Quick Navigation

Overview

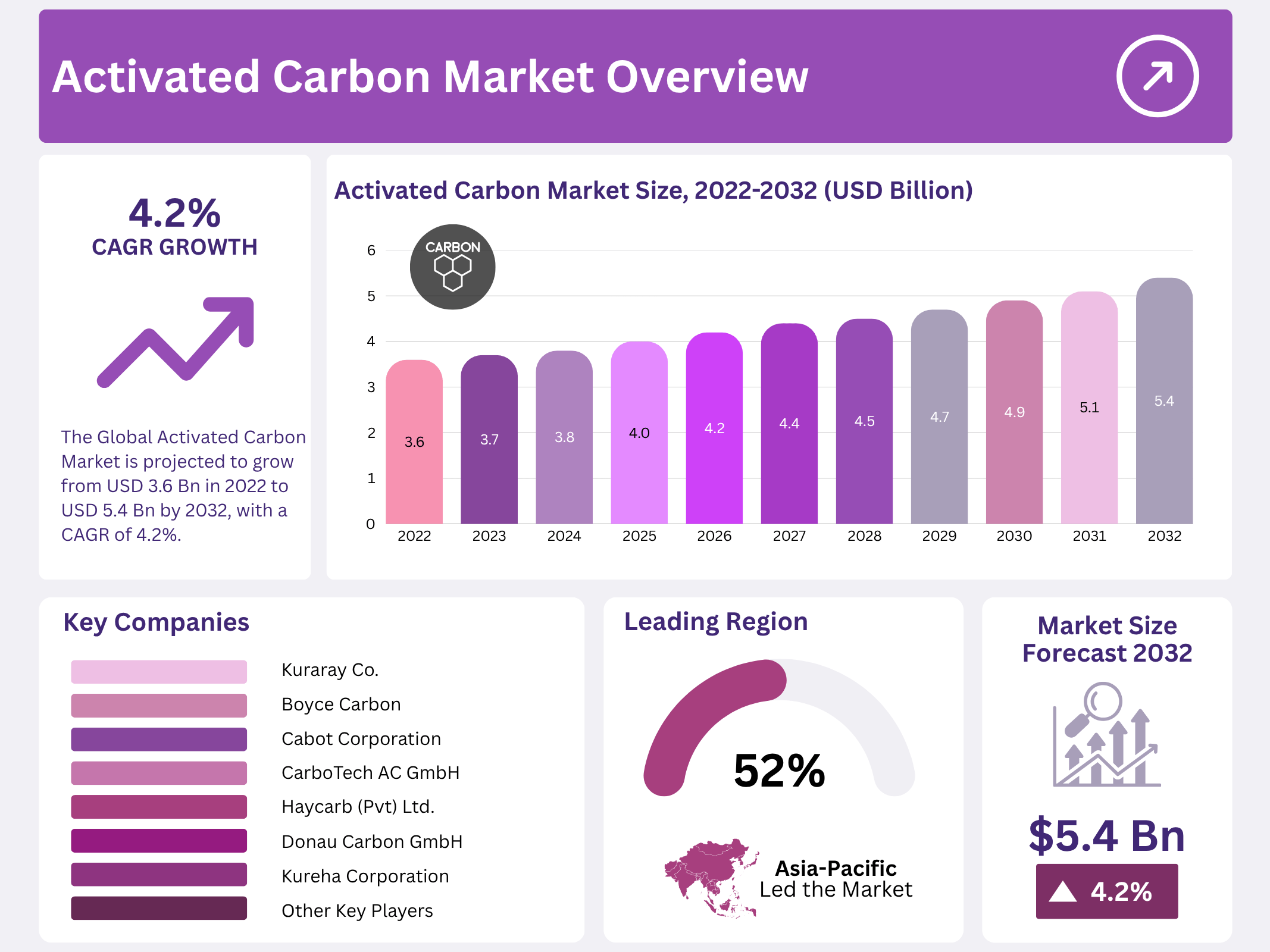

New York, NY – October 03, 2025 – The Activated Carbon Market is projected to reach around USD 5.4 billion by 2032, rising from USD 3.6 billion in 2022, with a CAGR of 4.2% between 2023 and 2032. A key factor driving this growth is the increasing demand for wastewater treatment applications.

Activated carbon, also known as activated charcoal, is characterized by its tiny pores, which significantly expand its surface area and enhance its adsorption capacity. Adsorption, the process by which a solid removes soluble substances from water, is central to activated carbon’s role in filtering potable water systems and sewage treatment plants. It effectively removes sediments, taste, odor, chlorine, and volatile organic compounds, though it cannot eliminate dissolved organic compounds, salts, or minerals.

The raw materials used to produce activated carbon typically include carbon-rich substances such as coal, wood, nutshells, and coconuts. In general, any organic material with high carbon content can serve as a source for activated carbon powder. This overview highlights the market’s size, growth trajectory, and the essential role activated carbon plays in water purification and environmental applications.

Key Takeaways

- The Activated Carbon Market is projected to grow from USD 3.6 billion in 2022 to USD 5.4 billion by 2032, with a CAGR of 4.2%.

- Powdered Activated Carbon (PAC) led the market in 2022 at USD 2,192 million.

- PAC’s high adsorption capacity drives its demand, especially in mercury removal, with Cabot Corporation expanding production in Canada.

- Increasing demand for wastewater treatment, driven by strict regulations, boosts market growth.

- Gas-phase activated carbon is key for air purification, with Kuraray Corporation leading in gas separation products.

- Liquid-phase activated carbon, used in eco-friendly water treatment, is the second-largest revenue segment.

- Water treatment dominates applications due to advanced technologies and eco-friendly practices.

- Activated carbon removes pollutants, organic compounds, heavy metals, and pharmaceuticals from wastewater.

- Asia Pacific held 52% of the market in 2022, driven by coconut shell-based activated carbon supply.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 3.6 Billion |

| Forecast Revenue (2032) | USD 5.4 Billion |

| CAGR (2023-2032) | 4.2% |

| Segments Covered | By Type – Granular Activated Carbon, Powdered Activated Carbon, Other Types; By Form – Gas Phase, Liquid Phase; By End-Use – Air Purification, Food & Beverage Processing, Water Treatment, Pharmaceutical & Medical, and Other End-Uses |

| Competitive Landscape | CarbPure Technologies, Cabot Corporation, Boyce Carbon, Jacobi Carbons Group, CarboTech AC GmbH, Kuraray Co., Haycarb (Pvt) Ltd., Kureha Corporation, Donau Carbon GmbH, Calgon Carbon Corporation, Carbon Activated Corporation, Albemarle Corporation, Osaka Gas Chemicals Co., Silcarbon Aktivkohle GmbH, Evoqua Water Technologies LLC, Oxbow Activated Carbon LLC, Other Key Players |

Key Market Segments

Type Analysis

The activated carbon market is segmented by product type into Powdered Activated Carbon (PAC), Granular Activated Carbon (GAC), and others. In 2022, PAC held the dominant share, valued at USD 2,192 million. Its high adsorption capacity and ability to remove various particulates drive demand, particularly in the mercury removal industry. Cabot Corporation, for instance, doubled its PAC production capacity in Canada to meet this growing need.

Form Analysis

Increasing demand for water treatment technologies, spurred by stringent industry standards and environmental regulations, supports market expansion. Gas-phase activated carbon, used primarily for air purification, is a key focus, with companies like Kuraray Corporation leading in gas separation and solvent extraction products. The liquid phase segment is the second-largest revenue contributor, driven by the need for eco-friendly water treatment solutions. Evoqua Technologies, for example, provides AquaCarb granular activated carbon for liquid-phase water treatment applications.

End-Use Analysis

Activated carbon is widely utilized in water treatment, air purification, food & beverages, automotive, and healthcare industries. Water treatment dominates due to the global adoption of advanced technologies and environmentally friendly practices. Activated carbon effectively removes dissolved and undissolved pollutants, organic compounds, heavy metals, and pharmaceuticals from wastewater.

It is often used as a final treatment step after sedimentation, flocculation, and biological processes to eliminate persistent contaminants like pharmaceuticals and reduce residual COD. The specific type of activated carbon or mobile filter required depends on wastewater characteristics, often necessitating lab or pilot testing.

Regional Analysis

The Asia Pacific accounted for 52% of the global activated carbon market, driven by its abundant supply of coconut shell-based activated carbon, widely used in water purification and gold mining. Major players like Jacobi Carbons and Haycarb source coconut shells from countries such as Sri Lanka, Indonesia, and the Philippines, with India’s high-oil-content coconuts enhancing product quality.

North America ranks second, propelled by rising automotive demand, an aging population, and environmental concerns. The U.S. is expected to record the highest regional CAGR during the forecast period, with PAC and gas-phase applications seeing significant growth.

Europe’s market is driven by strict environmental regulations promoting air purification, mercury absorption, and water treatment, alongside automotive emission control applications. Latin America anticipates robust growth due to increasing pharmaceutical and water purification needs for decolorization and deodorization. In the Middle East & Africa, market growth is fueled by industrial activities, oil exploration, and limited water availability, driving demand for purification solutions.

Top Use Cases

- Water Purification: Activated carbon acts like a super sponge, trapping dirt, chemicals, and bad tastes from drinking water in homes and cities. It helps make tap water safe by removing harmful bits that regular filters miss, keeping families healthy and supporting clean water projects worldwide. This simple process boosts trust in everyday hydration without fancy setups.

- Air Cleaning: In busy factories and offices, activated carbon grabs smoky fumes and stinky gases from the air, making spaces fresher and safer to breathe. It fights pollution from machines and cars, easing lung issues for workers and neighbors. Easy to fit into vents, it quietly guards indoor quality every day.

- Food and Drink Refining: Brewers and cooks use activated carbon to zap out weird colors and off-flavors from juices, beers, and oils, creating crisp, tasty products that delight shoppers. It ensures natural purity without changing the core goodness, helping brands shine on shelves with reliable, clean results from simple mixing steps.

- Gold Mining Recovery: Miners rely on activated carbon to pull tiny gold flecks from ore slurries, turning muddy mixes into shiny treasures efficiently and cheaply. This eco-friendlier method cuts waste and speeds up extraction in remote sites, letting operations run smoothly while respecting land and water nearby.

- Medicine and Health Aids: Doctors turn to activated carbon to soak up poisons in emergencies, saving lives by blocking toxins in the gut before they spread. It also freshens wound dressings and calms tummy troubles, offering gentle, natural relief that’s easy to use in clinics or home kits.

Recent Developments

1. CarbPure Technologies

CarbPure Technologies is focusing on specialty activated carbons for critical applications. A key development is the advancement of their high-purity, acid-washed products for the pharmaceutical and food & beverage industries, ensuring ultra-low heavy metal content. They are also enhancing their reactivation services, promoting a circular economy by restoring spent carbon to near-virgin quality for clients, reducing waste and procurement costs. Their R&D continues to target precise impurity removal.

2. Cabot Corporation

Cabot Corporation is expanding its activated carbon offerings through innovation and sustainability. A major recent development is the launch of its EVOLVE Sustainable Solutions product line, which includes activated carbons with verified recycled content and a lower carbon footprint. They are also advancing materials for electric vehicle batteries and emission control systems, aligning their extensive R&D with global megatrends in clean energy and environmental protection.

3. Boyce Carbon

Boyce Carbon has recently emphasized its leadership in carbon reactivation and recycling services. A significant development is the expansion of their thermal reactivation facilities, allowing them to process a greater volume of spent carbon from various industries. This service provides clients with a cost-effective and environmentally superior alternative to landfill disposal, turning waste into a reusable resource and supporting corporate sustainability goals through a closed-loop solution.

4. Jacobi Carbons Group

Jacobi Carbons is aggressively innovating for water purification and food safety. A key recent development is the expansion of their AquaSorb BP line of specialty carbons for point-of-use water filters, targeting PFAS and microplastic removal. They have also introduced new high-performance carbons for decolorization in the food and sweetener industry. Their global production network ensures supply chain resilience, and they continue to invest in sustainable, coal-free carbon products.

5. CarboTech AC GmbH

CarboTech AC GmbH is leveraging its expertise in engineering advanced adsorbents for the future. Recent developments focus on hydrogen-related technologies, including activated carbons for efficient hydrogen storage via adsorption and purification for fuel cells. They are also advancing carbon molecular sieves for biogas upgrading and VOC abatement systems. Their focus remains on creating high-performance, tailored solutions for the energy transition and industrial gas separation markets.

Conclusion

Activated Carbon is a quiet hero in today’s green push, quietly tackling pollution in water and air while polishing products in food and health realms. Its magic lies in that vast, hole-filled structure that snags impurities effortlessly, fitting seamlessly into factories, homes, and labs alike. With rules tightening on clean living and industries chasing smarter fixes, this trusty material stands poised to grow its reach, blending old-school reliability with fresh innovations for a healthier planet.