Quick Navigation

Introduction

The global Autonomous Vehicles Market is undergoing a transformational shift. With technological breakthroughs accelerating, autonomous vehicles are poised to redefine modern transportation. These self-driving systems, powered by AI and smart sensors, enable safer, more efficient mobility solutions across passenger and commercial segments worldwide.

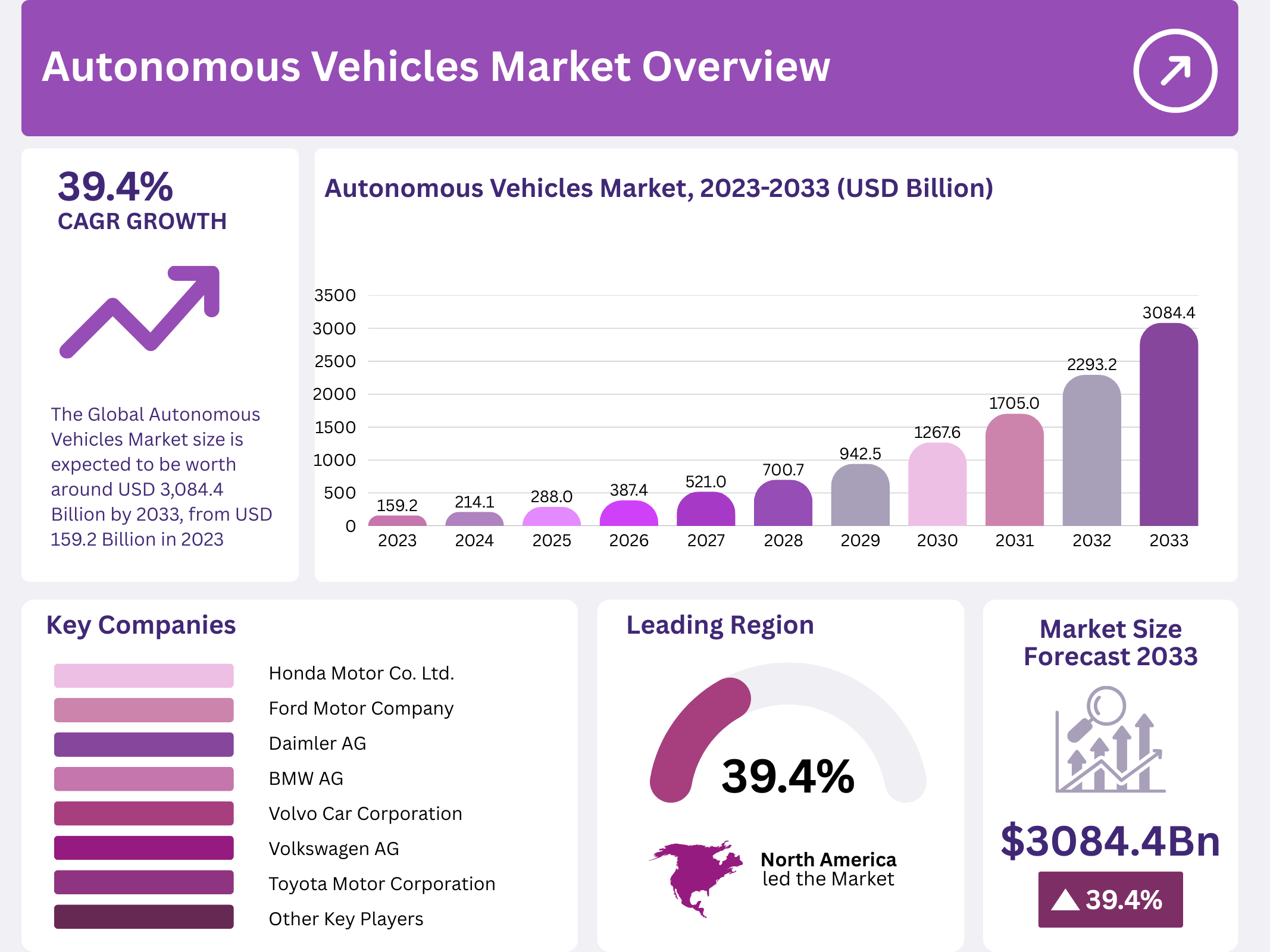

In 2023, the Autonomous Vehicles Market reached a value of USD 159.2 billion. By 2033, it is projected to hit USD 3,084.4 billion, expanding at a CAGR of 34.5%. Such exponential growth underscores the disruptive nature of AVs in reshaping road safety, logistics, and passenger experiences.

North America led the market in 2023 with a 39.4% share, contributing USD 62.7 billion. This dominance stems from robust R&D investment, regulatory readiness, and consumer openness to innovation. Simultaneously, emerging economies are laying the foundation for rapid AV deployment in coming years.

Autonomous vehicles operate via a combination of LIDAR, radar, machine vision, and predictive analytics. These systems empower vehicles to detect obstacles, predict road behavior, and take appropriate decisions without driver intervention. The result is a new era of mobility defined by automation, safety, and data-driven insights.

As countries invest in smart infrastructure and green technologies, the autonomous vehicle landscape will witness accelerated adoption. Government incentives, particularly in the UK, Europe, and Asia, are setting the tone for large-scale integration and strategic collaborations across the automotive and tech sectors.

Key Takeaways

- The Global Autonomous Vehicles Market is projected to grow from USD 159.2 Billion in 2023 to USD 3,084.4 Billion by 2033 at a CAGR of 34.5%.

- Passenger Vehicles dominated with a 72.3% share in 2023 by vehicle type.

- Level 1 autonomy led the market in 2023, accounting for 48.3% market share.

- Transportation accounted for 88.3% of the market by application in 2023.

- North America led with 39.4% market share and USD 62.7 Billion revenue in 2023.

Market Segmentation Overview

By Vehicle Type

Passenger Vehicles held a commanding 72.3% share in 2023. This dominance reflects strong consumer demand for safety, convenience, and smart driving solutions. Increasing urbanization and premium segment adoption continue to drive interest in autonomous features across personal vehicle buyers.

Meanwhile, Commercial Vehicles are gaining traction as businesses integrate AVs for cost savings and logistics optimization. As AI improves route planning and cargo handling, commercial fleets are increasingly piloting autonomous solutions across last-mile delivery and freight segments.

By Level

Level 1 autonomy maintained the largest market share at 48.3% in 2023. These vehicles offer driver assistance systems like adaptive cruise control, appealing to consumers due to affordability and enhanced safety. This tier serves as a gateway for users to adopt higher autonomy levels gradually.

Levels 2 and 3 are expanding as automakers introduce features such as hands-free driving and lane centering. Level 4 and 5 technologies remain in pilot stages but hold immense growth potential as AI systems mature and regulatory frameworks evolve.

By Application

Transportation accounted for a massive 88.3% share in 2023. AVs are revolutionizing passenger mobility and ride-sharing services, offering convenience, lower emissions, and enhanced traffic management. Infrastructure readiness and regulatory support continue to push adoption forward in public transit and private mobility.

In Defense, autonomous vehicles are being deployed for logistics, surveillance, and combat support. This segment is driven by the need to reduce risks to personnel and enhance operational efficiency in high-risk environments through remote-controlled and AI-driven military vehicles.

Drivers

Technological Advancements in AI and Sensors: The core growth driver for autonomous vehicles is the rapid progress in AI, LIDAR, and computer vision. These technologies enable real-time decision-making, obstacle detection, and efficient vehicle control, fostering trust and adoption across markets.

Regulatory and Government Support: Policies promoting AV testing and deployment are emerging worldwide. Governments offer incentives and funding for R&D, infrastructure upgrades, and green mobility goals, encouraging manufacturers and consumers to embrace self-driving technology.

Use Cases

Shared Mobility and Ride-Hailing: Companies are integrating AVs into ride-hailing platforms to reduce labor costs and enhance operational uptime. These services are particularly effective in urban zones where real-time traffic data helps optimize routes and improve customer experience.

Autonomous Logistics and Delivery: Last-mile delivery is transforming with autonomous vans and drones. Retailers and logistics providers are investing in AVs to streamline deliveries, reduce fuel consumption, and ensure timely, contactless service in both urban and rural settings.

Major Challenges

Public Safety and Trust Concerns: Despite technological readiness, consumer skepticism persists regarding AV safety. Incidents involving semi-autonomous vehicles have heightened scrutiny, demanding rigorous testing, transparency, and user education before full-scale adoption.

Legal and Liability Issues: The lack of standardized global legal frameworks for AV liability in accidents creates uncertainty. Questions about insurance, data ownership, and ethical decision-making during critical scenarios remain unresolved, delaying regulatory approvals.

Business Opportunities

Mobility-as-a-Service (MaaS): AV integration into on-demand transport platforms opens new business models. Consumers access fleets via apps without owning vehicles, reshaping urban transport economics and encouraging environmentally responsible commuting habits.

Data Monetization: AVs generate vast amounts of behavioral and traffic data. Automakers, municipalities, and mobility platforms can harness this for infrastructure planning, personalized services, predictive maintenance, and smart city optimization.

Regional Analysis

North America: With 39.4% market share, the U.S. and Canada lead AV adoption. Key factors include government-backed testing programs, presence of tech giants, and a mature EV and infrastructure ecosystem supporting AV deployment.

Asia Pacific: Rapid urbanization and proactive government policies in China, Japan, and South Korea are driving demand. Public-private partnerships and investments in AI and robotics make APAC a hotbed for AV innovation and scale-up potential.

Recent Developments

- In June 2023, Volkswagen AG partnered with a Silicon Valley AI startup to accelerate next-gen autonomous vehicle development.

- In March 2023, Volvo raised USD 500 million to enhance its autonomous driving capabilities.

- In January 2023, BMW AG launched a fully autonomous driving system for luxury models, emphasizing safety and comfort.

Conclusion

The global Autonomous Vehicles Market is at the forefront of a mobility revolution. Driven by technological breakthroughs, regulatory momentum, and consumer demand, AVs are redefining safety, efficiency, and convenience in transportation. Strategic investments, especially in AI and connected ecosystems, will continue to unlock new value streams.

With market size projected to surpass USD 3,084.4 billion by 2033, autonomous vehicles are not just a future possibility—they are an imminent reality. Businesses, governments, and consumers must collaborate to address challenges and seize the immense opportunities this transformative sector presents.