Quick Navigation

Overview

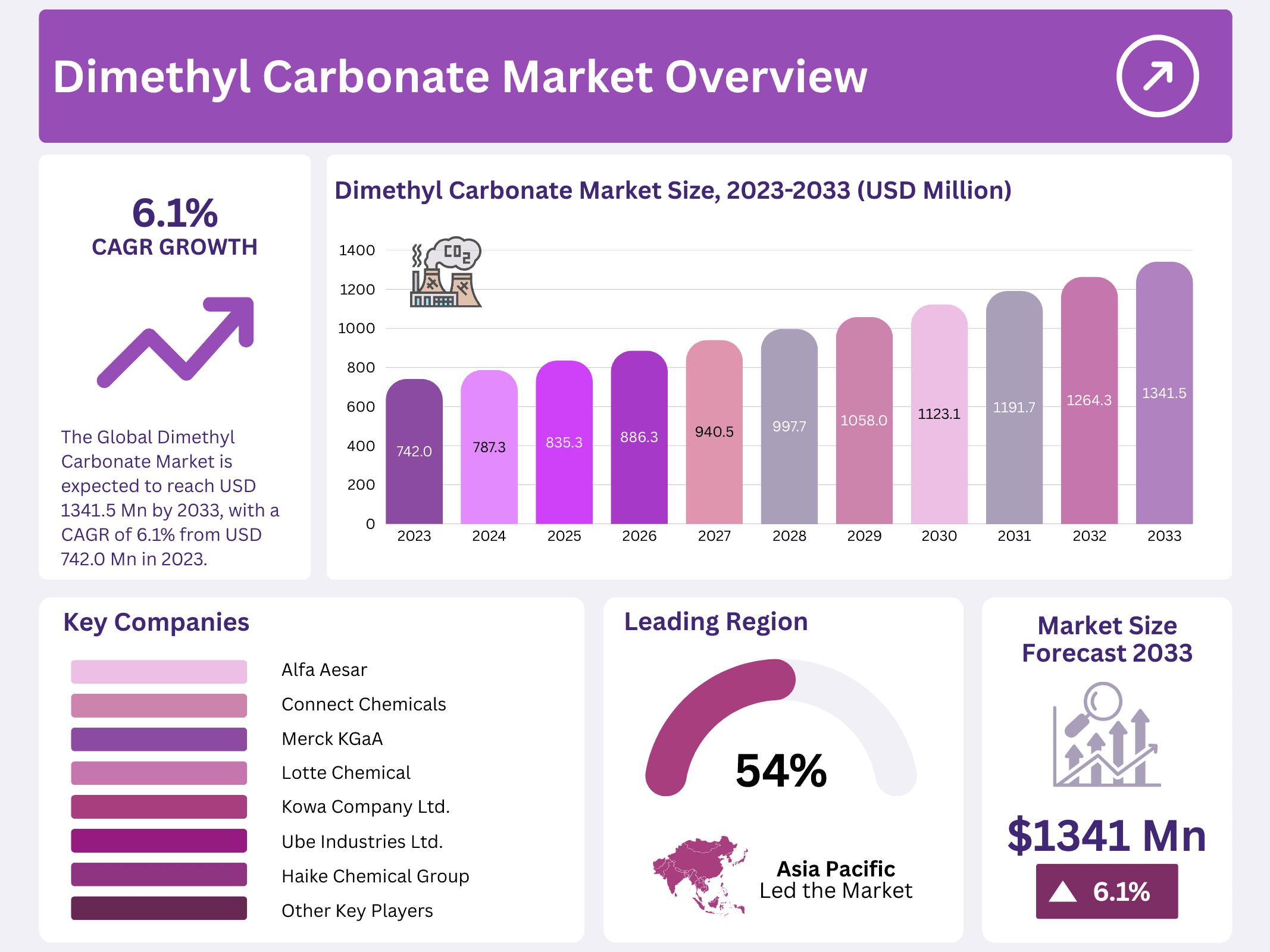

New York, NY – January 19, 2026 – The Global Dimethyl Carbonate (DMC) Market is projected to reach approximately USD 1,341.5 million by 2033, rising from USD 742.0 million in 2023, and expanding at a CAGR of 6.1% between 2023 and 2033. The Dimethyl Carbonate market represents the worldwide ecosystem involved in the manufacturing, distribution, and utilization of DMC—an organic, colorless, and mildly aromatic compound with the formula (CH₃O)₂CO. Known for its low toxicity, excellent solvency, and high versatility, DMC plays an essential role across numerous industries.

The market’s importance is closely linked to its contribution to safer and more sustainable industrial practices. As industries shift toward greener formulations, DMC’s appeal continues to grow due to its eco-friendly profile and compatibility with cleaner manufacturing processes. Market dynamics are shaped by stringent environmental regulations, technological progress in chemical synthesis, and rising demand for biodegradable and low-impact solvents.

With increasing emphasis on innovation and sustainability, the DMC market continues to evolve rapidly. Manufacturers are prioritizing improved production efficiency, exploring new application opportunities, and strengthening compliance with global environmental standards. These efforts position Dimethyl Carbonate as a critical and future-forward component within the global chemical industry.

Key Takeaways

- The Global Dimethyl Carbonate Market is expected to reach USD 1341.5 million by 2033, with a CAGR of 6.1% from USD 742.0 million in 2023.

- Industry Grade DMC captures over 48.9% market share, favored for its solvency and low toxicity in industrial applications.

- Polycarbonate synthesis holds over 45.5% market share, crucial for high-performance polymer production in the automotive and electronics industries.

- Asia Pacific leads with a 54% market share, driven by rapid development and strong demand from countries like China and India.

- The Plastics sector dominates with 36.5% market share, driving demand across the packaging, automotive, and consumer goods industries.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 742.0 Million |

| Forecast Revenue (2033) | USD 1341.5 Million |

| CAGR (2024-2033) | 6.1% |

| Segments Covered | By Grade(Industry Grade, Pharmaceutical Grade, Battery Grade), By Application(Polycarbonate Synthesis, Battery Electrolyte, Solvents, Reagents, Others), By End-use(Plastics, Paints & Coating, Pharmaceutical, Battery, Agrochemicals, Others), By Sales Channel(Direct Sales, Indirect Sales) |

| Competitive Landscape | Alfa Aesar, Connect Chemicals, Dongying Hi-tech Spring Chemical Industry Co., Ltd., Guangzhou Tinci Materials Technology Co., Ltd., Haike Chemical Group, Hebei New Chaoyang Chemical Stock Co., Ltd., Kishida Chemical Co., Ltd., Kowa Company Ltd., Lotte Chemical, Merck KGaA, Shandong Depu Chemical Industry Science and Technology Co., Ltd., Shandong Shida Shenghua Chemical Group Co., Ltd., Tokyo Chemical Industry Co., Ltd, Ube Industries Ltd., Qingdao Aspirit Chemical Co., Ltd. |

Key Market Segments

By Grade

Industry Grade DMC dominated the market with a share exceeding 48.9%. It is widely used as a solvent and reagent in paints, coatings, adhesives, and plastics manufacturing. Its strong market position is driven by excellent solvency, low toxicity, and high compatibility with sustainable industrial processes. The growing emphasis on eco-friendly chemical solutions has significantly boosted demand for Industry Grade DMC, making it a crucial component in greener manufacturing practices.

Pharmaceutical Grade DMC plays a critical role in synthesizing various medicines and in serving as a solvent for drug formulations. Distinguished by its high purity and strict quality specifications, this grade supports the pharmaceutical industry’s ongoing innovations and drug-development activities. With the sector expanding and new therapies emerging, demand for safe, high-purity pharmaceutical-grade DMC continues to accelerate.

Battery Grade DMC is essential in lithium-ion battery production, functioning as an electrolyte component. As electric vehicles (EVs) and portable electronics gain traction, demand for high-performance batteries has surged. Battery-grade DMC, known for its superior purity and electrochemical stability, enhances battery lifespan and efficiency. The global shift toward electrification and renewable energy storage further strengthens its strategic importance in the energy ecosystem.

By Application

Polycarbonate Synthesis led the market, commanding over 45.5% share. As a key input for producing high-strength polycarbonate polymers used in automotive, electronics, and engineering applications, dimethyl carbonate (DMC) remains indispensable. Battery Electrolytes represent a rapidly growing segment, driven by the rising adoption of EVs and renewable energy storage systems.

The Solvent segment continues steady growth, supported by strong usage in paints, coatings, pharmaceuticals, and industrial processes where DMC’s efficient solvency is preferred. In Reagent applications, DMC serves as a versatile chemical used in organic synthesis and specialty chemical formulations. Other applications, including agriculture, electronics, and personal care, highlight DMC’s broad adaptability across industries.

By End-use

Plastics led the market with a 36.5% share. DMC is vital in producing various plastic materials used across packaging, automotive components, and consumer goods. Paints & Coatings form a major end-use category, benefiting from DMC’s effectiveness as a solvent and intermediate in surface coatings and industrial paints. The Pharmaceutical sector shows strong uptake due to the demand for safe, high-quality solvents and intermediates in drug manufacturing.

Battery applications are expanding rapidly with the global acceleration of EVs and renewable energy deployments, where DMC is used as a key electrolyte ingredient. The Agrochemicals sector also grows steadily, employing DMC in pesticide formulations and agricultural solvents. Other end-use industries—such as electronics and personal care—underline DMC’s extensive industrial versatility.

By Sales Channel

Direct Sales dominated the market with more than a 56.7% share. Manufacturers prefer direct distribution due to better customer engagement, tailored services, and efficient communication, leading to stronger long-term partnerships. Indirect Sales, handled through distributors and retailers, provide broader market reach and regional penetration, offering convenience to customers through established supply networks.

Regional Analysis

The Dimethyl Carbonate (DMC) Market experienced strong growth, with the Asia Pacific region standing out as the leading contributor, accounting for 54% of the global share. This dominance is largely fueled by rapid industrial expansion supported by increasing urbanization, rising population levels, and large-scale infrastructure development across key economies in the region.

China and India have been central to this growth, leveraging their strong economic performance and extensive urban development initiatives. These countries have driven substantial demand for DMC across industries such as automotive, electronics, pharmaceuticals, and agriculture, attracting major investments and boosting the manufacturing landscape for DMC.

The region’s significant consumption of DMC is further supported by its diverse application range. With well-established manufacturing capabilities and robust supply-chain infrastructure, Asia Pacific efficiently produces and distributes DMC to meet growing domestic and international requirements.

Top Use Cases

- Solvent in Paints and Coatings: Dimethyl carbonate serves as an eco-friendly solvent in the paint and coatings industry, replacing harmful chemicals like benzene. Its low toxicity and quick evaporation make it ideal for formulating high-quality paints used in homes and vehicles. As demand for green products rises, this application boosts market growth by meeting environmental regulations and consumer preferences for safer materials.

- Electrolyte in Lithium-Ion Batteries: In the battery sector, dimethyl carbonate acts as a key component in electrolytes for lithium-ion batteries, enhancing energy storage and performance. It’s widely used in electric vehicles and portable devices due to its stability and efficiency. This use case drives innovation in renewable energy, supporting the shift toward sustainable power solutions amid growing electrification trends.

- Production of Polycarbonates: Dimethyl carbonate is essential in manufacturing polycarbonates, which are durable plastics used in automotive parts, electronics, and packaging. Its role as a safe intermediate promotes cleaner production processes. The expanding demand for lightweight, strong materials in various industries positions this application as a major contributor to the chemical market’s evolution.

- Fuel Additive in Gasoline and Diesel: As a fuel additive, dimethyl carbonate improves combustion efficiency and reduces emissions in gasoline and diesel blends. It’s valued for its high oxygen content, making fuels cleaner and more biodegradable. This application aligns with global efforts to lower pollution from transportation, opening opportunities in the energy sector for greener fuel alternatives.

- Intermediate in Pharmaceuticals and Pesticides: Dimethyl carbonate functions as a methylating agent in synthesizing pharmaceuticals and pesticides, enabling efficient chemical reactions with minimal environmental impact. It’s preferred for creating active ingredients in medicines and crop protection products. This versatile role supports the agrochemical and healthcare industries, fostering advancements in safe and effective solutions.

Recent Developments

1. Alfa Aesar (Thermo Fisher Scientific)

- Alfa Aesar, as part of Thermo Fisher Scientific, has expanded its high-purity dimethyl carbonate (DMC) offerings to meet demand from battery electrolyte and pharmaceutical synthesis markets. Recent focus is on supplying ultra-high purity DMC for lithium-ion battery electrolyte formulations. The company highlights stringent quality control and reliable scaling for research and pilot-scale production.

2. Kishida Chemical Co. Ltd.

- Kishida Chemical has strengthened its position as a key supplier of battery-grade solvents. It recently promoted its “High Purity” DMC series, optimized for lithium-ion battery electrolytes, emphasizing low moisture and metal impurity specs. The company supports the EV supply chain and invests in stable sourcing to meet growing Asian battery manufacturing demand.

3. Kowa Company Ltd.

- Kowa’s recent developments involve promoting dimethyl carbonate as a sustainable, non-toxic solvent and chemical intermediate, aligning with green chemistry trends. While not a major producer, its specialty chemicals segment emphasizes DMC’s application in eco-friendly paint strippers, coatings, and adhesives. Kowa highlights DMC’s role as a methylating agent to replace more hazardous reagents.

4. Lotte Chemical

- Lotte Chemical made a major move by completing its new Dimethyl Carbonate plant in South Korea (2023), significantly boosting production capacity. This expansion, using a non-phosgene process, targets the booming electric vehicle battery electrolyte market. The company aims to become a leading global supplier, integrating DMC production with its existing carbonate chain and battery materials business.

5. Merck KGaA (Performance Materials)

- Under its Performance Materials division, Merck KGaA supplies high-purity DMC primarily for lithium-ion battery electrolytes under the “Selectipur” brand. Recent developments include quality enhancements to meet next-generation battery specifications for longer life and higher voltage. The company integrates DMC into its broader portfolio of battery materials and custom electrolyte formulations for R&D and manufacturing.

Conclusion

Dimethyl Carbonate is a promising chemical with broad appeal due to its eco-friendly profile and versatility across industries like energy, plastics, and pharmaceuticals. Its ability to replace toxic alternatives positions it well for sustained growth, driven by regulatory pushes for sustainability and innovation in green technologies, making it a key player in future markets.