbanization in countries like China and India.

Market Segmentation Overview

By Motor Type: AC motors maintain leadership at 69.3% share, propelled by reliability, cost efficiency, and easy integration across appliances and plant equipment. Furthermore, variable frequency drives expand precision control, boosting energy efficiency and uptime. Consequently, AC platforms will continue outpacing DC and hermetic peers through heightened automation cycles.

By Power Output: Fractional horsepower (up to 1 HP) motors capture 58.2%, reflecting their compactness, cost-effectiveness, and applicability in HVAC, household appliances, and vehicle subsystems. In addition, miniaturization and smart control enhance duty cycles. Therefore, consumer electronics and space-saving designs keep demand resilient through the forecast period.

By Voltage: Units up to 1 kV hold 59.3% share, given their safety, compatibility with standard grids, and broad applicability across light industrial, commercial, and residential loads. As buildings adopt automation, these motors streamline retrofits and reduce lifecycle costs, while higher-voltage classes (1 kV–6.6 kV, above 6.6 kV) serve heavier assets.

By Application: Industrial machinery leads with 39.2% share, powering conveyors, pumps, fans, and assembly lines. Additionally, precision control and efficiency regulations elevate replacement cycles. Subsequently, motor vehicles, HVAC equipment, and electrical appliances add volume, as OEMs prioritize quieter operation, higher torque density, and predictive maintenance features.

By End-User: The industrial sector represents 48.1%, driven by continuous operations and stringent efficiency targets. Moreover, commercial and residential segments accelerate upgrades for HVAC and appliances. Meanwhile, agriculture and transportation add steady consumption, adopting ruggedized designs and electrified drive systems to improve reliability and reduce emissions.

Drivers

Enhanced energy-efficiency standards: Governments are mandating higher motor efficiencies, compressing timelines for IE3/IE4 adoption and incentivizing variable speed drives. With industrial motors consuming roughly 40% of global electricity—and about 70% of industrial sector electricity in some markets—policy pressure expedites retrofits, lowers OPEX, and shrinks carbon footprints across factories and buildings.

Electrification and automation momentum: EV adoption is climbing toward 25 million units annually by 2025, while industrial automation expands roughly 7% per year. As a result, high-efficiency traction motors, auxiliary vehicle drives, and precision servo systems see sustained demand. This virtuous cycle also stimulates local supply chains and inverter ecosystems.

Use Cases

Smart HVAC and building systems: Variable-speed AC motors in chillers, air handlers, and pumps cut energy use and noise while improving comfort. Integrated IoT analytics can trim operational costs by up to 20%, enabling predictive maintenance and peak-load optimization—vital as HVAC demand rises roughly 15% annually in many emerging markets.

Renewables and distributed energy: Wind and solar value chains require reliable motors for trackers, yaw/pitch systems, cooling, and balance-of-plant equipment. With renewable sectors demanding about 10% more motors annually, manufacturers supplying corrosion-resistant enclosures, higher IP ratings, and smart monitoring capture recurring project and services revenue.

Major Challenges

High upfront costs for premium efficiency: IE3/IE4-class motors and advanced drives can cost 20%–30% more than legacy units, straining SME budgets and lengthening payback horizons. Although lifecycle savings are compelling, procurement constraints and CapEx approval cycles can delay upgrades, especially in cost-sensitive and developing markets.

Supply chain and skills gaps: Volatility in copper, rare-earth materials, and electronics lead times can inflate BOMs and extend delivery. Simultaneously, commissioning and maintenance require upgraded skills in drives, controls, and condition monitoring, challenging end-users without robust training or digital maintenance programs.

Business Opportunities

Smart motors and IoT-enabled services: Embedding sensors and edge analytics unlocks performance transparency, automated tuning, and predictive upkeep—often reducing OPEX by up to 20%. Vendors can monetize through software subscriptions, remote diagnostics, and extended warranties, deepening customer stickiness and enabling outcome-based service contracts.

EV and e-mobility expansion: Beyond traction motors, vehicles incorporate numerous auxiliary motors for steering, braking, pumps, and thermal management. With EV sales scaling and component standardization advancing, suppliers of high-torque-density, low-NVH designs—and integrated inverter solutions—can capture multi-year platform awards and aftermarket revenue streams.

Regional Analysis

APAC leadership: Asia-Pacific commands 49.5% share (~USD 73.8 billion), propelled by rapid industrialization, urban infrastructure buildouts, and expanding automotive output in China and India. Furthermore, competitive manufacturing costs and deep supply ecosystems attract fresh capacity and R&D centers, reinforcing the region’s scale and export competitiveness.

Europe and North America momentum: Policy frameworks, electrification targets, and retrofit incentives drive accelerated replacements with IE3/IE4 motors and VFDs. Additionally, reshoring and energy-security initiatives increase orders for efficient industrial machinery. As factories digitize, demand for connected motors and analytics rises across OEM and MRO channels.

Recent Developments

- 2025: ABB introduced “GMD Copilot,” a digital tool that streamlines operations, maintenance, and troubleshooting for gearless mill drives—enhancing decision-making and automation across mining and metals operations.

- 2024: Allient Inc. rebranded to reflect a broader scope as a technology solutions provider, including precision-controlled motion products such as electric motors, emphasizing integrated motion systems for medical, aerospace, and industrial markets.

Conclusion

The Electric Motors Market is entering a decisive growth phase, scaling from USD 149.5 Billion in 2024 to an expected USD 283.3 Billion by 2034 at a CAGR of 6.6%. With efficiency mandates tightening, EVs accelerating, and automation broadening, leaders that deliver smart, reliable, and cost-efficient motor solutions will capture outsized value.

As APAC’s manufacturing muscle meets Western retrofits, opportunities abound across AC architectures, fractional horsepower classes, and up-to-1-kV systems. By pairing high-efficiency hardware with IoT-enabled services, suppliers can reduce downtime, cut energy bills, and secure enduring partnerships across industrial, commercial, and residential landscapes.