Quick Navigation

Introduction

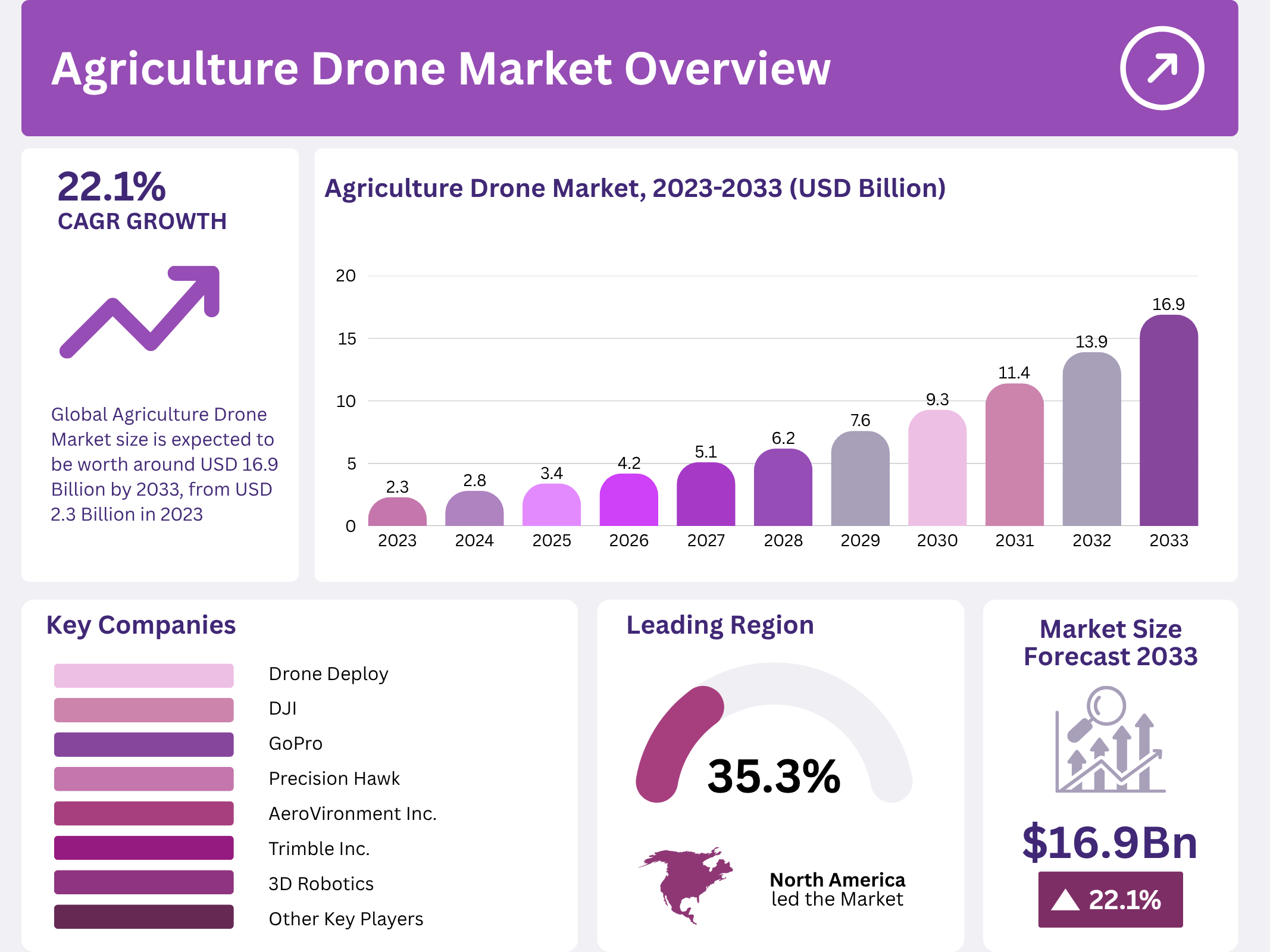

The Global Agriculture Drone Market is experiencing rapid expansion, driven by advancements in drone technology and the increasing adoption of precision farming. The market is projected to reach USD 16.9 Billion by 2033, up from USD 2.3 Billion in 2023, reflecting a strong CAGR of 22.1% from 2024 to 2033.

Rising global demand for high-yield crops and efficient farming methods has accelerated drone deployment across large-scale and smallholder farms. Agriculture drones enhance productivity by providing aerial surveillance, crop health monitoring, and targeted spraying, significantly reducing labor costs and resource wastage.

Moreover, government initiatives promoting sustainable and smart agriculture, coupled with the integration of AI and data analytics in UAVs, continue to drive market expansion. With increasing regulatory support and technological improvements, agriculture drones are becoming indispensable tools for modern farming.

Key Takeaways

- The Global Agriculture Drone Market size is projected to reach USD 16.9 Billion by 2033, from USD 2.3 Billion in 2023, at a CAGR of 22.1%.

- In 2023, Fixed Wing dominated the By Type segment with a 55% share.

- Hardware led the By Component segment in 2023, capturing 52.4% of the market.

- Outdoor Farming held a significant 81.6% share in the By Farming Environment segment.

- Crop Spraying was the leading application in 2023.

- North America accounted for 35.3% of the global share, valued at USD 0.8 Billion.

Market Segmentation Overview

In 2023, the Fixed Wing segment dominated the Agriculture Drone Market with a 55% share, owing to its extended range and flight endurance. Fixed-wing drones are highly efficient for large-scale field mapping and continuous aerial data collection, making them the preferred choice for extensive agricultural landscapes.

The Hardware segment secured a 52.4% share, driven by the critical role of frames, propulsion systems, sensors, and cameras in drone functionality. Hardware remains a fundamental revenue contributor due to continuous innovation in imaging and navigation systems that improve precision in crop surveillance and data capture.

Outdoor Farming commanded a strong 81.6% market share, benefiting from large-scale drone deployment for field monitoring, pesticide spraying, and soil mapping. The extensive use of drones in outdoor farming underscores their scalability in managing vast farmlands efficiently and promoting precision agriculture practices.

Crop Spraying dominated the application segment in 2023 as drones provide efficient, uniform pesticide and fertilizer distribution. This segment’s leadership stems from its ability to reduce chemical waste, ensure worker safety, and increase yield, marking a transformative step toward sustainable agriculture.

Drivers

The rising adoption of precision farming is a major driver propelling the Agriculture Drone Market. Farmers increasingly rely on drones for accurate mapping, crop analysis, and input management, significantly improving productivity and reducing operational costs. The ability to collect and analyze real-time data fosters informed decision-making, optimizing yield and resource utilization.

Another crucial driver is technological innovation in UAVs. Enhanced battery life, autonomous navigation, and multispectral imaging systems have made drones more reliable and accessible. The integration of AI and IoT further enables predictive analytics, allowing farmers to identify pest infestations, nutrient deficiencies, and irrigation needs with exceptional accuracy.

Use Cases

Agriculture drones are widely utilized for crop spraying, ensuring precise application of fertilizers and pesticides. This not only enhances uniformity in coverage but also reduces chemical consumption by up to 30%, promoting sustainability and cost-efficiency across agricultural operations.

Another significant use case lies in soil and field analysis. Drones equipped with multispectral sensors capture detailed data on moisture levels, crop stress, and soil fertility. This information enables farmers to plan irrigation and nutrient distribution effectively, improving yield and reducing environmental impact.

Major Challenges

High initial investment costs pose a considerable challenge to drone adoption in agriculture. Advanced drones with AI-enabled imaging and mapping technologies are expensive, limiting accessibility for small and mid-sized farmers, particularly in developing regions.

Additionally, complex regulatory frameworks and airspace restrictions hinder widespread drone operations. Inconsistent drone usage policies, coupled with privacy concerns and the need for trained operators, create operational bottlenecks that slow market growth and innovation adoption.

Business Opportunities

Emerging economies offer substantial growth potential for drone adoption in agriculture. Expanding drone-based services such as field mapping, crop spraying, and yield monitoring across Asia Pacific, Latin America, and Africa presents untapped market opportunities for manufacturers and service providers.

Furthermore, integration of AI, cloud analytics, and machine learning in drones creates avenues for precision agriculture platforms. These technologies can process drone-acquired data to predict weather impacts, detect early crop diseases, and optimize resource allocation, transforming drone usage into a critical decision-support tool for farmers.

Regional Analysis

North America led the Agriculture Drone Market with a 35.3% share in 2023, valued at USD 0.8 Billion. The region’s leadership stems from advanced agricultural infrastructure, early technology adoption, and supportive policies that promote precision farming and sustainable crop management.

Asia Pacific is poised for rapid expansion, driven by large-scale agricultural operations and rising government initiatives in China, Japan, and India. Government subsidies, like India’s investment of Rs. 129.19 crores to promote Kisan Drones, are accelerating technology adoption and transforming regional agricultural efficiency.

Recent Developments

- In September 2023, Precision Hawk upgraded its drone software to enhance farm data analytics, streamlining monitoring and operational efficiency.

- In August 2023, AeroVironment Inc. introduced a new crop analysis drone featuring high-resolution imaging and improved battery performance.

- In July 2023, Trimble Inc. launched an advanced navigation update for agriculture drones, improving precision mapping and data reliability.

Conclusion

The Agriculture Drone Market is entering a transformative phase as UAVs become integral to modern precision farming. With projected revenues reaching USD 16.9 Billion by 2033 at a CAGR of 22.1%, the sector demonstrates strong potential driven by innovation, sustainability, and data-driven agriculture.

While challenges such as high costs and regulatory limitations persist, opportunities in AI integration, cloud analytics, and service expansion promise significant growth. As governments and technology providers continue to invest in precision agriculture, drones are set to redefine global farming efficiency and productivity.