Quick Navigation

Introduction

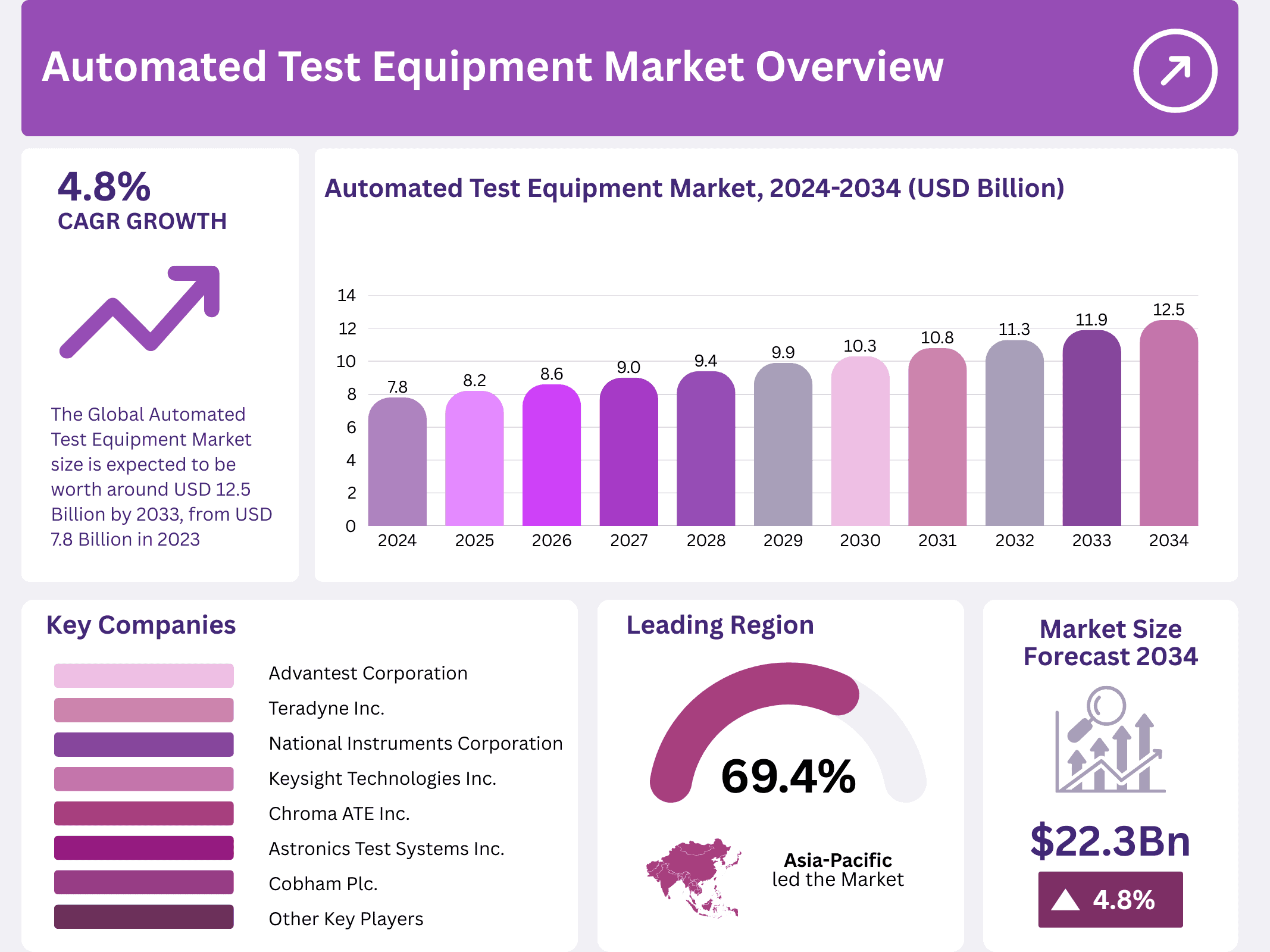

The global Automated Test Equipment market demonstrates remarkable momentum, projected to surge from USD 7.8 billion in 2023 to USD 12.5 billion by 2033. This expansion reflects a compound annual growth rate of 4.8% throughout the forecast period. Industry stakeholders are witnessing unprecedented transformation driven by technological innovations.

Furthermore, the integration of advanced technologies like 5G, artificial intelligence, and robotics continues reshaping testing paradigms. Global 5G connections reached 1.76 billion in 2023, representing a 66% annual increase. These developments necessitate sophisticated testing solutions capable of validating increasingly complex electronic systems across multiple industries.

Additionally, semiconductor manufacturers face mounting pressure to enhance production efficiency while maintaining stringent quality standards. Automated Test Equipment addresses these challenges by reducing human error and accelerating testing cycles. The technology proves indispensable for industries spanning telecommunications, automotive, aerospace, and consumer electronics sectors.

Meanwhile, digital transformation initiatives amplify market demand, particularly across emerging economies. The GCC region exemplifies this trend, with 80% of companies embracing digital technologies. Regional investments are projected to escalate from USD 38.4 billion in 2022 to USD 298.2 billion by 2032.

Moreover, automation adoption continues accelerating globally, evidenced by robot density increasing to 162 units per 10,000 employees in 2023. This represents significant growth from 74 units seven years earlier. Such expansion indicates substantial opportunities for further market penetration across manufacturing environments.

Consequently, leading market players are intensifying innovation efforts and forging strategic partnerships. Companies recognize that maintaining competitive advantage requires continuous technological advancement. The convergence of artificial intelligence with Industrial Internet of Things creates new possibilities for intelligent testing systems that deliver unprecedented accuracy and efficiency.

Key Takeaways

- The Automated Test Equipment Market reached USD 7.8 billion in 2023 and projects growth to USD 12.5 billion by 2033 at a 4.8% CAGR

- Non-Memory ATE commanded 64.2% of the product segment in 2023, driven by complex integrated circuit testing requirements

- Handlers dominated the component segment with 34.2% market share, essential for accurate device testing in production

- IT and Telecommunications sector led end-use industries with 49.4% share, fueled by high-speed communication device demand

- Asia-Pacific region maintained market leadership with 69.4% share and USD 5.41 billion revenue in 2023

- 5G subscriptions expected to reach 6.3 billion by 2030, accounting for 80% of mobile traffic

Market Segmentation Overview

Non-Memory ATE secures dominant positioning with 64.2% market share, primarily testing digital and mixed-signal circuits. This equipment category addresses critical needs for microprocessor, microcontroller, and digital signal processor validation. Growing semiconductor complexity drives sustained demand across consumer electronics, automotive, and telecommunications applications.

Conversely, Memory ATE focuses specifically on testing memory chips including DRAM, flash memory, and storage devices. Discrete ATE serves individual semiconductor components like transistors and diodes. Both segments contribute meaningfully to overall market expansion through continuous technological adaptation and specialization.

Among components, Handlers capture 34.2% segment share by automating critical testing processes. These systems precisely position devices under test, manage test sequences, and sort outputs based on results. Industrial PCs, mass interconnect systems, and probers complement handler functionality throughout comprehensive testing workflows.

Subsequently, the IT and Telecommunications sector dominates end-use industries with 49.4% market share. Rapid 5G deployment and advanced communication technology development necessitate extensive component testing. Consumer electronics, automotive, aerospace, defense, and healthcare sectors represent additional significant application areas driving diversified market growth.

Drivers

Growing Demand for Consumer Electronics: The proliferation of smartphones, tablets, and wearable devices creates substantial testing equipment demand. Manufacturers require efficient solutions ensuring product quality and functionality across expanding device portfolios. This consumer-driven demand fuels continuous market expansion as electronic devices become increasingly sophisticated and ubiquitous in daily life.

5G Technology Expansion: Global 5G network deployment accelerates testing equipment requirements significantly. Telecom companies need advanced solutions handling faster data speeds and complex hardware configurations. By 2030, 5G is expected to dominate mobile traffic, creating sustained demand for testing equipment validating network reliability and performance standards.

Use Cases

Semiconductor Manufacturing Quality Control: Automated Test Equipment ensures semiconductor devices meet stringent performance specifications before market release. Manufacturers leverage ATE systems to identify defects, validate functionality, and optimize production yields. This application proves critical as chip complexity increases across computing, automotive, and communications sectors requiring zero-defect manufacturing standards.

Automotive Electronics Validation: Modern vehicles incorporate sophisticated electronic systems including advanced driver-assistance systems, infotainment platforms, and sensor networks. ATE solutions validate these components under various operational conditions, ensuring safety and reliability. As automotive digitization accelerates, rigorous electronic testing becomes indispensable for meeting regulatory requirements and consumer expectations.

Major Challenges

High Initial Investment Costs: Sophisticated automated test equipment requires substantial capital investment, creating barriers for small and medium-sized enterprises. The advanced nature of these systems limits widespread adoption, particularly in price-sensitive markets. Companies must carefully balance investment costs against long-term operational benefits and competitive advantages.

Rapid Technological Obsolescence: Constant semiconductor technology advancements render existing test equipment outdated quickly. Organizations face continuous pressure to upgrade systems, incurring significant ongoing expenses. Additionally, the shortage of skilled professionals capable of operating and maintaining complex ATE systems compounds operational challenges across the industry.

Business Opportunities

Automotive Electronics Growth: Expanding demand for automotive sensors, infotainment systems, and advanced driver-assistance systems creates substantial opportunities. As vehicles become increasingly digitized and connected, rigorous electronic component testing requirements multiply. ATE manufacturers can capitalize on this trend by developing specialized solutions addressing automotive industry quality standards.

IoT Application Expansion: Billions of connected devices require comprehensive testing for performance, reliability, and security validation. The Internet of Things revolution across industries generates substantial demand for innovative testing solutions. Companies integrating artificial intelligence and machine learning into ATE systems can deliver more intelligent, efficient testing processes.

Regional Analysis

Asia-Pacific Market Leadership: The region commands 69.4% market share, contributing USD 5.41 billion in revenue. China, Taiwan, and South Korea host major semiconductor manufacturing operations driving substantial ATE demand. Cost-effective labor, robust electronics production capabilities, and aggressive 5G deployment position Asia-Pacific for continued market dominance throughout the forecast period.

North America Innovation Hub: The region maintains strong market presence through technological advancement and research leadership. Significant focus on aerospace, defense, and automotive sectors drives high-end semiconductor testing demand. Strategic investments in artificial intelligence and advanced manufacturing technologies ensure North America remains a critical market for innovative ATE solutions.

Recent Developments

- Boeing delivered its 100th Next Generation Automatic Test System in November 2023, revolutionizing fault detection for the U.S. Army

- ProteanTecs partnered with Teradyne in July 2023 to integrate machine learning-driven telemetry into system-on-chip testing

- Teradyne introduced AI tools in December 2024, reducing test system development timelines from months to days

- KingSpec Electronics launched the ZS101 in June 2024, testing up to 600 SATA or 480 M.2 NVMe SSDs simultaneously

- Averna acquired Global Equipment Services from Kimball Electronics in April 2024, enhancing automation capabilities

- Qualcomm announced collaboration with BMW and Mercedes in 2024, targeting USD 4 billion in automotive revenue by 2026

Conclusion

The Automated Test Equipment market stands positioned for substantial growth, driven by semiconductor complexity, 5G deployment, and digital transformation initiatives. Market expansion from USD 7.8 billion to USD 12.5 billion reflects strong industry fundamentals and technological advancement. Strategic partnerships, continuous innovation, and regional market dynamics will shape competitive landscapes throughout the forecast period, creating opportunities for established players and new entrants alike.