Quick Navigation

Overview

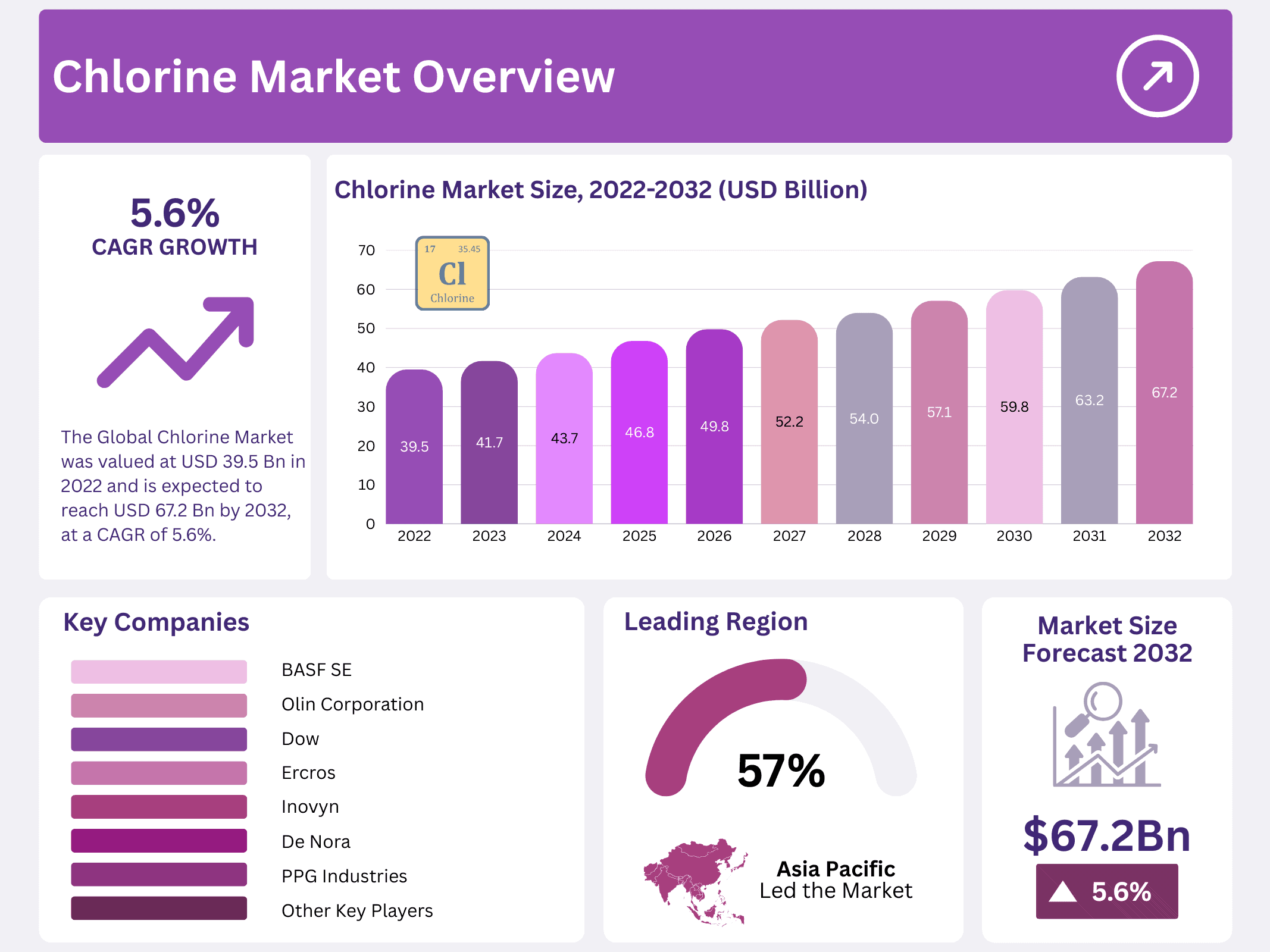

New York, NY – January 30, 2026 – The Global Chlorine Market, valued at USD 39.5 billion in 2022, is projected to reach USD 67.2 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032. This market represents the large-scale production, distribution, and commercialization of chlorine, a highly reactive yellow-green gas known for its wide industrial utility.

Chlorine plays a critical role in essential sectors such as water treatment, pharmaceuticals, chemical manufacturing, and plastics production. It is a key building block in creating various chemicals, including chloromethanes, polyvinyl chloride (PVC), and numerous organic and inorganic compounds. These downstream derivatives significantly expand the market’s overall scope and economic value.

Market growth is largely driven by rising global demand for clean water, robust expansion in the chemical industry, and increasing adoption of PVC across construction, automotive, and packaging applications. The competitive landscape includes major multinational companies such as BASF SE, Dow Chemical Company, Occidental Petroleum Corporation, and Ineos Group Limited, all contributing to the innovation and scale of the chlorine sector.

Key Takeaways

- The Global Chlorine Market was valued at USD 39.5 billion in 2022 and is expected to reach USD 67.2 billion by 2032, at a CAGR of 5.6% from 2023 to 2032.

- EDC/PVC accounted for 35.1% of revenue in 2022, making it the leading application segment.

- The water treatment segment leads the end-user market with a 22.5% share due to high adoption for disinfection.

- Asia-Pacific dominates with 57.5% market share, driven by rapid industrial expansion in China and India.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 39.5 Billion |

| Forecast Revenue (2032) | USD 67.2 Billion |

| CAGR (2023-2032) | 5.6% |

| Segments Covered | By Application -EDC/PVC, Inorganic Chemicals, Chloromethanes, Organic Chemicals, Bleaching, Solvents & Epichlorohydrin, Isocyanates, and Other Applications; By End User -Government, Pharmaceutical, Chemicals, Paper and Pulp, Plastic, Pesticides, Water Treatment, Other End Users |

| Competitive Landscape | BASF SE Profiled, Olin Corporation, The Dow Chemical Company, Occidental Petroleum Corporation, Ercros, PPG Industries, De Nora, Inovyn, Hanwha Chemical Corporation, Formosa Plastics Corporation, Ineos Group Ltd, Tata Chemicals Limited, Xinjiang Zhongtai Chemicals Co.Ltd, Tosoh Corporation |

Key Market Segments

Application Analysis

In 2022, the EDC/PVC segment accounted for a 35.1% revenue share, making it the leading application area in the global chlorine market. Based on application, the market is categorized into EDC/PVC, Inorganic Chemicals, Chloromethanes, Organic Chemicals, Bleaching, Solvents, Epichlorohydrin, Isocyanates, and Other Applications. Among these, EDC/PVC remains the most lucrative segment.

Chlorine plays a key role in producing numerous downstream chemicals, including titanium dioxide, sodium hypochlorite, magnesium chloride, and a variety of chloromethanes such as methyl chloride, methylene chloride, and chloroform. It further supports the production of diverse organic chemicals like glycols, solvents, and amines. In addition, the paper and pulp sector uses chlorine extensively as a bleaching agent, while industries such as cosmetics, pharmaceuticals, and food processing rely on chlorine-based compounds for various formulations and manufacturing needs.

End-User Analysis

The global chlorine market is segmented by end-users into Government, Pharmaceuticals, Chemicals, Paper and Pulp, Plastic, Pesticides, Water Treatment, and Other End-Users. Among these, the water treatment segment leads with a 22.5%. Chlorine is widely adopted in water treatment facilities as an effective disinfectant to eliminate harmful pathogens, ensuring safe water for residential, municipal, and industrial use.

The paper and pulp industry continues to utilize chlorine for bleaching applications, while the pharmaceutical sector depends on chlorine derivatives in the production of drugs such as antibiotics and analgesics. Beyond these sectors, chlorine also supports the manufacturing of cosmetics, agrochemicals, electronics, and consumer products, including household cleaners and personal care formulations, reflecting its broad industrial relevance.

Regional Analysis

Asia-Pacific is projected to remain the most lucrative region in the global chlorine market, accounting for the largest market share of 57.5%. This dominance is supported by the rapid industrial expansion in major economies such as China and India. The region’s strong demand for chlorine is primarily fueled by the construction, chemical, and pharmaceutical sectors, all of which continue to expand in line with rising urbanization, manufacturing output, and infrastructure development.

Beyond Asia-Pacific, the Middle East and Africa also represent an important regional market for chlorine. Growth here is driven by increasing demand from industries such as water treatment, construction, and chemicals. The region additionally serves as a notable exporter of chlorine and its derivatives, contributing to its strategic importance in the global supply chain.

Top Use Cases

- Water Treatment: Chlorine is widely used to clean and purify drinking water by killing harmful bacteria and viruses. In the market, this drives demand from municipal suppliers and wastewater plants, ensuring safe public health. Its low-cost effectiveness makes it a staple in global water management systems, supporting urban growth and hygiene standards.

- Plastics Production: As a key ingredient in making PVC, chlorine helps create durable materials for pipes, windows, and packaging. Market analysts see steady growth here due to the construction and consumer goods sectors, where PVC’s versatility reduces costs and enhances product longevity in everyday applications.

- Pharmaceuticals: Chlorine aids in synthesizing various drugs by altering chemical structures for purity and efficacy. In the healthcare market, this boosts innovation in medications, meeting rising demands from aging populations and disease control, positioning chlorine as essential for affordable and effective treatments worldwide.

- Bleaching Agents: Used in paper and textile industries to whiten materials, chlorine improves product quality and appearance. Market trends show its role in sustainable manufacturing, where efficient bleaching processes cut waste and appeal to eco-conscious consumers in the printing and fashion sectors.

- Disinfectants and Cleaners: Chlorine forms the base for household and industrial cleaners, effectively removing germs from surfaces. This use case fuels market expansion in sanitation products, especially post-health crises, as businesses and homes prioritize hygiene, driving sales in retail and commercial cleaning supplies.

Recent Developments

1. BASF SE

- BASF has increased investment in membrane electrolysis technology for chlorine production, emphasizing energy efficiency and reduced carbon emissions. This aligns with their 2025 climate targets, aiming to lower the energy intensity of their Verbund sites. Developments focus on integrating chlorine production with renewable power sources to support sustainable value chains, particularly for the polyurethane and water treatment sectors.

2. Olin Corporation

- Olin, a leading chlor-alkali producer, has recently optimized its asset portfolio by permanently closing older, less efficient chlor-alkali capacity. This strategic move focuses on strengthening their integrated model with epoxy and vinyls, improving cash flow, and reducing fixed costs. The company is leveraging its low-cost position to meet strong demand in water treatment and PVC markets.

3. The Dow Chemical Company

- Dow is advancing its circular economy goals by using chlorine in new processes to recycle mixed plastic waste. Recent developments include partnerships to scale electrolysis technology, aiming to decarbonize its chlorine and derivative production. Investments focus on enhancing the efficiency and sustainability of their chlor-alkali assets to support downstream products like epoxy and polyurethanes.

4. Occidental Petroleum Corporation

- Through its subsidiary OxyChem, Occidental has maintained a focus on safe, reliable chlor-alkali operations amid strong caustic soda and chlorine demand. Recent developments include ongoing capital investments to modernize facilities and ensure compliance with environmental standards. Their integrated model supports vinyl production, with a strategic emphasis on operational excellence rather than major capacity expansions.

5. Ercros

- Ercros has modernized its chlorine production facilities in Spain, investing in technology to improve energy efficiency and safety. The company focuses on the chlor-alkali derivative market, including disinfectants and intermediates for pharmaceuticals. Recent developments highlight their commitment to the circular economy, utilizing by-product hydrogen, and adapting production to meet specific regional demand in the European market.

Conclusion

Chlorine is a versatile chemical powerhouse that underpins multiple industries, from health to manufacturing. Its broad applications ensure stable demand and innovation opportunities, making it a reliable asset for economic growth while addressing essential needs like safety and efficiency in daily operations.