Quick Navigation

Overview

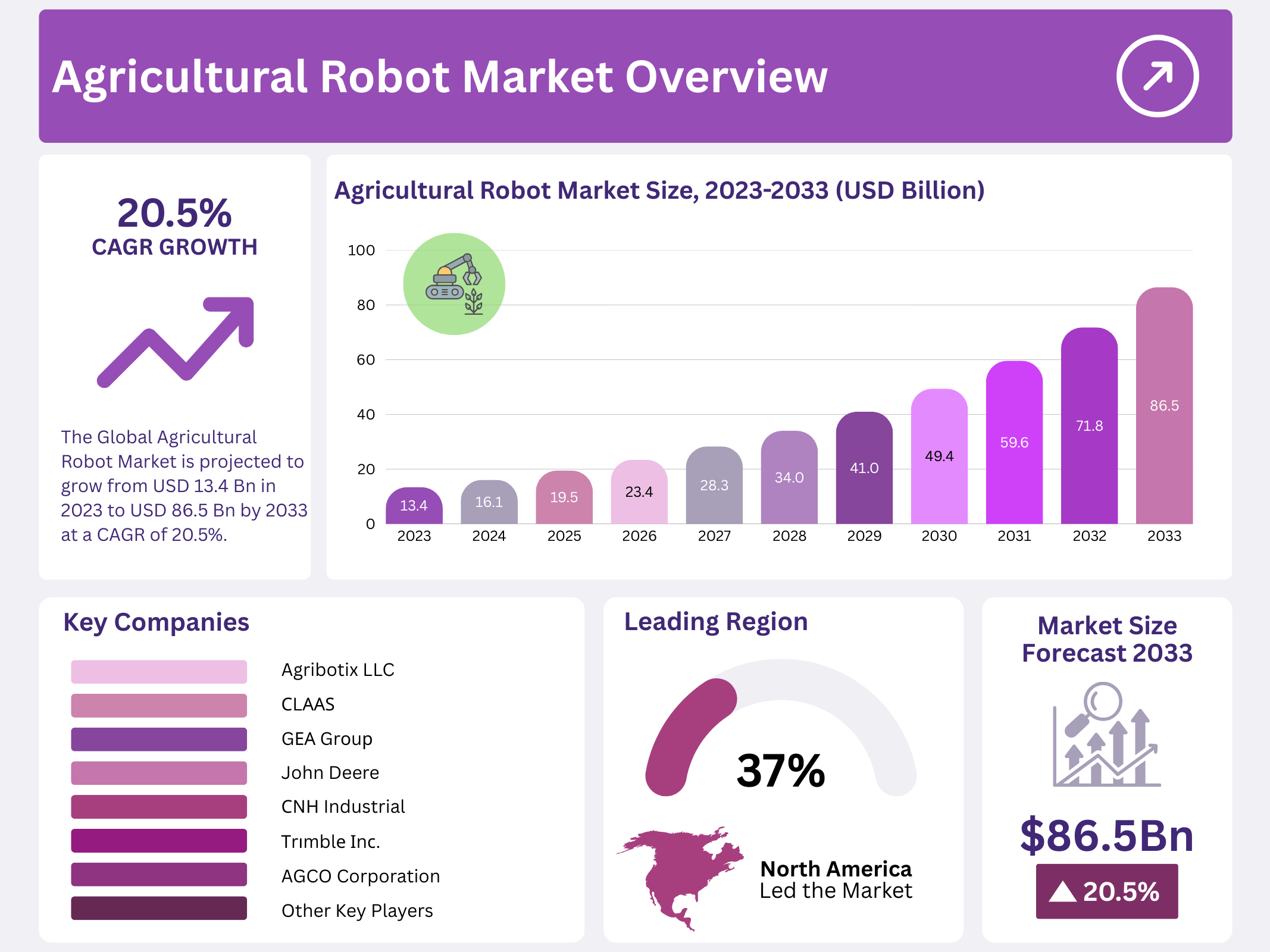

New York, NY – November 24, 2025 – The Global Agricultural Robot market is projected to reach USD 86.5 billion by 2033, rising significantly from USD 13.4 billion in 2023. This strong growth represents an impressive CAGR of 20.5% during the forecast period. The increasing need for automation in farming, growing food demand, and a shrinking agricultural workforce are some of the key forces driving this expansion.

One of the major reasons behind this rapid adoption is the rise of advanced electronic technologies such as the Global Positioning System (GPS) and the Geographic Information System (GIS). These tools help farmers monitor fields with higher accuracy, reduce human effort, and improve operational efficiency. Robots are now being used for tasks like planting, harvesting, spraying, soil analysis, and livestock monitoring.

Precision farming is also growing across the industry as farmers shift from traditional methods to data-driven decision-making. The use of Big Data, AI, sensors, drones, and GPS-based systems is making farm management more predictable and efficient. As a result, agricultural robots are becoming a central part of modern farming strategies, supporting higher productivity, reduced resource waste, and better crop outcomes.

Key Takeaways

- The Global Agricultural Robot Market is projected to grow from USD 13.4 billion in 2023 to USD 86.5 billion by 2033 at a CAGR of 20.5%.

- Milking robots held the largest share in 2023 with over 48.6% of the market.

- Hardware dominated in 2023, accounting for over 55% of market revenue.

- North America led the market in 2023, capturing nearly 37% of global agricultural drone sales.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 13.4 Billion |

| Forecast Revenue (2033) | USD 86.5 Billion |

| CAGR (2024-2033) | 20.5% |

| Segments Covered | By Product Type (Milking robots, UAV, and Others), By Offering (Hardware, Software, Service), By Application (Field farming, Crop management, Animal Management, and Others) |

| Competitive Landscape | Agribotix LLC, AGCO Corporation, Autonomous Solutions, Inc., BouMatic Robotics B.V., СNН Industrial, СLААЅ, Drone Deploy, GЕА Grоuр, Harvest Automation Inc., Тrіmblе Іnс., AgEagle Aerial Systems, Inc., Naio Technologies, Deere & Company, John Deere, Deepfield Robotics, Other Key Players |

Key Market Segments

Type Analysis

In 2023, Milking Robots dominated the agricultural robot market with over 48.6% share, reflecting strong adoption across dairy farms as farmers sought automation to enhance productivity and herd health. Their role in reducing labor dependency and improving operational precision made them a preferred solution. Drone technology also gained momentum, largely fueled by rising venture investments and improvements in imaging, sensing, and AI.

These drones are increasingly used for field scouting, crop monitoring, spraying, and yield assessment, which continues to support growth in this segment. Meanwhile, driverless tractors are anticipated to see the fastest adoption rate over the coming years. Their ability to automate labor-intensive activities such as planting, tillage, and seeding—especially in large-scale operations in countries like China and India—positions them as a future growth catalyst in the market.

By Offering

Hardware remained the leading category in 2023, accounting for over 55% of the market share, as physical robotic systems like autonomous tractors, robotic arms, and drones form the backbone of agricultural automation. Software also played an increasingly vital role, powering the intelligence behind these systems—enabling features such as real-time analytics, crop health monitoring, and autonomous navigation.

Services, which include maintenance, upgrades, and training, added further value by ensuring long-term performance, reliability, and operational efficiency. Together, hardware, software, and services form an interconnected ecosystem that supports the rapid digitalization of farming operations.

Application Analysis

In 2023, Planting and Seeding led the market with over 24.6% share, driven by demand for precision agriculture solutions that reduce seed loss and boost crop yields. Soil management is projected to record the fastest growth as more farms adopt automated solutions for fertilization, weeding, and nutrient optimization.

Crop management tools are widely used in small to medium-sized farms and horticulture applications, supported by increasing awareness of analytics-based decision-making. Meanwhile, field farming applications—especially those utilizing drones—are expected to expand further due to improved disease detection, remote monitoring capabilities, and rising farmer adoption of aerial surveying technologies.

Regional Analysis

North America held a leading position in the agricultural robotics landscape in 2023, accounting for nearly 37% of global drone sales. The region’s strong adoption is largely influenced by its readiness to integrate advanced farming technologies and automation tools. Supportive policy adjustments by aviation regulators, particularly the Federal Aviation Administration (FAA), have accelerated the commercial use of drones in farming activities. This regulatory flexibility has encouraged farmers and organizations to capitalize on drone-based imaging and analytics, ultimately improving crop productivity, soil monitoring, and overall profitability.

Developed agricultural economies continue to benefit from mechanization and digital integration, significantly boosting output and operational efficiency. Government programs across regions are also playing a vital role in expanding the use of robotics in farming. Europe’s Farm Advisory System (FAS) supports farmers in understanding and applying regulations related to sustainability, food safety, and animal welfare. Such initiatives help bridge the knowledge gap and foster technological adoption.

Europe is also seeing strong traction due to clear regulatory frameworks for drone operations and increasing investment activity in agri-tech. The rise of industrialized farming, paired with growing venture capital interest in automation for crop management, livestock monitoring, and precision agriculture, is expected to sustain regional growth over the coming years. Overall, policy support, investment momentum, and the need to improve productivity continue to drive adoption across global markets.

Top Use Cases

- Precise Crop Harvesting: Agricultural robots equipped with smart cameras and gentle grippers pick ripe fruits and vegetables without damage, working day and night to gather produce from fields or greenhouses. This approach eases the burden on seasonal workers, ensures fresher yields, and cuts down on food waste by timing harvests perfectly. Farmers gain more reliable output, allowing focus on planning rather than backbreaking labor in varying weather conditions.

- Automated Weeding and Pest Control: These robots roam fields using sensors to spot weeds or bugs, then zap or pull them out precisely without harming nearby plants. By skipping broad chemical sprays, they promote healthier soil and safer food while saving time and resources. Growers benefit from cleaner crops and lower upkeep costs, turning a tedious chore into a hands-free process that boosts overall farm efficiency.

- Smart Soil and Crop Monitoring: Mobile robots with built-in tools scan soil for moisture and nutrients, while tracking plant health through aerial or ground views. They deliver easy-to-read insights on a farmer’s device, guiding better decisions on watering or feeding crops. This leads to stronger plants and less guesswork, helping small and large operations alike thrive with targeted care that mimics expert oversight.

- Efficient Seeding and Planting: Autonomous seeders drop seeds at exact spots and depths, adjusting for soil type to promote even growth and save on supplies. They navigate rows smoothly, covering large areas quickly without tiring. This setup means farmers spend less on seeds and labor, fostering uniform fields that yield better and require fewer fixes down the line for smoother seasons.

- Livestock Care Automation: Robots handle milking, feeding, or health checks for animals by moving through barns with gentle precision, reducing stress on herds. They monitor vital signs in real time, alerting owners to issues early. This frees farmers for strategic tasks, improves animal well-being, and streamlines daily routines for more consistent dairy or meat production.

Recent Developments

1. Agribotix LLC

Agribotix, now part of Hylio, focuses on drone-based data analytics and spraying solutions. A key recent development is the integration of its data processing software with Hylio’s fleet of heavy-lift agricultural drones. This synergy provides farmers with a comprehensive system for crop scouting and variable-rate application of pesticides and fertilizers, enhancing precision and efficiency while reducing chemical usage and operational costs.

2. AGCO Corporation

AGCO is advancing its Fendt Xaver seeding robot system, which operates as a swarm of small, lightweight, autonomous units. Recent developments include refining the cloud-based “Fendt Guide” platform for managing the robot swarm and optimizing planting patterns. This approach minimizes soil compaction and allows for 24/7 operation, representing a significant shift from large, single machinery to distributed, smart robotics for precise crop input placement.

3. Autonomous Solutions, Inc. (ASI)

ASI provides robust autonomy kits for existing farm vehicles. A major recent development is the launch of their “OmniDrive” platform, which enables true omnidirectional movement for tractors and sprayers. This allows for complex maneuvers like crab-steering, significantly improving operational efficiency in tight spaces and on hillsides. Their focus is on retrofitting autonomy onto a wide range of equipment brands for versatile, driverless operations.

4. BouMatic Robotics B.V.

BouMatic Robotics specializes in dairy automation. Its flagship development is the “Merlin” robotic feeding system. The system autonomously mixes and delivers fresh feed to cows 24/7 based on herd requirements. Recent enhancements focus on data integration, allowing the feeder to communicate with milking robots and herd management software. This creates a fully connected data-driven farm, optimizing individual animal nutrition and overall herd health.

5. CNH Industrial

CNH Industrial is progressing its autonomous tractor concepts, recently demonstrating a cableless, fully autonomous prototype. This machine uses GPS, LiDAR, and cameras to perform tillage and other field operations without a human operator. The development is part of a broader strategy to create an integrated autonomous ecosystem, including partnerships for implementing advanced path planning and real-time data sharing between machines for coordinated fieldwork.

Conclusion

Agricultural robots emerge as a game-changer for farming, blending smart tech with everyday needs to tackle labor gaps and push for greener practices. They streamline tasks like picking and monitoring, making operations smoother and more reliable without the old hassles. These tools promise a wider reach, helping farms of all sizes adapt to bigger demands while keeping soil healthy and outputs strong.