Quick Navigation

Introduction

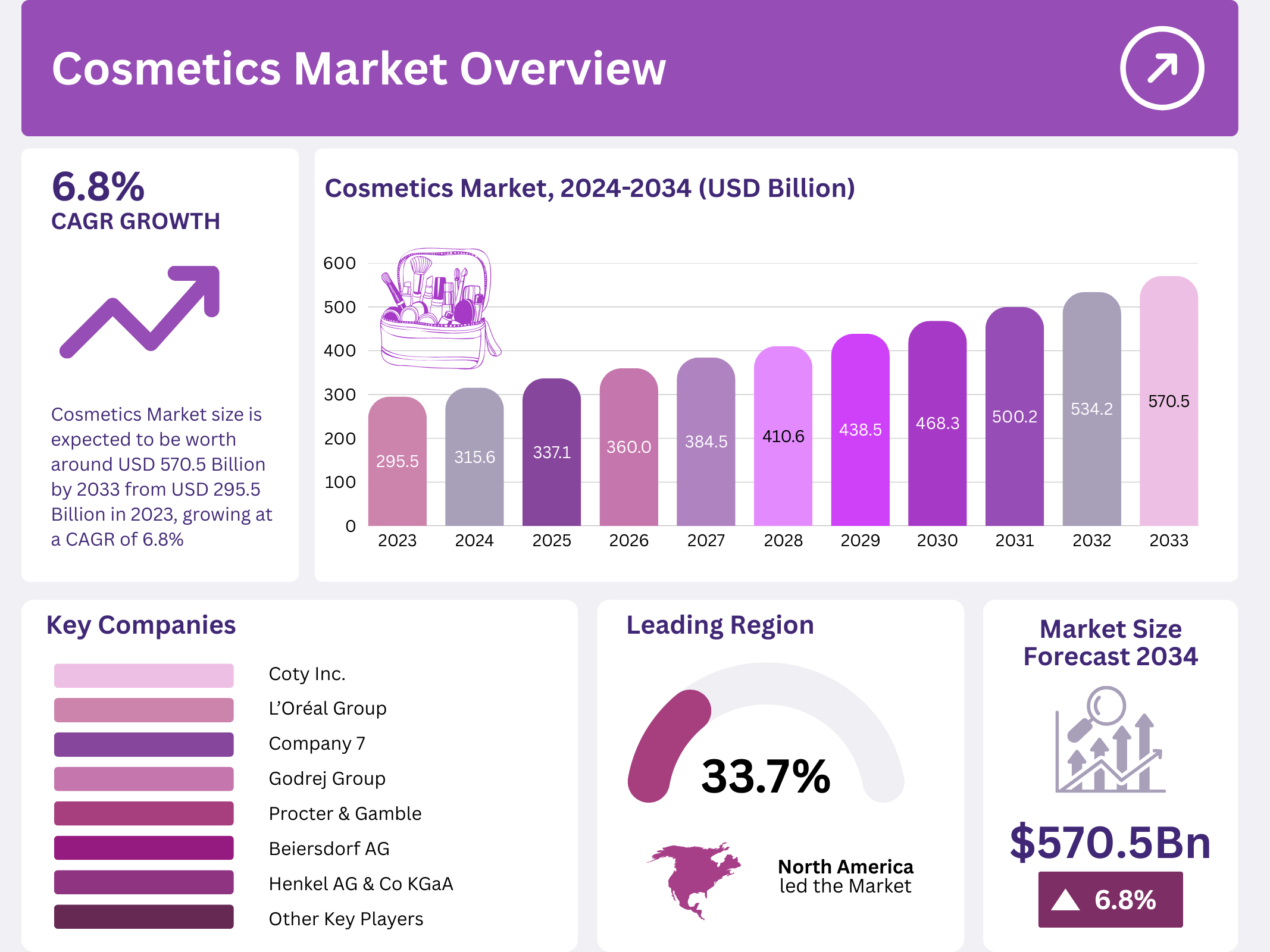

The global cosmetics market is on a rapid growth trajectory, expected to reach USD 570.5 billion by 2033, up from USD 295.5 billion in 2023, representing a CAGR of 6.8% from 2024 to 2033. This market encompasses a diverse range of products designed for personal care, skin health, and enhancing appearance, including skincare, haircare, makeup, perfumes, and hygiene products for both men and women.

The cosmetics sector has seen significant evolution, with innovative product offerings, rising consumer awareness regarding health and wellness, and an increasing shift towards sustainable and eco-friendly products.

Major players in the market, such as L’Oréal, Estée Lauder, and Procter & Gamble, alongside emerging indie brands, are capitalizing on these trends, providing a wide variety of products that cater to evolving consumer preferences.

Technological advancements, the rise of e-commerce, and the influence of social media influencers have further driven the growth of this market. Additionally, the global focus on health-conscious beauty and sustainability continues to shape the future of the cosmetics industry.

Key Takeaways

- The global cosmetics market is projected to grow from USD 295.5 billion in 2023 to USD 570.5 billion by 2033, with a CAGR of 6.8% during the forecast period.

- The skincare segment leads the market with a 36.2% share in 2023, driven by the increasing demand for anti-aging and natural products.

- The women’s segment dominates, holding a 66.9% share in 2023, attributed to a wide variety of beauty products targeted at women.

- E-commerce and digital transformation are revolutionizing how consumers engage with beauty brands, with 37% of American consumers discovering new beauty products through social media ads.

- The U.S. cosmetics market was valued at approximately USD 91.4 billion in 2023, contributing significantly to the global cosmetics industry.

- Regulatory shifts, such as the reduction of the Goods and Services Tax (GST) on beauty products, are expected to fuel further market expansion.

Market Segmentation Overview

The global cosmetics market is divided into several key segments based on product types, end-users, and distribution channels. The main product categories include skincare, haircare, makeup, fragrances, and others, with skincare holding the largest share in the market.

- Skincare: Dominating the cosmetics market with a 36.2% share in 2023, driven by the growing consumer interest in health-conscious beauty products, especially anti-aging and natural skincare solutions.

- Haircare: Emerging as a key growth driver, particularly due to the increasing demand for specialized hair treatments like scalp care, color protection, and anti-hair fall products.

- Makeup: Benefiting from the influence of social media and the growing trend of self-expression through cosmetics, makeup products are experiencing strong growth.

- Fragrances: Rising consumer demand for premium and personalized scents is expanding this segment, with luxury fragrances becoming more accessible due to the growth of online sales channels.

- Others: A smaller category that includes products like nail care and personal hygiene, which is seeing steady growth as holistic beauty trends gain traction.

End-use segments include men, women, and unisex products, with the women’s segment accounting for 66.9% of the market share. The increasing adoption of grooming products for men is also driving notable growth in this category.

In terms of distribution channels, hypermarkets/supermarkets dominate with a 24.2% share, followed by specialty stores, pharmacies, and the rapidly growing online sales channel, driven by the rise in e-commerce platforms.

Drivers

- Rising Disposable Incomes: With increasing disposable incomes across both developed and emerging markets, consumers are spending more on beauty products, thereby driving the overall market growth.

- Health and Wellness Trends: An increasing focus on health and wellness, combined with rising awareness about the ingredients used in cosmetics, has led to the growing popularity of organic, vegan, and cruelty-free products.

- E-commerce and Digital Transformation: The rise of e-commerce platforms and digital marketing strategies has significantly expanded the reach of beauty brands, making it easier for consumers to access a diverse range of products online.

- Social Media Influence: The power of social media platforms like Instagram and YouTube, where beauty influencers significantly impact purchasing decisions, continues to boost consumer demand for innovative beauty products.

- Personalization: Technology, including AI and AR, is enabling brands to offer personalized product recommendations and virtual try-ons, further enhancing consumer engagement and satisfaction.

Use Cases

- Skin Care: Anti-aging products, sunscreen, moisturizers, and serums are widely used for maintaining healthy skin, driven by consumer awareness about the importance of skincare routines.

- Hair Care: Shampoos, conditioners, hair oils, and styling products are essential for maintaining hair health, with consumers seeking specialized treatments for specific hair types and concerns.

- Makeup: Makeup products like foundations, lipsticks, and eye shadows cater to the rising demand for self-expression and beauty enhancement, especially among millennials and Gen Z.

- Fragrance: The fragrance industry is seeing strong growth in both luxury and niche fragrances, with consumers increasingly opting for personalized scent experiences.

Major Challenges

- Regulatory Hurdles: The cosmetics industry is highly regulated, with strict guidelines enforced by agencies such as the U.S. FDA and European Chemicals Agency. These regulations ensure product safety but can be burdensome for companies, especially smaller players.

- High Competition: The market is extremely competitive, with both established brands and emerging indie labels vying for consumer attention. Differentiation through innovation and branding is crucial.

- Sustainability Concerns: While sustainability is becoming a priority for consumers, brands face challenges in sourcing ethical ingredients, reducing their carbon footprint, and adopting sustainable packaging solutions.

Business Opportunities

- Sustainability: With consumers increasingly seeking eco-friendly products, brands that emphasize sustainable sourcing, biodegradable packaging, and cruelty-free practices are well-positioned to capture market share.

- Technology and Personalization: The integration of AI, AR, and data analytics provides an opportunity for brands to create personalized skincare and beauty routines that cater to individual needs, thereby improving customer satisfaction and loyalty.

- Men’s Grooming: As societal norms evolve, there is a growing demand for men’s grooming products. This segment, including skincare, beard care, and haircare products, is expected to experience substantial growth.

Regional Analysis

North America is the largest market for cosmetics, holding a 33.7% share in 2023, valued at USD 99.5 billion. High consumer spending, coupled with innovation and the presence of leading beauty brands, drives market growth. The U.S. market alone was valued at USD 91.4 billion in 2023.

Europe is also a key player in the cosmetics industry, particularly driven by the increasing consumer demand for organic and eco-friendly products. Stringent regulations, such as those enforced by the EU, ensure the safety and quality of products, supporting consumer trust.

Asia-Pacific is witnessing rapid growth, fueled by increasing disposable incomes and urbanization. The region’s diverse consumer base and preference for both premium and mass-market products present a significant opportunity for brands. The region is expected to become a major player in the coming years.

Recent Developments

- In 2023, L’Oréal acquired the premium skincare brand Aesop for USD 2.525 billion, marking one of the largest beauty industry deals of the year. This acquisition strengthens L’Oréal’s position in the luxury skincare segment, catering to growing consumer demand for high-quality, sustainably sourced products.

- In September 2024, Euroitalia acquired the beauty and fragrance rights for Moschino from the Aeffe Group for 39.6 million euros, aiming to expand its luxury fragrance offerings.

- e.l.f. Beauty acquired Naturium, a high-performance skincare brand, for USD 355 million in August 2023, diversifying its product range and positioning itself for growth in the skincare market.

Conclusion

The global cosmetics market is expected to continue its upward trajectory, driven by strong consumer demand for innovative, sustainable, and personalized beauty products. Key market segments, such as skincare and makeup, are set to lead growth, while regions like North America, Asia-Pacific, and Europe remain dominant.

The growing emphasis on digital transformation, sustainability, and personalization will further shape the future of this market, providing ample opportunities for both established players and emerging brands to innovate and expand. As consumer preferences evolve, businesses must adapt to meet the increasing demand for clean, effective, and ethically produced products, ensuring a competitive edge in an ever-changing landscape.