Quick Navigation

Introduction

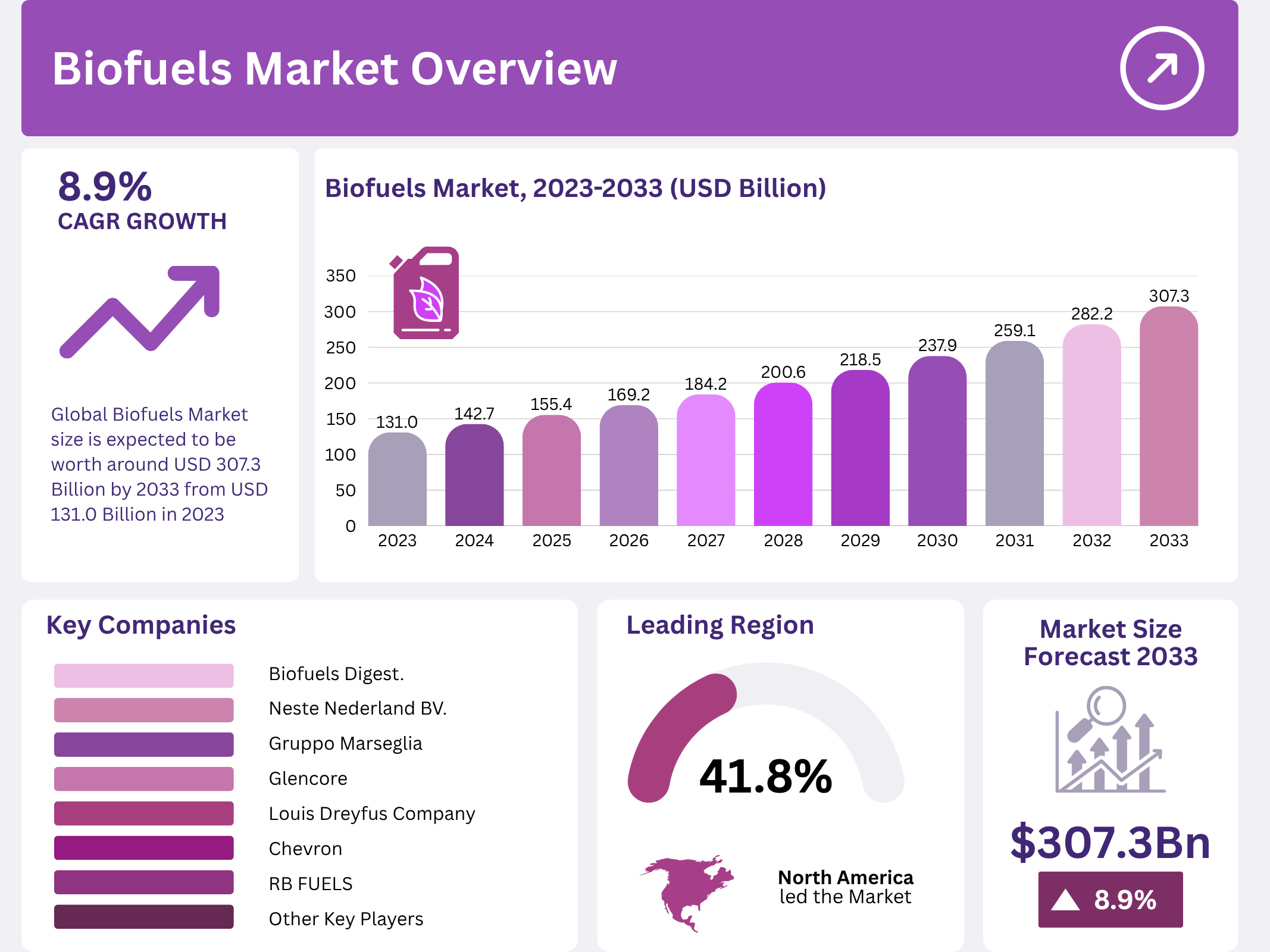

The global biofuels market is poised for substantial expansion, projected to grow from USD 131.0 billion in 2023 to USD 307.3 billion by 2033, registering a CAGR of 8.9%. This surge reflects increasing global demand for cleaner, renewable energy alternatives amid intensifying climate change concerns.

Moreover, growing government incentives, blending mandates, and investments in advanced technologies are accelerating adoption across key sectors like transportation and aviation. As nations commit to net-zero carbon targets, biofuels are becoming integral to sustainable energy strategies.

Transitioning toward renewable energy, biofuels derived from sugar crops, maize, waste, and algae are offering viable substitutes for fossil fuels. This shift not only enhances energy security but also drives innovation across emerging economies.

Key Takeaways

- The global biofuels market is projected to grow from USD 131.0 billion in 2023 to USD 307.3 billion by 2033, at a CAGR of 8.9%.

- Bioethanol leads the biofuels market with a 41.3% market share in 2023, driven by blending in gasoline, especially in the U.S. and Brazil.

- Liquid biofuels dominate with a 46% share, due to their use in transportation and compatibility with existing engines.

- Sugar crops dominate the feedstock segment, holding 41% of the market share, led by ethanol production from sugarcane in Brazil.

- North America leads the global biofuels market with a 41.8% share, supported by favorable policies and agricultural supply chains.

- Asia-Pacific shows strong potential, with India targeting 20% ethanol blending by 2025.

- High production costs and limited scalability, especially for advanced biofuels, remain critical restraints.

Market Segmentation Overview

By Type

Bioethanol dominates with a 41.3% share, fueled by extensive blending programs in major economies like the U.S. and Brazil. Biodiesel follows closely, supported by the EU’s renewable mandates. Meanwhile, Methanol, Propanol, and Biogas are gaining traction for their cleaner combustion and industrial uses.

By Form

Liquid biofuels lead with a 46% market share, favored for ease of integration with existing transport systems. Gaseous biofuels such as biomethane are rising in popularity for industrial and power generation uses, while solid biofuels retain niche applications in heating and electricity.

By Feedstock Type

Sugar crops hold a 41% share, led by sugarcane in Brazil, ensuring high ethanol yield. Coarse grains like maize dominate in the U.S., while palm oil and Jatropha feed biodiesel output in Indonesia and Malaysia. The “Others” category—waste oils and residues—represents the future of sustainable feedstocks.

Drivers

Rising Energy Demand and Energy Security

With global energy consumption projected to rise over 20% by 2040, nations seek renewable, locally sourced fuels. Biofuels provide an avenue to cut dependency on imported oil while enhancing national energy resilience. Emerging economies like India and Indonesia view biofuels as critical for sustainable growth and reduced carbon reliance.

Supportive Government Policies and Blending Mandates

Policies mandating biofuel blending in transport fuels are boosting market stability. Programs like India’s 20% ethanol target by 2025, Brazil’s 15% biodiesel goal by 2026, and U.S. Inflation Reduction Act incentives exemplify global momentum toward clean energy transformation.

Use Cases

Transportation Sector

Biofuels serve as drop-in replacements for gasoline and diesel, reducing emissions across road, maritime, and aviation sectors. In 2023, ethanol and biodiesel together supplied over 3.5% of global transport energy, highlighting their critical role in decarbonizing mobility.

Aviation Industry

Sustainable Aviation Fuel (SAF) is gaining momentum, targeting 10% of aviation fuel by 2030. With 200 million liters produced in 2023, SAF represents a key pathway to achieving emission reduction goals for airlines worldwide.

Major Challenges

High Production Costs

Producing second-generation biofuels remains 2–5 times costlier than fossil fuels, limiting competitiveness. Complex biochemical processes and limited economies of scale elevate expenses, deterring large-scale adoption in price-sensitive markets.

Feedstock Availability and Scalability

Feedstock supply inconsistencies, land-use conflicts, and competition with food crops hinder scalability. Many facilities operate below optimal capacity due to biomass fragmentation and inadequate supply chain infrastructure.

Business Opportunities

Advances in Synthetic Biology

Breakthroughs in synthetic biology allow engineered microbes to efficiently convert non-food biomass into fuels. These technologies reduce costs and expand feedstock options, enabling higher yields from agricultural residues and waste materials, improving overall sustainability.

Growth in Emerging Economies

Rapid industrialization in Asia-Pacific, coupled with supportive policy frameworks, creates fertile ground for investment. Nations like India, China, and Indonesia are scaling biofuel initiatives to meet rising energy demands while pursuing carbon neutrality goals.

Regional Analysis

North America

Holding a 41.8% market share, North America dominates through strong policy support and vast agricultural resources. The U.S. Renewable Fuel Standard (RFS) and Canada’s Clean Fuel Regulations ensure sustained biofuel demand and technological innovation in ethanol and biodiesel.

Asia-Pacific

Driven by rapid urbanization, Asia-Pacific is a high-growth region. India’s 20% ethanol blending and Indonesia’s biodiesel programs underscore government-led efforts to reduce oil imports and boost renewable energy. Abundant feedstocks and rising green investments further accelerate regional adoption.

Recent Developments

- 2024: Trafigura Group Pte Ltd acquired Greenergy’s European and Canadian supply operations, strengthening its renewable fuel presence.

- August 2024: USDA announced funding for 160 clean energy projects across 26 states, enhancing domestic biofuel capacity under the Inflation Reduction Act.

- 2023: HF Sinclair Corporation completed its acquisition of Holly Energy Partners, consolidating its energy infrastructure portfolio.

Conclusion

The global biofuels market is on a transformative path, growing at a CAGR of 8.9% toward USD 307.3 billion by 2033. As nations strive for net-zero emissions, biofuels offer an indispensable solution bridging today’s energy needs with tomorrow’s sustainability goals.

Supported by technological innovations, favorable policies, and expanding feedstock diversity, biofuels are set to redefine global energy systems. Overcoming cost and scalability barriers will be pivotal in ensuring biofuels’ integral role in the clean energy transition.