Quick Navigation

Overview

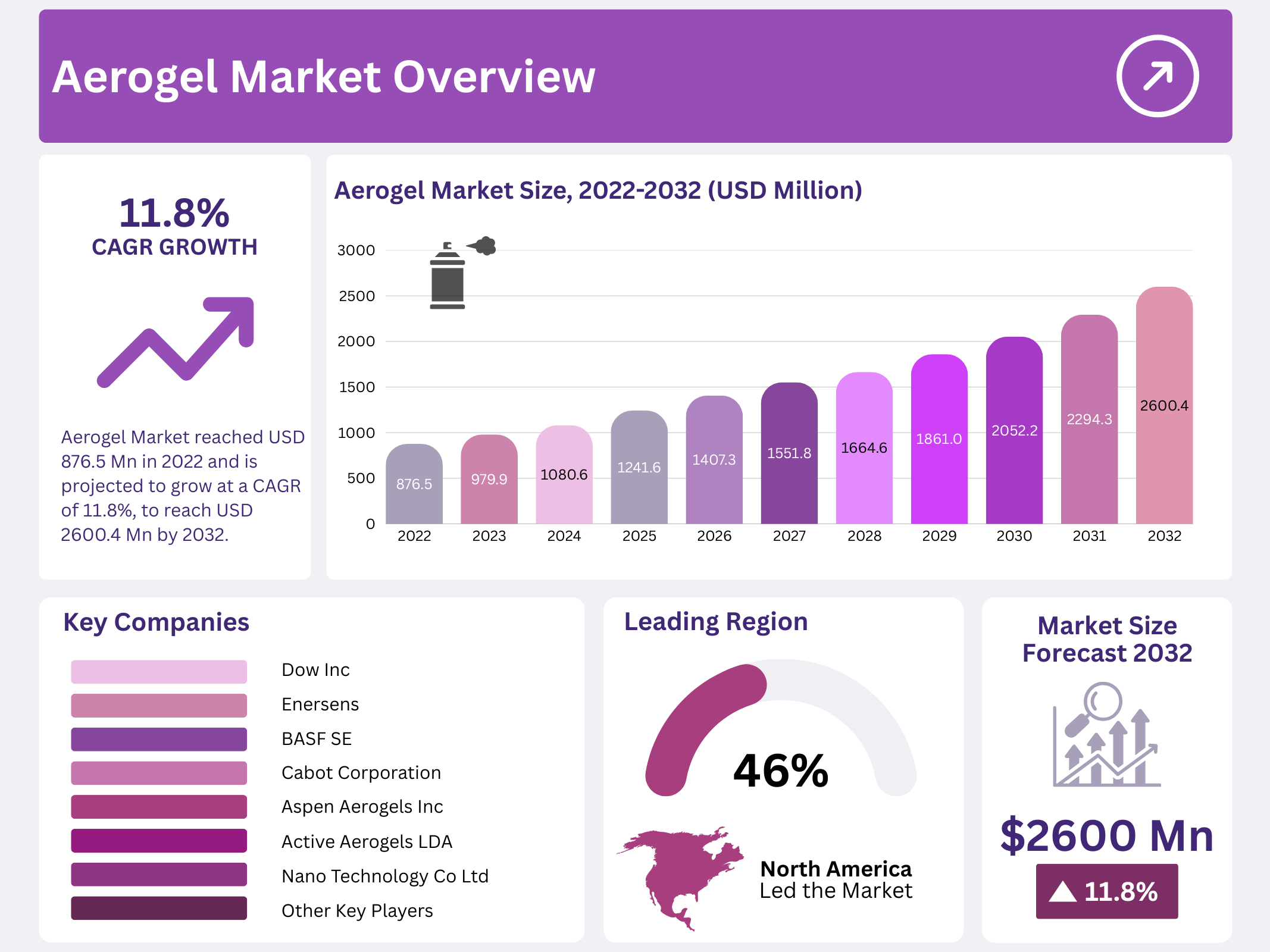

New York, NY – December 04, 2025 – In 2022, the Global Aerogel Market was valued at USD 876.5 million and is projected to reach USD 2,600.4 million by 2032, growing at a strong CAGR of 11.8% between 2023 and 2032. Aerogels are lightweight, highly porous materials formed into thin monoliths or films. They are widely used in structural foam replacement, vibration dampening, thin-film thermal insulation, coatings, and acoustic applications, especially within the automotive industry.

Earlier, vehicle manufacturers focused separately on comfort, performance, efficiency, or safety. However, aerogels allow all these requirements to be addressed simultaneously due to their excellent thermal insulation, low density, and high strength. This makes them highly suitable for modern automotive designs. As the automotive sector shifts from internal combustion engine vehicles to electric and autonomous systems, aerogels are emerging as critical materials for improving energy efficiency, thermal management, and passenger comfort.

Aerogels are typically produced in solid form using specialized manufacturing methods. Traditionally, production relied on supercritical drying, but newer technologies now offer more efficient and scalable processes. During manufacturing, liquid is removed from a gel to form a three-dimensional structure containing 80–99% air, resulting in exceptional insulating properties. While aerogels can be made from various materials, silica aerogel remains the most widely used, followed by polymer and carbon aerogels, each offering distinct performance advantages for different industrial applications.

Key Takeaways

- The Aerogel Market reached USD 876.5 million in 2022 and is projected to grow at a CAGR of 11.8%, reaching USD 2600.4 million by 2032.

- Silica aerogels dominate the market with a 67% share, while polymer aerogels are the fastest-growing segment.

- Supercritical drying is the predominant technology, making up 73% of the market share.

- The oil and gas sector accounts for the largest share 62% due to its wide range of applications, and the building and construction sector is the fastest-growing segment.

- North America leads the market with a 46% share, driven by demand from diverse end users.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 876.5 Million |

| Forecast Revenue (2032) | USD 2600.4 Million |

| CAGR (2023-2032) | 11.8% |

| Segments Covered | By Product (Silica, Polymers, Carbon, and Other Products) By Technology (Supercritical Drying, and Other Technologies) By Form (Blanket, Particle, Panel, Monolith) By End-User (Oil & Gas, Building & Construction, Automotive, Aerospace & Marine, Performance Coatings, and Other End-Users) |

| Competitive Landscape | Aspen Aerogels Inc., Cabot Corporation, Aerogel Technologies LLC, Active Aerogels LDA, BASF SE, JIOS Aerogel Corporation, Nano Technology Co Ltd, Dow Inc., Emersions, Other Key Players |

Key Market Segments

By Product Analysis

Silica Segment Dominates the Aerogel Market

Based on product type, the silica segment accounted for the largest share of the aerogel market in 2022, holding approximately 67% of total revenue. This dominance is driven by silica aerogel’s excellent chemical stability and wide applicability across multiple technical fields. Silica aerogels are nanostructured materials known for exceptional thermal insulation performance, high porosity, large specific surface area, low density, and a low dielectric constant. These properties make them highly suitable for applications in construction, oil & gas insulation, aerospace, and industrial thermal management, supporting their strong global adoption.

Polymer Segment Shows the Fastest Growth

The polymer aerogel segment is projected to be the fastest-growing product category in the aerogel market during the forecast period from 2023 to 2032. Growth is supported by the favorable chemical and mechanical characteristics of polymer aerogels, including high strength and monolithic structural form. Polymer aerogels are increasingly used in automotive antennas, vehicle interiors, electronic substrates, building applications, and defense systems. While polymer aerogels may sacrifice some properties of silica aerogels, such as optical transparency and very low thermal conductivity, their durability and flexibility continue to drive rising demand.

By Technology Analysis

Supercritical Drying Leads the Technology Segment

By technology, supercritical drying dominates the aerogel market, accounting for around 73% of the total market share. This method plays a critical role in scaling aerogel production from laboratory to industrial levels and has a significant influence on production economics. Supercritical drying effectively minimizes material shrinkage and preserves the aerogel’s porous structure. High-temperature supercritical drying using organic solvents is widely adopted, as it enables processing at lower pressures compared to carbon dioxide–based methods, improving efficiency and performance.

By Form Analysis

Blanket Form Holds the Largest Market Share

Based on form, the blanket segment led the global aerogel market with a share of approximately 68%. Aerogel blankets are widely used for insulation purposes due to properties such as high breathability, low dust formation, water resistance, reduced powdering, and effective light diffusion. These characteristics make blanket aerogels suitable for both building insulation and specialized clothing applications. Their ease of installation and versatility are expected to continue supporting strong demand.

By End-User Analysis

Oil and Gas Sector Leads End-User Demand

The oil and gas sector dominates the aerogel market, accounting for approximately 62% of end-user demand. Aerogels are extensively used for thermal insulation in pipelines, processing equipment, and offshore facilities, where temperature control and energy efficiency are critical. Oil and gas also play a central role in powering industrial operations, transportation, and petrochemical manufacturing. Major producing countries such as Russia, Saudi Arabia, and the United States continue to rely heavily on oil and gas for economic growth, further supporting aerogel consumption in this sector.

Building and Construction Emerges as the Fastest-Growing End User

The building and construction segment is projected to be the fastest-growing end-user category in the aerogel market. Rising demand is driven by aerogel’s superior thermal insulation properties, which make it ideal for use in walls, floors, windows, doors, and roofs. As construction industries increasingly focus on energy-efficient and space-saving insulation solutions, aerogel materials are gaining strong traction across residential and commercial applications.

Regional Analysis

North America Dominated the Global Aerogel Market with the Largest Revenue Share in 2022

North America held the leading position in the global aerogel market, accounting for the highest revenue share of approximately 46%. This dominance is fueled by strong demand from key end-use industries, including construction, oil & gas, automotive, and aerospace. The region benefits from continuous product innovation, advanced research and development activities, and superior manufacturing quality.

The United States and Canada are the primary contributors driving market growth in North America. Europe Emerges as the Fastest-Growing Region During the Forecast Period. Europe is projected to be the fastest-growing regional market for aerogel throughout the forecast period. Growth in this region is largely driven by stringent government regulations focused on energy efficiency and the rising adoption of sustainable construction practices.

Top Use Cases

- Building & Construction Insulation: Aerogel can be used inside walls, roofs, and window panels to dramatically reduce heat flow. Because it is extremely lightweight and blocks heat very efficiently, buildings insulated with it need less energy for heating or cooling — making them more energy-efficient and lowering utility bills.

- Cryogenic & Pipeline Thermal Protection: Industries that transport very cold liquids or gases (like LNG or other cryogenic fuels) benefit from aerogel wrapping on pipes or tanks. Its superb insulation prevents unwanted freezing or heat exchange, improving safety and reducing energy losses during storage and transport.

- Aerospace and Spacecraft Thermal Shielding: In spacecraft, rockets, or satellites, aerogel serves as a thermal barrier — protecting sensitive equipment from extreme cold, heat, or temperature swings. Its ultra-light weight adds little mass, which is critical in aerospace, while offering reliable thermal protection in harsh environments.

- Lightweight Thermal Clothing or Protective Apparel: Aerogel’s insulation properties find use even in personal gear — for example, in gloves, footwear insoles, or cold-weather clothing — to keep warmth in without making garments bulky or heavy. This makes it useful for extreme cold climates or specialized outdoor gear.

- Electronics, Batteries & Energy Equipment Insulation: Aerogel can be used to manage heat around electronic components or battery systems — inhibiting unwanted heat transfer and improving performance and longevity. Its low density and insulation help in compact devices where thermal control matters.

Recent Developments

1. Aspen Aerogels Inc

Recent focus is on expanding PyroThin aerogel for EV battery thermal barriers, securing multi-year contracts with major automakers. They are also commissioning a new Rhode Island plant to meet demand. In 2023, they launched Spaceloft Subsea for offshore pipeline insulation. Financially, they reported record revenue driven by the energy industry and EV markets.

2. Cabot Corporation

Developing LITX aerogel technology, focusing on formulations for high-performance building insulation and industrial applications. Recent advancements target reducing embodied carbon in construction materials. They collaborate across the supply chain to integrate aerogels into composites and coatings, emphasizing energy efficiency and sustainability in their material science pipeline.

3. Aerogel Technologies LLC

Launched the Airloy X103 series, a robust, machinable polymer aerogel for high-temperature (up to 300°C) applications in aerospace and electronics. They continue to scale production of their proprietary manufacturing process (CO2 drying) to offer a wider range of non-silica, engineered aerogel monoliths and composites for technical OEMs.

4. Active Aerogels LDA

Commercializing the patented Particle/Powder Process (3P) for ambient pressure drying, aiming to lower production costs. Their recent development focus is on AEROQ, an acoustic and thermal insulation aerogel blanket for industrial and HVAC use. They are also advancing aerogel-enhanced plasters and boards for building retrofits in the European market.

5. BASF SE

Progressed with the Slentite aerogel, a transparent, nanoporous polyurethane panel for high-performance internal wall insulation. Recent developments involve optimizing production and integrating it into prefabricated building elements. BASF leverages its polymer expertise to address aerogel processing challenges, targeting the renovation market for energy-efficient buildings.

Conclusion

Aerogel emerges as a uniquely versatile material — combining ultra-light weight with outstanding insulation performance. Across buildings, industrial infrastructure, aerospace, personal gear, and electronics, it enables higher energy efficiency, better thermal safety, and lighter-weight design. As technology advances and production improves, aerogel stands out as a future-ready solution for sectors demanding strong thermal control without bulk or excessive energy use.