Quick Navigation

Overview

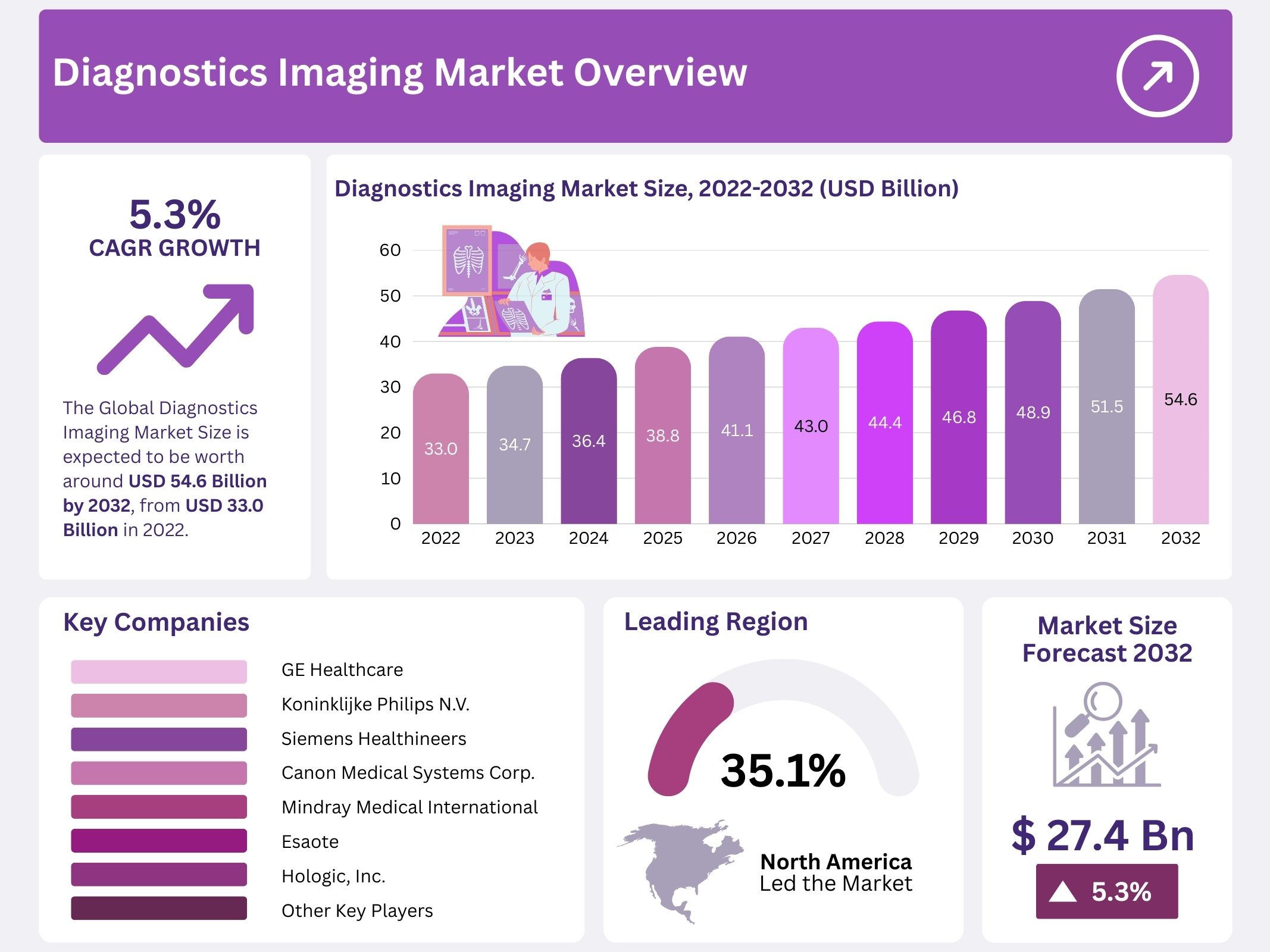

The Global Diagnostic Imaging Market was valued at USD 33 billion in 2022 and is projected to reach nearly USD 54.6 billion by 2032. A CAGR of 5.3% is expected during 2023–2032. Growth has been supported by the rising need for early and accurate disease detection, as many conditions are still identified at advanced stages. Healthcare providers have been increasing their use of imaging systems to improve clinical decision-making and reduce diagnostic errors.

A steady increase in chronic diseases such as cancer, cardiovascular disorders, and neurological conditions has been driving demand for imaging solutions. These illnesses require continuous monitoring, and modalities such as MRI, CT, ultrasound, and X-ray are widely used throughout the care pathway. As diagnosed cases rise, hospitals and clinics across both mature and emerging markets have been adopting advanced imaging technologies at a faster pace.

Technological progress has played a major role in strengthening market expansion. Advances in image resolution, faster scan speeds, and reduced radiation exposure have been improving diagnostic accuracy. The integration of artificial intelligence has further enhanced clinical efficiency by assisting in the early detection of abnormalities. As a result, healthcare institutions have been replacing older equipment with modern, high-performance systems to improve patient outcomes.

The shift toward non-invasive and minimally invasive diagnostic procedures has also contributed to market growth. Patients prefer imaging solutions that deliver clear results without surgical intervention. Modern systems provide real-time internal visualization with minimal discomfort, which supports their broader adoption. At the same time, rising healthcare spending and expanding insurance coverage have created favorable conditions for investments in advanced imaging infrastructure.

Increasing awareness of preventive healthcare and the rising global elderly population have further reinforced demand. Older individuals require regular diagnostic evaluations, and preventive screenings are becoming more common as patients recognize the importance of early intervention. These trends have supported greater utilization of imaging procedures and strengthened the long-term outlook for the diagnostic imaging market.

Key Takeaways

- The global diagnostic imaging market was valued at USD 33 billion in 2022 and is projected to reach USD 54.6 billion by 2032 at 5.3% CAGR.

- The ultrasound segment maintained dominance due to expanding clinical applications and innovations, including portable systems and AI-enabled imaging solutions enhancing diagnostic precision.

- The CT segment is forecasted to grow fastest, supported by rising demand for Point-of-Care CT systems and advanced AI-integrated high-precision scanners.

- Oncology imaging generated the highest revenue because increasing cancer incidence and strong emphasis on early detection strengthened adoption of advanced diagnostic imaging modalities.

- Orthopedics is expected to record the highest CAGR as aging populations and improved musculoskeletal diagnostic technologies increase imaging demand.

- Hospitals continued to capture the largest revenue share, supported by adoption of advanced imaging modalities and stronger integration of digital and AI-based technologies.

- Asia-Pacific growth is reinforced by expanding private healthcare providers and newly established hospitals equipped with modern diagnostic imaging systems.

- Market growth is driven by advanced technologies, cost-efficient diagnostic options, rising population, and innovative systems such as One-Beat Spectral Cardiac CT.

- Growth is hindered by frequent product recalls and competitive pressure from low-cost refurbished imaging equipment limiting new system adoption.

- Emerging economies offer opportunities through increasing healthcare expenditure, larger R&D investments, and adoption of next-generation imaging modalities.

- Mid-range CT scanners are positioned for strong market share owing to reliable performance across angiography and cardiac diagnostic applications.

- North America leads the market due to presence of major industry players, supportive reimbursement frameworks, and substantial healthcare expenditure.

- Asia-Pacific is projected to achieve the highest CAGR as chronic disease prevalence rises and demand for advanced imaging technologies strengthens.

Regional Analysis

North America accounted for a significant share of the global diagnostic imaging market. The region maintained its leadership position due to strong healthcare infrastructure and a large base of industry participants. Continuous product launches supported the adoption of advanced imaging systems. Favorable reimbursement policies further strengthened market penetration. High healthcare spending across the United States and Canada enabled rapid uptake of new technologies. These factors collectively created a mature and stable market environment. As a result, the region generated considerable revenue within the global landscape.

Market growth in North America was supported by rising chronic disease prevalence. The increasing burden of cardiovascular disorders, cancer, and neurological conditions enhanced the need for frequent diagnostic procedures. Preventive healthcare awareness improved consistently, encouraging early screening. Manufacturers accelerated research efforts to meet this demand. The region benefited from strong collaborations between hospitals and imaging companies. Government support also played an essential role. These combined elements strengthened market expansion and sustained the region’s dominant position during the assessment period.

The Asia-Pacific region is projected to record the fastest CAGR in the global diagnostic imaging market. Growth in this region can be attributed to expanding healthcare access and rising investments in medical technology. A growing population with increasing chronic disease incidence strengthened demand for imaging procedures. Countries such as China and India increased healthcare budgets to improve diagnostic capabilities. Adoption of modern imaging systems is rising at a steady rate. These structural improvements are expected to enhance market performance across the forecast timeframe.

Local manufacturing in the Asia-Pacific region is improving rapidly. Domestic producers supply diagnostic imaging systems at moderate prices. This cost advantage supports adoption in underserved markets. Growing support from regional governments further encourages production and distribution of affordable equipment. Healthcare providers benefit from reduced procurement costs and increased availability of essential imaging technologies. As a result, competition intensifies within the region. These developments are expected to accelerate market penetration and strengthen Asia-Pacific’s position as a high-growth diagnostic imaging hub.

Segmentation Analysis

The ultrasound segment dominated the market and accounted for the largest revenue share. Its continued lead is expected during the forecast period. The growth of this segment can be attributed to the rising number of ultrasound applications. Recent advances in transducer technology have widened its use in medical and cardiovascular imaging. The development of portable systems is also supporting expansion. The integration of Artificial Intelligence is improving image quantification. The CT segment is projected to record the fastest CAGR due to demand for Point-of-Care systems and AI-enabled scanners.

The market is segmented by product type, application, and region. Key product categories include MRI, ultrasound, CT, nuclear imaging, and mammography. MRI systems are further classified by field strength and architecture. Ultrasound systems include Doppler, HIFU, and extracorporeal shockwave lithotripsy. X-ray technology segments are also defined. Growth in hybrid imaging has increased adoption across neurology and cardiology. This has raised demand for trained professionals who can interpret multimodal data. Research institutes are expanding training programs to support these technical needs across clinical environments.

The oncology segment held the largest share of the diagnostic imaging market and is expected to sustain its lead. The rising global incidence of cancer and the push for early diagnosis support this demand. Lung and breast cancers account for significant imaging volumes. Orthopedics, however, is projected to grow at the fastest pace. This increase can be attributed to the aging population and higher accident rates. Emerging countries are witnessing better access to diagnostic centers, which further strengthens adoption across oncology and orthopedic imaging workflows.

Hospitals captured the highest revenue share among end users due to their wide adoption of advanced imaging modalities. Teaching hospitals show higher usage compared to general facilities. In developing regions, the number of hospitals has grown rapidly with the entry of multinational healthcare providers. Private players dominate service delivery in many Asian countries. New facilities allocate specific areas for imaging procedures. The diagnostic imaging segment is expected to grow further due to improved infrastructure, rising investment in smart hospitals, and increasing adoption of advanced imaging technologies.

Key Market Segments

By Type

- X-ray Imaging Systems

- Ultrasound Systems

- Computed Tomography (CT) Scanners

- Nuclear Imaging Systems

- Magnetic Resonance Imaging (MRI) Systems

- Others

By Application

- Gynecology

- Cardiology

- Neurology

- Oncology

- Orthopedics

- Other Applications

By End-Users

- Hospitals

- Specialty Clinics

- Diagnostic Imaging Centers

- Others

Key Players Analysis

The competitive environment of the diagnostics imaging market is shaped by a broad portfolio of imaging systems and extensive global distribution networks. Market dominance has been supported by sustained research investments that strengthen product pipelines and enhance technological capabilities. Increasing collaboration between multinational and regional manufacturers has accelerated innovation. These alliances have enabled faster product development cycles and contributed to the availability of advanced and cost-efficient imaging solutions across both developed and emerging markets.

Rising collaboration is expected to support market expansion. These partnerships promote technology exchange, improve manufacturing efficiency, and enhance access to cutting-edge diagnostic tools. The trend has strengthened competition among global players and supported the development of sophisticated modalities. The resulting advancements have improved diagnostic accuracy and widened clinical applications. This collaborative environment is expected to remain a key factor driving the future progression of the diagnostics imaging market.

Market fragmentation has been observed due to the presence of multiple global, regional, and local players. Competition has intensified as companies with strong brand equity and robust distribution networks continue to expand their market presence. To remain competitive, several manufacturers have adopted strategies such as product launches, portfolio diversification, and long-term agreements. These approaches have improved their operational reach and supported continuous development of innovative imaging systems.

Leading participants in the diagnostics imaging market include GE Healthcare, Koninklijke Philips N.V., Siemens Healthineers, Canon Medical Systems Corp., Mindray Medical International, Esaote, Hologic Inc., Samsung Medison Co., Ltd., Koning Corporation, PerkinElmer Inc., FUJIFILM VisualSonics Inc., and Cubresa Inc. These companies focus on high-performance imaging platforms and strategic partnerships. Their efforts have strengthened market competition and supported the availability of advanced diagnostic technologies. Other key players continue to contribute to industry growth through targeted innovation and regional expansion.

Leading Market Key Players

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corp.

- Mindray Medical International

- Esaote

- Hologic, Inc.

- Samsung Medison Co., Ltd.

- Koning Corporation

- PerkinElmer Inc.

- FUJIFILM VisualSonics Inc.

- Cubresa Inc.

- Other Key Players

Conclusion

The global diagnostic imaging market is expected to expand steadily as healthcare systems continue to prioritize early and accurate disease detection. Growth has been supported by rising cases of chronic illnesses, wider use of modern imaging technologies, and stronger focus on preventive care. Advances in scan quality, faster imaging, and integration of artificial intelligence have improved clinical decision-making and strengthened demand across hospitals and clinics. Adoption is increasing in both developed and emerging regions as healthcare investment rises. Despite challenges such as equipment recalls and competition from refurbished systems, ongoing innovation and broader access to advanced imaging solutions are expected to sustain long-term market progress.