Quick Navigation

Overview

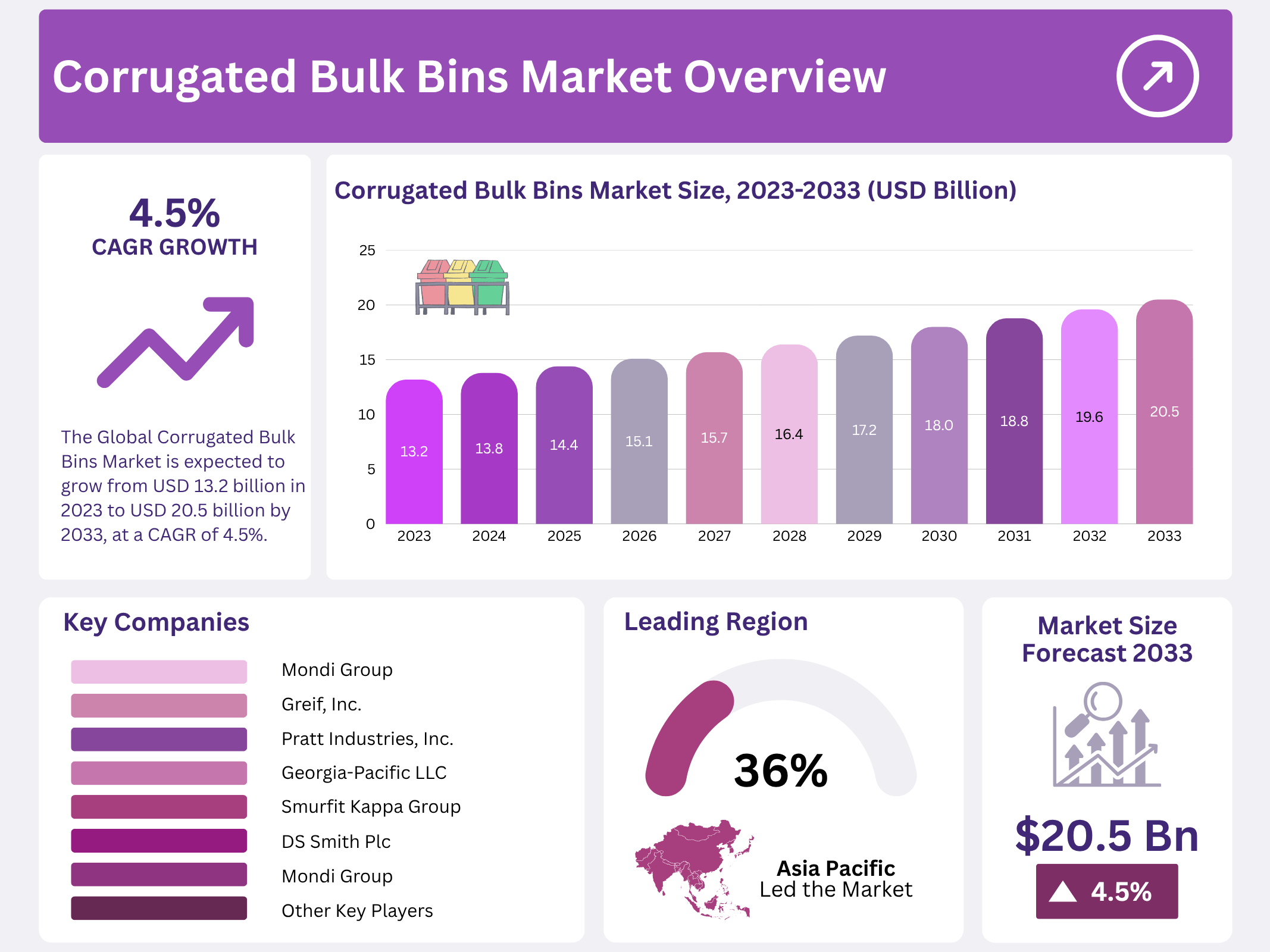

New York, NY – November 06, 2025 – The Global Corrugated Bulk Bins Market is projected to reach approximately USD 20.5 billion by 2033, rising from USD 13.2 billion in 2023, at a CAGR of 4.5% between 2023 and 2033. Corrugated bulk bins, also known as corrugated bins or bulk boxes, are robust containers used for storing, handling, and transporting large quantities of goods.

Typically constructed from corrugated fiberboard, these bins are valued for their strength, rigidity, and eco-friendly nature. They find extensive use across industries such as agriculture, manufacturing, and logistics for the efficient movement of bulk products like fruits, vegetables, and industrial components.

The fluted layers within the corrugated structure enhance durability and load-bearing capacity, making them ideal for heavy-duty applications. Moreover, their cost-effectiveness, recyclability, and easy customization have driven their growing popularity in the global packaging and supply chain sectors.

Key Takeaways

- The Global Corrugated Bulk Bins Market is expected to grow from USD 13.2 billion in 2023 to USD 20.5 billion by 2033, at a CAGR of 4.5%.

- Bins with 1000 to 1500 kg capacity dominated, making up over 45.6% of the market due to their optimal utility.

- Pallet Packs led the market with a 55.4% share, favored for their efficiency in handling and transporting goods.

- Double-wall bins, preferred for their durability, held a 42.7% market share, showcasing demand for robust packaging.

- The Food & Beverage sector was the top user, accounting for 28.7% of the market, highlighting the need for hygienic transport solutions.

- Asia Pacific leads with over 36.5% market share, while Europe’s focus on sustainability forecasts rapid growth in renewable packaging solutions.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 13.2 Billion |

| Forecast Revenue (2033) | USD 20.5 Billion |

| CAGR (2024-2033) | 4.5% |

| Segments Covered | By Load Capacity(More Than 1500 Kg, 1000 -1500 Kg, Below 1000 Kg), By Type(Hinged, Pallet Packs, Others, By Format, Single Wall, Double Wall, Triple Wall, Others), By Application(Food & beverage, Automotive, Pharmaceutical, Chemical, Oil & Lubricant, Building & Construction, Others) |

| Competitive Landscape | International Paper Company, Mondi Group, WestRock Company, DS Smith Plc, Smurfit Kappa Group, Georgia-Pacific LLC, Pratt Industries, Inc., Greif, Inc., Orora Packaging Australia Pty Ltd, Packaging Corporation of America, Cascades Inc., Sonoco Products Company, KapStone Paper and Packaging Corporation, Rengo Co., Ltd., UFP Technologies, Inc. |

Key Market Segments

By Load Capacity

In 2023, corrugated bulk bins with a load capacity of 1000–1500 kg dominated the market, accounting for over 45.6% of total revenue. This range emerged as the industry standard, reflecting its optimal balance of strength, versatility, and cost-effectiveness for mid-to-high-volume industrial applications. Its widespread adoption underscores alignment with core operational needs across manufacturing, logistics, and agriculture sectors.

By Type

Pallet Packs led the corrugated bulk bins market in 2023, securing more than 55.4% market share. This strong preference highlights their operational efficiency, seamless integration with palletized logistics systems, and adaptability for diverse bulk handling requirements. Pallet Packs remain the go-to solution for industries prioritizing streamlined storage, transport, and supply chain efficiency.

By Format

The Double Wall segment commanded the largest share in 2023, capturing over 42.7% of the market. Favored for superior structural integrity and impact resistance, double-wall corrugated bins provide enhanced protection for heavier and more sensitive loads. Their dominance reflects growing demand for durable, reliable packaging capable of withstanding rigorous handling and long-distance transport.

By Application

The Food & Beverage sector was the leading end-user of corrugated bulk bins in 2023, holding more than 28.7% of the market. This leadership is driven by the segment’s critical need for hygienic, sturdy, and recyclable packaging to ensure product safety and freshness throughout the supply chain. Corrugated bulk bins have become indispensable in food-grade logistics, supporting efficient bulk transport of perishables, ingredients, and packaged goods.

Regional Analysis

In 2023, Asia Pacific (APAC) led the Corrugated Bulk Bins market, capturing over 36.5% of global revenue. This leadership stems from strong growth in industrial packaging demand across emerging economies, fueled by expanding e-commerce, manufacturing, and agricultural sectors in countries like China and India.

North America demonstrated maturity in sustainable packaging adoption, with record levels of corporate procurement for eco-friendly solutions. The region signed nearly 20 GW in renewable energy Power Purchase Agreements (PPAs) in 2022, highlighting its commitment to integrating green materials like corrugated bulk bins into supply chains.

Europe, meanwhile, recorded the fastest growth in the broader packaging materials sector, including styrenic polymers. The region is poised to overtake North America in market share, propelled by rigorous EU environmental regulations and aggressive sustainability targets.

Europe’s PPA market, with contracted renewable volumes surpassing 16.2 GW. Forecasts for 2024 predict expansion beyond 20 GW, driven by rising corporate sustainability goals aimed at reducing carbon emissions and securing long-term green energy supplies. This trend underscores corrugated bulk bins’ growing role in supporting efficient, recyclable logistics for renewable energy components and other industries.

Top Use Cases

- Food and Beverage Packaging: Corrugated bulk bins provide sturdy, breathable storage for fresh fruits, vegetables, and packaged snacks, keeping items fresh during transport from farms to stores. Their lightweight design cuts shipping costs while ensuring food safety through moisture resistance, making them a top pick for grocers aiming to reduce waste and speed up delivery.

- Industrial Parts Transport: These bins securely hold automotive components, tools, and machinery pieces, protecting against bumps and shifts on long hauls. Easy to stack and unfold, they fit seamlessly into factory lines, helping manufacturers organize inventory without heavy lifting, which boosts workflow and lowers handling risks in busy warehouses.

- Pharmaceutical Storage and Shipping: Ideal for bulk meds, bottles, and supplies, corrugated bins offer a clean, protective shield against dust and light, meeting strict hygiene standards. Their recyclable nature appeals to health firms focused on green practices, allowing quick assembly for urgent shipments and safe stacking in climate-controlled facilities.

- Agricultural Produce Handling: Farmers use these bins to gather and move crops like grains or root veggies right from the field, with ventilation holes preventing spoilage. Durable yet affordable, they support seasonal bulk loads, easing the shift to sustainable farming by replacing plastic options and simplifying returns for reuse.

- E-commerce Fulfillment: Online retailers pack bulk orders of household goods or apparel in these bins for efficient sorting and dispatch, integrating well with automated conveyor systems. Their custom sizing reduces space in trucks, speeding up deliveries while cutting packaging costs for growing digital marketplaces.

Recent Developments

1. International Paper Company

International Paper is focusing on automation-friendly bulk bins with its MaxLock pallet-free bulk container. Recent developments highlight its quick-setup design, which reduces labor and eliminates the need for wooden pallets, cutting costs and improving sustainability. The company promotes its strength and stackability for automated warehousing and retail distribution, targeting supply chain efficiency gains.

2. Mondi Group

Mondi is advancing its EcoBulk range, emphasizing recyclable, heavy-duty corrugated solutions that replace timber or plastic. Recent developments include new, reinforced corner post designs for enhanced product protection and easier handling. They are heavily marketing the bin’s significant reduction in CO2 emissions and total cost of ownership compared to traditional materials, aligning with their sustainability goals.

3. WestRock Company

WestRock is innovating with its BulkKraft bins, which feature a robust, all-corrugated construction. Recent developments focus on integrating their Protectek moisture-resistant coating to safeguard contents in challenging environments. They are also promoting custom-designed, machine-erected bins to optimize customers’ automated filling lines, aiming to improve throughput and reduce manual labor in agricultural and industrial sectors.

4. DS Smith Plc

DS Smith is heavily promoting its OctaBinq bulk bin, highlighting innovations like the interlocking base for superior stability and pallet-free use. Recent developments include a focus on lightweighting the design without compromising strength, delivering supply chain efficiencies, and reducing material use. The company connects these innovations directly to its Now and Next sustainability strategy, emphasizing circular design principles.

5. Smurfit Kappa Group

Smurfit Kappa has launched its new Heavy Duty Bulk Bin range, developed to handle. Recent developments showcase advanced engineering with reinforced walls and bases, alongside the introduction of a secure, tool-free locking system for easy assembly. They emphasize using their proprietary material science to optimize performance-to-weight ratio, reducing transport costs while ensuring safety and reliability.

Conclusion

Corrugated Bulk Bins stand out as a smart, forward-thinking choice in today’s packaging landscape, blending toughness with everyday ease for businesses chasing greener paths. They tackle real-world needs like safe handling and cost savings across farms, factories, and online shops, all while embracing recycle-friendly habits that cut down on waste. As supply chains lean harder into smart, planet-smart solutions, these bins promise to keep evolving, helping companies stay nimble and responsible without skipping a beat.