Quick Navigation

Overview

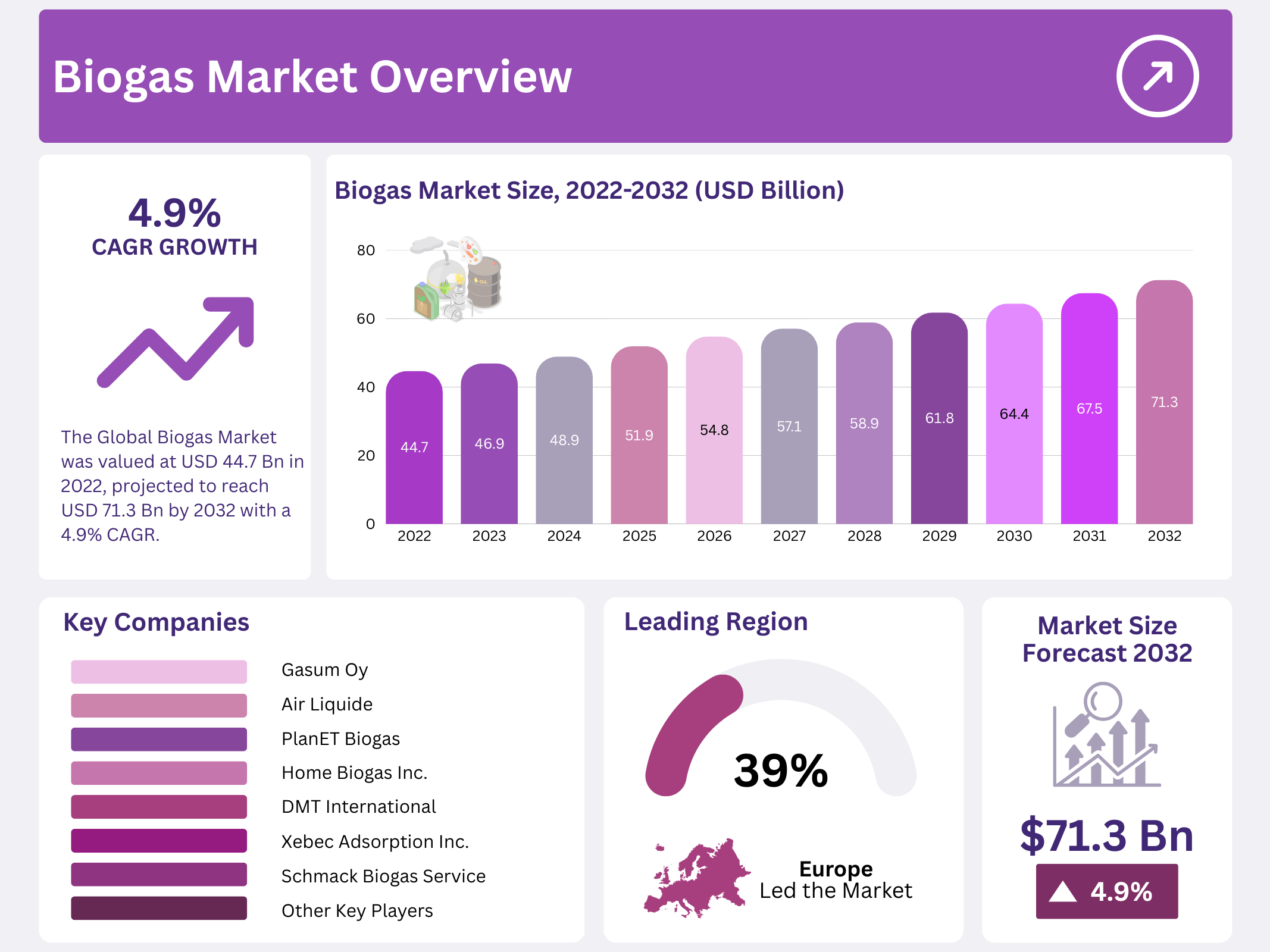

New York, NY – November 21, 2025 – The Global Biogas Market, valued at USD 44.7 billion in 2022, is projected to reach USD 71.3 billion by 2032, expanding at a 4.9% CAGR between 2023 and 2032. This steady growth reflects the increasing shift toward renewable and low-carbon energy systems, especially as countries seek cleaner alternatives to fossil fuels and aim to meet long-term climate commitments.

Biogas is generated through anaerobic digestion or fermentation of organic materials, producing a gas mixture containing 50–70% methane, 30–50% carbon dioxide, and trace gases. The production process relies on feedstocks such as agricultural residues, food waste, energy crops, and sewage sludge. These materials are decomposed by microorganisms inside oxygen-free digesters, producing biogas that can be used for electricity generation, heating, transportation fuel, or upgraded into biomethane.

The expansion of the biogas market is driven by rising environmental concerns, the need for sustainable energy, and growing interest in circular economy solutions. Strong government support through incentives, waste-to-energy programs, and renewable energy mandates has further accelerated adoption. Additionally, biogas offers economic advantages by reducing waste disposal costs, creating rural employment, and supporting decentralized energy production, making it an attractive component of global clean-energy strategies.

Key Takeaways

- The Global Biogas Market was valued at USD 44.7 billion in 2022, projected to reach USD 71.3 billion by 2032 with a 4.9% CAGR (2023–2032).

- Main feedstocks: municipal (41% share), industrial, and agricultural waste.

- Key applications: electricity generation (30% share in 2022), biofuel, heat, cogeneration.

- Europe holds the largest share (39%) due to strong policies, investment, advanced technology, and modern anaerobic digestion facilities.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 44.7 Billion |

| Forecast Revenue (2032) | USD 71.3 Billion |

| CAGR (2023-2032) | 4.9% |

| Segments Covered | By Source-Municipal, Industrial, and Agricultural; By Application-Electricity Generation, Biofuel Production, Heat Generation, Cogeneration, and Other Applications |

| Competitive Landscape | Agrinz Technologies GmbH, Air Liquide, DMT International, Gasum Oy, Home Biogas Inc., PlanET Biogas, Scandinavian Biogas Fuels International AB, Schmack Biogas Service, Total, Xebec Adsorption Inc. |

Key Market Segments

By Source Analysis

The biogas market is sourced mainly from municipal, industrial, and agricultural streams, with municipal waste holding a dominant 41% share. Household and city waste—such as food scraps, yard trimmings, and other biodegradable materials—form a major feedstock, enabling large-scale biogas generation through anaerobic digestion.

Industrial activities, including breweries, distilleries, and food-processing units, supply substantial organic residues that are efficiently converted into biogas. Agriculture also plays an important role, as livestock manure and crop residues like corn or sugarcane biomass offer high organic content that supports consistent biogas output.

By Application Analysis

Biogas applications span electricity production, biofuel generation, heat supply, cogeneration, and several smaller uses. Electricity generation led the market with a 30.0% share in 2022, driven by the use of gas engines and turbines that supply power to homes, commercial buildings, and local grids. Biogas is also upgraded into biomethane or CNG, enabling its use as a clean biofuel for mobility and industrial needs.

In heating applications, it supports industrial thermal processes and residential space heating. Cogeneration systems capitalize on biogas’ ability to produce heat and electricity simultaneously, improving efficiency. In many developing regions, biogas still serves essential functions such as cooking and lighting, where traditional energy access remains limited.

Regional Analysis

Europe leads the global biogas market, holding a 39% share, supported by strong policy frameworks and continuous investment in renewable energy infrastructure. The region’s biogas sector benefits from advanced technologies, well-established refinery operations, and steady funding that encourages expansion of modern anaerobic digestion facilities. Ongoing innovation and supportive regulations continue to strengthen Europe’s position.

Across the region, countries are accelerating biogas adoption to meet climate and decarbonization goals. Italy, in particular, is pushing the market forward through government-driven initiatives aimed at reducing carbon emissions. A notable example includes Eni SpA’s agreement in March 2021 to acquire an Italian biogas company from FRI EL Green Power through its circular economy arm, Ecofuel. The transaction, which aligns with Italy’s renewable-energy agenda, remains under review by antitrust authorities.

Top Use Cases

- Electricity Generation: Biogas serves as a reliable fuel for producing clean power in rural areas and small industries. It powers generators that supply electricity to homes and farms, reducing reliance on costly grid connections. This approach turns everyday waste like animal manure into a steady energy source, supporting off-grid communities while cutting down on fossil fuel use for a greener future.

- Cooking and Heating: In households and local eateries, biogas provides a safe, affordable gas for stoves and water heaters. Made from kitchen scraps and farm waste, it offers a smoke-free alternative to firewood or charcoal, improving indoor air quality and saving time on fuel gathering. This everyday use promotes healthier living in developing regions.

- Vehicle Fuel: Upgraded biogas, known as biomethane, powers buses and trucks as a cleaner alternative to diesel. It reduces tailpipe emissions in city fleets, helping transport companies meet green standards. By using food and sewage waste as input, this fuel option lowers operating costs and supports sustainable mobility in urban areas.

- Waste Management in Municipalities: Cities use biogas plants to process organic trash from homes and markets, turning it into energy while shrinking landfill sizes. This method curbs odors and pollution from dumpsites, creating a cleaner environment. It also generates revenue from the gas produced, making waste handling more efficient for local governments.

- Fertilizer Production on Farms: After biogas extraction, the leftover digestate becomes a nutrient-rich soil enhancer for crops. Farmers apply it to fields to boost yields without harsh chemicals, improving soil health over time. This cycle recycles livestock waste effectively, cutting fertilizer bills and fostering eco-friendly agriculture practices.

Recent Developments

1. Agrinz Technologies GmbH

Agrinz Technologies is advancing its patented “Hyperthermic Hydrolysis” process, which pre-treats organic waste to significantly increase biogas yield in anaerobic digesters. Recent projects focus on integrating this technology into larger, municipal-scale waste management facilities, enhancing efficiency and biogas output for renewable energy production. This positions them as a key technology provider for optimizing existing biogas plants.

2. Air Liquide

Air Liquide is expanding its footprint in renewable gas by investing in new biomethane production units across Europe and the US. A key development is their focus on upgrading biogas to grid-quality biomethane using membrane separation technology. They are also active in the development of a liquid biomethane (Bio-LNG) supply chain for heavy-duty transport, partnering with major players to decarbonize the logistics sector.

3. DMT International

DMT has seen increased global deployment of its Carborex MS biogas upgrading systems, which produce high-purity biomethane. A recent development is the integration of their technology with carbon capture solutions, creating carbon-negative energy systems. They are also focusing on digital monitoring and control services to optimize the performance and profitability of biogas upgrading plants for their international client base.

4. Gasum Oy

Nordic energy company Gasum is aggressively expanding its liquefied biogas (LBG) infrastructure. Recent developments include opening new biogas fueling stations for heavy-duty vehicles in Sweden and Finland and securing long-term agreements with industrial partners for bio-LNG supply. They are also investing in new biogas production capacity to meet the rising demand from the transport and industrial sectors, aiming to significantly cut carbon emissions.

5. Home Biogas Inc.

Home Biogas has launched its newest system, HomeBiogas 8, designed for backyard use by households. A major recent development is their successful implementation of systems in off-grid and humanitarian contexts, providing clean cooking fuel and organic fertilizer from kitchen waste. They continue to focus on making small-scale anaerobic digestion accessible and affordable for individual families, promoting circular living at a local level.

Conclusion

Biogas is emerging as a versatile player in the shift toward sustainable energy solutions. It transforms abundant organic waste into valuable resources, addressing energy needs while tackling waste challenges across homes, farms, and cities. With growing policy support and tech improvements, biogas strengthens circular economies, promising broader adoption in diverse sectors.