Quick Navigation

Introduction

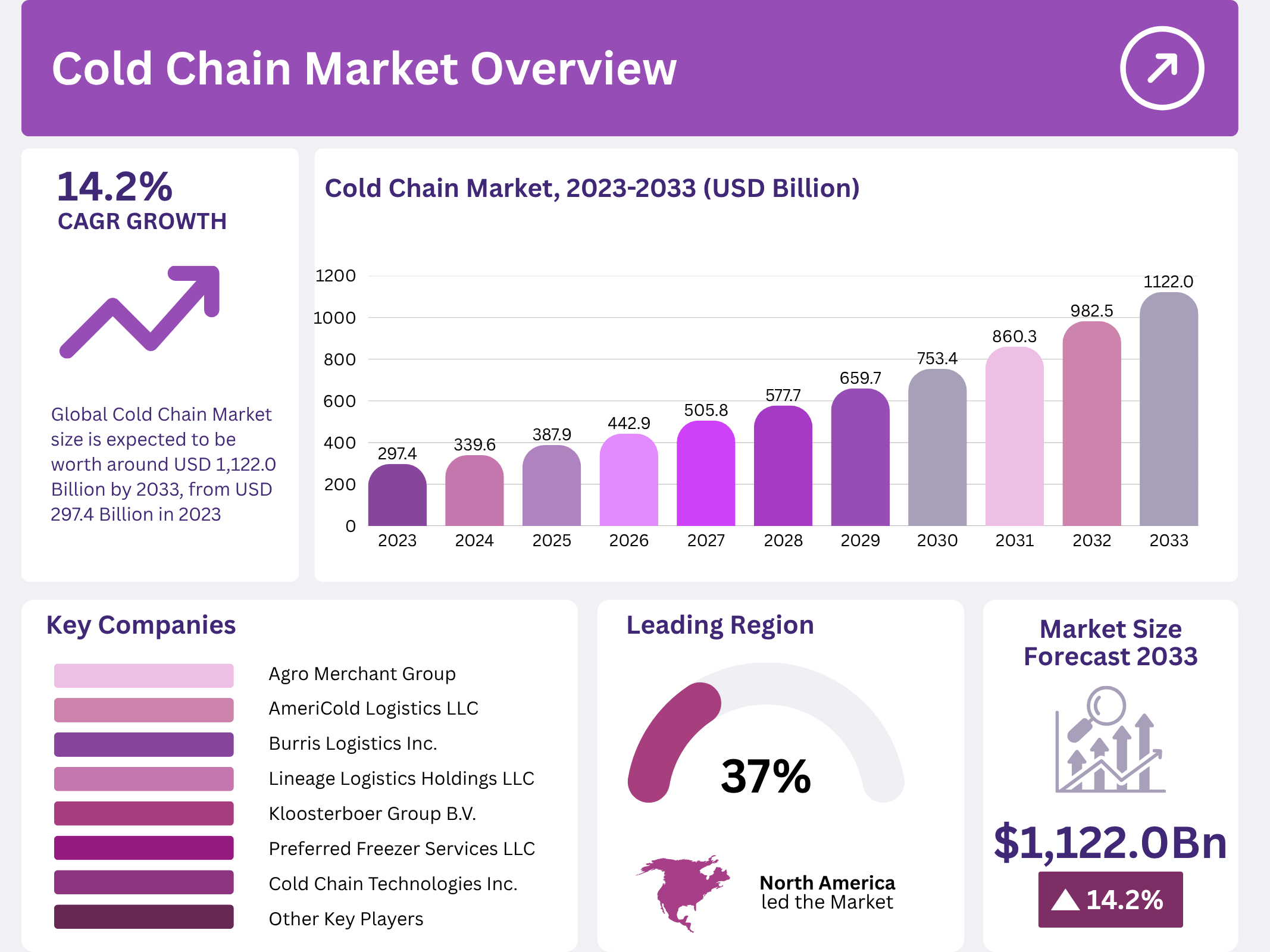

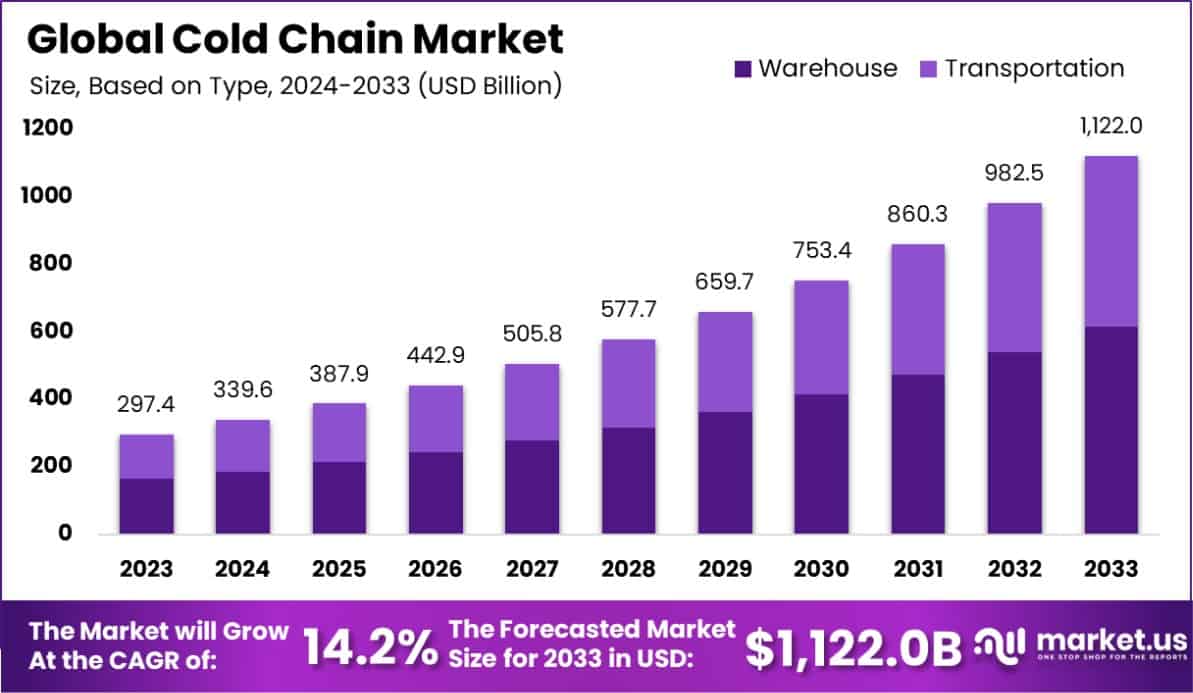

The Global Cold Chain Market is experiencing robust growth, projected to reach USD 1,122.0 Billion by 2033 from USD 297.4 Billion in 2023, expanding at a CAGR of 14.2% between 2024 and 2033. The increasing demand for perishable foods and temperature-sensitive pharmaceuticals is propelling this remarkable market expansion.

Moreover, the integration of advanced technologies like IoT and blockchain is transforming the cold chain landscape, improving traceability, efficiency, and safety. North America led the global market in 2023 with a 37% share, valued at USD 110.0 Billion, underscoring the region’s mature logistics infrastructure and strong regulatory standards.

As global supply chains evolve, the cold chain sector remains vital in supporting food security, healthcare, and pharmaceutical distribution. The sector’s steady advancement emphasizes its indispensable role in ensuring product quality and safety from production to consumption.

Key Takeaways

- The Global Cold Chain Market size is expected to reach USD 1,122.0 Billion by 2033, growing at a 14.2% CAGR from 2024 to 2033.

- In 2023, Warehouse dominated the Type segment with a 55% market share.

- Chilled held a dominant position in Temperature Type with a 60% share.

- Products captured a 75% share in the Packaging segment.

- On-grid solutions held a 60% share in Storage Equipment.

- Fish, Meat, & Seafood accounted for 25% of the Application segment.

- North America dominated with a 37% market share and USD 110.0 Billion in revenue.

Market Segmentation Overview

The Cold Chain Market, based on Type, was divided into Warehouse and Transportation. The Warehouse segment held 55% of the market in 2023, driven by the critical need for temperature-controlled storage facilities that maintain the integrity of perishable goods, pharmaceuticals, and frozen products across the supply chain.

Based on Temperature Type, the market was segmented into Chilled and Frozen categories. Chilled dominated with 60% of the market in 2023, reflecting rising consumer demand for fresh produce and dairy products. This growth is supported by enhanced refrigerated warehousing technologies ensuring product quality and freshness.

In terms of Packaging, the Products segment led with a 75% share in 2023. This category includes insulated containers, temperature-controlled boxes, and refrigerated pallets—essential components in ensuring consistent thermal protection during transport and storage.

Based on Storage Equipment, On-grid systems dominated with a 60% market share. These energy-connected refrigeration solutions ensure stable power supply and consistent cooling conditions, minimizing spoilage and ensuring regulatory compliance for temperature-sensitive products.

By Application, Fish, Meat, & Seafood led the market with a 25% share in 2023. This dominance underscores the demand for precise temperature management in preventing spoilage and maintaining food safety throughout the global supply chain.

Drivers

The primary driver of the Cold Chain Market is the surging global demand for perishable goods, including fresh produce, dairy, and pharmaceuticals. As consumer preferences shift toward fresher and healthier food options, efficient cold storage and logistics systems have become critical to maintaining product integrity and extending shelf life.

Another key driver is the advancement in refrigeration and logistics technologies. Modern IoT-enabled sensors, AI-driven monitoring systems, and blockchain traceability are improving efficiency, accuracy, and real-time management. These innovations ensure temperature consistency and compliance with regulatory standards, fostering trust and reliability across industries.

Use Cases

One significant use case of the cold chain system is in the pharmaceutical industry, especially for vaccine storage and distribution. With global immunization programs expanding, maintaining precise temperature control ensures vaccine efficacy, supporting public health initiatives and preventing product losses during long-distance shipments.

Another vital use case lies in food logistics, where cold chain systems prevent spoilage of seafood, meats, and fresh produce. By maintaining controlled temperatures from production to retail, these systems reduce global food wastage, enhance food security, and meet consumer expectations for freshness and safety.

Major Challenges

A major challenge facing the Cold Chain Market is the high operational and energy costs associated with maintaining temperature-controlled facilities. The installation, maintenance, and continuous operation of advanced refrigeration systems significantly increase overhead expenses, especially for small and mid-sized enterprises.

Additionally, unreliable power infrastructure and inconsistent logistics networks in developing regions hinder market scalability. Frequent power outages or inadequate transportation infrastructure can cause product spoilage, financial losses, and reduced confidence in supply reliability, slowing down global cold chain adoption.

Business Opportunities

The surge in online grocery and e-commerce platforms presents substantial business opportunities for cold chain service providers. Growing consumer preference for home delivery of perishable products drives the need for last-mile temperature-controlled logistics solutions, boosting market expansion.

Moreover, emerging economies offer untapped potential due to rising urbanization, infrastructure investments, and stricter food safety regulations. The increasing pharmaceutical demand and government-backed health programs create new avenues for investment in cold chain storage, especially for biologics and vaccines.

Regional Analysis

North America led the Cold Chain Market in 2023 with a 37% share, generating USD 110.0 Billion in revenue. The region’s dominance stems from advanced logistics infrastructure, high consumption of frozen and packaged foods, and stringent pharmaceutical transport regulations that demand reliable cold chain systems.

Asia Pacific is the fastest-growing region, fueled by rising consumer demand for fresh foods, expanding retail networks, and rapid infrastructure development. Governments across countries like China and India are investing heavily in cold storage facilities to improve food preservation and enhance export potential.

Recent Developments

- In July 2023, Lineage Logistics secured USD 500 million in funding to expand globally and increase warehouse capacity by 15%.

- In May 2023, Kloosterboer Group launched an eco-friendly refrigerated storage facility, adding 30,000 pallets of capacity.

- In March 2023, Burris Logistics Inc. acquired a regional competitor, boosting its distribution capability by 20%.

Conclusion

The Global Cold Chain Market is evolving as a cornerstone of modern logistics, supporting industries from food to pharmaceuticals. With projections reaching USD 1,122.0 Billion by 2033, its growth underscores the increasing global reliance on temperature-controlled systems.

Technological advancements, regulatory support, and consumer demand for quality are shaping a resilient and innovative market landscape. While challenges such as operational costs persist, the surge in e-commerce and the expansion of healthcare logistics present vast opportunities for continued development and investment in this crucial global industry.