Quick Navigation

Agentic AI Market Size

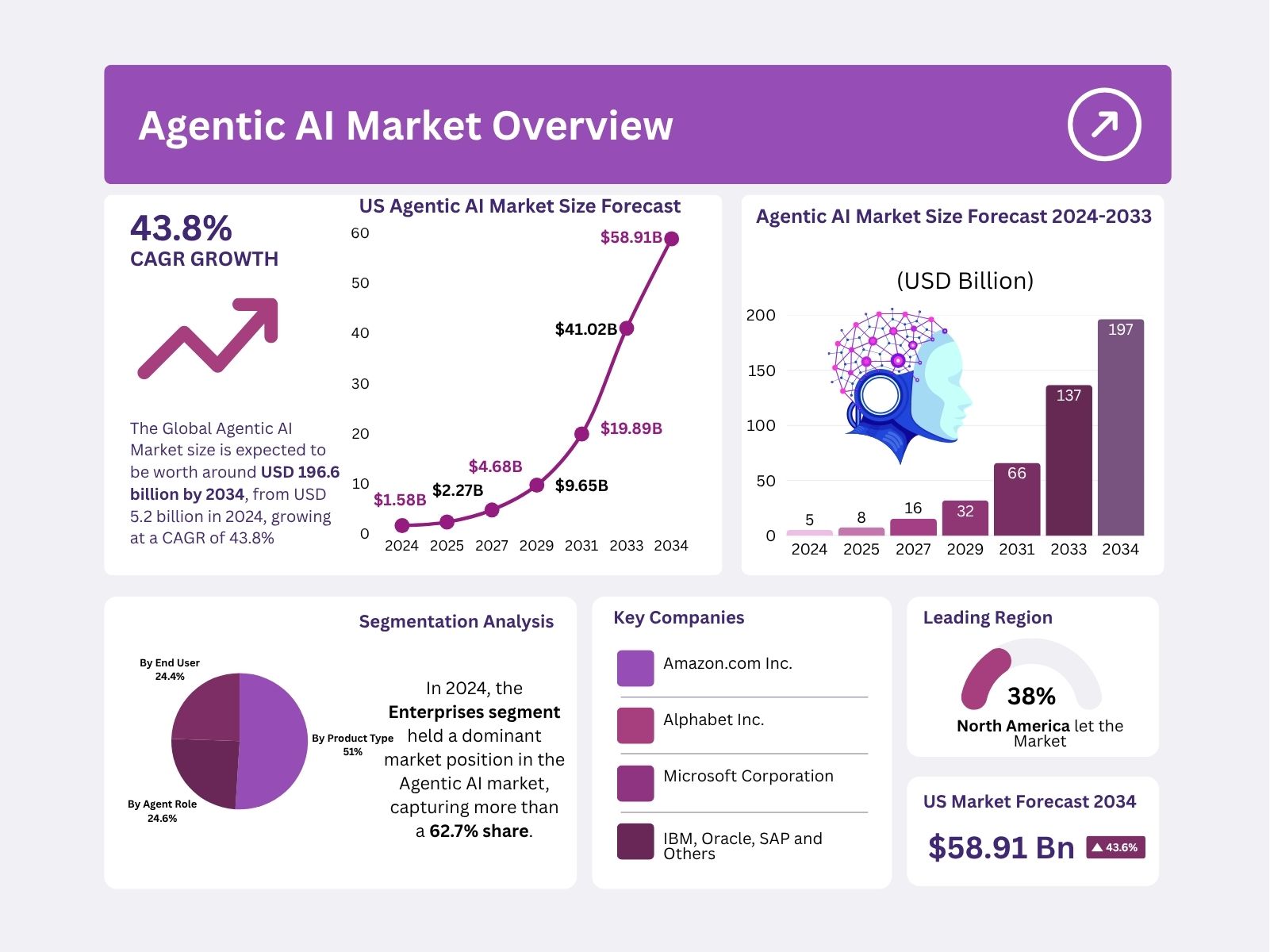

According to Market.us, The global agentic AI market is expected to expand from USD 5.2 billion in 2024 to approximately USD 196.6 billion by 2034, registering a strong CAGR of 43.8% between 2025 and 2034. This rapid growth is fueled by advancements in autonomous AI systems capable of decision-making, problem-solving, and executing complex tasks without human intervention.

The Agentic AI market is a rapidly evolving segment within the broader artificial intelligence landscape, focusing on autonomous AI systems that can independently perceive, reason, plan, and act to achieve complex goals with minimal human intervention. These intelligent agents operate across dynamic environments, continuously learn from data, optimize workflows, and coordinate with other agents to enhance enterprise automation and decision-making processes.

To Gain greater insights, Request a sample report @ https://market.us/report/agentic-ai-market/request-sample/

According to Deloitte’s fourth wave of the State of GenAI report (India perspective), over 80% of Indian organizations are actively pursuing the development of autonomous agents. This trend marks a significant strategic shift toward agentic AI, highlighting the country’s rapid embrace of self-governing systems to enhance enterprise operations and decision-making capabilities.

Based on data from DigitalDefynd, over 60% of new enterprise AI deployments in 2025 are expected to incorporate agentic capabilities, marking a shift from static AI models to autonomous, goal-driven systems capable of managing complex workflows. Between 2023 and 2025, the use of AutoGPT and agentic frameworks increased by 920% across developer repositories, reflecting strong adoption among engineers seeking scalable automation.

“The Agentic AI market is rapidly evolving, driven by the shift from static automation to autonomous, goal-oriented systems capable of reasoning, decision-making, and real-time adaptation – reshaping how industries operate.” says Yogesh Shinde, ICT – Manager at Market.us.

Agentic AI has demonstrated the potential to cut human task time by up to 86% in multi-step workflows, with 45% of Fortune 500 companies piloting such systems in 2025. These agents can complete tasks up to 12 times more complex than traditional LLMs, enabled by dynamic feedback loops and autonomous decision-making. Investment in the sector remains robust, with over USD 9.7 billion directed toward agentic AI startups since 2023.

Google DeepMind’s SIMA agent has showcased the ability to learn more than 600 skills across 9 game engines, while Microsoft’s AutoGen framework is deployed by 40% of Fortune 100 firms to automate IT and compliance operations. In software engineering, agentic AI is enabling 4x faster code debugging, reinforcing its strategic value in DevOps workflows.

Key Insights

- Ready-to-Deploy Agents led the market with a 58.5% share, reflecting strong enterprise preference for pre-built, easily deployable AI solutions that reduce time-to-value and integration complexity.

- The Productivity & Personal Assistant segment accounted for 28.2%, driven by rising adoption of AI agents for scheduling, task automation, and workflow optimization.

- Multi-Agent systems dominated with a 66.4% share, as organizations increasingly leverage collaborative AI agents for complex, distributed problem-solving.

- The Enterprises segment held a 62.7% share, underscoring the role of Agentic AI in enhancing operational efficiency, decision-making, and customer engagement at scale.

- The U.S. market reached USD 1.58 billion in 2024 and is expected to grow at a remarkable CAGR of 43.6%, fueled by AI readiness, infrastructure maturity, and enterprise innovation strategies.

- North America led the global market in 2023 with a 38% share, supported by early adoption across industries including finance, healthcare, and public services.

- According to The Financial Express, by 2028, 33% of enterprise applications are expected to feature Agentic AI, a sharp increase from less than 1% in 2024.

- OECD reports that 90% of constituents are ready for AI agents in public service, signaling broad acceptance and potential for government adoption.

Analysts’ Viewpoint

Technological adoption in agentic AI is being advanced by large language models, reinforcement learning, autonomous orchestration frameworks, and integration with cloud and edge computing. These innovations allow AI agents to plan multi-step actions, retain context, interact with APIs and physical systems, and self-improve. Tools for memory persistence, multi-agent collaboration, and real-time environment sensing, combined with modular AI architectures, enable adaptability and scalable performance.

The key reasons for adopting agentic AI include improving efficiency, scalability, and accuracy while reducing operational costs and manual oversight. Autonomous agents can manage complex workflows beyond the reach of traditional AI or robotic process automation, delivering continuous 24/7 operations and faster service. Real-time data-driven decision-making strengthens risk management and enhances customer satisfaction.

Investment potential in the agentic AI market is strong, driven by enterprise adoption of automation and digital transformation. High-growth opportunities exist in autonomous agent platforms, orchestration tools, and industry-specific applications. Rapidly digitizing markets and sectors such as finance, healthcare, and e-commerce offer fertile ground, while partnerships between AI developers and platform providers are accelerating commercial expansion.

U.S. Agentic AI Market Size

The US agentic AI market was valued at USD 1.58 billion in 2024 and is projected to grow at a strong CAGR of 43.6%. This growth is largely driven by rapid technological advancements in the region, supported by a mature digital infrastructure. The presence of major technology giants actively investing in AI innovation further accelerates the development and deployment of advanced agentic AI solutions.

In 2024, North America dominated the market with over 38% share, generating USD 1.97 billion in revenue. Within the region, the United States accounted for USD 1.58 billion and is projected to grow at a CAGR of 43.6%, driven by early adoption, robust AI research, and a strong ecosystem of technology providers.

Top 5 Growth Drivers

| Key Factors | Description |

|---|---|

| Enterprise Demand for Workflow Automation | Organizations seek to automate complex, interdependent processes beyond static automation |

| Advances in Foundation Models | Innovations in large language models, reinforcement learning, and generative AI expand agentic capabilities |

| Real-Time Decision-Making Needs | Increased need for AI systems that respond autonomously and contextually under changing conditions |

| Digital Transformation & Cloud Platforms | Growing adoption of cloud computing enables scalable deployment and integration |

| Industry-Specific Solutions | Verticalized agentic AI addressing domain-specific compliance, risk, and operational challenges |

Top Trends and Innovations

| Trend/Innovation | Description |

|---|---|

| Multi-Agent Collaboration | Multiple AI agents working together on interdependent tasks to increase efficiency and scale |

| Self-Healing and Autonomous Systems | AI agents that detect, diagnose, and fix issues without human intervention |

| Hyper-Personalized Adaptive Agents | Agents continuously learn and tailor behaviors to users and organizational needs |

| Hybrid Architectures Combining LLMs & RPA | Integration of large language models with robotic process automation for complex task orchestration |

| Responsible and Explainable AI Practices | Emphasis on governance, transparency, auditability, and mitigation of AI risks |

Product Type Analysis

In 2024, ready-to-deploy agents held more than 58.5% of the global Agentic AI market, making them the leading offering type. These agents are pre-built AI solutions that come with core functionalities already designed, allowing businesses to integrate and use them with minimal customization. They are particularly valuable for organizations looking to accelerate AI adoption without the lengthy and costly process of building systems from scratch.

The popularity of ready-to-deploy agents stems from their scalability, ease of integration, and ability to generate quick returns on investment. They cater to diverse use cases – from customer service bots to automated process managers – enabling companies to enhance efficiency and performance while reducing deployment time.

Agent Role Analysis

The productivity and personal assistant segment accounted for more than 28.2% of the market in 2024. This category includes AI assistants that manage schedules, automate repetitive tasks, enable voice or chat-based interactions, and provide real-time insights. Businesses and individuals alike use these tools to streamline workflows, enhance decision-making, and improve time management.

Demand is being fueled by a growing need for AI systems that can handle multitasking and function seamlessly across devices and platforms. These assistants are becoming an integral part of modern work environments, helping boost overall productivity and creating more space for high-value strategic work.

Agent System Analysis

Multi-agent systems dominated the architecture segment with over 66.4% of the market share in 2024. These systems feature multiple AI agents working together in a collaborative, distributed manner to address complex problems. Each agent may have specialized skills, and their ability to coordinate and share information enhances efficiency, adaptability, and problem-solving capabilities.

This architecture is particularly impactful in areas like autonomous vehicles, supply chain optimization, and large-scale simulations. The collaboration between multiple agents enables faster decision-making and allows systems to operate effectively in dynamic, real-world environments where multiple objectives must be balanced.

By End-User Analysis

Enterprises were the largest end-user group in 2024, representing more than 62.7% of the Agentic AI market. Large organizations in finance, healthcare, manufacturing, and retail are leveraging these AI systems to automate processes, analyze big data, personalize services, and improve customer interactions. The versatility of agentic AI makes it a powerful tool for enhancing both operational efficiency and strategic decision-making.

Adoption among enterprises is being driven by the need to remain competitive in increasingly fast-moving markets. By integrating agentic AI into their workflows, organizations gain the agility to respond to changes quickly, reduce costs, and innovate faster.

Key Market Segments

By Product Type

- Ready-To-Deploy Agents

- Build-Your-Own Agents

By Agent Role

- Customer Service and Virtual Assistants

- Sales and Marketing

- Human Resources

- Legal and Compliance

- Financial Services

- Other Applications

By Agent System

- Single Agent

- Multi Agent

By End User

- Enterprises

- BFSI

- IT & Telecom

- Government & Public Sector

- Healthcare

- Manufacturing

- Media & Entertainment

- Others

- Consumers

Top Key Players in the Market

- Amazon.com Inc.

- Alphabet Inc.

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- ServiceNow, Inc.

- UiPath, Inc.

- Zendesk, Inc.

- Others

Recent Developments

- In April 2025, UiPath launched its enterprise-grade agentic automation platform, featuring Maestro orchestration and controlled agency models. During the private preview, thousands of agents were recorded in operation, showcasing the platform’s scalability and strong governance capabilities for secure enterprise automation.

- By June 2025, Accenture introduced its AI Refinery distiller agentic framework with dedicated SDKs, enabling developers to rapidly build, deploy, and scale advanced AI agents. The solution’s modular design streamlines development, supporting faster innovation across multiple industry applications.

- In March 2025, Oracle and NVIDIA partnered to accelerate agentic AI adoption, integrating Oracle Cloud Infrastructure with the NVIDIA AI Enterprise platform. This made 160+ AI tools and 100+ NVIDIA NIM™ microservices available directly through the OCI Console, reducing barriers to enterprise AI deployment.