Quick Navigation

Overview

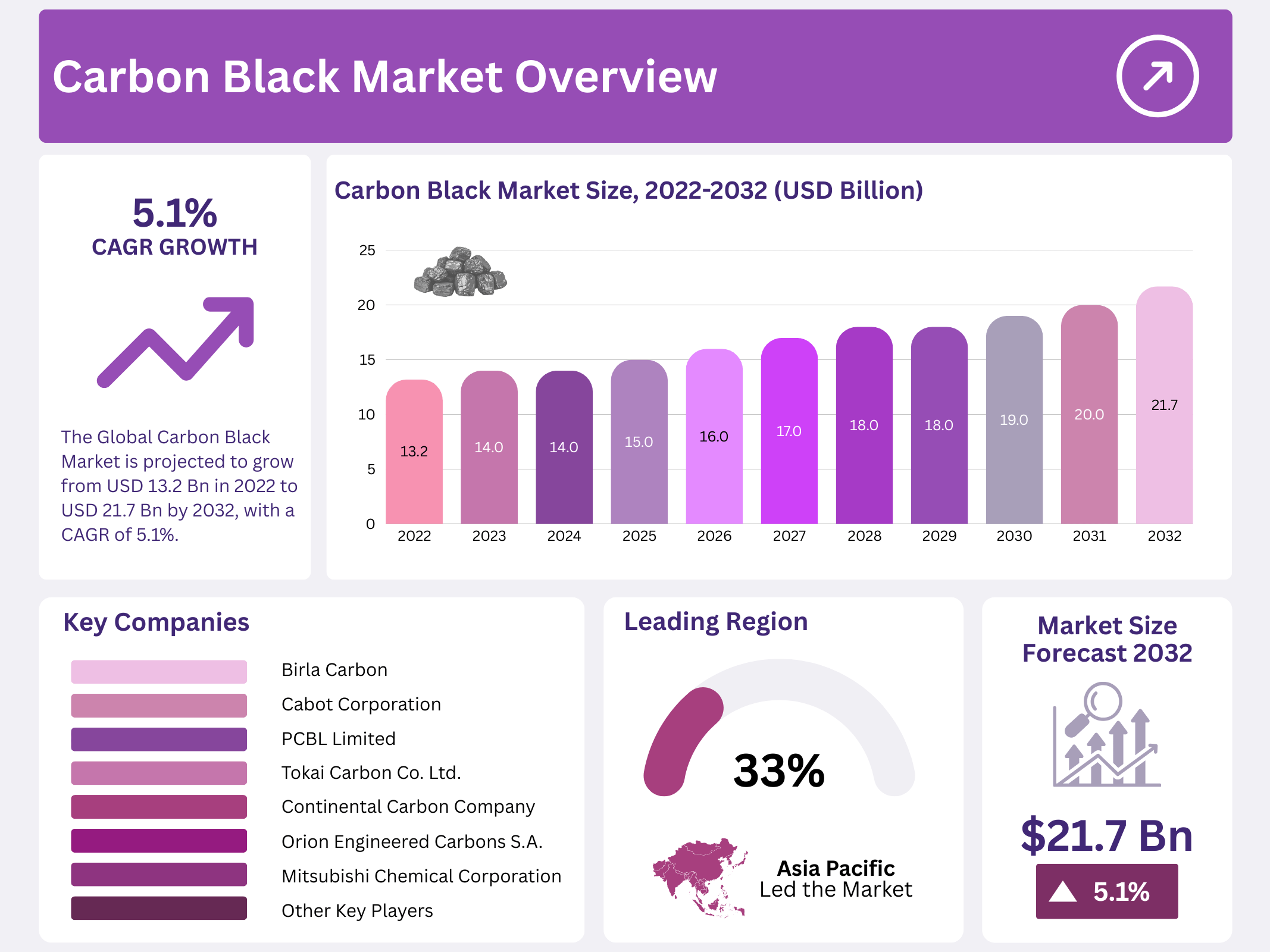

New York, NY – September 25, 2025 – The Global Carbon Black Market was valued at USD 13.2 billion and is projected to reach approximately USD 21.7 billion by 2032, registering a CAGR of 5.1% between 2023 and 2032.

Carbon black is a para-crystalline form of carbon that contains around 95% pure carbon, widely recognized for enhancing the physical and mechanical properties of materials. Its reinforcing ability makes end products stronger, more durable, and efficient. The material is extensively applied in plastics, printing inks, tires, mechanical rubber goods, and toners. A key application is in wire and cable insulation, where carbon black plays a vital role by absorbing ultraviolet light and converting it into heat, thereby protecting the material from UV degradation.

Additionally, it serves as a crucial ingredient in the production of various rubber components and pigments. As an inexpensive yet highly effective reinforcing agent, carbon black remains essential in the tire industry, where it significantly improves wear resistance and performance, solidifying its role as a backbone material in multiple industrial applications.

Key Takeaways

- Market Growth: The global carbon black market is projected to grow from USD 13.2 billion in 2022 to USD 21.7 billion by 2032, with a CAGR of 5.1%.

- Furnace Black Dominance: Furnace black leads the market due to its critical role in rubber reinforcement and tire production, boosted by cosmetic pigment applications.

- Specialty Grade Leadership: Specialty grade carbon black dominates, driven by its use in polymers, printing, and coatings for strength and UV resistance.

- Tire Rubber Application: Tire rubber accounts for 70% of carbon black use, enhancing tire durability by dissipating heat from treads and belts.

- Asia Pacific Market Share: The Asia Pacific region holds a 33.8% market share, fueled by high plastic consumption in the construction and automotive sectors.

- Regional Demand Growth: North America and Europe see rising demand due to automotive, polymer, manufacturing, and textile industry growth.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 13.2 Billion |

| Forecast Revenue (2032) | USD 21.7 Billion |

| CAGR (2022-2032) | 5.1% |

| Segments Covered | By Type- Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others; By Grade- Standard Grade, Specialty Grade; By Application-Tire Rubber, Non-Tire Rubber, Inks and Coatings, Plastics, and Others |

| Competitive Landscape | Birla Carbon, Cabot Corporation, Continental Carbon Company, Orion Engineered Carbons S.A., PCBL Limited, Mitsubishi Chemical Corporation, Jiangxi Black Cat Carbon Black Co. Ltd., Tokai Carbon Co. Ltd., Longxing Chemical Stock Co. Ltd, Omsk Carbon Group, Atlas Organics Private Limited, Continental Carbon Company, Himadri Speciality Chemical Ltd, Philips Carbon Black Limited, Orion Engineered Carbons GmbH, and Other Key Players |

Key Market Segments

Type Analysis

Furnace Black Leads the Carbon Black Market

The carbon black market is segmented by type into furnace black, channel black, acetylene black, thermal black, and others. The furnace black segment dominates, driven by its widespread use in rubber reinforcement and blackening processes, particularly in the production of tires. Its increasing application as a color pigment in cosmetics is also expected to fuel market growth.

The thermal black segment is projected to grow significantly during the forecast period due to its UV-absorbent properties, making it essential in the plastics industry and rubber-based adhesives. Acetylene black, known for its high purity and conductivity, is used in silicon products, dry cells, and electric power cables. Channel black, produced as soot from natural gas flames on metal surfaces, and acetylene black, derived through thermal decomposition of acetylene gas, also contribute to the market.

Grade Analysis

Specialty Grade Takes the Lead

By grade, the carbon black market is divided into standard grade and specialty grade, with the specialty grade segment leading. Specialty grade carbon black is a critical raw material in industries such as polymers, printing, and coatings, valued for its strength, electrical conductivity, dispersibility, and UV resistance. The growing demand from the consumer goods, construction, and automotive sectors is expected to drive the specialty grade market.

The expanding manufacturing sector will likely further boost consumption during the forecast period. Standard-grade carbon black, such as N772, offers low surface area and structure, providing minimal latency and high resiliency compared to grades like N774 and N660, making it ideal for heavy-duty industrial rubber products.

Application Analysis

Tire Rubber Dominates

The carbon black market is categorized by application into tire rubber, non-tire rubber, inks, coatings, plastics, and others. The tire rubber segment led the market in 2022, accounting for approximately 70% of carbon black usage as a pigment and reinforcing agent. Carbon black dissipates heat from tire treads and belts, reducing heat damage and extending tire life.

Rising vehicle demand is expected to drive growth in the automotive sector, particularly for tires and seat belts. The non-tire rubber segment is also poised for growth, serving as a strengthening and shock-absorbing agent in industrial rubber products like roofing, gaskets, cables, and mats. Additionally, demand from the inks, coatings, paints, and plastics industries is fueled by consumer preference for black-colored products, further driving market growth.

Regional Analysis

Asia Pacific Holds the Largest Share

The Asia Pacific region commands the largest share of the global carbon black market at 33.8%. This growth is driven by increased plastic consumption in industries such as construction, automotive, conductive polymers, and packaging, particularly in China, India, and Southeast Asian countries like Korea, Thailand, Malaysia, and Vietnam. North America is expected to see strong demand due to growth in its automotive, polymer, and manufacturing sectors. Europe will also experience notable growth, driven by demand in the textile industry.

Top Use Cases

- Tire Reinforcement: Carbon black acts as a key strengthener in tire making, helping to boost durability and wear resistance. By blending it into rubber compounds, manufacturers create tires that handle rough roads better and last longer without cracking. This simple addition improves safety and performance for everyday drivers, making vehicles more reliable on highways and city streets alike.

- Plastic UV Protection: In plastics production, carbon black serves as a shield against sunlight damage, keeping items like outdoor furniture or pipes from fading or breaking down quickly. It absorbs harmful rays and turns them into harmless heat, ensuring products stay strong and colorful over time. This makes it essential for building materials that face daily weather exposure.

- Ink and Toner Pigment: Carbon black provides deep black color for printing inks and copier toners, delivering sharp, lasting prints on paper. Its fine particles mix easily into formulas, offering high coverage without smudging or fading. This quality supports everything from books to office documents, helping businesses and publishers create clear visuals that stand out.

- Coating Durability Enhancer: For paints and protective coatings, carbon black adds toughness and color depth to surfaces like metal or wood. It resists scratches and weathering, extending the life of items such as car exteriors or building walls. This easy-to-use ingredient ensures coatings stay vibrant and protective, reducing the need for frequent touch-ups in harsh environments.

- Battery Conductivity Booster: In battery manufacturing, carbon black improves electrical flow within electrodes, making power storage more efficient for devices like phones or electric cars. Its conductive nature helps energy move smoothly, leading to longer-lasting charges and quicker recharges. This application supports greener tech by enhancing performance in portable gadgets and vehicles without added weight.

Recent Developments

1. Birla Carbon

Birla Carbon is advancing its sustainability agenda with the launch of new CONTINUA sustainable carbonaceous materials (SCM), designed for a circular economy. They are also expanding production capacity in India and Thailand to meet growing demand in the battery and specialty segments. Their focus remains on reducing their carbon footprint through energy-efficient manufacturing and product innovation.

2. Cabot Corporation

Cabot Corporation is focusing on innovation for sustainable mobility, including EV battery conductive additives like ENERMAX. They recently announced a capacity expansion for specialty compounds in the Americas and Europe. Financially, they reported strong earnings, driven by robust demand in performance chemicals, and continue to invest in circular economy initiatives, such as using alternative feedstocks to produce recycled content carbon black.

3. Continental Carbon Company

Continental Carbon Company, a subsidiary of Koppers Inc., is investing in operational upgrades and environmental compliance at its plants. Recent developments include securing long-term supply agreements with key tire manufacturers and focusing on process optimization to improve product consistency for the rubber and industrial markets. Their strategy emphasizes reliability and meeting specific customer requirements in a competitive landscape.

4. Orion Engineered Carbons S.A.

Orion is aggressively expanding its battery materials portfolio, commissioning new acetylene black production lines in Texas. The company is also progressing its joint venture for recycled carbon black (rCB) in Louisiana. Financially, Orion reported record results and is strategically investing in high-growth specialties like polymers, coatings, and inks, while managing the energy transition impacts on its commodity business.

5. PCBL Limited

PCBL is undergoing a significant transformation, diversifying beyond tire carbon black into specialty segments and battery materials. A major recent development is the acquisition of Aquapharm Chemicals, marking a strategic entry into the water treatment chemicals market. They are also expanding domestic capacity and investing heavily in R&D for sustainable products, aligning with their new identity as a diversified chemical company.

Conclusion

Carbon Black is a quiet powerhouse in modern industry, quietly supporting everything from safer roads to vibrant prints and durable goods. Its ability to strengthen materials, block harmful rays, and conduct energy makes it indispensable across sectors like automotive, packaging, and electronics. The push for greener production methods, such as recycling old tires into fresh supplies, promises to keep this versatile powder at the heart of innovation.