Quick Navigation

Introduction

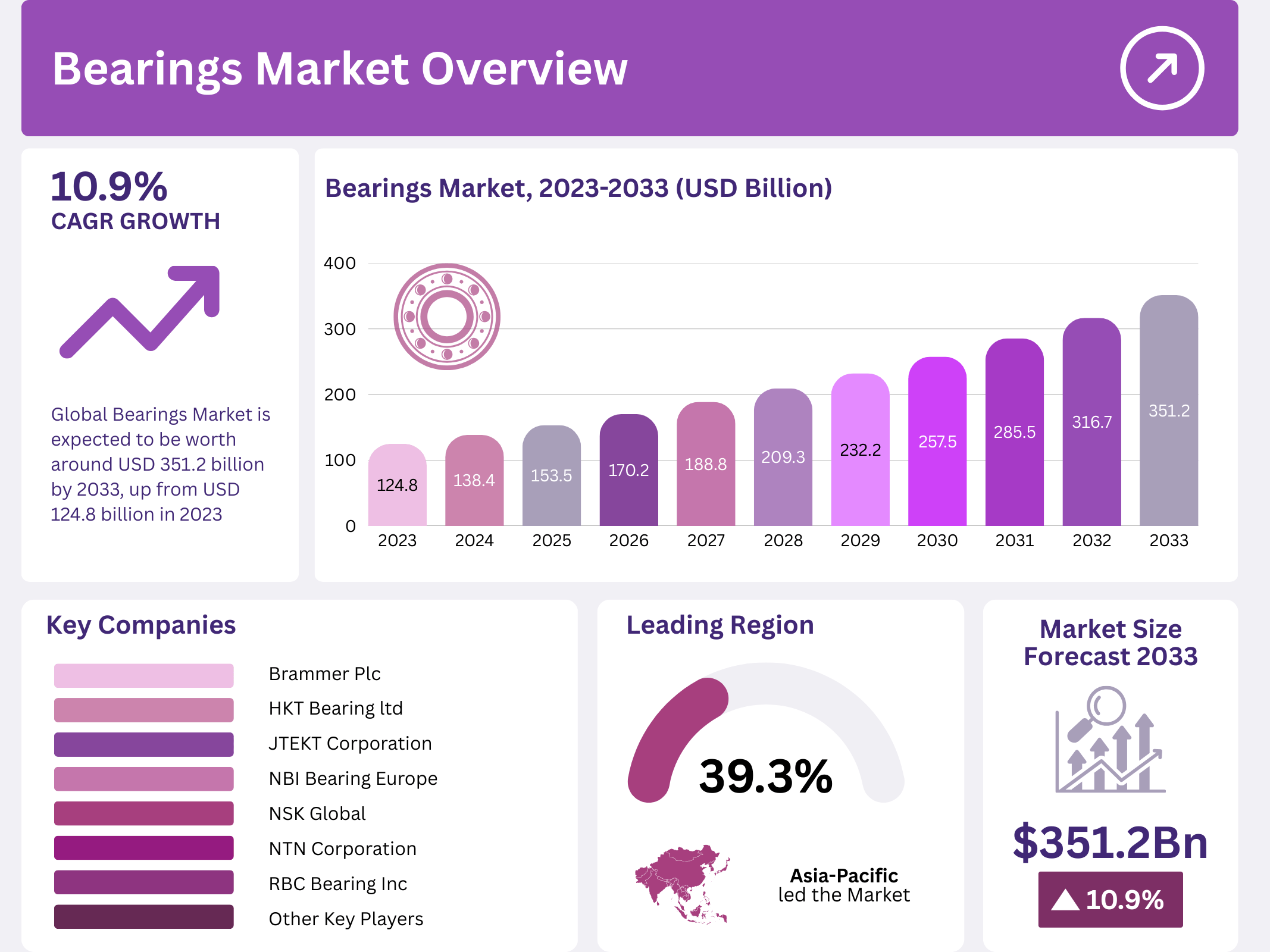

The Global Bearings Market is projected to be worth around USD 351.2 billion by 2033, growing from USD 124.8 billion in 2023, at a CAGR of 10.9% between 2024 and 2033. Bearings, which reduce friction and facilitate smooth rotational or linear movement, are indispensable in industries such as automotive, aerospace, construction, and manufacturing. Their critical role in ensuring efficiency and reliability positions the bearings industry at the heart of global industrial and technological transformation.

Growing emphasis on vehicle efficiency, industrial automation, and renewable energy adoption are accelerating market expansion. Asia Pacific led the market in 2023 with a 39.3% share, generating USD 49.04 billion in revenue, reflecting its strong manufacturing and automotive bases.

Key Takeaways

- The Global Bearings Market is expected to reach USD 351.2 billion by 2033, from USD 124.8 billion in 2023, at a 10.9% CAGR.

- In 2023, Roller Bearings dominated with a 49.2% share in the product segment.

- Industrial Machinery held the leading machine type segment share with 60.1%.

- Online Distribution accounted for a significant 72.4% share in 2023.

- Automotive Applications contributed 50.3% of the global demand in 2023.

- Asia Pacific led the global market with a 39.3% share and USD 49.04 billion revenue in 2023.

Market Segmentation Overview

- By Products: Roller Bearings dominate due to superior load-handling capacity, followed by Ball Bearings and Plain Bearings.

- By Machine Type: Industrial Machinery leads with 60.1%, fueled by global industrialization and automation adoption. Automotive (ICE and EV) and Aerospace machinery are steadily rising.

- By Distribution: Online channels commanded 72.4% in 2023, driven by digital transformation and e-commerce adoption.

- By Application: Automotive accounted for 50.3%, followed by Mining, Construction, Aerospace, Electrical, and Agriculture applications.

Drivers

- Automotive Expansion: The global shift toward electric and hybrid vehicles is driving demand for advanced, high-performance bearings.

- Industrial Advancements: Rapid automation and mechanization in industrial machinery require durable, efficient components.

- Smart Bearings Adoption: Bearings equipped with sensors for predictive maintenance are gaining traction, improving efficiency and reducing downtime.

- Material Innovations: Advanced materials like ceramics and polymers are enhancing durability and performance, catering to demanding environments.

- Infrastructure Investments: Expanding global infrastructure projects necessitate high-capacity machinery, further fueling demand.

Use Cases

- Automotive: From internal combustion engines to EV drivetrains, bearings ensure smooth functioning, reduced friction, and improved energy efficiency.

- Aerospace: Bearings are critical in jet engines and landing gear, where precision and reliability are paramount.

- Construction and Mining: Heavy-duty bearings withstand extreme loads and harsh environments, ensuring equipment longevity.

- Renewable Energy: Wind turbines heavily rely on specialized bearings. According to the U.S. Department of Energy, 76% of wind turbine gearbox failures are linked to bearing issues, underscoring the opportunity for innovation in this sector.

- Industrial Machinery: Bearings ensure minimal downtime and smooth operations in manufacturing plants, boosting productivity.

Major Challenges

- Raw Material Volatility: Fluctuating prices of steel and aluminum directly impact manufacturing costs.

- EV Transition: Electric vehicles typically require fewer bearings than combustion vehicles, presenting a demand challenge.

- Environmental Regulations: Compliance with sustainability norms requires costly investments in cleaner technologies.

- Counterfeit Products: Low-quality counterfeits impact brand reputation and compromise safety.

- Technological Complexity: Modern machinery requires highly specialized bearings, pressuring manufacturers to invest heavily in R&D.

Business Opportunities

- Wind Energy Expansion: With bearings being critical to wind turbine performance, innovations to prevent gearbox failures represent a multi-billion-dollar opportunity.

- Smart Bearing Technologies: Integration of IoT-enabled sensors for real-time monitoring is revolutionizing machinery maintenance.

- EV Boom: While EVs require fewer bearings, demand for lightweight, precision-engineered solutions tailored for EV designs is increasing.

- Customized Solutions: Rising industry-specific requirements, particularly in aerospace and defense, create demand for highly specialized bearings.

- Green Manufacturing: Adoption of sustainable processes and eco-friendly materials offers competitive advantage and regulatory compliance benefits.

Regional Analysis

- Asia Pacific: Leading with a 39.3% share and USD 49.04 billion in revenue (2023), the region is driven by China and India’s industrialization, robust automotive manufacturing, and large-scale infrastructure projects.

- North America: Strong adoption of advanced sensor-bearing units in automotive and revitalization of industrial sectors supports growth.

- Europe: With stringent environmental regulations, Europe emphasizes energy-efficient bearing solutions, fostering innovation.

- Middle East & Africa: Growth stems from infrastructure expansion and increased industrial machinery demand.

- Latin America: Countries like Brazil and Mexico are driving moderate growth, primarily through automotive and industrial recovery.

Recent Developments

- In August 2023, RHP Bearings introduced advanced industrial bearings with new grease technology, extending service life.

- In May 2023, RBC Bearings Inc. launched a new aerospace series designed for extreme conditions, strengthening its aerospace footprint.

- In March 2023, NBI Bearing Europe acquired Industrias Beta, enhancing its presence in automotive, lifting, and electric sectors.

Conclusion

The global bearings market is undergoing a transformative phase, fueled by automotive advancements, industrial expansion, and renewable energy adoption. With the market set to reach USD 351.2 billion by 2033, opportunities abound for manufacturers to innovate in smart technologies, sustainable solutions, and precision engineering. While challenges such as raw material volatility and counterfeit products persist, the industry’s resilience, coupled with its strategic role in modern machinery, ensures a promising growth trajectory.

Asia Pacific’s dominance, rising EV adoption, and wind energy integration highlight the bearings industry’s strategic importance in the coming decade. With key players such as Brammer Plc, HKT Bearing Ltd., JTEKT Corporation, and SKF spearheading innovation, the global bearings market is positioned to thrive as industries worldwide embrace efficiency, reliability, and sustainability.