Quick Navigation

Overview

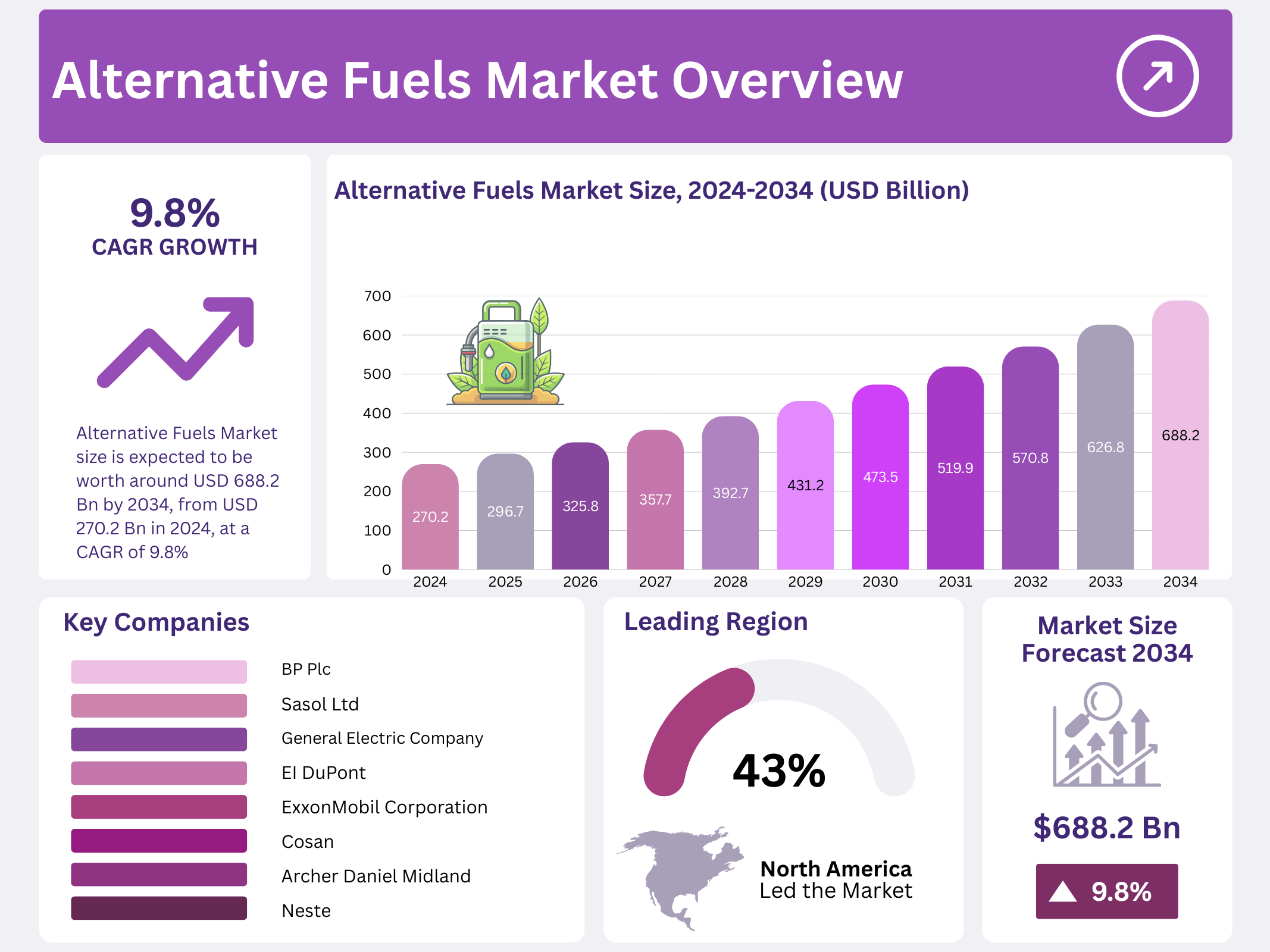

New York, NY – August 21, 2025 – The Global Alternative Fuels Market is projected to grow from USD 270.2 billion in 2024 to USD 688.2 billion by 2034, achieving a CAGR of 9.8% during the 2025–2034 forecast period. In 2024, North America led the market, holding a 43.2% share with USD 0.4 billion in revenue. The alternative fuels sector is a key driver of the global energy transition, spurred by government mandates for lower-carbon transportation and industrial fuels. In the U.S., the Renewable Fuel Standard (RFS2) under the Energy Independence and Security Act required 36 billion gallons of renewable fuel blending, including 16 billion gallons from cellulosic biofuels, displacing roughly 13.6 billion gallons of petroleum-based fuel, about 7% of transport fuel consumption.

In India, policies like the modified Pradhan Mantri JI-VAN Yojana promote advanced biofuels from lignocellulosic feedstocks such as agricultural residues, industrial waste, synthesis gas, and algae. The Sustainable Alternative Towards Affordable Transportation (SATAT) initiative targets 5,000 compressed biogas (CBG) plants by 2023–24, with a production capacity of 15 million metric tonnes annually, reducing fossil fuel reliance and boosting rural economies. Key drivers include regulatory mandates, carbon pricing, subsidies, and corporate sustainability goals. U.S. EPA data shows corn ethanol reduces lifecycle greenhouse gas emissions by ~21%, sugarcane ethanol by ~61%, and cellulosic ethanol by up to 129% compared to fossil fuels.

Economic benefits, such as USD 13 billion in annual farm income by 2022, further support growth. India’s Ethanol Blended Petrol (EBP) programme targets 20% ethanol blending, expected to save USD 4 billion (₹30,000 crore) annually through import substitution. The national biofuel policy allocated ₹5,000 crore for seven second-generation (2G) bioethanol refineries, with a broader ₹10,000 crore plan for 12 plants. In 2018, India aimed to establish 5,000 large-scale biogas plants producing 15 million tonnes (62 mmcmd) of bio-CNG annually. State-level efforts bolster these initiatives. Bihar’s Biodev Policy (Amended) 2025 supports ethanol and CBG, with 12 ethanol units producing 1,617.5 kilolitres daily and incentives for expansion. In Gujarat, ₹3,300 crore in dairy cooperative-led investments will establish ethanol plants with 2,800 KLPD capacity, alongside 30 CBG plants and 32,550 household biogas units, with a ₹1,000 crore investment to power 80,000 vehicles annually.

Key Takeaways

- The Global Alternative Fuels Market is projected to reach USD 688.2 billion by 2034, up from USD 270.2 billion in 2024, growing at a CAGR of 9.8% during the forecast period.

- Electric held a dominant position, accounting for more than 37.5% of the global alternative fuels market.

- Passenger Vehicles led the market with a share of over 57.1%.

- Battery Electric Drive was the leading segment, holding more than 42.2% market share.

- The Transportation segment dominated, contributing more than 68.9% to the overall market.

- North America was the leading regional market, capturing 43.2% share, which translated to a market value of approximately USD 0.4 billion.

Alternative Fuels Statistics

- Biodiesel must be blended with fossil diesel for use in compression ignition (CI) engines. Ethanol, blended with gasoline, is used in spark ignition (SI) vehicles, with over 98% of U.S. gasoline containing significant ethanol.

- The Cummins Inc. Ethos engine runs on E85 85% ethanol without changes, while flex-fuel vehicles over 21 million in the U.S. can use 51-83% ethanol blends E85.

- Biodiesel and ethanol blends offer higher cetane and octane ratings, enhancing performance. NASCAR uses a 15% ethanol-gasoline blend, exceeding typical pump fuel.

- As the IMO aims to cut marine shipping emissions by 50% by 2050, alternative fuels are gaining traction.

- LPG, safely transported by LPG gas carriers for over 80 years, is a promising option. Currently, 72 LPG carriers use LPG for propulsion, with 93 more carriers and four ethane carriers on order, designed to utilize LPG as bunker fuel.

Report Scope

| Market Value (2024) | USD 270.2 Billion |

| Forecast Revenue (2034) | USD 688.2 Billion |

| CAGR (2025-2034) | 9.8% |

| Segments Covered | By Fuel Type (Biofuel, CNG, Electric, Hybrid, Hydrogen, LPG), By Vehicle Type (Commercial Vehicle, Off-Road Vehicle, Passenger Vehicle), By Propulsion Type (Battery Electric Drive, Fuel Cell Electric Drive, Hybrid Electric Drive, Internal Combustion Engine), By End Use (Power Generation, Residential, Transportation, Others) |

| Competitive Landscape | BP Plc, Sasol Ltd., General Electric Company, EI DuPont, ExxonMobil Corporation, Cosan, Archer-Daniels Midland, Neste, INEOS Enterprises |

Key Market Segments

By Fuel Type Analysis

In 2024, the electric segment commanded a 37.5% share of the global alternative fuels market, driven by surging electric vehicle (EV) sales, expanding charging infrastructure, and growing consumer demand for sustainable transport. The widespread adoption of electric powertrains in passenger and commercial vehicles has solidified electricity’s role as a key alternative fuel. Government incentives for EV purchases and charging network development, coupled with stricter emission regulations, have accelerated this trend.

By Vehicle Type Analysis

In 2024, passenger vehicles held a 57.1% share of the alternative fuels market, driven by the rising popularity of electric and hybrid cars in urban and suburban regions. Soaring fuel costs, environmental awareness, and government subsidies have spurred consumers to embrace alternative fuel vehicles. Automakers have responded by introducing a diverse range of electric and biofuel-compatible models, expanding consumer choice.

By Propulsion Type Analysis

In 2024, battery electric drive captured a 42.2% share of the alternative fuels market, fueled by demand for zero-emission vehicles powered by rechargeable batteries. Government incentives, tax breaks, and infrastructure investments across major economies have accelerated adoption. Declining battery costs and improved driving ranges have made these vehicles more accessible, while automakers have expanded their electric vehicle offerings across various price points.

By End Use Analysis

In 2024, the transportation sector held a 68.9% share of the alternative fuels market, driven by a shift to cleaner alternatives in vehicles, aviation, and rail. Public and private initiatives to cut carbon emissions have boosted electric vehicle adoption, biofuel-powered fleets, and sustainable aviation fuel programs. Global policies to phase out diesel and petrol vehicles, alongside expanded alternative fuel infrastructure, have supported this transition.

Regional Analysis

North America leads with a 43.2% share, reaching USD 0.4 billion in 2024.

In 2024, North America dominated the global alternative fuels market with a 43.2% share, valued at USD 0.4 billion. This leadership stems from robust regulatory frameworks, technological advancements, and heightened environmental awareness in the U.S. and Canada. The U.S. Renewable Fuel Standard (RFS) and Inflation Reduction Act have driven investment in clean hydrogen, sustainable aviation fuel, and EV infrastructure, with over 3.5 million EVs and 160,000 public charging stations in the U.S. alone.

The region’s significant biofuel production, including over 15 billion gallons of ethanol annually, further strengthens its position. Canada’s Clean Fuel Regulation, targeting a 15% reduction in fuel carbon intensity by 2030, complements these efforts. In 2025, North America is expected to maintain its lead, driven by ongoing clean energy investments, localized supply chains, and strong policy support.

Top Use Cases

- Electric Vehicles in Urban Transport: Electric vehicles (EVs) are transforming city transportation with zero tailpipe emissions. Supported by expanding charging networks and government incentives, EVs reduce air pollution and fuel costs. Their use in public buses and taxis is growing, making urban mobility cleaner and more sustainable, especially in densely populated areas.

- Biofuels in Heavy-Duty Trucking: Renewable diesel and biodiesel power heavy-duty trucks, offering a lower-carbon alternative to traditional diesel. These fuels, made from organic waste, work in existing engines, reducing emissions without major infrastructure changes. They’re ideal for long-haul logistics, supporting sustainability goals while maintaining performance and range.

- Hydrogen for Rail Systems: Hydrogen fuel cells are powering trains in regions where electrification isn’t feasible. They emit only water, cutting greenhouse gas emissions. With refueling stations expanding, hydrogen trains offer a clean, efficient solution for regional and freight rail, aligning with global decarbonization efforts and reducing reliance on diesel.

- Sustainable Aviation Fuel for Airlines: Sustainable aviation fuel (SAF), derived from biomass, reduces aviation’s carbon footprint by up to 80%. Compatible with existing aircraft, SAF is gaining traction as airlines face pressure to meet net-zero goals. Its adoption is growing in commercial flights, supporting greener air travel without compromising performance.

- Compressed Natural Gas in Public Fleets: Compressed natural gas (CNG) powers buses and municipal vehicles, offering lower emissions and cost savings compared to gasoline. With established refueling infrastructure, CNG is a practical choice for public fleets, reducing urban air pollution and operational costs while supporting cleaner transportation solutions.

Recent Developments

1. BP Plc

BP is aggressively expanding its bioenergy portfolio, focusing on low-carbon biofuels like sustainable aviation fuel (SAF) and renewable natural gas (RNG). A key recent development is the acquisition of Archaea Energy, a leading RNG producer in the US. This significantly scales up BP’s ability to capture waste emissions from landfills and convert them into clean energy.

2. Sasol Ltd.

The South African chemical and energy giant is pivoting towards green hydrogen and sustainable fuels to decarbonize its extensive operations. A flagship project is the Boegoebaai green hydrogen feasibility study, in partnership with the South African government, aiming to export ammonia to Europe. Domestically, Sasol is a key player in developing South Africa’s green hydrogen economy.

3. General Electric Company (GE Vernova)

Through its spin-off GE Vernova, the company is driving alternative fuel adoption in the power and aviation sectors. GE Aerospace is leading the testing of 100% Sustainable Aviation Fuel (SAF) on its advanced jet engines, demonstrating significant CO2 reduction potential. In power generation, GE Vernova’s gas turbine portfolio is increasingly capable of running on hydrogen blends, with a clear roadmap to achieve 100% hydrogen combustion.

4. DuPont (Now DowDuPont spin-offs)

The legacy DuPont business is now split into three entities. The most relevant for alternative fuels is DuPont Water & Protection, whose technologies are critical enablers. Their focus is on advanced membranes and materials used in the production of green hydrogen. Their products are essential for proton exchange membrane (PEM) electrolysis, a key method for producing hydrogen from water using renewable electricity.

5. ExxonMobil Corporation

ExxonMobil is betting heavily on biofuels, specifically focusing on algae and cellulosic ethanol. Their most significant recent move is the nearly all-stock acquisition of Denbury Inc., giving them the largest owned and operated CO2 pipeline network in the US. This infrastructure is crucial for Carbon Capture, Utilization, and Storage (CCUS), which supports their low-carbon biofuels strategy.

Conclusion

The Alternative Fuels Market is rapidly expanding, driven by environmental regulations, cost savings, and technological advancements. Electric, biofuels, hydrogen, and CNG offer diverse solutions across transportation sectors, from urban EVs to aviation’s sustainable fuels. Growing infrastructure and government support are accelerating adoption, positioning alternative fuels as key to achieving sustainable, low-carbon mobility in the coming years.