Quick Navigation

Overview

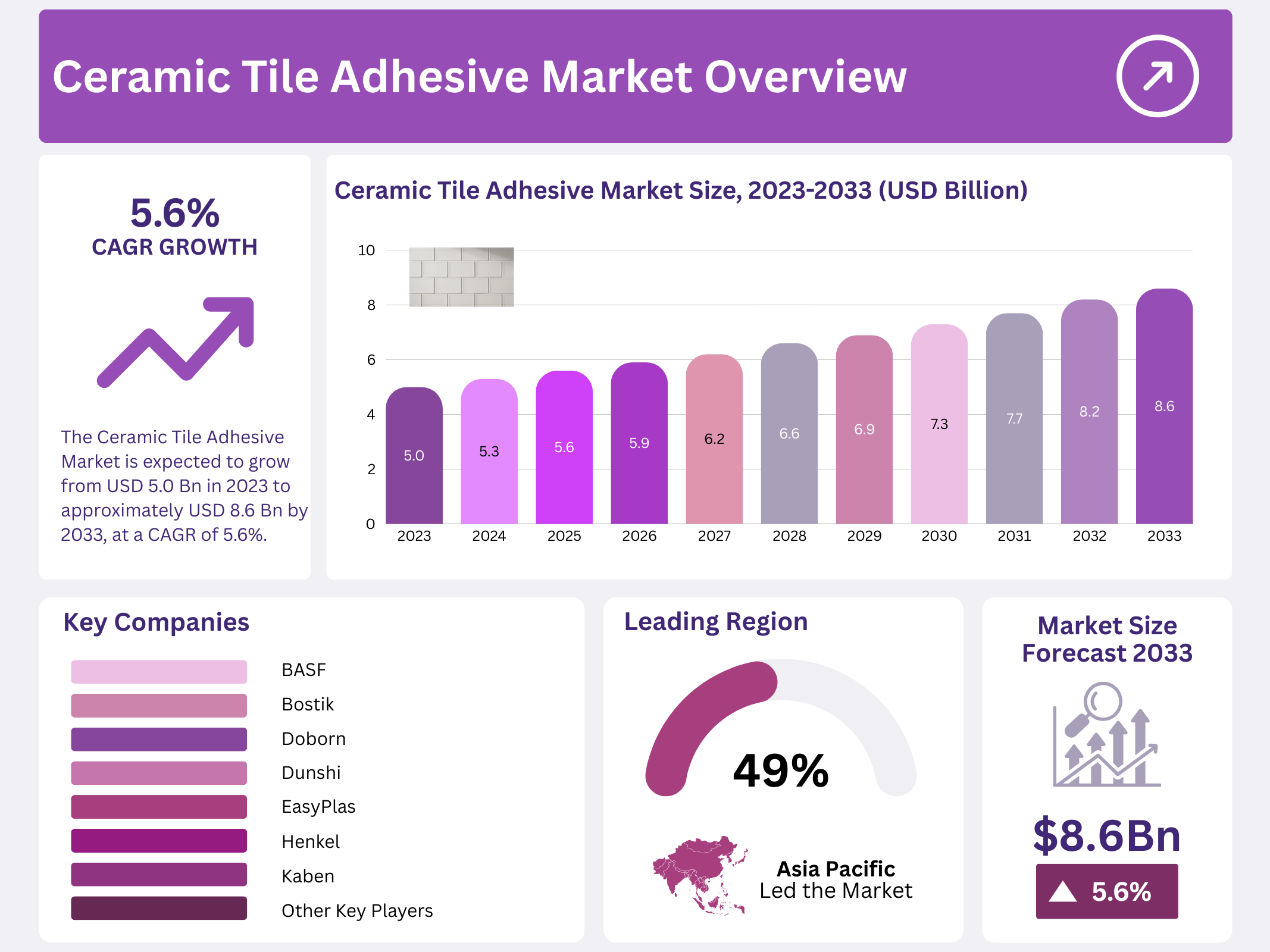

New York, NY – January 15, 2026 – The global Ceramic Tile Adhesive Market is projected to reach a value of around USD 8.6 billion by 2033, rising from USD 5.0 billion in 2023, and expanding at a CAGR of 5.6% during the forecast period from 2023 to 2033. This steady growth reflects increasing construction activity worldwide, supported by rapid urbanization and rising investments in residential, commercial, and infrastructure projects.

Ceramic tile adhesives play a critical role in modern construction by enabling secure and long-lasting installation of ceramic tiles on surfaces such as floors, walls, and countertops. These adhesives are specially formulated to offer strong bonding strength, durability, and resistance to moisture, temperature variations, and environmental stress. Their performance ensures the structural stability and extended lifespan of tiled surfaces across a wide range of applications.

The market includes various adhesive types, such as thin-set mortars, epoxy adhesives, and acrylic-based adhesives, each designed to meet specific installation requirements. Growing consumer preference for visually appealing interiors, coupled with the demand for durable and low-maintenance surface materials, continues to support market expansion. Additionally, ongoing infrastructure development and renovation activities across emerging and developed economies are further strengthening demand for ceramic tile adhesives.

Key Takeaways

- The Global Ceramic Tile Adhesive Market is expected to grow from USD 5.0 billion in 2023 to approximately USD 8.6 billion by 2033, at a CAGR of 5.6% during the forecast period (2023–2033).

- Epoxy Adhesives hold a dominant position, accounting for over 62.7% of total demand in the ceramic tile adhesive market.

- Wood Floor Pasting is the top application segment, capturing more than 48.3% market share.

- The Residential sector dominates consumption, with wood-based residential applications representing over 47.8% of total demand.

- Asia Pacific commands the largest regional share at 49.1% of the global market and is projected to reach USD 2.3 billion during the forecast period.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 5.0 Billion |

| Forecast Revenue (2033) | USD 8.6 Billion |

| CAGR (2024-2033) | 5.6% |

| Segments Covered | By Type(Epoxy, Acrylic, Silicone, Cyanoacrylate, Others), By Application(Wood Floor Pasting, Tiled Floor Pasting, Polyethylene Floor Pasting, Stonefloor Passing), By End-User(Residential, Commercial, Industrial) |

| Competitive Landscape | By Type(Epoxy, Acrylic, Silicone, Cyanoacrylate, Others), By Application(Wood Floor Pasting, Tiled Floor Pasting, Polyethylene Floor Pasting, Stonefloor Passing), By End-User(Residential, Commercial, Industrial) |

Key Market Segments

By Type

Epoxy Adhesives dominated the ceramic tile adhesive market, accounting for over 62.7% of total demand. This leadership was driven by epoxy’s superior bonding strength and high resistance to moisture and chemicals, making it especially suitable for high-traffic zones and wet areas such as bathrooms, kitchens, and industrial floors.

Acrylic adhesives represented another important segment, supported by their versatility, cost-effectiveness, and ease of application. These adhesives provide reliable bonding across multiple substrates and are widely used in both residential and commercial tile installations.

Silicone adhesives gained increased adoption due to their excellent flexibility, weather resistance, and ability to absorb movement. They are commonly applied in environments exposed to temperature changes or vibrations, including outdoor tiling, swimming pools, and expansion joints.

By Application

Wood Floor Pasting led the application segment with a market share exceeding 48.3%. This dominance reflects the growing preference for wooden flooring in residential and commercial interiors, which has increased demand for tile adhesives compatible with wood substrates.

Tiled floor pasting followed as a major application area, driven by the widespread use of ceramic tiles for both indoor and outdoor flooring. The durability and aesthetic appeal of tiles continue to support steady demand in this segment.

Polyethylene floor pasting recorded consistent growth, supported by the rising use of polyethylene-based flooring materials in construction and renovation projects. Adhesives developed for polyethylene offer strong bonding performance and align with modern building practices.

Stone floor pasting, while a smaller segment, maintained a stable demand due to the continued popularity of natural stone flooring. Adhesives in this category emphasize durability and high bonding strength to ensure long-term performance in residential and commercial spaces.

By End-User

The Residential Sector dominated the ceramic tile adhesive market, with wood-based residential applications accounting for more than 47.8% of total demand. Growth in home renovations, remodeling projects, and new housing developments continues to drive adhesive consumption in this segment.

The commercial sector also held a significant share, covering applications in offices, retail outlets, hospitality spaces, and public buildings. Commercial adhesives focus on durability, visual appeal, and efficient installation to meet high-usage requirements.

Industrial end-users contributed a meaningful portion of market demand, supported by installations in factories, warehouses, and industrial facilities. Adhesives used in these environments are engineered to withstand heavy loads, vibrations, and harsh conditions, requiring advanced and robust formulations.

Regional Analysis

The Asia Pacific region leads the Ceramic Tile Adhesive Market with a commanding 49.1% share and is projected to reach a market value of USD 2.3 billion during the forecast period. This dominance is driven by rising usage of ceramic tile adhesives across high-growth sectors such as construction, automotive manufacturing, conductive polymers, and packaging. Rapid urban development and infrastructure spending continue to strengthen regional demand.

Strong production growth in countries including China, India, South Korea, Thailand, Malaysia, and Vietnam is further accelerating market expansion in the Asia Pacific. Increasing residential and commercial construction, along with expanding manufacturing capabilities, is creating sustained demand for high-performance tile adhesive solutions across both urban and semi-urban areas.

In North America, steady economic expansion and increased activity in automotive, polymer processing, and manufacturing industries are supporting consistent demand for ceramic tile adhesives. Meanwhile, Europe is expected to experience healthy market growth, supported by ongoing construction projects and strong demand from textile and industrial renovation activities, reinforcing the region’s role as a key contributor to global market growth.

Top Use Cases

- Residential floors and living spaces: Ceramic tile adhesive is widely used to fix tiles on home floors in bedrooms, living rooms, corridors, and stair landings. It spreads evenly, grips strongly, and helps tiles stay aligned during installation. For builders, it reduces common issues like hollow spots, tile lifting, and uneven finishes after the floor is put into daily use.

- Bathroom, kitchen, and other wet areas: In moisture-prone zones, ceramic tile adhesive is used to bond tiles on walls and floors where water splashes are frequent. When paired with the right preparation, it helps tiles stay stable under repeated wetting and drying. This is important for bathrooms, shower areas, laundry rooms, and kitchen backsplashes where long-term adhesion matters.

- Exterior walls, facades, and elevation cladding: Tile adhesive is used for fixing ceramic tiles on building exteriors where surfaces face sun, rain, wind, and temperature changes. A suitable exterior-grade adhesive helps manage movement and weather exposure so tiles remain attached over time. This use case is common in modern residential towers, commercial buildings, and decorative elevation cladding projects.

- Commercial flooring in high-traffic areas: Shopping areas, offices, schools, hospitals, and public corridors use ceramic tile adhesive to support tiles under constant footfall and cleaning routines. Installers prefer adhesives that hold firm and reduce tile shift during placement. In commercial work, consistent bonding helps lower maintenance complaints like loose tiles, edge chipping from movement, and premature repair cycles.

- Renovation work and quick repair projects: Ceramic tile adhesive is often chosen in remodels because it can be applied in controlled layers and supports efficient tile replacement. It’s used when re-tiling bathrooms, upgrading kitchens, or repairing cracked sections without disturbing larger areas. For contractors, the key benefit is faster installation with predictable bonding, especially when deadlines are tight.

Recent Developments

1. BASF

- BASF continues to innovate with its Master Builders Solutions range, focusing on sustainable, high-performance tile adhesives. Recent developments highlight ultra-low dust production technology for improved jobsite air quality and health. They are also advancing formaldehyde-free and high-recycled content formulas, responding to green building demands. Their global R&D emphasizes adhesives for large-format tiles and challenging substrates.

2. Bostik (An Arkema Company)

- Bostik is leading in smart adhesive solutions, including its “Bostik Smart” digital platform for product selection and technical data via QR codes. Recent launches feature bio-based and recycled raw material formulations under their sustainable construction initiative. They have also introduced advanced, rapid-curing mortars for fast-track commercial projects and high-flexibility adhesives for heated floors and panels.

3. Doborn

- Doborn, a significant China-based manufacturer, has recently expanded its product line with new high-bonding, crack-resistant adhesives specifically for large-format porcelain slabs. Their development focuses on improving anti-sag performance and workability (open time). They are also enhancing production capacity and distribution within the Asian market, promoting products that meet international green certification standards.

4. Dunshi

- Dunshi (also from China) is aggressively innovating for the modern tiling market. Key launches include a new generation of C2TE S1 polymer-enhanced adhesives offering superior deformability and adhesion for demanding applications. They emphasize user-friendly, one-component products and have invested in automated production lines to ensure consistent quality for both domestic and growing export markets.

5. EasyPlas

- EasyPlas, specializing in polymer additives for construction chemicals, has developed new redispersible polymer powders (RDP) and cellulose ethers that enhance key adhesive properties. Their recent work provides formulations that improve slip resistance, water retention, and flexibility in tile adhesives, enabling manufacturers to upgrade product performance and efficiency. They focus on tailored additive solutions for specific regional raw materials.

Conclusion

Ceramic tile adhesive plays a practical role in modern construction because it supports reliable tile fixing across homes, commercial sites, wet rooms, and even exterior surfaces. From an analyst’s view, demand is supported by renovation activity, new building projects, and the shift toward cleaner, faster installation methods. Products are also evolving toward better workability, stronger bonding, and improved performance under real site conditions.