Quick Navigation

Overview

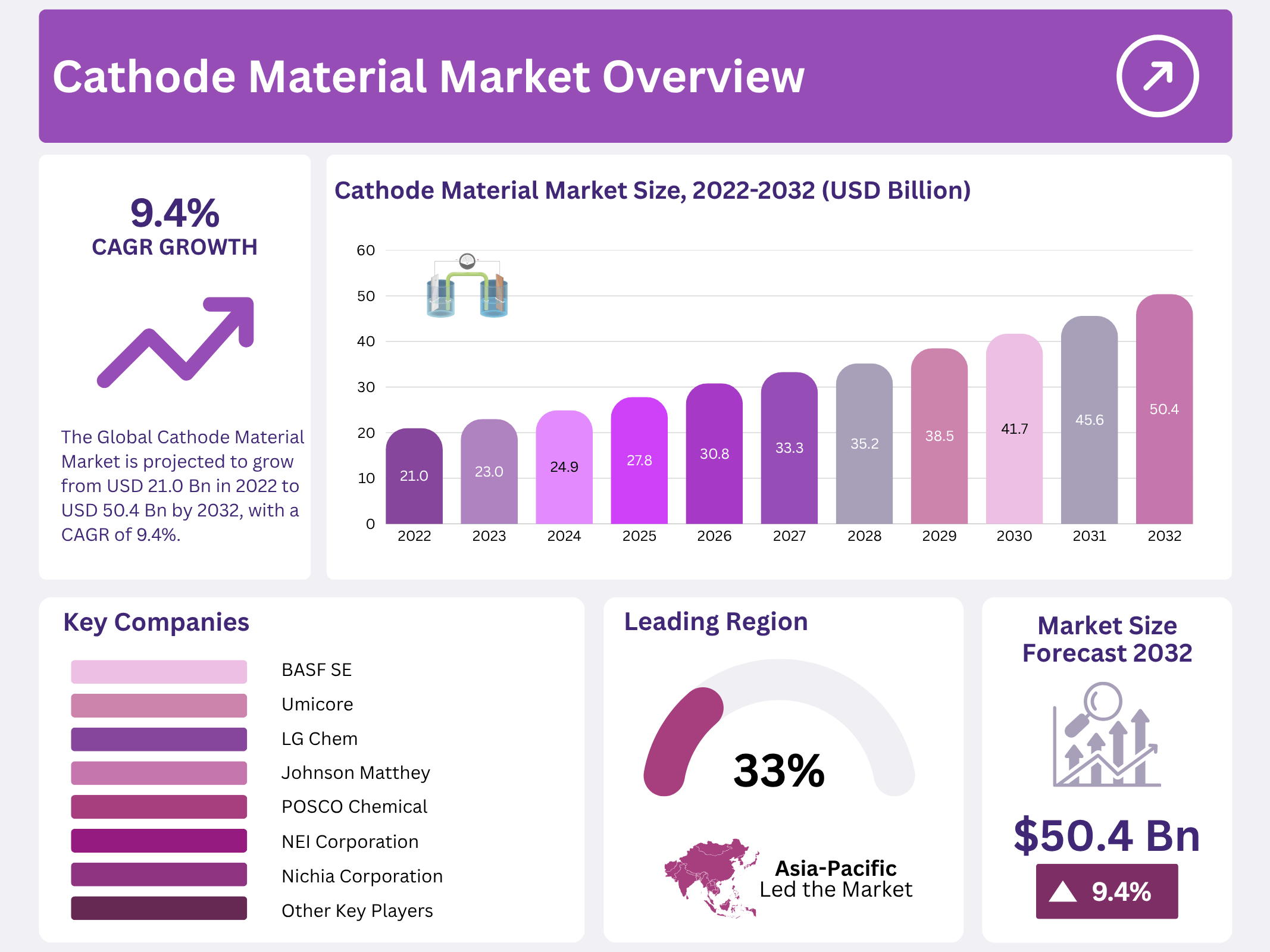

New York, NY – October 16, 2025 – The Global Cathode Material Market was valued at USD 21.0 billion by 2022 and is projected to reach USD 50.4 billion by 2032, growing at a CAGR of 9.4% from 2023 to 2032. Cathode materials form the positive electrode in battery cells and consist mainly of elements such as nickel, cobalt, and manganese. These materials are essential in producing motors, transformers, and generators across various end-use sectors.

In the electrical industry, components such as laminated cores, insulating materials, and wire windings heavily rely on cathode materials. Commonly used variants include lithium iron phosphate, lithium cobalt oxide, lead oxide, and graphite cathodes, each chosen for its unique conductivity and stability properties. The growing adoption of batteries across industrial and consumer applications continues to drive the demand for these materials globally.

The accelerating shift toward zero-emission mobility is a major catalyst for market expansion. Increasing awareness about electric vehicles and strong government support for sustainable transport are fueling the uptake of advanced battery systems. As electric vehicle sales surge worldwide, the demand for high-performance cathode materials is expected to grow rapidly, making this market one of the most dynamic segments of the energy and materials industry.

Key Takeaways

- Market Growth: The Global Cathode Material Market is projected to grow from USD 21.0 billion in 2022 to USD 50.4 billion by 2032, with a CAGR of 9.4%.

- Battery Type Dominance: Lead acid batteries hold the largest revenue share in the cathode material market due to their widespread use in energy storage and automotive sectors.

- Material Type Leader: Lead dioxide commands the largest share among cathode materials, driven by its extensive application in battery production.

- End-Use Sector: The automotive industry leads in revenue share, fueled by the rising adoption of electric vehicles (EVs) globally.

- Regional Leader: Asia Pacific holds a 33.4% revenue share, led by high EV and energy storage demand in China, Japan, India, Taiwan, and South Korea.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 21.0 Billion |

| Forecast Revenue (2032) | USD 50.4 Billion |

| CAGR (2025-2032) | 9.4% |

| Segments Covered | By Battery Type – Lead Acid, Lithium-Ion, and Other Battery Types; By Material – Lithium Iron Phosphate (LFP), Lithium Cobalt Oxide (LCO), Lead Dioxide, Graphite Cathode, Oxyhydroxide, and Other Materials; By End-Use – Consumer Electronics, Automotive, and Other End-Uses |

| Competitive Landscape | Umicore, Johnson Matthey, LG Chem, BASF SE, Sumitomo Metal Mining Co. Ltd, Targray Technology International, NEI Corporation, Nichia Corporation, POSCO Chemical, Hitachi Chemical Co. Ltd, and Other Key Players |

Key Market Segments

Battery Type Analysis

The cathode material market is segmented by battery type into lead acid, lithium-ion, and other battery types. Among these, lead acid batteries hold the largest revenue share, dominating the segment. The widespread use of lead-acid batteries, particularly those utilizing lead oxide, in energy storage systems and the automotive industry is fueling their market dominance.

However, lithium-ion batteries are expected to experience significant growth during the forecast period. Batteries such as lithium cobalt oxide, lithium iron phosphate, and lithium manganese oxide are increasingly utilized in electric vehicles (EVs). The rising global adoption of EVs has driven the demand for lithium-ion batteries, a trend projected to continue over the forecast period.

Material Analysis

The cathode material market is categorized by material type into lead dioxide, lithium cobalt oxide (LCO), lithium iron phosphate (LFP), graphite cathode, oxyhydroxide, and other materials. Lead dioxide commands the largest share of the material segment. The prominence of lead dioxide is driven by its extensive use in telecommunications, energy storage, and automotive applications. Its moderate discharge rate compared to competing materials further supports its growth in the cathode material market.

End-Use Analysis

The cathode material market is divided by end-use into automotive, consumer electronics, and other sectors. The automotive industry leads this segment, capturing the majority of the market’s revenue share. The surge in electric vehicle adoption globally over recent years has significantly boosted the automotive sector’s growth in the cathode material market. Cathode materials are critical in manufacturing batteries such as lithium-ion and lead acid, which are widely used in EVs for their high efficiency. As the demand for these batteries grows, the cathode material market continues to expand.

Regional Analysis

The Asia Pacific region leads the global cathode material market, capturing a significant revenue share of 33.4%. This dominance is driven by key countries such as China, Japan, India, Taiwan, and South Korea, where rising demand for electric vehicles (EVs) and energy storage systems fuels market growth. Additionally, increasing disposable incomes and improving living standards in the region are boosting EV adoption, further propelling the cathode material market. Following Asia Pacific, North America holds the second-largest market share. The region’s growth is supported by advanced infrastructure and growing investments in the automotive industry, particularly in EV development.

Top Use Cases

- Electric Vehicles: Cathode materials power the batteries in electric cars, helping them run longer on a single charge. They store energy efficiently, making drives smoother and greener by cutting down on fuel use. As more people switch to clean transport, these materials boost vehicle range and speed up charging times for everyday travel.

- Consumer Electronics: In smartphones and laptops, cathode materials keep devices working all day without quick battery drain. They pack more power into small spaces, supporting apps, videos, and calls on the go. This keeps gadgets reliable for busy users who rely on them for work and fun.

- Renewable Energy Storage: Cathode materials help store extra power from solar panels and wind turbines in big batteries. They hold energy steady for homes and grids when the sun isn’t shining or wind isn’t blowing. This makes clean energy more dependable and supports a shift away from dirty fuels.

- Power Tools: For drills and saws on job sites, cathode materials deliver quick bursts of energy in cordless tools. They make work faster and easier without needing plugs nearby. Builders and DIY fans love the freedom to move around while handling tough tasks all day.

- Grid Backup Systems: Cathode materials in large batteries act as emergency power for cities during blackouts. They keep lights on and fridges running when storms hit. This ensures safe and stable electricity flow, helping communities bounce back quickly from disruptions.

Recent Developments

1. BASF SE

BASF is advancing its CAM (Cathode Active Materials) portfolio with a strong focus on high-nickel and manganese-rich chemistries. A key development is the HEDTM series, designed for higher energy density and lower cost. They are also heavily investing in local, resilient supply chains, with new production facilities under construction in Canada and Europe to serve the North American and European electric vehicle markets with localized, CO2-reduced materials.

2. Umicore

Umicore is progressing its super-high-nickel cathode materials to maximize energy density and range. Simultaneously, they are scaling up their proprietary “Generation 5” cobalt-free LMNO (high-voltage spinel) technology, which offers high power, safety, and sustainability. The company is also building a new large-scale cathode materials plant in Poland to increase its production capacity and meet growing European EV battery demand.

3. LG Chem

LG Chem is aggressively expanding its production capacity for high-nickel NCMA (Nickel Cobalt Manganese Aluminum) cathode materials. This proprietary quad-component technology increases stability and energy density while reducing cobalt content. A major recent development is the mass production of NCMA and the construction of a new cathode plant in Tennessee, USA, in a joint venture with GM to create a localized supply chain for Ultium Cells LLC.

4. Johnson Matthey

Johnson Matthey has strategically shifted its battery materials business, now focusing on its eLNO portfolio of proprietary high-nickel, cobalt-rich cathode materials. Recent developments include licensing this technology and selling its battery materials plant in Poland to EVE Energy, ensuring the commercial production and scaling of eLNO. This allows them to de-risk their business model while advancing next-generation cathode chemistries through partnerships.

5. Targray Technology International

Targray, a global supplier of advanced materials, has expanded its cathode material portfolio to include a wide range of Lithium Iron Phosphate (LFP) and high-nickel NMC options. A key recent development is their focus on securing supply and distributing LFP materials to meet the growing demand from the EV and energy storage sectors in North America, positioning themselves as a key distributor for this cost-effective and safe chemistry.

Conclusion

Cathode materials sit at the heart of modern batteries, quietly driving the world’s push toward cleaner energy and smarter tech. As a market research analyst, I see them evolving to meet rising needs in electric rides and home power setups, making energy storage simpler and stronger. Their role in blending renewables with daily life promises a greener tomorrow, where batteries last longer and cost less, fueling innovation without the old hassles.