Quick Navigation

Overview

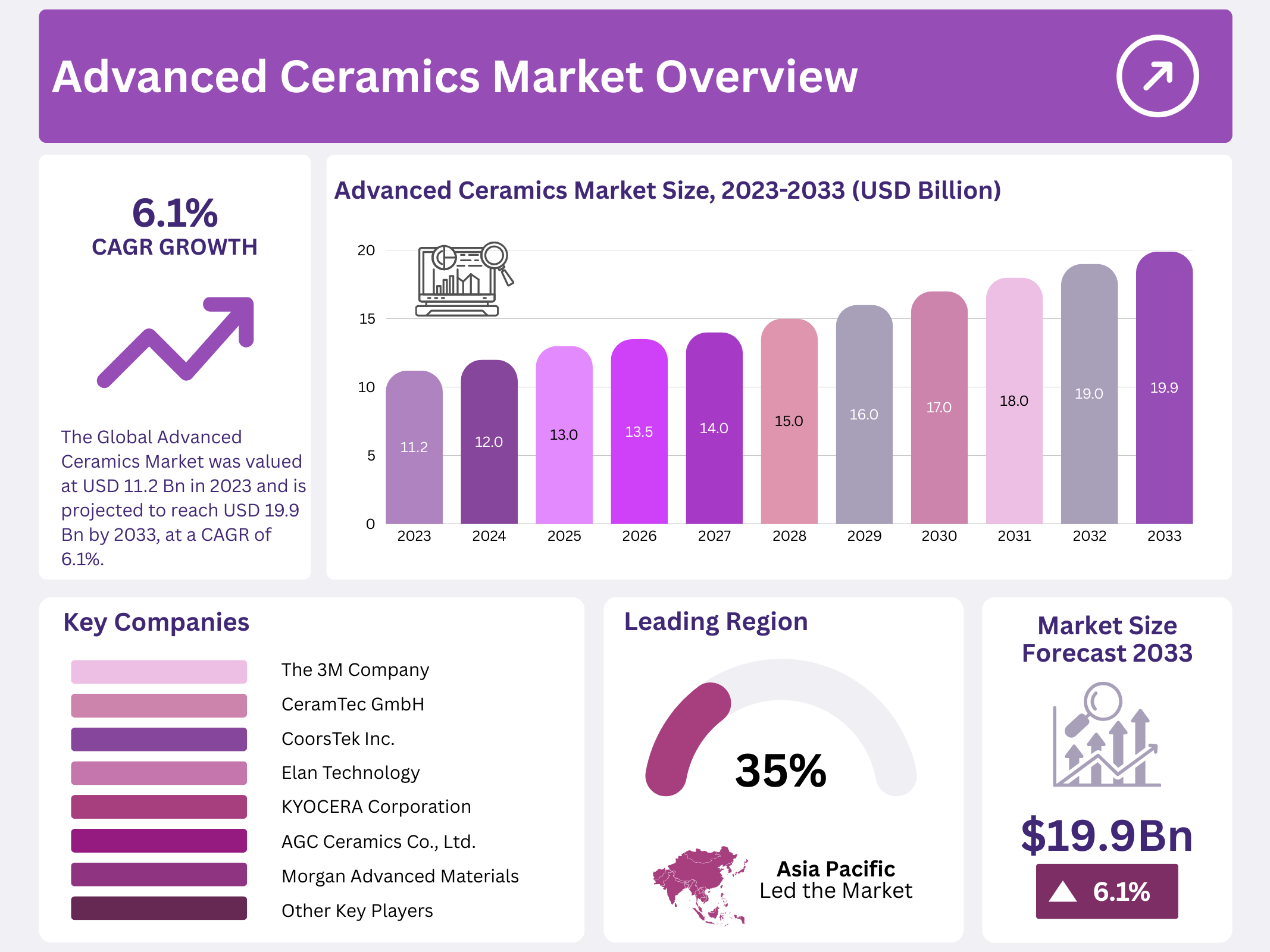

New York, NY – December 24, 2025 – The Advanced Ceramics Market is growing steadily as more industries adopt high-performance materials that can withstand extreme conditions and enhance product reliability. In 2023, the market was valued at USD 11.2 billion and is projected to reach around USD 19.9 billion by 2033, expanding at a CAGR of 6.1 % from 2024 to 2033. Demand is rising because advanced ceramics are used in critical applications such as electronics, automotive components, medical devices, aerospace parts, and energy systems, where durability, heat resistance, and light weight are essential.

Growth is driven by the push for miniaturization in electronics, the shift toward electric vehicles, and the need for better performance in healthcare implants and industrial tools. Market popularity is increasing as manufacturers seek materials that offer longer life, improved efficiency, and lower maintenance costs.

Alongside this, new opportunities are emerging in renewable energy, where advanced ceramics play key roles in high-frequency components and energy conversion systems. Expansion is also supported by technological advancements and increasing investments in industries that require sophisticated material solutions. The advanced ceramics market is positioned for strong growth as demand broadens across traditional and emerging sectors, creating opportunities for innovation and new applications.

Key Takeaways

- The Global Advanced Ceramics Market was valued at USD 11.2 billion in 2023 and is projected to reach USD 19.9 billion by 2033, at a CAGR of 6.1% from 2024 to 2033.

- Alumina held the largest material share in 2023 with over 32.2% of revenue and is expected to maintain its leadership.

- Monolithic ceramics dominated the application segment in 2023, accounting for over 74.4% of revenue.

- The Electronics Sector was the largest end-use segment in 2023, contributing 44.1% of total revenue.

- The Asia Pacific region led the market in 2023 with a 35.9% revenue share and is projected to maintain its dominance.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 11.2 Billion |

| Forecast Revenue (2033) | USD 19.9 Billion |

| CAGR (2024-2033) | 6.1% |

| Segments Covered | By Material Type (Titanate, Alumina, Ferrite, Zirconate, Other Material Types), By Application (Monolithic Ceramics, Ceramic Coatings, Ceramic Filters, Others), By End-use Industry (Electrical & Electronics, Transportation, Medical, Defence & Security, Environmental, Chemical, Others) |

| Competitive Landscape | The 3M Company, AGC Ceramics Co., Ltd., CeramTec GmbH, CoorsTek Inc., Elan Technology, KYOCERA Corporation, Morgan Advanced Materials, Murata Manufacturing Co., Ltd., Nishimura Advanced Ceramics Co., Ltd., Ortech Advanced Ceramics, Other Key Players |

Key Market Segments

Material Type Analysis

In 2023, Alumina captured the largest revenue share at over 32.2%, a position it is expected to maintain in the coming years. Its strong thermal stability, wear resistance, and structural strength make alumina-based advanced ceramics suitable for demanding environments. These materials are widely used in mechanical seals, ballistic armor, and semiconductor components, where consistent performance under extreme conditions is essential.

Titanate is projected to demonstrate the fastest growth, with its growth rate expected to reach 1 over the forecast period. Titanate materials are essential for antennas and resonators, especially in today’s microwave communication systems, where titanium-based dielectric resonators play a critical role. Growth in this segment is supported by the rapid expansion of wireless communication infrastructure, accelerated further by post-pandemic digitalization trends.

By Application

Monolithic ceramics dominated the application segment in 2023, accounting for over 74.4% of revenue. Their high-temperature tolerance, durability, and reliability make them ideal for electronic components and automotive systems. This segment is expected to retain its leadership over the next five years as industries continue integrating stable ceramic components to enhance performance and longevity.

Ceramic matrix composites (CMCs) are forecast to expand. These composites combine ceramic matrices with ceramic reinforcements, resulting in lightweight, strong, and thermally stable materials. Their exceptional thermal shock resistance makes them well-suited for advanced mobility, aerospace, and industrial applications.

Supporting this momentum, Mitsubishi Chemical Corporation announced in 2021 the development of a next-generation CMC blend using carbon fiber and metal, delivering high molding capability and lower production costs while maintaining performance features such as heat resistance, rigidity, and wear resistance. These CMCs are increasingly used in industrial brake systems and mobility-related components.

By End-use Industry

Electronic devices represented 44.1% of total revenue in 2023 and are expected to remain the leading end-use sector. Advanced ceramics are widely integrated into smartphones, televisions, computers, and home appliances, driven by the surging need for compact, efficient, and thermally stable components. The market will continue to expand as global investments in electronics manufacturing accelerate.

A notable example is Reliance Industries, which announced in 2022 its plan to invest in Sanmina (U.S.) to establish a high-tech electronics manufacturing hub. This initiative aims to strengthen India’s presence in producing advanced technology infrastructure used across aerospace, defense, healthcare, and medical systems.

Regional Analysis

The Asia Pacific region held the largest revenue share, 35.9% in the advanced ceramics market in 2023, and it is expected to maintain its leading position in the coming years. This dominance is driven by strong growth in electric vehicles (EVs) and medical equipment sectors, along with rising investments in these areas across countries like China, Japan, and India.

A notable development supporting this trend occurred in 2021, when seven companies established their factories at the Medical Devices Park in Telangana, India. This initiative has boosted local manufacturing capabilities in medical technologies, where advanced ceramics play a key role due to their biocompatibility and durability.

In North America, the region accounted for a significant revenue share in the market. Growth here is fueled by thriving industries in electronics, medical devices, and electric vehicles. Additionally, increasing demand for high-quality semiconductors that support ultra-high frequency signal transmission is enhancing connectivity and driving further expansion in this competitive landscape.

Top Use Cases

- Aerospace Applications: Advanced ceramics are vital in aerospace for creating lightweight parts that withstand extreme heat and stress. They form engine components, heat shields, and turbine blades, improving fuel efficiency and safety in aircraft and spacecraft. This helps companies build faster, more reliable vehicles while reducing overall weight and maintenance costs in a competitive industry.

- Medical Devices: In healthcare, advanced ceramics make biocompatible implants like hip joints and dental crowns that last longer and resist wear. They also form surgical tools and diagnostic equipment due to their strength and non-reactive nature. This supports better patient outcomes and allows medical firms to innovate in prosthetics and minimally invasive procedures.

- Electronics Industry: Advanced ceramics serve as insulators and substrates in electronic devices, enabling high-performance chips and sensors. They handle high temperatures and electrical loads in smartphones, computers, and semiconductors. This drives efficiency in consumer electronics, helping manufacturers meet demands for smaller, faster gadgets in a rapidly evolving tech market.

- Energy Sector: These materials enhance energy systems by forming durable parts in solar panels, fuel cells, and batteries that resist corrosion and heat. They improve efficiency in power generation and storage, supporting renewable energy goals. Companies benefit from longer-lasting equipment, reducing downtime and costs in the shift toward sustainable power solutions.

- Automotive Components: Advanced ceramics are used in car engines for valves, brakes, and sensors that endure high friction and temperatures. They contribute to lighter vehicles with better fuel economy and lower emissions. This aids automakers in meeting environmental standards and enhancing vehicle performance in an industry focused on electric and hybrid models.

Recent Developments

The 3M Company

- 3M is advancing its advanced ceramics through additive manufacturing and material science for the electronics and automotive sectors. Recent developments focus on ceramic matrix composites and thermal management solutions for electric vehicles and 5G infrastructure. Their innovation leverages proprietary processes to enhance durability and performance in extreme environments.

AGC Ceramics Co., Ltd. (Part of AGC Inc.)

- AGC Ceramics has expanded its high-purity alumina and silicon carbide ceramic products for semiconductor manufacturing equipment. Recent investments aim to increase production capacity to meet global demand, focusing on components for etching and CVD applications. The company emphasizes materials that improve wafer fabrication efficiency and precision.

CeramTec GmbH

- CeramTec is pioneering bioceramics for medical implants and advanced technical ceramics for Industry 4.0. Recent highlights include the development of innovative piezoelectric ceramics for sensors and actuators, and the “CeramTec 360” digital platform for enhanced customer collaboration and product lifecycle management.

CoorsTek Inc.

- CoorsTek continues to innovate with engineered ceramics for aerospace, defense, and semiconductor markets. A key recent development is the advancement of its proprietary “CoorsTek Pyroceram” glass-ceramics for extreme thermal shock resistance, alongside expansions in global manufacturing capabilities to ensure supply chain resilience.

Elan Technology

- Elan Technology specializes in custom-designed advanced ceramic components, focusing on hermetic sealing and insulating applications. Recent work involves developing new glass-ceramic-to-metal seals for aerospace and medical devices, enhancing reliability and miniaturization for next-generation electronic packages.

Conclusion

Advanced Ceramics is a game-changer across industries due to their unique properties, like durability and heat resistance. Ongoing innovations are expanding their role in emerging technologies, driving growth through better performance and sustainability. This positions them as essential for future advancements, offering exciting opportunities for businesses to stay ahead in competitive markets.