Quick Navigation

Introduction

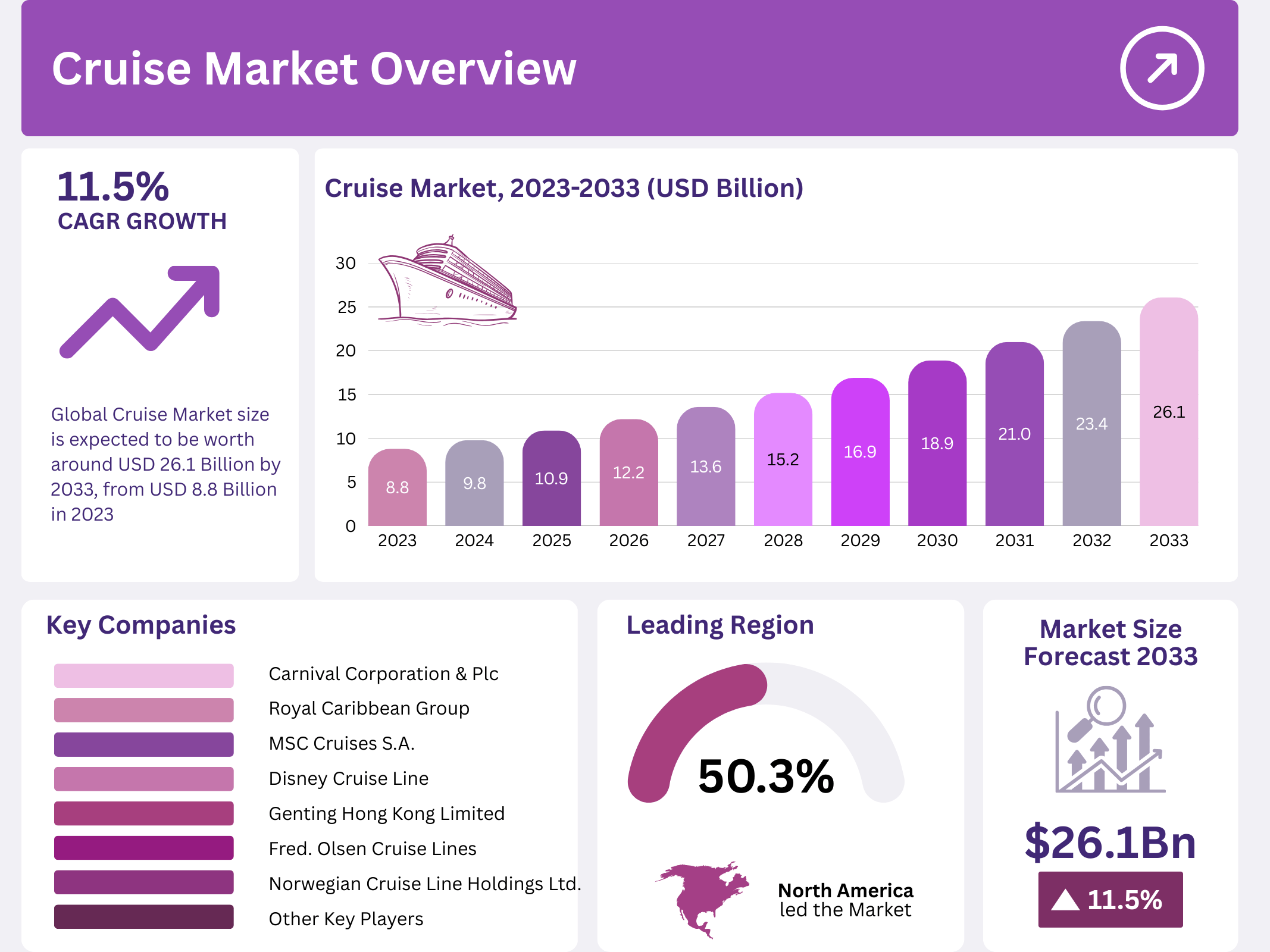

The global cruise market is experiencing impressive growth, with a projected value of USD 26.1 billion by 2033, up from USD 8.8 billion in 2023, reflecting a CAGR of 11.5% during the forecast period from 2024 to 2033. This surge is largely driven by rising consumer demand for both luxury and family-oriented travel experiences. Cruises offer a blend of relaxation, exploration, and cultural immersion, appealing to a broad spectrum of travelers.

The cruise industry is marked by its diverse offerings, catering to both high-net-worth individuals (HNWIs) and family groups. Luxury cruise lines, such as Regent Seven Seas and Oceania Cruises, attract affluent travelers seeking personalized services. Simultaneously, the demand for family-oriented experiences, exemplified by Disney Cruise Line, is driving substantial growth in the sector. As the market evolves, sustainability and innovation in cruise technologies are crucial factors influencing future trends.

Key Takeaways

- The global cruise market was valued at USD 8.8 billion in 2023 and is expected to reach USD 26.1 billion by 2033, growing at a CAGR of 11.5% during the forecast period from 2024 to 2033.

- Ocean Cruises dominated the market in 2023, capturing 79.7% of the market share due to high demand from emerging markets and luxury offerings.

- Touring Cruises are growing due to a rising demand for niche, immersive travel experiences that focus on cultural and adventure itineraries.

- North America dominated the cruise market with 50.3% market share in 2023, benefiting from strong demand and advanced infrastructure.

- Major players include Carnival Corporation, Royal Caribbean, MSC Cruises, and Norwegian Cruise Line, who dominate with expansive fleets and diverse offerings.

- The rise in the number of billionaires in the U.S. and China presents significant opportunities for luxury cruise lines.

- The U.S. EPA’s emission standards aim to reduce sulfur emissions by 90% and nitrogen oxide emissions by 80% by 2025, pushing the cruise industry toward greener solutions.

Market Segmentation Overview

By Type

The cruise market is primarily divided into ocean cruises and river cruises. Ocean cruises hold the largest share, capturing 79.7% of the market in 2023. These cruises offer luxurious experiences with expansive itineraries, catering to travelers seeking all-inclusive vacation packages. River cruises, while smaller in size, are gaining traction with affluent travelers seeking intimate, culturally immersive experiences along scenic routes in Europe and Asia.

By Applications

The cruise industry also segments by applications, with touring cruises experiencing significant growth due to rising demand for unique, immersive travel experiences. These cruises often include excursions that focus on culture, adventure, or nature, attracting travelers who desire enriched vacation experiences. On the other hand, the daily commute segment remains steady in certain regions, primarily driven by its necessity for short-distance travel in geographical areas that make land transport less feasible.

Drivers

Consumer Preferences for Luxury and Experience

The growing demand for luxury cruises is one of the primary drivers behind the cruise market’s expansion. As consumers increasingly seek unique, all-inclusive vacation options, cruise lines are responding by investing in larger, more luxurious ships. These cruises offer personalized services, gourmet dining, premium entertainment, and access to exclusive destinations, which have become highly appealing to high-net-worth individuals.

Technological Advancements in Cruising

Technological innovations are playing a crucial role in the cruise market’s growth. The advent of larger, more fuel-efficient ships, improved onboard connectivity, and the integration of advanced technologies such as AI and IoT is enhancing the cruise experience. These advancements not only help cruise operators reduce operational costs but also elevate passenger satisfaction through more personalized and seamless experiences.

Use Cases

Family-Oriented Cruises

Family-oriented cruises, particularly those offered by brands like Disney Cruise Line, are increasingly popular. In 2022, Disney Cruise Line attracted 4 million passengers, underscoring the rising demand for cruises that cater to families. These cruises provide entertainment, amenities, and activities designed for all ages, creating memorable vacations for families seeking both relaxation and adventure.

Luxury Cruises for High-Net-Worth Individuals (HNWIs)

Luxury cruises are becoming increasingly popular among affluent travelers. Brands like Regent Seven Seas offer bespoke travel experiences, attracting passengers with high disposable incomes. Over 40% of their passengers are aged 50 and above, and they spend an average of USD 15,000 per person on extended voyages, illustrating the immense potential of the luxury cruise segment.

Major Challenges

Environmental Sustainability Concerns

One of the primary challenges faced by the cruise industry is the environmental impact of cruise ships. While cruise lines have made strides in improving fuel efficiency and waste management, the industry still faces substantial pressure to reduce its carbon footprint. Stricter regulations, particularly in the European Union and North America, are forcing operators to invest heavily in sustainable technologies to meet emission reduction targets.

High Operational Costs

Cruise lines are dealing with high operational costs, driven by the need to maintain large vessels, provide high-quality services, and adopt sustainable technologies. Fluctuations in fuel prices, along with regulatory compliance costs, increase financial pressures. Smaller cruise operators may find it challenging to invest in the necessary technologies to remain competitive while managing these high costs.

Business Opportunities

Expansion of Cruise Routes

The expansion of cruise routes and the increasing accessibility of new destinations offer significant business opportunities for cruise operators. New ports in Asia, Africa, and other previously untapped regions present an opportunity for cruise lines to diversify their itineraries. The growth of river cruising in less-developed regions also allows for new market expansion.

Government Support for Infrastructure Development

Government investments in cruise terminal infrastructure are another key opportunity for the cruise market. For instance, Canada’s USD 35 million investment to modernize cruise port facilities on the east coast is expected to enhance its cruise offerings. Similarly, other regions are investing in port upgrades, supporting the cruise industry’s growth by improving facilities and increasing passenger capacity.

Regional Analysis

North America Dominates the Market

North America remains the largest region in the global cruise market, with 50.3% of the market share in 2023. This dominance is driven by strong consumer demand in the U.S. and Canada, bolstered by advanced tourism infrastructure and favorable regulatory environments. The U.S. alone accounts for a substantial portion of global cruise passengers, with leading companies like Carnival Corporation and Royal Caribbean Group based in the region.

Europe and Asia Pacific Emerging Markets

Europe and Asia Pacific are also emerging as significant regions for cruise growth. Europe continues to thrive, particularly in the luxury and river cruise segments. The region’s rich cultural heritage and well-established cruise routes make it an attractive destination. Meanwhile, Asia Pacific is poised for growth, driven by increasing disposable incomes and rising interest in cruises from countries like China and Japan.

Recent Developments

- AD Ports Group announced an investment of USD 4.7 million in June 2024 to enhance Egypt’s cruise terminal infrastructure, meeting increasing tourism demand.

- Disney Cruise Line revealed plans for a new fleet addition, the D23 Horizon, in September 2024, offering family-friendly features and immersive experiences.

- PhilaPort introduced its Strategic Plan 2040 in October 2024 to enhance cruise facilities and improve competitive positioning.

- Royal Caribbean acquired Costa Maya in October 2024, planning to transform the port into a world-class destination with enhanced amenities.

- Singapore Cruise Center partnered with SITA in November 2024 to streamline ferry travel experiences using advanced check-in and management solutions.

Conclusion

The global cruise market is set for substantial growth, with opportunities in luxury cruising, technological advancements, and expanding cruise routes. North America remains the dominant market, while regions like Europe and Asia Pacific are emerging as key players. However, challenges related to environmental sustainability and high operational costs must be addressed to ensure long-term growth. With continued government support, technological innovations, and a shift toward sustainability, the cruise market is well-positioned for a prosperous future.