Quick Navigation

Overview

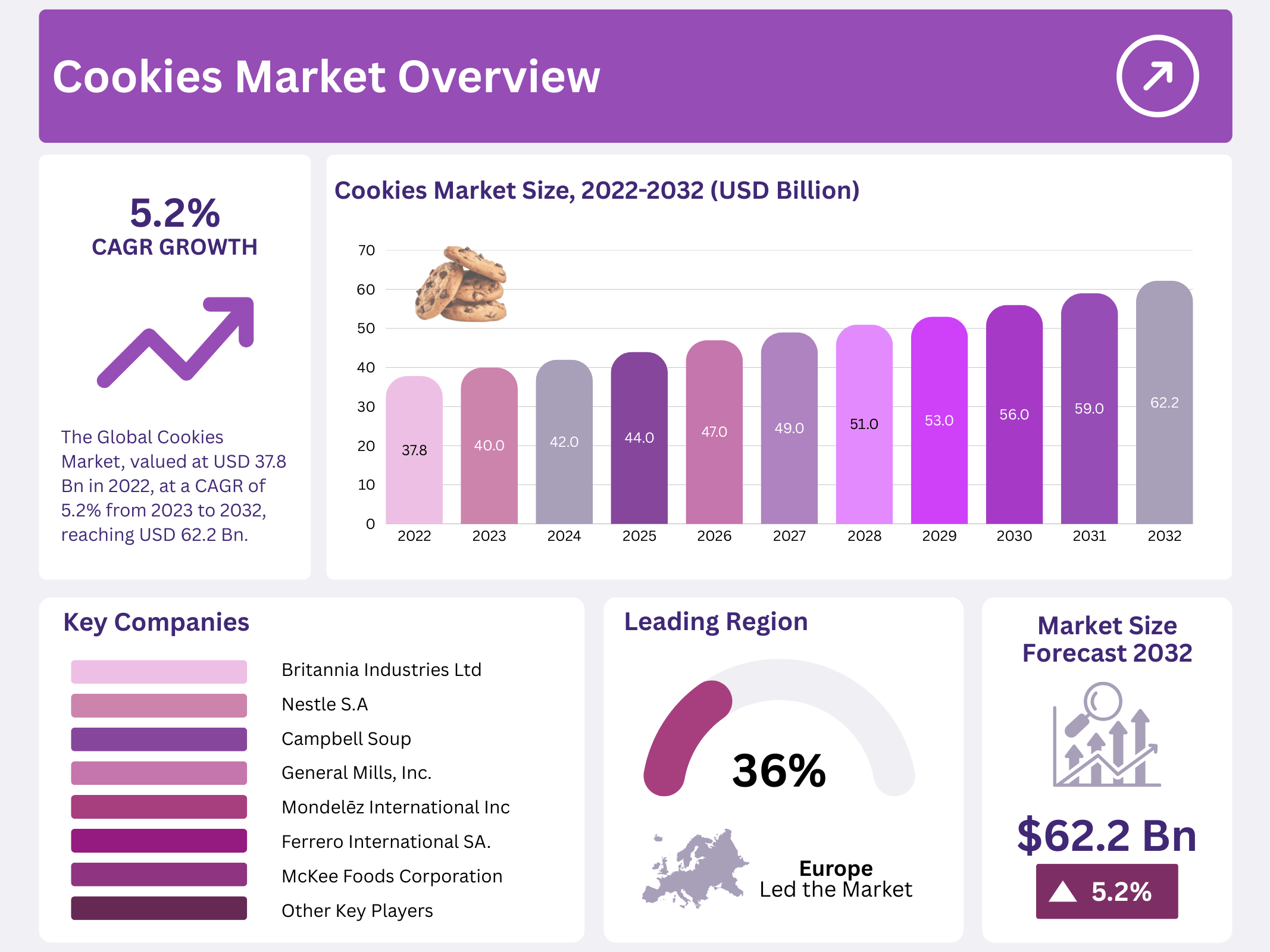

New York, NY – September 10, 2025 – In 2022, The Global Cookies Market was valued at USD 37.8 billion. From 2023 to 2032, it is projected to grow at a CAGR of 5.2%, reaching USD 62.2 billion by 2032. Cookies are popular worldwide as nutritious snacks, containing essential ingredients like flour, sugar, eggs, oil, and butter, enriched with vitamins and minerals. To meet evolving consumer preferences, manufacturers are introducing innovative flavors with exotic additives, including fat-free and high-protein options achieved through streamlined baking processes.

Market growth is driven by increasing awareness of dietary needs, such as gluten intolerance and lactose sensitivity, particularly in developed regions like North America and Europe. Cookies remain a staple snack in countries including the US, UK, Italy, and India. Cookies come in various forms, including bar, drip, filled, molded, no-bake, pressed, refrigerator, rolled, sandwich, and low-fat varieties. They are produced through home baking, commercial bakeries, or large-scale industrial roasting.

Key Takeaways

- The Global Cookies Market is projected to grow at a CAGR of 5.3% through 2032.

- Bar cookies lead the market due to their wide flavor availability and versatility.

- Rigid packaging dominates as it offers better protection and a longer shelf life for cookies.

- Supermarkets hold the largest distribution share thanks to variety and convenience.

- Demand for healthier, gluten-free, and sustainable cookie options is rising globally.

- Europe leads the global cookie market, accounting for 36% of total sales.

- Key players rely on innovation, collaborations, and expansion strategies to stay competitive.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 37.8 Billion |

| Forecast Revenue (2032) | USD 62.2 Billion |

| CAGR (2023-2032) | 5.2% |

| Segments Covered | By Type- Bar Cookies, Sandwich Cookies, Molded Cookies, Pressed Cookies, and Others; By packaging- Rigid Packaging and Flexible Packaging; and By Distribution Channels- Retailers, Supermarkets, Hypermarkets, and Online Retailing |

| Competitive Landscape | Britannia Industries Ltd, Campbell Soup Company, General Mills, Inc., Mondelēz International, Ferrero International S.A., McKee Foods Corporation, PepsiCo Inc., Bahlsen GmbH, ITC Ltd., Parle Products Pvt. Ltd, Danone S.A., and Other Key Players |

Key Market Segments

Type Analysis

Bar Cookies Dominate the Market

By product type, the cookies market is segmented into bar cookies, sandwich cookies, molded cookies, pressed cookies, and others. Among these, bar cookies lead the market due to their wide availability in different flavors and their ease of preparation. Popular examples like brownies and blondies are simple to bake—mixing ingredients, baking in a pan, and serving directly once cooled. Their versatility and use of easily available ingredients make them highly popular.

Sandwich cookies, also known as sandwich biscuits, consist of two thin cookies with a filling in between, which may include cream, ganache, buttercream, chocolate, jam, lemon curd, or even ice cream. Molded cookies, on the other hand, are prepared by shaping stiff dough into balls, crescents, or logs by hand. Pressed cookies are made from softer dough placed in a cookie press (or cookie gun) to form decorative shapes. Each type has its own appeal, but bar cookies remain the most dominant due to convenience and variety.

Packaging Analysis

Rigid Packaging Segment Leads the Market

When segmented by packaging, cookies are sold in either rigid or flexible packaging. In 2022, the rigid packaging segment dominated as it provides the highest level of protection, ensuring cookies maintain freshness and flavor over a longer shelf life. Rigid packaging prevents exposure to air, moisture, microorganisms, and external odors while also blocking light and UV radiation.

It is particularly important in preserving the crispness and taste of cookies during storage and transport, while also making products visually attractive on supermarket shelves. Materials such as polypropylene (OPP), polyester (PET), laminates, plastic-coated paper, aluminum foil, and carton boards are commonly used. Typically, cookies have a moisture content of less than one percent, allowing for a shelf life of six months or more.

Distribution Channel Analysis

Supermarkets Offer Greater Variety

By distribution channel, the cookies market is divided into retailers, shopping malls, supermarkets, and others. Supermarkets account for the largest share, as they offer consumers a wide variety of cookie brands and flavors in one place. This convenience and variety make them the preferred choice for most buyers.

At the same time, online retail is gaining momentum due to the increasing number of internet users and faster delivery options. Many cookie brands now advertise heavily on social media and e-commerce platforms, expanding their reach. Retail stores also continue to grow steadily, offering easy accessibility and quick purchases for daily consumers.

Regional Analysis

Europe is projected to remain the most lucrative region in the global cookies market, holding the largest share of 36%. This leadership is supported by large-scale cookie production and strong exports of branded products to international markets. In contrast, North America is expected to witness rapid growth, driven by its position as the highest consumer of bakery goods.

Latin America is also set for positive momentum, with the Brazilian baking industry fueling higher cookie sales. Meanwhile, the Asia Pacific region is emerging as a highly promising market. The rising populations of China and India are expanding the consumer base, creating fresh opportunities for cookie makers. The Middle East & Africa will experience gradual growth as shifting lifestyles and a growing preference for ready-to-eat snacks increase cookie demand.

Top Use Cases

- Personalized Advertising: Cookies track user browsing habits to deliver tailored ads. By analyzing preferences, businesses show relevant products, increasing engagement and sales. For example, a user searching for shoes may see shoe ads across websites, making marketing more effective and improving user experience with ads that match their interests.

- E-commerce Insights: Cookies collect data on shopping habits, such as items viewed or added to carts. This helps businesses understand customer preferences and predict trends. For instance, tracking popular products allows companies to adjust inventory or offer promotions, boosting sales and improving customer retention through personalized offers.

- Consumer Behavior Analysis: Cookies gather data on how users interact with websites, like time spent or pages visited. This helps businesses identify trends, such as popular content or peak browsing times. Understanding these patterns allows companies to refine marketing strategies and create content that resonates with their target audience.

- Health-Conscious Product Development: Cookies track demand for healthier snack options, like gluten-free or low-sugar cookies. By analyzing search and purchase data, companies can develop products that align with wellness trends. This meets consumer needs, expands market share, and positions brands as responsive to evolving dietary preferences.

Recent Developments

1. Britannia Industries Ltd

Britannia is aggressively expanding its premium cookie portfolio to counter market competition. A key launch is the ‘Britannia Bourbon’ to rival Oreo, featuring a chocolate cream filling. They are also innovating within their core brands like Good Day, introducing new flavors and variants. This focus on premiumization and flavor innovation aims to drive growth in the competitive Indian biscuit market.

2. Nestlé S.A

Nestlé recently announced a significant global initiative to make its entire cookie portfolio healthier by the end of 2025. This involves reducing sugar, sodium, and saturated fat while incorporating more whole grains and fiber. For its flagship brand, KitKat, Nestlé launched a new Chocolatory cookie line in various markets, expanding the brand beyond the traditional wafer bar into the baked goods category.

3. Campbell Soup Company

Through its subsidiary Campbell Snacks (which includes Pepperidge Farm), the company is focusing on premium and nostalgic innovation. A key launch was the Milano Slices, a softer-baked cookie with creamy filling in flavors like Milk Chocolate & Carmel. They are also leveraging data analytics to optimize product assortments and promotions, aiming to drive growth in the fresh bakery aisle and the branded cookie segment.

4. General Mills, Inc.

General Mills is driving growth for its iconic Betty Crocker and Pillsbury brands by capitalizing on the at-home baking trend. Recent developments focus on launching new cookie mixes and ready-to-bake doughs, including seasonal offerings and collaborations. They emphasize convenience and variety, introducing new flavors like Pillsbury Halloween Monster Cookies and expanding their gluten-free and “Undeniably Dairy” options to meet diverse consumer needs.

5. Mondelēz International, Inc.

Mondelēz continues to heavily invest in its global powerhouse, Oreo. Recent innovations include limited-edition flavors like Oreo Mega Stuf and collaborations. A major development is their focus on sustainability, aiming for 100% recyclable packaging for cookies in the EU and globally. They are also expanding production capacity to meet soaring demand.

Conclusion

The Cookies Market is growing due to rising demand for convenient, indulgent snacks and innovative flavors. Consumers seek healthier options, like organic or vegan cookies, and sustainable packaging. E-commerce expands access, while premium and artisanal products gain popularity. Businesses must focus on health trends, eco-friendly practices, and digital platforms to stay competitive and meet evolving consumer preferences.