Quick Navigation

Overview

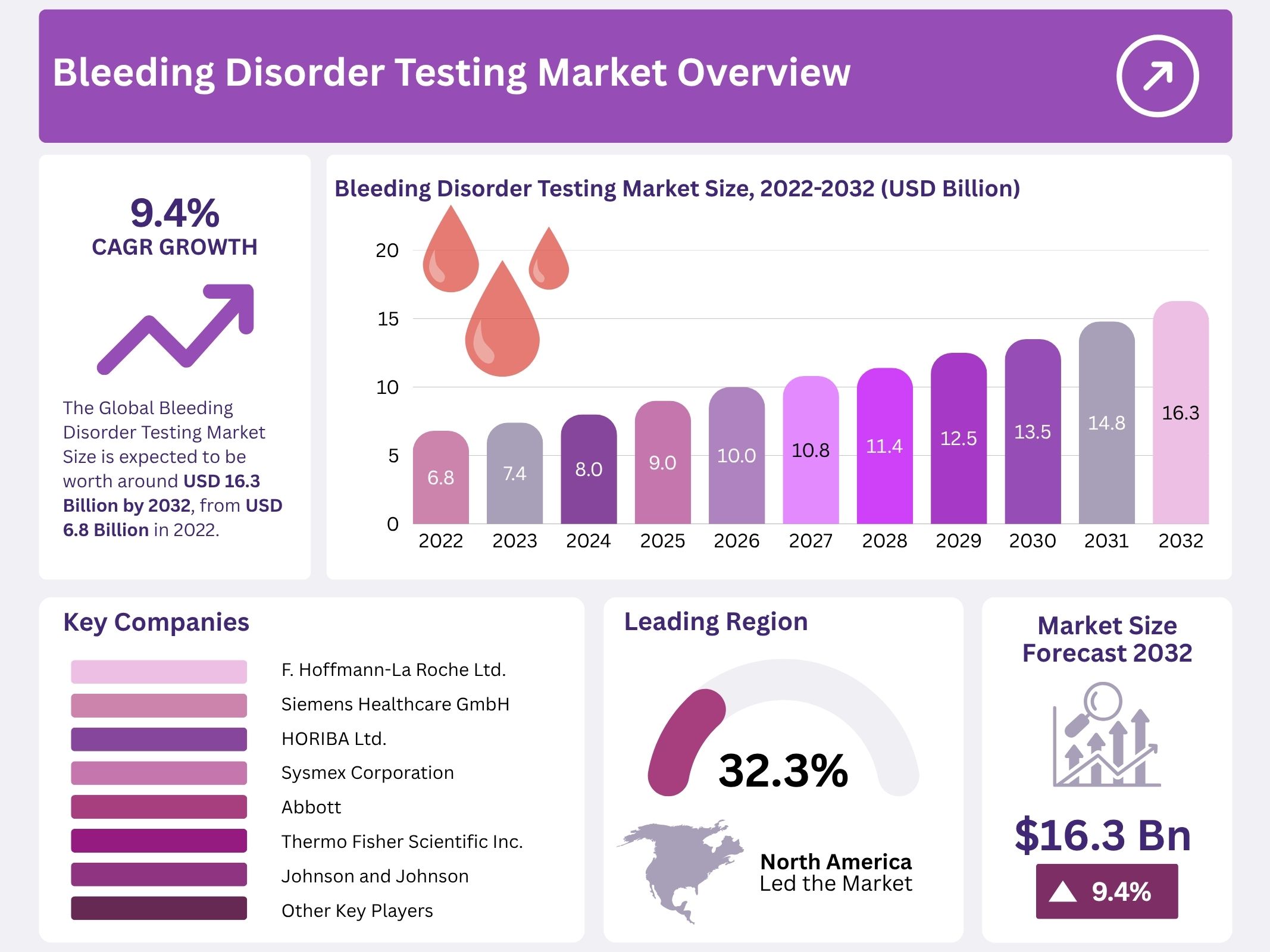

The Global Bleeding Disorder Testing Market is projected to reach USD 16.3 billion by 2032, rising from USD 6.8 billion in 2022. Steady demand has been supported by improved disease identification and stronger diagnostic coverage across clinical settings. Broader screening in pediatric and high-risk groups has expanded the tested population. Increased clinical awareness has supported the detection of mild or previously missed cases, which has strengthened the long-term need for reliable diagnostic solutions.

Technological progress has enhanced the accuracy and efficiency of hemostasis testing. Automated coagulation analyzers, advanced reagents, and high-throughput platforms have improved test performance. Molecular tools such as next-generation sequencing have enabled detailed genetic assessment. The adoption of point-of-care solutions has increased access in decentralized environments. These innovations have contributed to faster workflows and stronger diagnostic confidence across laboratories and treatment centers.

Demand has also been influenced by the shift toward personalized medicine. Precision diagnosis is now essential for selecting targeted therapies and monitoring disease progression. Molecular confirmation, genotype-phenotype analysis, and inhibitor detection assays are increasingly used to guide treatment decisions. Comprehensive coagulation panels support individualized care pathways. These testing needs have reinforced consistent market growth as clinical practice moves toward more tailored treatment strategies.

Rising availability of prophylactic therapies, extended-half-life factors, and gene-based treatments has increased the requirement for continuous monitoring. Regular evaluation of factor levels, inhibitor development, and therapeutic response has become central to long-term care. Hospitals and hemophilia centers have expanded diagnostic capacity to manage ongoing therapy monitoring. Preventive healthcare programs and newborn screening initiatives have further strengthened early detection, leading to sustained investment in laboratory infrastructure.

Growth in emerging markets has been supported by expanding healthcare capacity, improved reimbursement structures, and strengthened patient advocacy. Awareness campaigns have encouraged early consultation and increased diagnostic uptake. Collaboration among advocacy groups, diagnostic manufacturers, and research institutions has improved testing ecosystems. Continued clinical research focused on new biomarkers and coagulation pathways is expected to support innovation, ensuring a positive outlook for the bleeding disorder testing sector.

Key Takeaways

- Market growth was described by an external observer, noting a projected 9.4% CAGR from 2022–2032, with the sector expected to reach USD 16.3 billion.

- Reagents and consumables were highlighted by a third-party source as a rapidly expanding segment due to rising testing volumes across many developing healthcare markets.

- Hemophilia A, reported by outside experts as affecting approximately 1 in 10,000 individuals, was identified as a central factor strengthening overall market expansion.

- Diagnostic centers were noted by independent reviewers as benefitting from heightened awareness and improved diagnosis rates, contributing to sustained growth within this end-user category.

- Market drivers were outlined by a separate industry commentator, emphasizing patient population expansion, active R&D activity, and increasing focus on recombinant DNA-based therapeutic products.

- Growth constraints were cited by external analysts, including limited testing penetration in emerging economies, shortages of trained specialists, and elevated treatment-related financial burdens.

- Broader trends were identified by third-party observers, pointing to consolidation, accelerated R&D investments, and ongoing technological innovation as key forces shaping forthcoming market dynamics.

- Regional performance was described by independent reviewers, noting North America and Europe as established leaders supported by strong healthcare frameworks and favorable regulatory pathways.

- Asia-Pacific expansion was emphasized by external market watchers, who indicated that the region is positioned for robust and accelerated growth over the forecast period.

- South America’s potential was referenced by third-party insights, attributing future growth to persistent genetic disorders and increasing interest in tailored, personalized medical approaches.

Regional Analysis

In 2024, North America secured a dominant position with a 32.3% market share, representing US$ 2.2 billion in value. The expansion was supported by the increasing availability of advanced testing tools. The rise in regulatory approvals also strengthened regional performance. Improved diagnostic capabilities contributed to higher testing volumes. Growing awareness of bleeding disorders supported further adoption of testing systems. These elements enhanced market visibility in the region. Overall, sustained technological progress and structured oversight encouraged steady growth across North America.

Europe experienced expanding demand for bleeding disorder testing, driven by rising case numbers in Germany, the U.K., and other major countries. Strong regulatory frameworks supported diagnostic adoption. Increasing patient awareness also encouraged higher compliance with testing guidelines. The regional healthcare landscape benefited from structured reimbursement policies. Continued improvement in clinical infrastructure strengthened the market outlook. The region maintained a stable pace of adoption across laboratories. Advancements in diagnostic technologies further enhanced testing accuracy. These factors collectively positioned Europe as a key market contributor.

Industry assessments indicated that North America and Europe will continue to lead the global bleeding disorder treatment market. Their dominance is supported by strong healthcare systems and broad access to medical services. Favorable reimbursement structures encouraged higher testing uptake. Insurance coverage contributed to better diagnostic participation. Meanwhile, Asia-Pacific was projected to expand rapidly over the forecast period. Rising healthcare investments supported this upward trend. Improving clinical capabilities strengthened adoption across developing economies. Growing diagnostic awareness further contributed to the positive regional outlook.

North America is expected to retain the highest market value during the projection period. Growth is supported by the availability of advanced diagnostic tools and increasing regulatory approvals. Rising awareness of bleeding disorder symptoms encouraged earlier diagnosis. Enhanced detection rates contributed to market expansion. South America was also expected to show strong momentum. The region experienced increasing cases of genetic conditions. Demand for personalized medicine and forensic testing continued to rise. Growing recognition of genetic abnormalities supported broader diagnostic adoption across the region.

Segmentation Analysis

The Blood Coagulation Market is categorized into instruments, reagents, and consumables. Strong growth is expected in reagents and consumables due to the rising testing rate supported by better healthcare access in developing regions. Increased adoption of regionally accepted therapies has supported market acceptance. Growth is also influenced by rising disease incidence and improved diagnostic capabilities. Innovations such as Delfi Diagnostics’ low-cost blood test for early cancer detection have strengthened the outlook. The market expansion is driven by higher patient numbers, research activity, and the focus on recombinant DNA products.

The Market is divided into hemophilia A, hemophilia B, and von Willebrand disease. Hemophilia A is expected to maintain dominance because of its higher global prevalence. The condition affects about one in 10,000 individuals, while von Willebrand disease impacts nearly 1% of the population. Growth is supported by increased diagnosis and a rising patient pool. Treatment options include plasma-derived factors, recombinant factors, and fibrin sealants. Recombinant coagulation factors are projected to lead the drug class segment due to higher usage and increasing incidence of bleeding disorders worldwide.

The Market includes hospitals and clinics, diagnostic centers, and other end users. Diagnostic centers are expected to record substantial growth due to rising awareness of bleeding disorders and higher diagnosis rates across populations. Increased disease prevalence and improved access to screening have strengthened this segment. Market expansion is also supported by advancements in treatment methods and a growing patient base. Research activities and the continued shift toward recombinant products by pharmaceutical companies contribute to the sector’s positive outlook and sustained development across key regions.

Based on Type

- Reagents

- Consumables

- Instruments

By Induction

- Hemophilia A

- Hemophilia B

- Von Willebrand Disease

- Others

By End-user

- Hospitals & Clinics

- Diagnostic Centers

- Others

Key Players Analysis

The competitive landscape of the Bleeding Disorder Testing Market is shaped by rising demand for advanced diagnostic solutions. Growth has been driven by an increase in hemophilia cases, improved laboratory infrastructure, and wider adoption of coagulation assays. Innovation has remained a central factor, as companies focus on reliable and rapid testing technologies. This shift has strengthened the position of established manufacturers and encouraged broader investment across global healthcare systems, creating solid momentum for future advancements supported by players such as F. Hoffmann-La Roche Ltd. and Siemens Healthcare GmbH.

Product expansion strategies continued to influence market performance. Companies introduced new analyzers, enhanced reagent portfolios, and integrated digital tools to improve test accuracy. This approach has helped strengthen brand visibility and support adoption across hospitals and diagnostic laboratories. Research pipelines expanded as organizations pursued next-generation coagulation systems that deliver precise results. These developments have enabled stronger competitive positioning for firms including Sysmex Corporation, HORIBA Ltd., and Thermo Fisher Scientific Inc., who remain active across key regional markets.

Strategic partnerships and clinical collaborations have also supported industry growth. Several manufacturers entered agreements with research institutions and care centers to validate bleeding disorder testing platforms. These collaborations improved clinical outcomes and expanded commercial reach. Healthcare providers increasingly preferred companies with strong distribution networks and proven product performance. This trend has reinforced the role of multinational entities such as Abbott and Johnson & Johnson, which maintained consistent progress through targeted initiatives and broader operational capabilities.

Market expansion has further been supported by investments in diagnostic innovation and improved patient-centric solutions. Companies strengthened their laboratory testing portfolios to address rising demand for early detection and monitoring of hemophilia and related conditions. The introduction of advanced coagulation analyzers and validated assay kits improved confidence among clinicians. This environment has encouraged continued participation from leading pharmaceutical developers, including Pfizer Inc. and other emerging players, who have adopted focused strategies to secure sustainable growth within the global Bleeding Disorder Testing Market.

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Siemens Healthcare GmbH (Germany)

- HORIBA Ltd. (Japan)

- Sysmex Corporation (Japan)

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Johnson and Johnson

- Pfizer Inc.

- Other key players

Conclusion

The Bleeding Disorder Testing Market is expected to advance steadily as diagnostic awareness increases and healthcare systems strengthen their capabilities. Growth is supported by wider testing coverage, improved laboratory technologies, and the rising need for precise and early diagnosis. Expanding use of genetic tools and reliable coagulation assays continues to enhance clinical decision-making and long-term patient management. Strong participation from global manufacturers and ongoing research activity are shaping a more efficient testing environment. Increasing adoption of personalized care approaches is expected to maintain consistent demand, positioning the market for sustained development across established and emerging regions.