Quick Navigation

Overview

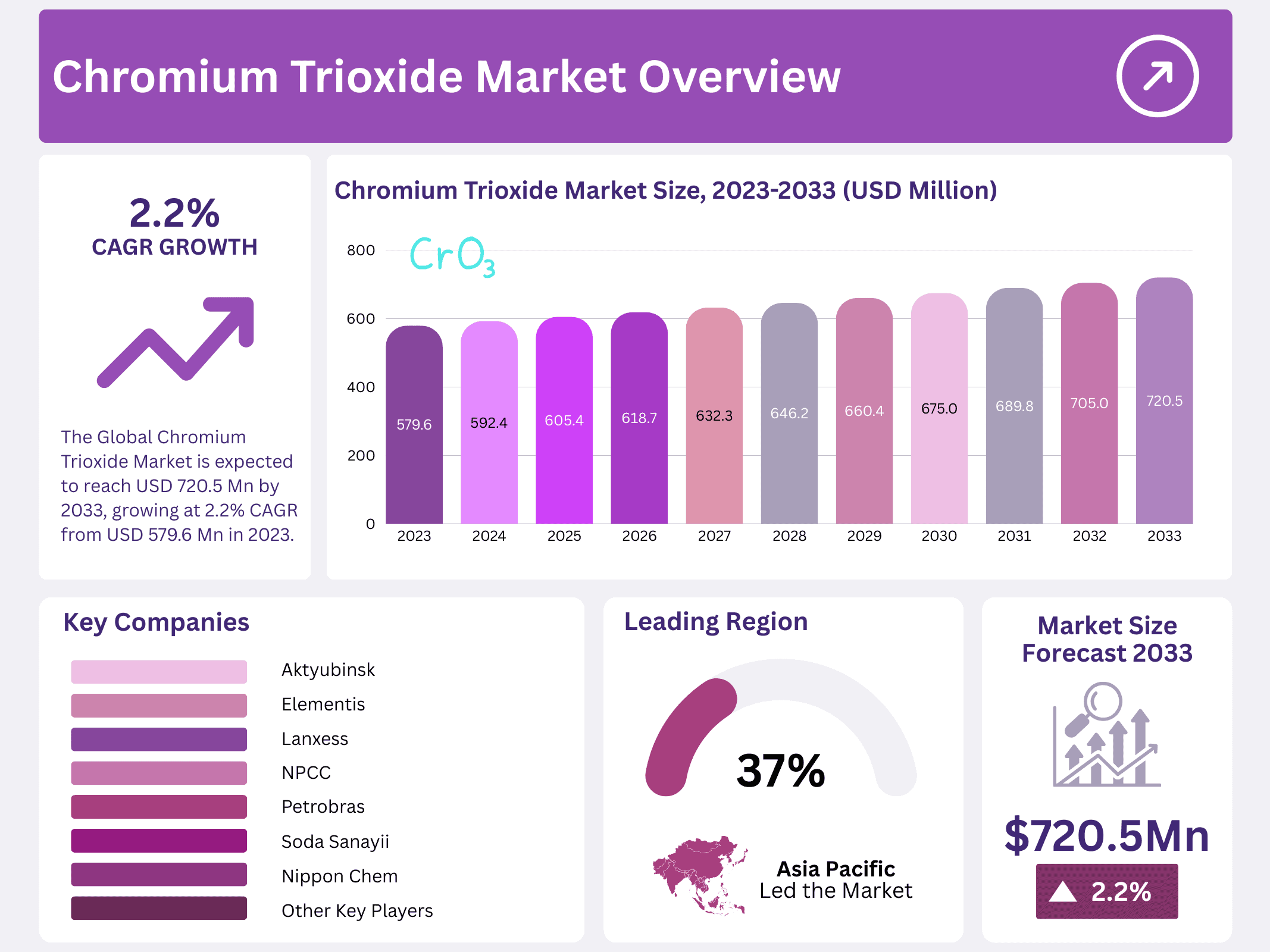

New York, NY – January 21, 2026 – The Global Chromium Trioxide Market is projected to reach USD 720.5 million by 2033, rising from USD 579.6 million in 2023 at a CAGR of 2.2%. Chromium trioxide, commonly known as chromic acid (CrO₃), is a key industrial chemical widely used across multiple manufacturing processes. Its strong oxidative properties make it essential in applications that require high durability and precision.

Chromium trioxide plays a critical role in metal finishing, electroplating, anodizing, and the production of pigments, dyes, and organic chemicals. These applications drive steady demand from industries such as automotive, aerospace, construction, coatings, and specialty chemicals. The market ecosystem includes manufacturers, suppliers, distributors, and end-users who collectively contribute to the procurement, processing, and commercialization of this compound.

Market behavior is influenced by factors such as supply–demand trends, pricing fluctuations, regulatory frameworks, and technological developments. Increasing environmental and health regulations, especially surrounding chromium (VI) compounds, are pushing manufacturers toward safer processes and sustainable innovations. Despite regulatory challenges, chromium trioxide remains a crucial part of the global chemical industry due to its unique performance characteristics and its ability to support a wide range of industrial applications.

Key Takeaways

- The Global Chromium Trioxide Market is expected to reach USD 720.5 million by 2033, growing at 2.2% CAGR from USD 579.6 million in 2023.

- Chromium Trioxide with purity above 99% dominates with over 74.5% share in 2024.

- The printing and dyeing sector leads with 56.4% market share in 2024.

- Indirect sales hold 65.3% share, favored for wide reach and convenience.

- Asia Pacific dominates with 37.5% market share in 2024, led by China and India.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 579.6 Million |

| Forecast Revenue (2033) | USD 720.5 Million |

| CAGR (2024-2033) | 2.2% |

| Segments Covered | By Purity(Upto Purity 99%, Above 99%), By Application(Printing and Dyeing, Electroplating Industry, Wood Preservation, Others), By Distribution Channel(Direct Sales, Indirect Sales) |

| Competitive Landscape | Aktyubinsk, Chongqing Minfeng Chemical, Elementis, Haining Peace Chemical, Hunter Chemical LLC, Lanxess, MidUral Group, Nippon Chem, NPCC, Soda Sanayii, Vishnu, Yinhe Chemical, Zhenhua Chemical, Zhonglan Yima Chemical |

Key Market Segments

By Purity

In 2024, Chromium Trioxide with a purity above 99% dominated the market, capturing over 74.5% of the global share. Its strong position stems from its critical use in precision-driven industries such as electroplating, metal finishing, and high-grade pigment manufacturing. These sectors rely on superior purity levels to achieve consistent performance, enhanced efficiency, and reliable end-product quality.

Conversely, Chromium Trioxide with purity up to 99% continues to serve an important role despite holding a smaller market share. This segment supports industries where ultra-high purity is less critical, such as wood preservation, glass manufacturing, and certain ceramic applications. Its cost-effectiveness makes it ideal for businesses seeking functional performance at a lower price point, balancing acceptable purity with economic efficiency.

Overall, the purity-based segmentation highlights distinct market needs. The above 99% purity category leads due to its necessity in high-performance applications, while the up to 99% purity segment remains valuable for cost-sensitive sectors. Together, both segments reflect the diverse industrial demand shaping the Chromium Trioxide market.

By Application

In 2024, the Printing and Dyeing segment emerged as the leading application area for Chromium Trioxide, accounting for over 56.4% of total market share. This dominance is driven by its essential role in producing vibrant, long-lasting, and fade-resistant dyes—a critical requirement for textile manufacturers seeking superior color quality and durability.

The Electroplating Industry followed as another major application segment. Chromium Trioxide is indispensable in electroplating for creating corrosion-resistant, glossy metal finishes widely used in automotive parts, aerospace components, and electronics. Its ability to enhance both durability and aesthetics sustains strong demand across these sectors.

Meanwhile, the Wood Preservation segment, although smaller, remains strategically important. Chromium Trioxide is used to protect wood from decay, rot, and termite damage, effectively extending its lifespan. This makes it a valuable input in construction, outdoor structures, and furniture production.

By Distribution Channel

In 2024, Indirect Sales held a commanding position in the Chromium Trioxide market, securing over 65.3% of the share. This channel—comprising distributors, resellers, and online platforms—remains popular due to its broad reach, convenience, and accessibility. It allows manufacturers to serve a wider customer base, especially small and mid-sized enterprises, while offering competitive pricing and multiple purchasing options.

Direct Sales, though representing a smaller share, remain vital for large-scale industrial buyers. This channel is preferred by major electroplating facilities and high-volume printing and dyeing units that require tailored services, customized supply arrangements, and negotiated pricing. Direct engagement strengthens partnerships and ensures consistent quality and supply reliability for demanding industrial operations.

Regional Analysis

In 2024, the Chromium Trioxide market saw notable growth, with the Asia Pacific region leading strongly by capturing 37.5% of the global share. This dominance was primarily driven by rapid industrial expansion across the region, supported by fast-paced urbanization, rising population levels, and large-scale infrastructure development.

Major economies such as China and India played a central role in strengthening the Asia Pacific’s market position. Their expanding industrial bases and continuous urban growth significantly increased the need for Chromium Trioxide across key sectors like automotive, electronics, pharmaceuticals, and agriculture. This escalating demand spurred new investments and development activities, reinforcing the region’s leadership.

The wide-ranging applications of Chromium Trioxide further contributed to its strong regional demand. With China and India serving as major manufacturing hubs, the Asia Pacific benefits from advanced production capabilities and well-established infrastructure, ensuring efficient supply across domestic and international markets.

The region’s market strength is amplified by Chromium Trioxide’s growing use in industries such as paints, coatings, adhesives, and batteries. Its high versatility and adaptability in various manufacturing processes continue to drive demand, supporting ongoing market expansion throughout the Asia Pacific.

Top Use Cases

- Chrome Plating in the Automotive Industry: Chromium trioxide plays a key role in electroplating metal parts for cars and trucks, creating a shiny, durable finish that resists rust and wear. This helps manufacturers produce long-lasting components like bumpers and wheels, boosting product appeal and reliability in a competitive market where appearance and strength matter.

- Surface Treatment for Aerospace Parts: In aerospace, chromium trioxide is used for anodizing aluminum to form protective coatings that prevent corrosion and improve adhesion for paints. This ensures aircraft parts withstand harsh conditions like high temperatures and moisture, supporting safety and performance in an industry focused on innovation and regulatory compliance.

- Wood Preservation Applications: Chromium trioxide acts as a preservative in treating wood for outdoor structures like decks and fences, protecting against decay and insects. This extends the lifespan of wood products, making it a valuable choice for construction firms seeking sustainable materials that reduce replacement costs and environmental impact.

- Pigment Production for Paints and Coatings: As an ingredient in creating vibrant pigments, chromium trioxide helps formulate colors for paints, plastics, and ceramics. This supports industries like manufacturing and design, where consistent, fade-resistant hues enhance product quality and meet consumer demands for aesthetically pleasing and durable goods.

- Oxidizing Agent in Chemical Synthesis: Chromium trioxide serves as a strong oxidizer in producing dyes, synthetic rubies, and other chemicals, facilitating reactions that yield high-purity materials. This aids sectors like textiles and jewelry, enabling efficient processes that drive innovation and supply chain efficiency in specialty chemical markets.

Recent Developments

1. Aktyubinsk

- Aktyubinsk (Khimprom) remains a significant producer of chromium compounds in Kazakhstan. Recent developments indicate continued production of chromium trioxide for the metal finishing and plating industries. The company’s operations focus on supplying the regional market, with an emphasis on basic chromium chemicals. Environmental compliance for hexavalent chromium production remains a key operational focus.

2. Chongqing Minfeng Chemical

- Chongqing Minfeng Chemical is a notable Chinese manufacturer of chromium compounds. Recent information shows ongoing chromium trioxide production, primarily serving the domestic electroplating and surface treatment sectors. The company’s developments are likely tied to adapting to China’s evolving environmental and safety regulations for hazardous chemicals, impacting production standards and supply chains.

3. Elementis

- Elementis, a global specialty chemicals company, announced in 2021 the cessation of all chromium trioxide production at its Castle Hayne, NC, facility by the end of 2023. This is the most significant recent development, driven by regulatory pressures and a strategic shift toward more sustainable chemistries. Their focus is now on supporting customers through this transition with alternative products.

4. Haining Peace Chemical

- Haining Peace Chemical Co., Ltd. is an active Chinese supplier of chromium trioxide. Recent developments involve maintaining production for the electroplating, wood preservation, and metal treatment markets. The company’s focus is on securing supply amidst industry-wide environmental scrutiny and potential raw material cost fluctuations within China.

5. Hunter Chemical LLC

- Hunter Chemical LLC is a major US distributor and supplier of chromium trioxide, historically sourcing from producers like Elementis. The key recent development is managing the supply chain disruption caused by Elementis’s exit from production. Hunter is focused on securing alternative global sources to continue supplying the North American market for aerospace and other critical plating applications.

Conclusion

Chromium Trioxide is a versatile chemical with strong demand across industries due to its effectiveness in protection and enhancement applications. Despite regulatory challenges emphasizing safer alternatives, its unique properties continue to support growth in manufacturing and specialized sectors, positioning it as an essential material for future innovations while balancing environmental considerations.