Quick Navigation

Overview

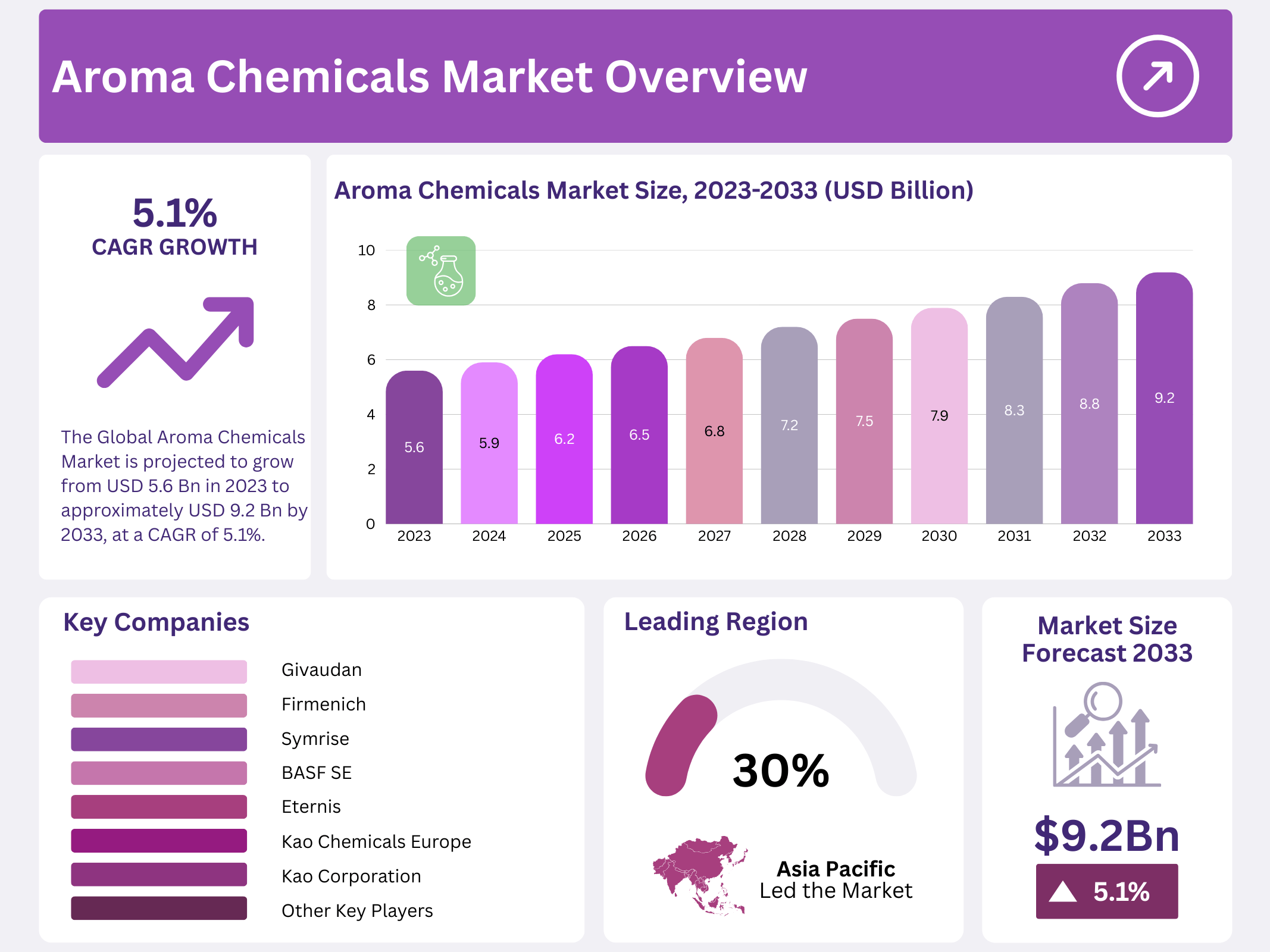

New York, NY – January 14, 2026 – The global Aroma Chemicals Market is projected to show steady growth over the next decade. Market size is expected to increase from USD 5.6 billion in 2023 to around USD 9.2 billion by 2033, registering a CAGR of 5.1% during the forecast period from 2023 to 2033. This growth reflects rising consumption across multiple end-use industries that rely heavily on aroma-enhancing ingredients.

Demand for aroma chemicals is primarily driven by the expanding flavor and fragrance sector. Increasing consumer preference for appealing scents and tastes in food & beverages, soaps & detergents, and cosmetics & toiletries continues to support market expansion. Urbanization, lifestyle changes, and higher spending on personal care and packaged foods are further accelerating product adoption worldwide.

This market report offers a comprehensive evaluation of the Aroma Chemicals industry, covering market size, share, growth outlook, and key trends shaping future demand. It also provides insights into the competitive landscape and examines critical factors influencing industry performance, helping stakeholders understand emerging opportunities and challenges within the global market.

Key Takeaways

- The Global Aroma Chemicals Market is projected to grow from USD 5.6 billion in 2023 to approximately USD 9.2 billion by 2033, at a CAGR of 5.1%.

- Synthetic aroma chemicals dominated the market in 2023, accounting for 57.6% of total revenue.

- The Terpenes and Terpenoids segment led by product type, contributing 36.4% of total revenue in 2023.

- Fragrance applications held the largest share at 68.9% of total revenue in 2023.

- The Asia Pacific region captured the highest revenue share of 30.6% in 2023.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 5.6 Billion |

| Forecast Revenue (2033) | USD 9.2 Billion |

| CAGR (2024-2033) | 5.1% |

| Segments Covered | By Source(Synthetic, Natural, Natural-Identical), By Products(Benzenoids, Terpenes & Terpenoids, Musk Chemicals, Others)(Ketones, Esters, Aldehydes), Application, Flavors, Convenience Foods, Confectionery, Dairy Products, Bakery Foods, Others, Fragrance, Cosmetics and Toiletries, Fine Fragrance, Soaps and Detergents, Others) |

| Competitive Landscape | Givaudan, Firmenich, Symrise, IIF (International Flavors & Fragrances), Takasago International Corporation, Privi Organics India Ltd., Bell Flavors & Fragrances, S H Kelkar and Company, Kao Corporation, BASF SE, Henkel AG & Co. KGAA, Eternis, Kao Chemicals Europe, Privi Speciality Chemicals Limited, Oriental Aromatics |

Key Market Segments

Source Analysis

The Synthetic Source segment led the aroma chemicals market in 2023, accounting for 57.6% of total revenue. This dominance is mainly driven by rising demand from the food & beverage, personal care, and cosmetics industries, where consistency, scalability, and cost efficiency are critical. Synthetic aroma chemicals are produced using advanced ingredient technologies that enable manufacturers to accurately replicate natural scents through carefully engineered chemical compositions.

Naturally derived aroma chemicals also represent an important segment, as they are obtained through traditional extraction methods from plant- and animal-based sources. Growing global awareness about the potential health concerns linked to artificial additives is encouraging manufacturers and consumers to explore natural alternatives.

The high production cost associated with natural aroma chemicals remains a limiting factor for market growth. Limited raw material availability, seasonal variations, and complex extraction processes often increase final product prices, which may restrict broader adoption compared to synthetic alternatives.

By Products

The Terpenes and Terpenoids segment dominated the aroma chemicals market, contributing 36.4% of total revenue in 2023. This strong position is supported by their natural abundance and extensive use across multiple industries, including paints, printing inks, rubber, and food & beverages. Terpenes are widely valued for their aromatic properties, making them suitable for both flavoring and fragrance applications.

Despite strong demand, market expansion for terpenes may be constrained by limited raw material supply in certain regions and high extraction costs. These challenges can affect pricing stability and availability, especially for naturally sourced terpenes.

Meanwhile, the benzenoids segment continues to witness rapid growth due to its increasing commercial importance. Benzenoids are widely used for their distinctive fragrances in soaps, shampoos, detergents, cosmetics, personal care products, and selected food and beverage applications, supporting consistent demand growth.

Application Analysis

The Fragrance Applications segment held the largest share of the aroma chemicals market, accounting for 68.9% of total revenue. This leadership is driven by rising consumption in cosmetics, fine fragrances, and men’s perfumes, along with expanding applications in emerging lifestyle and grooming categories. The availability of rare and premium ingredients in high-end fragrance formulations further supports demand.

Flavor applications are also gaining momentum as manufacturers respond to rising consumer interest in natural flavoring ingredients. Emerging economies are expected to play a key role in future market growth, supported by rising disposable incomes, increased consumption of processed foods and beverages, and growing interest in exotic and innovative flavors.

Demand is particularly strong across food categories such as baked goods, convenience foods, and confectionery, where aroma chemicals enhance taste appeal and product differentiation. These trends collectively reinforce the long-term growth outlook for the aroma chemicals market across both flavor and fragrance applications.

Regional Analysis

The Asia Pacific region dominated the global aroma chemicals market, capturing the highest revenue share of 30.6% in 2023. Supported by strong demand for flavor and fragrance ingredients across key economies such as India, China, and Japan. Rapid urbanization, rising disposable incomes, and expanding food, beverage, and personal care industries continue to strengthen regional market growth.

In North America, particularly in the United States and Canada, the aroma chemicals market is expected to grow at a moderate pace. Increasing consumer demand for low-carbohydrate and low-fat food and beverage products, along with rising consumption of packaged and convenience foods, is driving steady demand. An expanding food processing industry further supports market expansion across the region.

Additionally, growing consumer awareness around healthy nutrition and organic personal care products has increased the use of aroma chemicals in both food and cosmetic formulations. This shift toward cleaner-label foods and natural or organic cosmetics is reinforcing long-term demand for aroma chemicals across developed markets.

Top Use Cases

- Perfumes and Fragrances: Aroma chemicals form the backbone of modern perfumery by mimicking natural scents or creating unique blends. They allow perfumers to craft long-lasting signatures for colognes, eau de parfums, and body sprays, enhancing emotional appeal and brand identity in the beauty sector. This versatility helps meet consumer demands for personalized and exotic aromas in daily wear products.

- Personal Care Products: In shampoos, conditioners, lotions, and deodorants, aroma chemicals add pleasant scents that boost user experience and mask unwanted odors. They contribute to product differentiation in a crowded market, where fresh or soothing fragrances influence buying decisions and promote feelings of cleanliness and well-being during routine self-care.

- Household Cleaning Supplies: Aroma chemicals are key in detergents, floor cleaners, and air fresheners, infusing homes with inviting smells like citrus or lavender. This enhances the perception of cleanliness and creates a welcoming environment, driving consumer loyalty to brands that prioritize sensory satisfaction alongside effective cleaning performance.

- Food and Beverage Flavoring: These chemicals enhance tastes in snacks, drinks, and processed foods by replicating natural flavors such as vanilla or fruit essences. They ensure consistent quality across batches, appealing to taste preferences and extending shelf life, which supports innovation in the food industry to meet evolving consumer trends for enjoyable eating experiences.

- Industrial Applications: Aroma chemicals scent plastics, textiles, and paints, making everyday items like toys, fabrics, and furniture more appealing. They provide stability in manufacturing processes, allowing for odor control or enhancement that improves product usability and market acceptance in sectors focused on functional yet sensory-enhanced materials.

Recent Developments

Givaudan recently expanded its captive diacetyl facility in Switzerland to enhance production of this key dairy aroma chemical. This investment supports growing demand for authentic dairy notes in plant-based and traditional products, aligning with sustainability goals through optimized local production.

Firmenich (now DSM-Firmenich) has advanced its renewable aroma chemicals portfolio, launching ingredients like Clearwood through biotechnology. Recent focus is on scaling up carbon-negative and plant-based aroma molecules to meet demand for sustainable, natural fragrances.

Symrise has developed novel green chemistry processes to produce sustainable aroma chemicals, such as converting sawmill by-products into valuable sandalwood odorants. They are investing in biotechnology to expand their natural aroma ingredients portfolio.

International Flavors & Fragrances (IFF) introduced new biotransformation and fermentation platforms to produce high-quality, natural aroma chemicals like gamma-decalactone. Their recent R&D emphasizes reducing environmental impact while delivering cost-effective solutions.

Takasago International Corporation is pioneering catalytic synthesis for efficient, sustainable production of key aroma molecules like menthol. Their recent advancements focus on energy-saving processes and expanding high-purity ingredients for global flavor and fragrance markets.

Conclusion

Aroma chemicals play a vital role in elevating everyday products across industries by delivering captivating scents and flavors that connect with consumers on an emotional level. As a market research analyst, I see their ongoing importance in driving innovation and satisfaction, ensuring brands stay relevant in a world where sensory experiences increasingly shape preferences and loyalty.