Quick Navigation

Introduction

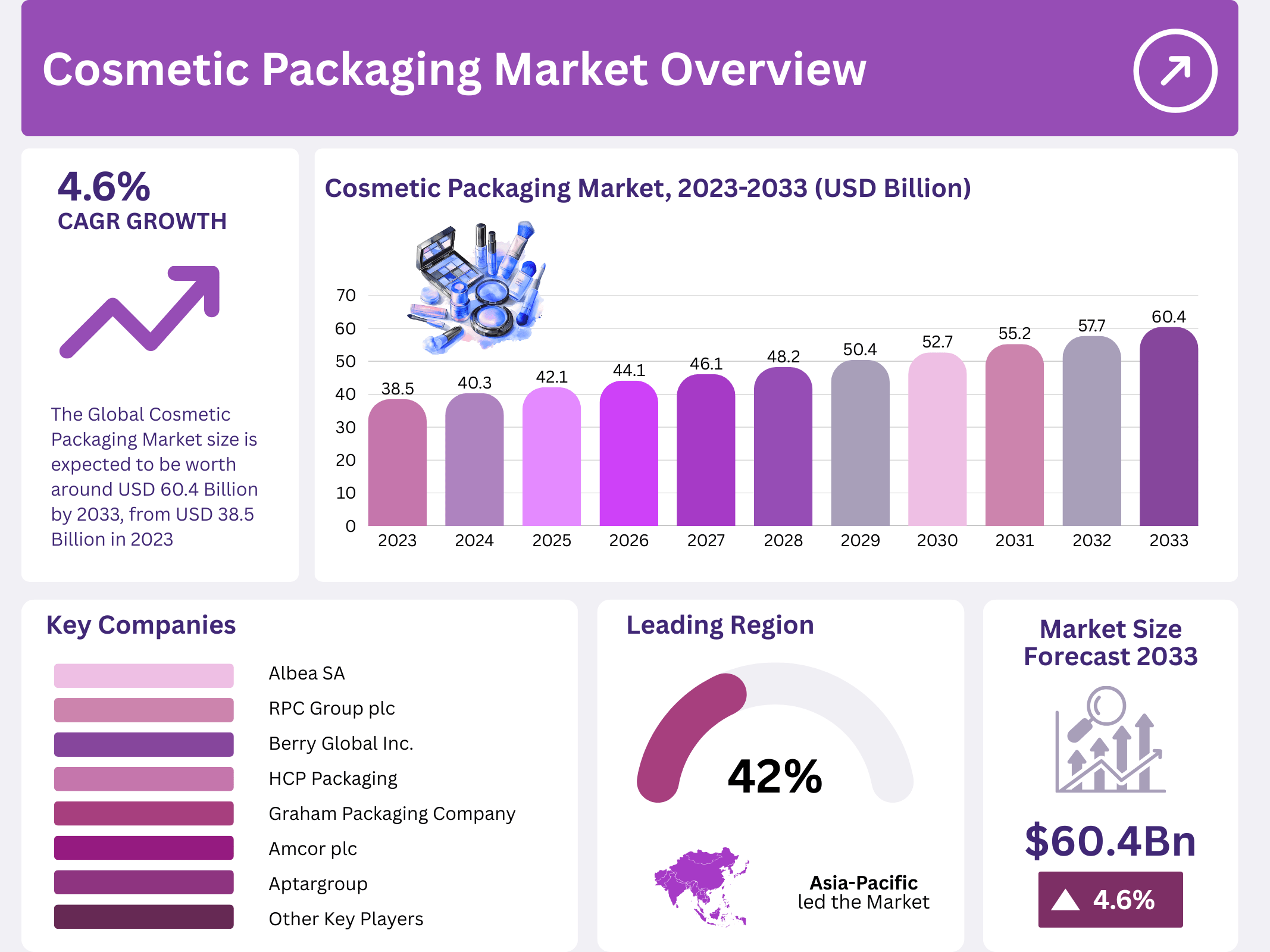

The Global Cosmetic Packaging Market is witnessing robust growth, projected to reach USD 60.4 billion by 2033, rising from USD 38.5 billion in 2023. Driven by sustainability, innovation, and increasing consumer demand, the market is transforming the beauty industry worldwide.

Packaging is no longer just a container; it plays a vital role in branding, functionality, and environmental responsibility. With beauty brands embracing eco-friendly materials and innovative designs, packaging has evolved into a key marketing tool.

Growing environmental awareness and stricter regulations are pushing companies toward sustainable solutions. As major FMCG players commit to 100% recycled packaging by 2030, the cosmetic packaging sector stands at the forefront of green transformation.

Furthermore, the rise of e-commerce and premium beauty products has heightened the need for functional and aesthetically appealing packaging. These trends collectively position the cosmetic packaging industry as a significant contributor to the global circular economy.

Asia Pacific continues to dominate the market, while technological innovations and material advancements are setting new standards for sustainability and design efficiency. The next decade promises smart, recyclable, and customizable cosmetic packaging solutions globally.

Key Takeaways

- The Cosmetic Packaging Market was valued at USD 38.5 billion in 2023 and is projected to reach USD 60.4 billion by 2033, with a CAGR of 4.6%.

- Plastics led the material segment with 58.7% market share in 2023.

- Skin Care dominated the application segment in 2023.

- Asia Pacific held 42.0% of the global market share.

Market Segmentation Overview

Material Segment

Plastics dominate the cosmetic packaging market, holding 58.7% share in 2023. They offer design flexibility, light weight, and cost efficiency, making them suitable for mass production. However, innovations in biodegradable and recycled plastics are improving their environmental footprint.

Glass remains favored for premium cosmetic products, offering an elegant aesthetic and ensuring product integrity. Metal packaging is utilized for products needing strong protection, like perfumes and aerosols. Paper and bioplastics are gaining traction for sustainable alternatives.

Application Segment

Skin Care leads the application segment due to rising consumer awareness and product diversification. Packaging here enhances usability and maintains product freshness. Convenient formats like pump bottles and single-use packs are increasingly popular.

Hair Care packaging emphasizes durability and user-friendliness, while Nail Care requires precision-sealed containers. Make-up packaging remains design-driven, focusing on visual appeal and innovation, while other products like perfumes demand luxury-oriented designs.

Drivers

Sustainable Packaging Solutions: Growing eco-consciousness among consumers has accelerated the adoption of recyclable and biodegradable materials. Brands are redesigning packaging to reduce waste and align with global sustainability commitments.

Premium Product Demand: Increasing disposable income and consumer preference for luxury cosmetics have boosted demand for sophisticated packaging. Companies are focusing on premium aesthetics and eco-friendly luxury to attract modern consumers.

Use Cases

Eco-Friendly Packaging Implementation: Leading beauty brands are transitioning to recyclable materials such as glass and metal, meeting consumer expectations and complying with environmental regulations, especially in Europe and North America.

Smart and Interactive Packaging: Incorporation of QR codes and RFID tags enhances customer engagement by providing product details, authenticity verification, and personalized digital experiences, redefining the consumer-brand interaction.

Major Challenges

Rising Raw Material Costs: Increasing costs of plastics, metals, and glass directly impact manufacturers’ profit margins. These price fluctuations force companies to optimize production processes and explore cost-effective alternatives.

Regulatory and Environmental Constraints: Strict packaging regulations regarding material safety and recyclability raise compliance costs. Balancing innovation with adherence to sustainability laws poses an ongoing challenge for global players.

Business Opportunities

Customization and Personalization: Consumers increasingly seek unique packaging reflecting individuality. This trend encourages brands to develop customizable containers, labels, and finishes, enhancing customer loyalty and product differentiation.

Refillable and Reusable Packaging: Growing interest in circular economy models opens opportunities for refillable designs. Brands offering refill systems appeal to eco-conscious buyers and reduce waste, fostering long-term sustainability goals.

Regional Analysis

Asia Pacific: Holding 42.0% market share, Asia Pacific dominates the global market. Countries like China, Japan, and South Korea lead with strong cosmetic production bases and innovation in sustainable packaging technologies.

Europe and North America: Europe’s focus on eco-friendly materials and strict waste regulations drives innovation in recyclable packaging. Meanwhile, North America’s demand for premium, organic products supports growth in luxury packaging solutions.

Recent Developments

- October 2023: KDC/One acquired French company Laffon to enhance luxury and sustainable packaging capabilities in Europe.

- December 2023: Eastman partnered with Neutrogena to develop recyclable, film-free cosmetic packaging using Eastman Solus additives.

- August 2024: ALPLA collaborated with Zerooo to launch reusable PET bottles for personal care products, supporting circular economy initiatives.

- March 2024: Quadpack merged with Texen to form a global beauty packaging leader, focusing on sustainable packaging expansion across continents.

Conclusion

The Global Cosmetic Packaging Market is set for steady expansion, projected to grow at a CAGR of 4.6% through 2033. Sustainability, digital innovation, and personalization will shape its future. As environmental regulations tighten and consumer expectations evolve, brands embracing eco-friendly and intelligent packaging will lead the transformation.

With advancements in material science and smart design, cosmetic packaging is evolving from functional necessity to strategic advantage. Companies investing in sustainable innovation and global expansion will secure a competitive edge in this dynamic market landscape.