Quick Navigation

Introduction

The global contract furniture market is expanding rapidly, driven by modern workspace evolution and rising commercial infrastructure investments. Additionally, increasing demand for ergonomic and modular designs continues to shape product innovation and procurement strategies across commercial sectors. Furthermore, sustainability trends are influencing manufacturers to adopt eco-friendly materials and processes.

Moreover, hybrid work models are transforming office layouts, prompting organizations to invest in flexible, tech-integrated furniture solutions. As companies redesign spaces to enhance collaboration, the market experiences sustained momentum. Likewise, the hospitality and healthcare sectors contribute significantly to demand through ongoing renovation and expansion activities worldwide.

In addition, technological advancements such as smart desks, integrated charging systems, and IoT-enabled furniture are reshaping customer expectations. Consequently, manufacturers are investing in R&D to differentiate offerings in a competitive landscape. Simultaneously, rapid urbanization in emerging economies fuels the development of commercial hubs, further boosting market expansion.

Furthermore, strategic mergers and acquisitions, including high-profile deals, are consolidating the industry and strengthening players’ market penetration. As digital adoption grows, online channels gain traction, complementing the traditionally dominant offline distribution model. Ultimately, these combined forces position the contract furniture market for strong long-term growth and sustained innovation.

Key Takeaways

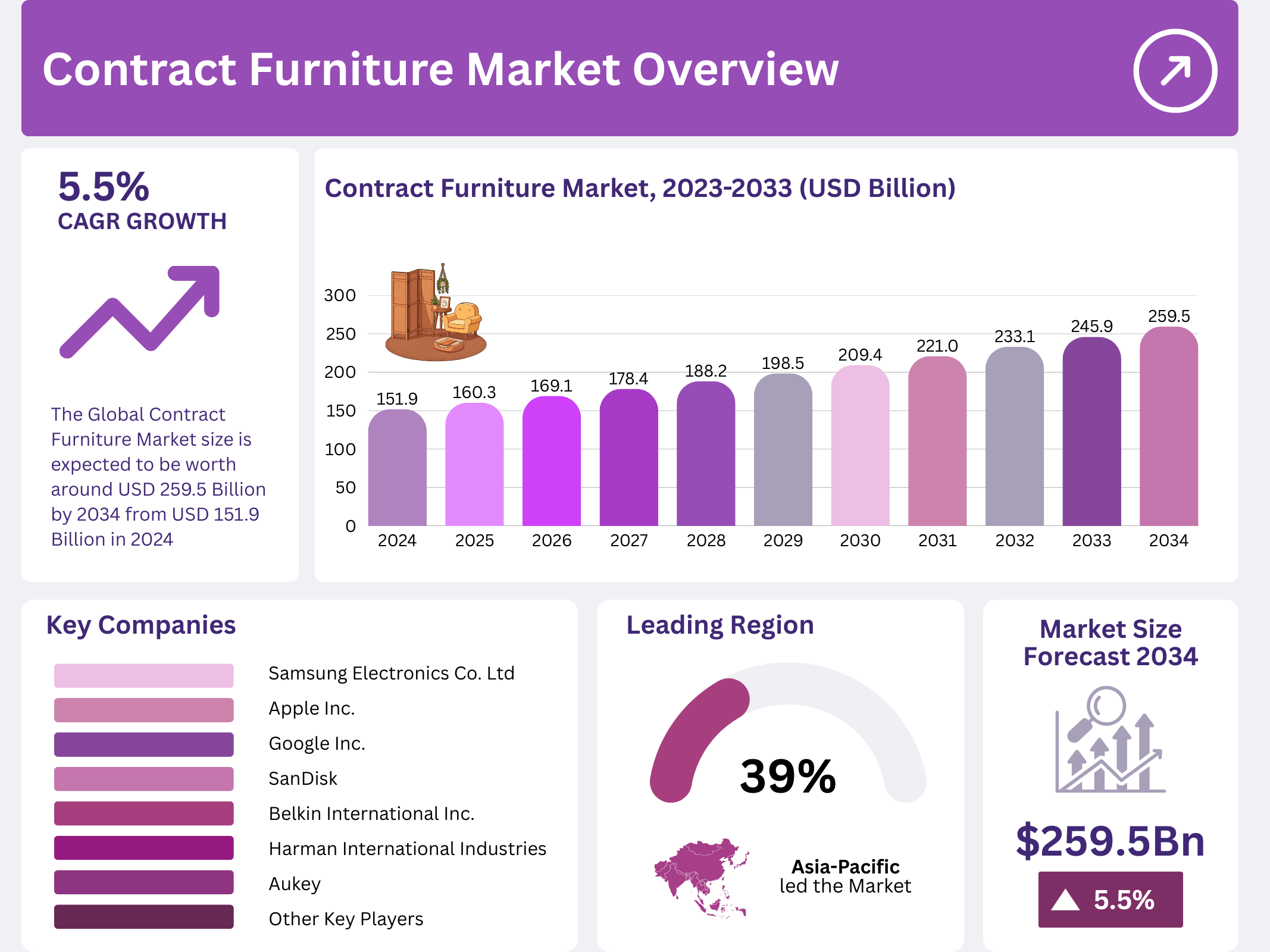

- The global contract furniture market is projected to reach USD 259.5 billion by 2034, up from USD 151.9 billion in 2024, reflecting a CAGR of 5.5% during 2025–2034.

- In 2024, Chairs & Stools led the market with over 37% share.

- Corporate Offices accounted for more than 42% of the market in 2024.

- The Offline distribution channel dominated with over 77% share in 2024.

- Asia Pacific held 39% of the global market in 2024, valued at USD 59.2 billion.

Market Segmentation Overview

By Type

Chairs & Stools dominated the market with a strong 37% share, driven by rising demand for ergonomic and modular seating. Additionally, workplaces prioritize comfort and flexibility, accelerating adoption across corporate, educational, and hospitality environments.

The Tables & Desks segment continues to grow as hybrid work trends reshape office layouts. Moreover, height-adjustable and tech-integrated designs support dynamic workflows and increase purchasing activity among corporate buyers.

Storage Furniture remains essential for organizational efficiency across commercial settings. Furthermore, smart storage solutions with digital locking and customization options are increasingly sought after in modern workplace designs.

The Sofa & Couch segment benefits from the rise of collaborative spaces and hospitality expansions. Consequently, modular lounge seating and premium upholstered solutions are gaining traction across commercial real estate and corporate interiors.

By End-User

Corporate Offices held over 42% share as businesses invest in flexible, ergonomic furniture for hybrid work strategies. Additionally, redesigning collaborative environments drives continuous procurement of premium commercial furnishings.

The Government sector contributes significantly through large-scale procurements emphasizing durability and sustainability. Moreover, public administrative expansions support consistent demand for functional, cost-effective solutions.

The Institutional segment grows steadily due to increased investments in modern learning spaces. Furthermore, technology-integrated furniture enhances educational environments, boosting demand from universities and training centers.

Healthcare facilities continue expanding their infrastructure, driving need for easy-to-maintain, ergonomic, and patient-centric furniture. Additionally, rising wellness initiatives influence procurement decisions.

By Distribution Channel

The Offline segment dominated with over 77% share due to corporate bulk buying and the need for physical product assessment. Additionally, long-standing supplier networks reinforce offline purchasing preferences.

Online channels are expanding rapidly as digital catalogs and virtual visualization tools grow more sophisticated. Consequently, businesses increasingly adopt online procurement for efficiency and competitive pricing.

Drivers

Expansion of Commercial Spaces: Rapid development of office buildings, hotels, clinics, and educational institutions continues to fuel demand for durable contract furniture. Additionally, hybrid work environments accelerate the need for adaptable, modular designs.

Shift to Ergonomic & Flexible Designs: Organizations prioritize productivity and employee well-being, driving investment in ergonomic seating, smart desks, and collaborative furniture systems. Moreover, evolving workplace expectations further reinforce this trend.

Use Cases

Corporate Workspaces: Businesses rely on ergonomic and modular furniture to enhance workflow efficiency and support hybrid teams. Additionally, tech-integrated desks streamline connectivity in modern work environments.

Hospitality Interiors: Hotels and commercial establishments use premium, customized furnishings to elevate guest experiences. Furthermore, growth in boutique and luxury accommodations expands demand for bespoke contract furniture.

Major Challenges

Raw Material Price Volatility: Fluctuating costs of wood, metals, and textiles strain manufacturer margins. Additionally, inflation and supply chain disruptions complicate long-term pricing strategies.

Regulatory Compliance Pressures: Sustainability standards and sourcing restrictions increase operational complexity. Consequently, manufacturers must invest more in compliant materials and advanced production techniques.

Business Opportunities

Smart & Connected Furniture: Growing interest in IoT-enabled desks, charging-integrated seating, and posture-monitoring systems creates new revenue streams. Additionally, digital transformation trends boost adoption across high-tech workplaces.

Sustainable Product Lines: Rising demand for eco-friendly materials opens lucrative opportunities for green-certified furniture. Furthermore, circular-design principles support long-term brand differentiation.

Regional Analysis

Asia Pacific: With 39% market share, the region benefits from rapid urbanization and major commercial infrastructure investments. Moreover, China and India lead demand with expanding corporate and hospitality sectors.

North America & Europe: These regions experience strong demand for ergonomic, sustainable furniture solutions. Additionally, hybrid work adoption and environmental regulations drive innovation and procurement activity.

Recent Developments

- Relso secured $840,000 in pre-seed funding in 2023.

- Gordon Brothers sold the Laura Ashley brand to Marquee Brands in 2025.

- HNI Corporation acquired Kimball International in a $485 million deal in 2023.

- The U.S. office market faced significant challenges in 2023 due to rising rates and declining demand.

Conclusion

The global contract furniture market is set for sustained expansion as hybrid work, sustainability, and smart technology redefine commercial interiors. Moreover, rising investments in corporate, hospitality, and healthcare infrastructure continue to elevate demand. With ongoing innovation and strategic industry consolidation, the market is positioned for long-term resilience and growth.