Quick Navigation

Introduction

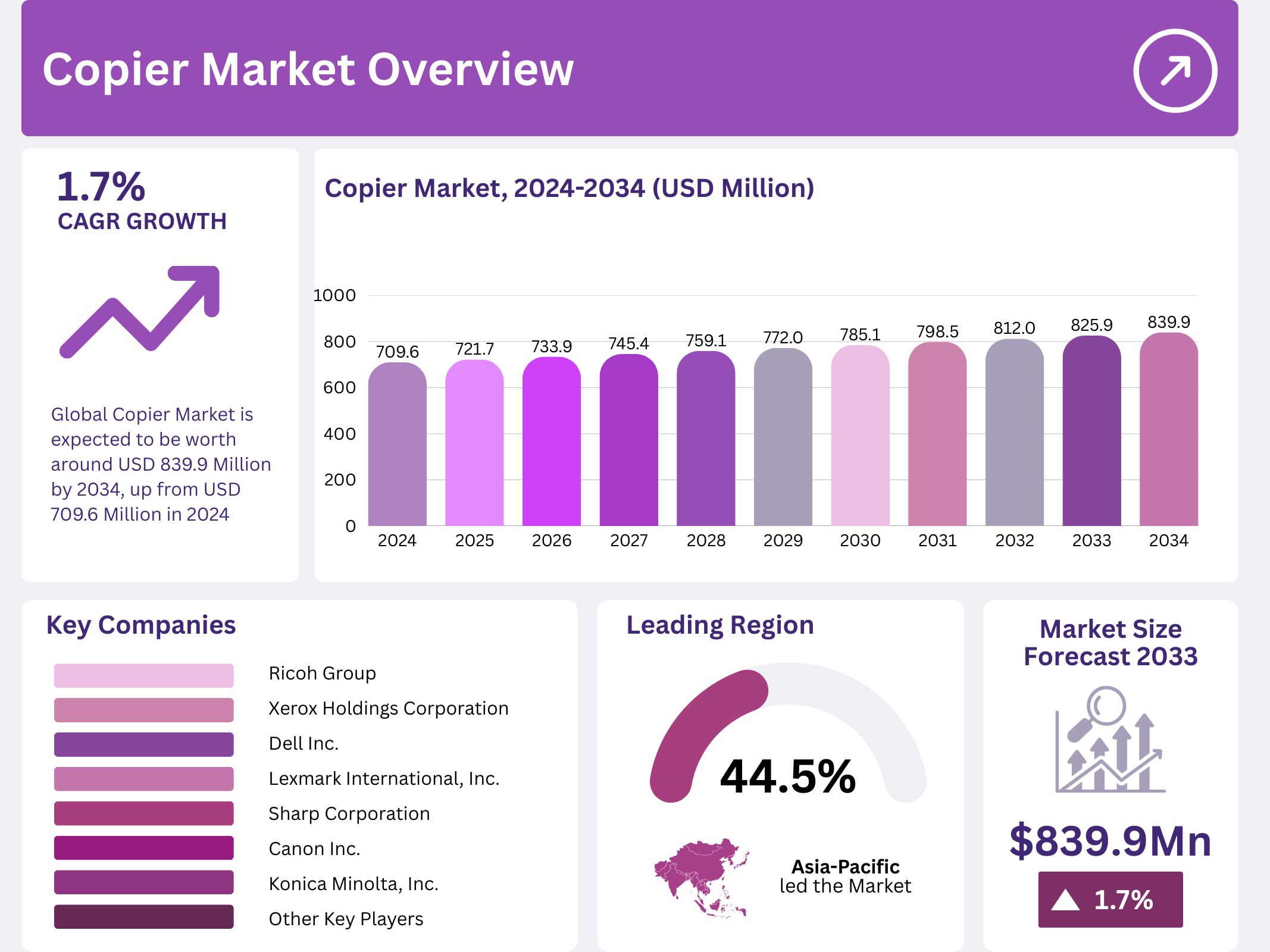

The global copier market is steadily advancing as multifunctionality, digital integration, and hybrid work solutions shape modern document infrastructure. Estimated at USD 709.6 million in 2024, it is projected to hit USD 839.9 million by 2034, growing at a CAGR of 1.7%.

Office environments continue to require versatile equipment to meet document processing needs. Traditional reliance on xerographic copiers is giving way to smart machines capable of cloud integration, scanning, and wireless functionalities. Compact designs now support both small and large enterprise workflows efficiently.

Growth is further fueled by the persistent need for printed documentation in sectors like government, law, and education. These industries still value hard copies for regulatory, archival, and legal compliance purposes, especially in emerging markets where digitization lags.

Despite digital transformations, paper remains a workplace staple in many regions. Especially in Asia-Pacific and Latin America, copier adoption aligns with infrastructure expansion, urbanization, and workforce growth, ensuring continued market traction in the coming decade.

As user expectations evolve, copier manufacturers are embedding cloud access, remote print capabilities, and mobile integration to meet rising demands for flexibility and workflow automation. This technological upgrade is shifting procurement patterns worldwide.

Key Takeaways

- Global Copier Market expected to reach USD 839.9 million by 2034, up from USD 709.6 million in 2024.

- Color copiers led with 67.3% market share due to growing demand for high-quality visual output.

- Analog copiers accounted for 68.4% share, preferred for affordability in cost-sensitive settings.

- Commercial offices represented 43.5% of copier demand, reflecting daily document usage.

- Asia-Pacific dominated regional sales, reaching USD 315.7 million with a 44.5% share.

Market Segmentation Overview

By Type

Color copiers held a dominant share of 67.3% in 2024. Their ability to produce visually vibrant documents has made them critical in marketing, education, and client-facing operations. Color multifunction printers also reduce the need for outsourcing print jobs, offering flexibility.

Monochrome copiers continue to serve environments prioritizing efficiency over color. These units are widely used in administrative, legal, and government offices with large volumes of basic duplication tasks, delivering high-speed, low-cost output.

By Technology

Analog copiers led with a 68.4% market share in 2024. Valued for their cost-effectiveness and simplicity, they remain staples in institutions with minimal digital infrastructure or budget constraints. Their plug-and-play nature supports immediate, high-volume use cases.

Digital copiers are increasingly penetrating developed regions where network connectivity, cloud access, and data security are critical. These systems are driving new office standards with scan-to-email, OCR, and remote print functionality built-in.

By End-User

Commercial offices comprised 43.5% of the market, as businesses continue to depend on document replication for contracts, compliance, and communication. High-speed copiers ensure operational continuity across departments, even as digital systems expand.

Education institutions, government bodies, and public offices also maintain significant copier fleets. These sectors rely on hardcopy formats for exams, notices, forms, and reports, especially where digital literacy or access is limited.

Drivers

Rising Demand for Office Productivity Solutions: Businesses are investing in copier systems that streamline print, scan, and duplication processes. These tools are pivotal in reducing manual effort and improving workflow efficiency in sectors like healthcare, law, and administration.

Hybrid Work Models Requiring Versatile Devices: The shift to flexible work has increased demand for cloud-enabled, mobile-accessible copiers. Employees need to print or scan documents remotely, prompting adoption of smart multifunction units with seamless digital integration.

Use Cases

Document Workflow in Legal and Financial Offices: These sectors handle sensitive and regulated information. Copiers enable secure duplication of contracts, tax filings, and client records while integrating with digital archives to ensure traceability and compliance.

Educational Institutions and Exam Administration: Schools and universities depend on copiers for exam printing, form distribution, and syllabus replication. The reliability and print speed of copiers support academic workflows under tight deadlines.

Major Challenges

Shift Toward Paperless Operations: The transition to digital documentation via cloud platforms, e-signatures, and shared drives is reducing dependence on printed copies, especially in developed economies focused on sustainability and data security.

Budget Constraints in Digitally Advancing Regions: While demand exists, many offices in low-income markets still lack the capital for advanced copier systems, delaying the transition from analog to multifunction digital solutions.

Business Opportunities

Emerging Demand in Developing Markets: Office expansion across Asia, Africa, and Latin America is creating strong demand for affordable copier infrastructure. Government offices, SMEs, and schools continue to adopt paper-based workflows in administrative functions.

Growth of Smart Copier Integration: OEMs can capitalize on the demand for Wi-Fi-enabled, cloud-ready copiers. Bundled services like remote diagnostics, print monitoring, and MPS (Managed Print Services) offer recurring revenue opportunities.

Regional Analysis

Asia-Pacific Leads with 44.5% Market Share: With copier revenue reaching USD 315.7 million, Asia-Pacific is the top region due to rapid urbanization, education sector growth, and continued paper usage in administrative ecosystems.

North America and Europe Maintain Steady Demand: In these mature markets, copiers are integrated into digitized workflows. Multifunction units that prioritize data security, energy efficiency, and remote functionality dominate procurement choices.

Recent Developments

- In April 2025, Ricoh USA launched new A3 color MFPs (IM C3510SD, C4510SD, C6010SD) with straight-path feeders for scanning media of various sizes without jams.

- In June 2024, Xerox introduced the PrimeLink C9200 Series, a compact production press tailored for SMBs with high-quality output and copier-style automation.

Conclusion

The global copier market is adapting to a dual reality—continued relevance in print-heavy sectors and rising demand for smart, multifunctional solutions. While analog copiers serve cost-sensitive users, digital models with cloud and wireless features are leading innovation.

With projected growth to USD 839.9 million by 2034, vendors must balance affordability, connectivity, and performance. As hybrid work reshapes office dynamics, the market will pivot toward agile, secure, and cloud-integrated copier systems across global geographies.