Quick Navigation

Overview

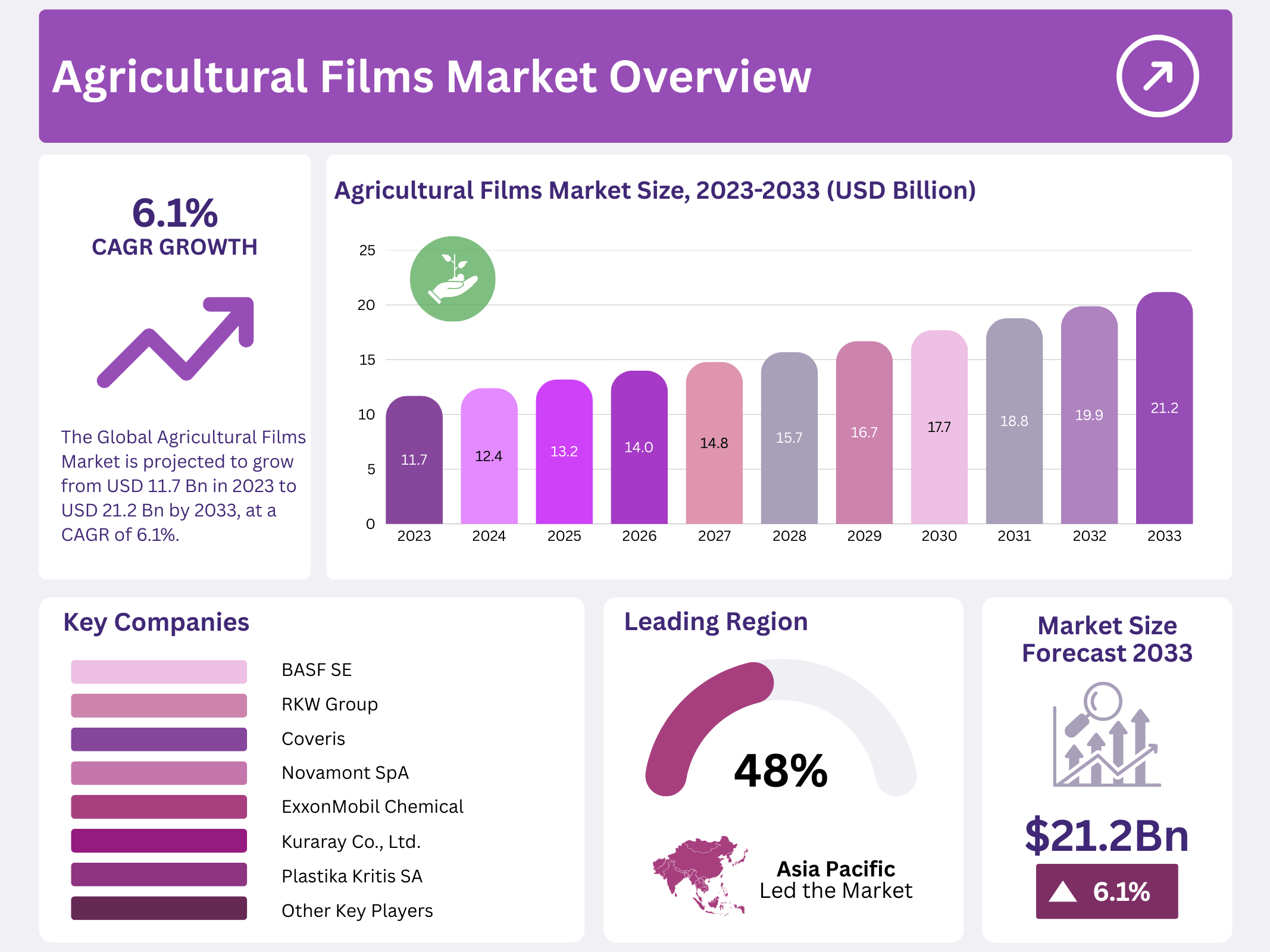

New York, NY – January 09, 2026 – The Global Agricultural Films Market is witnessing strong growth as farmers increasingly focus on improving productivity and adopting sustainable farming practices. Agricultural films play a vital role in modern agriculture by supporting crop protection, soil management, and greenhouse operations. The market is expected to grow from USD 11.7 billion in 2023 to nearly USD 21.2 billion by 2033, registering a steady 6.1% CAGR over the forecast period, driven by rising food demand and efficient farming needs.

This expansion is largely supported by the growing adoption of controlled-environment agriculture and the increasing need to enhance crop yields while optimizing water, fertilizer, and energy use. Agricultural films help regulate temperature, moisture, and light conditions, improving crop quality and consistency. Factors such as climate change, rapid population growth, and rising concerns over food security are encouraging farmers worldwide to invest in advanced agricultural technologies, further strengthening market demand.

Innovation in biodegradable and recyclable agricultural films is creating new growth opportunities as sustainability becomes a priority across the agricultural value chain. Both developed and developing economies are increasing investments in agricultural infrastructure and modern farming methods. With a strong focus on maximizing land efficiency and improving yield per hectare, the agricultural films market is well-positioned for long-term growth, offering attractive opportunities for manufacturers, suppliers, and investors.

Key Takeaways

- The Global Agricultural Films Market is projected to grow from USD 11.7 billion in 2023 to USD 21.2 billion by 2033, at a CAGR of 6.1%.

- Linear Low-Density Polyethylene (LLDPE) was the leading raw material segment in 2023 due to its superior durability, extended shelf life, and excellent thermal performance.

- The Greenhouse Segment held the largest share (42% of revenue) in 2023 and is expected to see continued strong demand during the forecast period.

- Asia Pacific dominated the market in 2023 with over 48.3% of global revenue, led by widespread adoption of mulch films.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 11.7 Billion |

| Forecast Revenue (2033) | USD 21.2 Billion |

| CAGR (2024-2033) | 6.1% |

| Segments Covered | By Raw Materials(Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Linear Low-Density Polyethylene (LLDPE), Ethylene Vinyl Acetate (EVA), Reclaim, Others), By Application(Soil Protection, Crop Protection, Greenhouse, Silage, Mulching, Others) |

| Competitive Landscape | Berry Plastics Group, Inc., Kuraray Co., Ltd., BASF SE, RKW Group, The Dow Chemical Company, Coveris, Plastika Kritis SA, Novamont SpA, ExxonMobil Chemical, Armando Alvarez Group, Trioplast Industrier AB, AL-PACK Enterprises Ltd |

Key Market Segments

Raw Material Analysis

Linear Low-Density Polyethylene (LLDPE) emerged as the leading raw material segment in 2023. Its rising market penetration is driven by strong durability, extended shelf life, and excellent thermal performance, making it well-suited for agricultural film applications.

EVA/EBA and HDPE materials are primarily used in agricultural applications that require higher rigidity. HDPE films are commonly applied in fumigation and mulching due to their structural strength. Reclaimed materials also offer recyclability and high tensile strength; however, their pricing remains less competitive compared to conventional polymer alternatives.

Other agricultural films produced from PVC and EVOH currently show low market penetration. This is largely due to their limited durability, non-biodegradable nature, and cost-related challenges. Despite these constraints, the industry is expected to experience significant future growth with the development of bioplastic PVC films and other innovative, sustainable material solutions.

Application Analysis

In 2023, the Greenhouse segment accounted for 42% of total market revenue. Demand is expected to rise during the forecast period, supported by increasing disposable incomes and a growing preference for high-quality crop production. Greenhouse films help maintain optimal soil temperature, improve water retention, and suppress unwanted seed growth.

Mulch films play a critical role in regions where crop survival is essential, particularly in dry and water-stressed areas. These films help preserve soil moisture and enhance crop stability. Agrifilms, in general, contribute to improved crop yield and quality across various farming practices.

Regional Analysis

Asia Pacific dominated the global agricultural films market, accounting for over 48.3% of worldwide revenue in 2023. The region shows strong adoption of mulch films, with more than 80% usage across agricultural practices. Market growth is largely supported by government-led initiatives, including investments in R&D for protected agriculture.

Europe is projected to experience relatively stagnant growth, mainly due to strict environmental regulations related to film manufacturing and disposal. Despite these challenges, the market is expected to gain momentum as farmers and consumers increasingly shift toward biodegradable and environmentally friendly agricultural films.

North America represents a mature market, resulting in slower demand growth over the forecast period. However, regional expansion may be indirectly supported by rising production costs and the relocation of polyethylene manufacturing facilities to regions such as the Asia Pacific, the Middle East, and Africa.

Top Use Cases

- Greenhouse Coverings: Agricultural films are widely used for greenhouse coverings to maintain a controlled environment for crops. These films help in regulating temperature, humidity, and light penetration, which can increase crop yield. The use of greenhouse films is especially popular in regions with extreme weather conditions.

- Mulching Films: Agricultural films, particularly polyethylene and biodegradable varieties, are used for mulching to conserve soil moisture, reduce weed growth, and maintain soil temperature. This can lead increase in crop yield, especially in crops like tomatoes, cucumbers, and strawberries.

- Frost Protection: Agricultural films are employed to protect crops from frost damage in colder climates. Films act as a barrier, maintaining soil warmth and preventing temperature drops that could harm plants. This application can reduce frost-related crop losses, enhancing overall crop survival rates.

- Soil Erosion Control: In regions prone to soil erosion, agricultural films serve as a protective layer to prevent soil degradation caused by wind and water. These films can improve soil structure and reduce erosion, ensuring better long-term agricultural productivity.

- High-Value Crop Production: High-value crops such as berries, flowers, and herbs benefit from the use of agricultural films that enhance growing conditions. By using UV-protective and infrared films, growers can increase the yield and quality of these crops, ensuring a more profitable harvest.

Recent Developments

- Berry Plastics Group, Inc. is a leading player in the agricultural films market, providing a range of high-performance polyethylene films for agricultural applications, including greenhouse covers, silage films, and mulching films. The company’s focus on innovative film technologies supports improved crop yields and sustainability.

- Kuraray Co. Ltd. specializes in manufacturing advanced polymer films, including those used in agriculture. The company offers products like UV-stabilized films and biodegradable options, catering to the growing demand for eco-friendly solutions. Kuraray’s innovations are helping to enhance crop protection and reduce environmental impact.

- BASF SE, a global chemical company, produces a wide range of agricultural films, including products for greenhouse covers, mulch films, and silage wraps. The company focuses on sustainability and crop productivity, developing films that improve resource efficiency, such as water retention and soil temperature regulation.

- RKW Group is a significant player in the agricultural films sector, providing high-quality films for applications like mulching, greenhouse coverings, and silage protection. The company is known for its durable and UV-resistant films, designed to optimize crop yield and minimize environmental impact through recyclable solutions.

- The Dow Chemical Company manufactures agricultural films that enhance crop production and efficiency, offering products like high-strength films for greenhouse structures and UV-protective mulch films. Dow’s advanced materials are widely used to optimize growing conditions, increase yields, and address sustainability challenges in agriculture.

Conclusion

The Agricultural Films Market is poised for continued growth, driven by increasing demand for higher crop yields, resource efficiency, and sustainability in farming practices. The adoption of agricultural films is being fueled by factors such as climate change, rising food demand, and advancements in farming technologies. The growing focus on environmentally friendly solutions, such as biodegradable films and smart agricultural films, offers significant opportunities for innovation and expansion.