Quick Navigation

Introduction

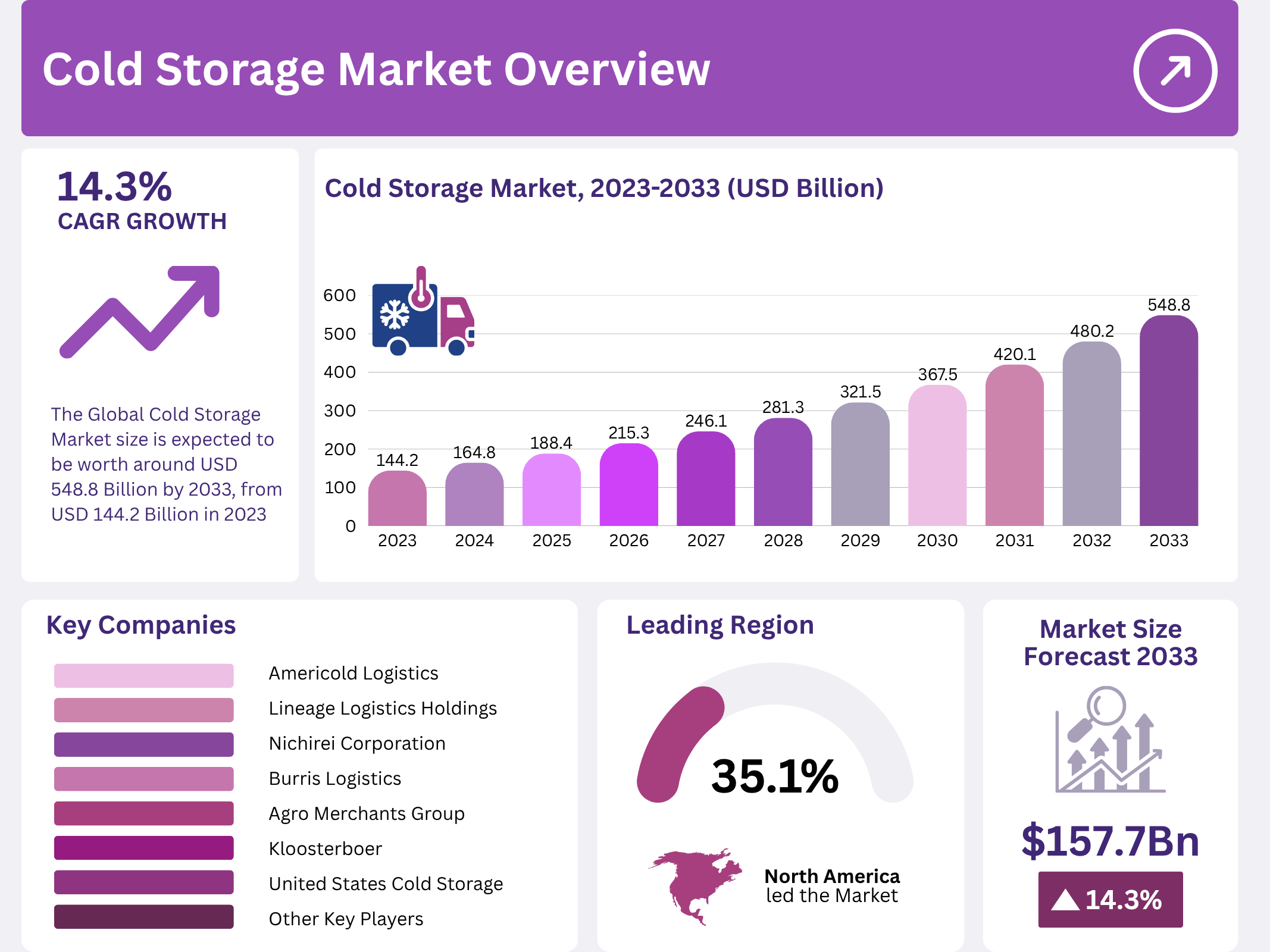

The global cold storage market is witnessing robust growth, projected to reach USD 548.8 billion by 2033, up from USD 144.2 billion in 2023, growing at a compound annual growth rate (CAGR) of 14.3% during the forecast period from 2024 to 2033. This growth is driven by the increasing demand for perishable goods and advancements in cold chain infrastructure.

Cold storage plays a vital role in preserving perishable goods by maintaining controlled, low-temperature environments. It is crucial for the preservation of products like food, pharmaceuticals, and chemicals, preventing spoilage and extending shelf life. As the demand for fresh food and temperature-sensitive medicines rises, the need for efficient cold storage solutions becomes even more critical.

Key Takeaways

– The global cold storage market is expected to be worth USD 548.8 billion by 2033, growing from USD 144.2 billion in 2023, at a CAGR of 14.3% from 2024 to 2033.

– In 2023, refrigerated warehouses dominated the market by type, holding 63.5% of the market share.

– The frozen segment led the market by temperature in 2023, holding 74.6% of the share.

– The food & beverages sector held 75.6% of the market share by application in 2023.

– North America led the market in 2023, with a 35.1% market share and USD 50.61 billion in revenue.

Market Segmentation Overview

By Type

In 2023, refrigerated warehouses dominated the cold storage market with 63.5% of the market share. This segment is crucial for large-scale storage solutions, ensuring the preservation of a wide range of perishable goods. Refrigerated transport, though smaller in share, is essential for maintaining the cold chain during transit, connecting production sites with end consumers.

By Temperature

The frozen category held a significant market share of 74.6% in 2023. This segment is essential for maintaining the shelf life of various products, such as frozen foods and pharmaceuticals, by keeping temperatures below freezing. The chilled segment, though smaller, is also critical, particularly for fresh produce, dairy products, and certain pharmaceuticals that require temperatures above freezing.

By Application

In 2023, the food & beverages sector was the largest application segment, holding 75.6% of the market share. This dominance is driven by the growing demand for fresh and frozen foods, along with beverages. Other important sub-segments include dairy products, meat, seafood, and processed foods, each requiring specialized temperature-controlled environments.

Drivers

Increased Demand for Perishable Goods

The increasing global consumption of fresh and frozen foods is a primary driver of the cold storage market. As urban populations expand and consumer preferences shift toward fresh products, the demand for efficient cold storage and transportation solutions to preserve food quality is rising rapidly. This trend is contributing significantly to the growth of the market.

Pharmaceutical Industry Growth

The pharmaceutical industry’s growing reliance on temperature-sensitive products, such as vaccines and biopharmaceuticals, is another key driver. With global health challenges and a need for precise temperature-controlled environments, the demand for cold storage solutions in this sector continues to increase, further boosting the market.

Use Cases

Food Distribution

Cold storage plays an essential role in the food distribution industry, ensuring the preservation of fresh produce, frozen goods, and beverages. With the rise of global food trade, cold storage is necessary to maintain food quality, prevent spoilage, and reduce waste, ensuring that products remain safe and consumable from farm to table.

Pharmaceuticals and Healthcare

The pharmaceutical sector relies on cold storage to preserve vaccines, medicines, and biological products. With the increasing need for vaccines and biopharmaceuticals, the requirement for reliable, temperature-controlled storage solutions has become critical to ensuring the safety and efficacy of medical products during storage and transport.

Major Challenges

High Operational Costs

The high capital investment required to establish and maintain cold storage facilities is one of the main challenges facing the market. The costs for advanced refrigeration systems, energy consumption, and regular maintenance can deter smaller players from entering the market. Additionally, ongoing energy costs further increase operational expenses.

Regulatory Hurdles

Cold storage facilities must adhere to strict health, safety, and environmental regulations, which vary by region. Complying with these regulations can add complexity and cost to operations. In some regions, the regulatory environment may delay the development of new facilities or hinder the expansion of existing ones.

Business Opportunities

Expansion of E-Commerce

The rise of e-commerce, particularly in food and pharmaceutical sectors, is creating new opportunities for cold storage providers. As online grocery sales increase, the demand for cold storage solutions that ensure the safe transport and storage of perishable goods is growing, opening new avenues for market expansion.

Sustainability Innovations

With growing environmental concerns, there is a push for more energy-efficient and sustainable cold storage solutions. Innovations such as green refrigeration technologies and the adoption of renewable energy sources present opportunities for businesses to reduce costs while aligning with global sustainability goals, attracting environmentally conscious customers.

Regional Analysis

North America

North America dominates the cold storage market, holding 35.1% of the market share in 2023. This is due to the region’s advanced logistics infrastructure and the high consumption of frozen and refrigerated goods. The increasing demand for fresh food and pharmaceuticals, along with the presence of key players like Americold Logistics, drives the region’s market growth.

Asia Pacific

Asia Pacific is experiencing rapid growth in the cold storage market, fueled by urbanization and rising incomes. As populations in countries like China, India, and Japan grow, there is a significant increase in demand for perishable goods, requiring advanced cold storage solutions. Investments in infrastructure are further supporting this expansion.

Recent Developments

- In October 2024, Kloosterboer received a $50 million investment to enhance automation technology at its European facilities.

- In July 2023, Agro Merchants Group launched an organic-certified cold storage facility in California with an initial capacity of 150,000 pallets.

- In March 2023, Burris Logistics acquired a smaller competitor, adding 200,000 square feet of cold storage space to expand its regional footprint in the Northeast.

Conclusion

The cold storage market is poised for significant growth, driven by rising demand for perishable goods, advancements in refrigeration technologies, and the expanding pharmaceutical sector. As new opportunities emerge, such as the growth of e-commerce and sustainability innovations, the market is well-positioned to address global challenges in food preservation and logistics. Despite challenges like high operational costs and regulatory complexities, the sector’s growth trajectory remains strong, with key players investing in technology and infrastructure to meet future demands. The cold storage market is set to continue evolving, offering robust business opportunities and solid returns for stakeholders across the globe.