Quick Navigation

Overview

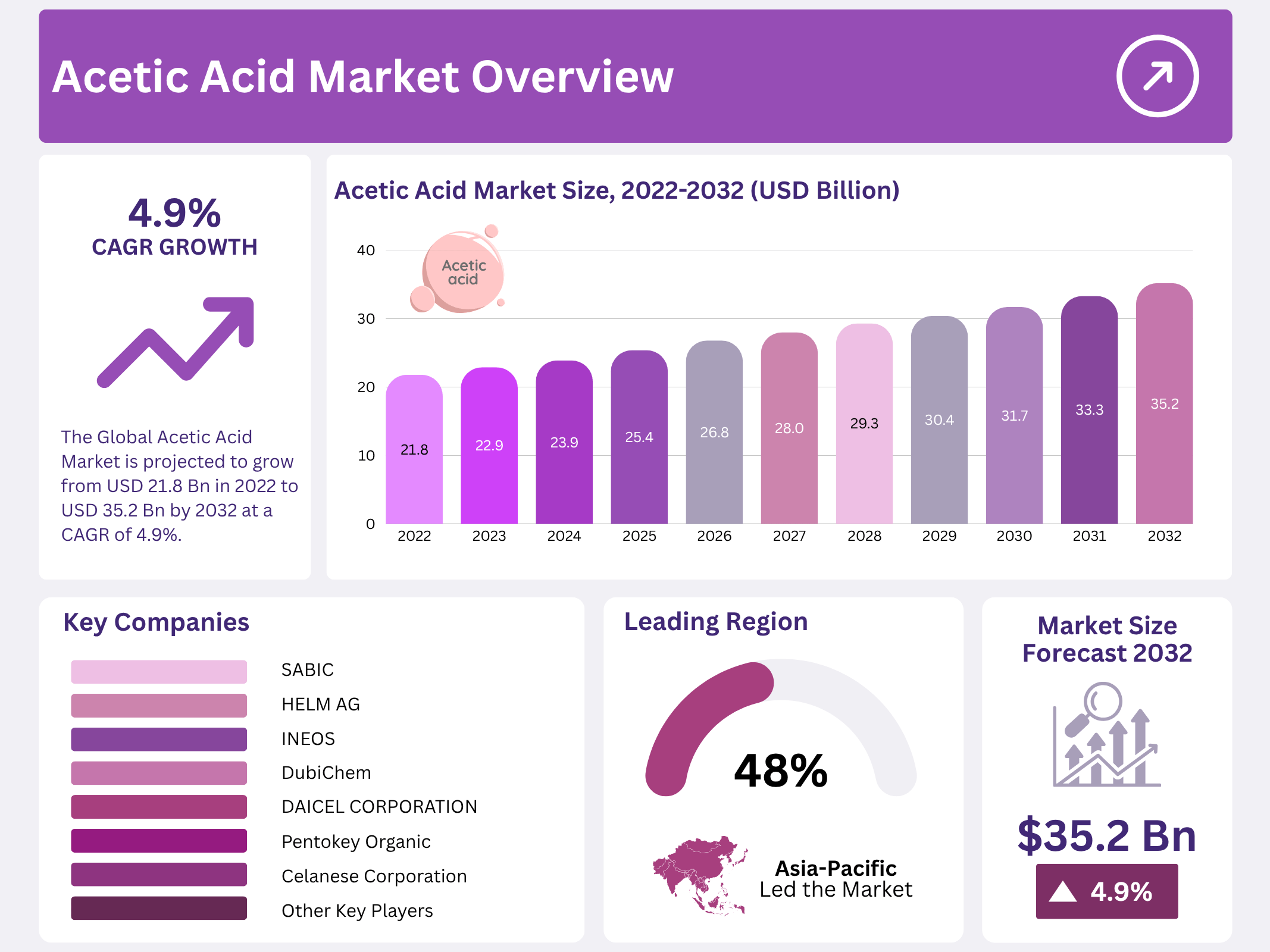

New York, NY – October 30, 2025 – The Global Acetic Acid Market is projected to reach USD 35.2 billion by 2032, up from USD 21.8 billion in 2022, reflecting a CAGR of 4.9% during 2022–2032. This growth is primarily driven by the compound’s critical role as a key chemical building block in various industries, including plastics, rubber, inks, and textiles. The increasing demand for high-purity acetic acid for applications in these sectors continues to support market expansion worldwide.

Rising global demand from end-use industries, notably plastics, textiles, and chemicals, will further strengthen the market outlook. Additionally, the ongoing replacement of PET bottles with glass containers for alcoholic beverages has increased the demand for terephthalic acid, indirectly benefiting the acetic acid market. Its recognized “food-grade” classification under the Food Chemical Code also promotes broader adoption in the food and beverage sector, especially where safety and purity are vital considerations.

Furthermore, the competitive landscape remains intense, with multinational manufacturers focusing on expansion, joint ventures, and R&D to strengthen their market positions. These strategic initiatives enhance production efficiency and product innovation, driving long-term industry growth. As global consumption of food, packaging, and industrial materials increases, the acetic acid market is expected to maintain strong momentum through the forecast period.

Key Takeaways

- The Global Acetic Acid Market is projected to grow from USD 21.8 billion in 2022 to USD 35.2 billion by 2032 at a CAGR of 4.9%.

- Vinyl Acetate Monomer (VAM) holds 44.5% market share, fueled by demand for paints, coatings, and printed goods.

- The Food and Beverage Sector leads in revenue, using acetic acid in packaging, cleaning, and vinegar-based products.

- Asia-Pacific dominates with 48.8% revenue share (USD 10.6 billion), driven by construction, pharma, and textile demand.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 21.8 Billion |

| Forecast Revenue (2032) | USD 35.2 Billion |

| CAGR (2023-2032) | 4.9% |

| Segments Covered | By Application (Vinyl Acetate Monomer (VAM), Purified Terephthalic Acid (PTA), Ester Solvents, Acetic Anhydride, and Others), By End-User (Food and beverages, Paints and coating, Plastics & Polymers, Pharmaceutical, Chemicals, and Others), By Region, and Companies |

| Competitive Landscape | Eastman Chemical Company, Celanese Corporation, LyondellBasell Industries Holding B.V., SABIC, HELM AG, Airedale Chemical Company Limited, Indian Oil Corporation Ltd, Gujrat Narmada Valley Fertilizers & Chemicals Limited, Pentokey Organy, Ashok Alco Chem Limited, DAICEL CORPORATION, The Dow Chemical Product, DubiChem, INEOS, Other Key Players |

Key Market Segments

Application Analysis

The Vinyl Acetate Monomer (VAM) segment dominated the acetic acid market with a 44.5% share. This leadership stems from surging demand for printed goods, paints and coatings, and paper coatings. Acetic acid serves as a key raw material in VAM production, which is polymerized into polyvinyl acetate, a core component in paints and coatings formulations.

Rising consumer lifestyles, coupled with increased home renovations and redecorations, are fueling demand for paints and coatings, directly boosting VAM consumption. Acetic anhydride ranked second globally in 2022, capturing 19% of market value. Its growth is driven by applications in photographic films, coated materials, and cigarette filters, alongside its role as a vital precursor in aspirin and other headache-relief medications. Acetic acid also plays a significant part in wood preservation.

End-User Analysis

The Food and Beverage sector leads the acetic acid market in revenue and continues to expand robustly. Acetic acid is essential for producing plastic bottles used in food and beverage packaging. In processing facilities, it functions as an effective cleaning agent and disinfectant. As the primary component of vinegar, it is widely used in culinary applications, including sauces and vegetable pickling.

The acetic acid market is expanding due to innovations in the food and beverage industry. The paints and coatings segment is the fastest-growing end-user category globally, driven by the need for substantial VAM volumes in polyvinyl acetate polymerization and other paint formulations.

Regional Analysis

Asia-Pacific commanded 48.8% of the global acetic acid market revenue. Growth is propelled by escalating demand across construction, pharmaceuticals, automotive, and textiles. The region’s booming pharmaceutical sector, where acetic acid is critical for drug synthesis, is a major driver. Increasing consumer dependence on medicinal tablets further amplifies overall demand. Asia-Pacific also led the global vinyl acetate monomer market in 2021.

Over the forecast period, rapid expansion in construction, particularly in China and India, will sustain this dominance. In the Middle East and Africa, acetic acid demand is poised to rise, supported by a strengthening pharmaceutical industry and growing medicine needs in countries like Saudi Arabia, Qatar, the UAE, and Bahrain. An aging population, contributing to higher incidences of diabetes, heart disease, and other ailments, combined with longer life expectancies, is intensifying pharmaceutical applications for acetic acid.

Top Use Cases

- Food Preservation and Flavoring: As a market research analyst, I see acetic acid shining in kitchens worldwide as the heart of vinegar. It adds that tangy kick to sauces, dressings, and pickles while acting as a natural preservative to keep foods fresh longer by stopping harmful bacteria growth. This everyday hero makes meals tastier and safer, boosting demand in busy households and food factories alike.

- Paints and Coatings Production: In the bustling world of construction and decor, acetic acid plays a key role by helping create vinyl acetate monomer, which turns into tough polymers for paints and coatings. These give walls and surfaces a smooth, lasting finish that resists wear. With more home makeovers, this use case drives steady growth in the building sector.

- Pharmaceutical Manufacturing: From my analyst view, acetic acid is a quiet powerhouse in pill bottles, serving as a building block for medicines like aspirin and antibiotics. It helps mix ingredients smoothly and keeps drugs stable for a longer shelf life. As health needs rise globally, its role in safe, effective treatments keeps pharma innovation humming.

- Textile Dyeing and Finishing: Acetic acid steps up in fashion factories, fixing dyes onto fabrics for vibrant, colorfast clothes that don’t fade in washes. It also softens fibers for comfy wear. With fast-changing trends and sustainable fabric pushes, this application supports the textile boom, ensuring quality from loom to wardrobe.

Recent Developments

1. Eastman Chemical Company

Eastman is advancing the molecular recycling of acetic acid waste streams. Their technology breaks down waste materials, like polyester, back into their core monomers, including acetic acid. This circular approach aims to create a sustainable and closed-loop system for chemical production, reducing reliance on fossil feedstocks and addressing plastic waste. This development is part of their broader sustainability commitments.

2. Celanese Corporation

Celanese, a global leader in acetyl products, is focused on capacity expansion and carbon capture. A key project is the Fairway Methanol LLC joint venture in the U.S., which will supply derivative products, including acetic acid. Concurrently, they are integrating carbon capture and utilization (CCU) technologies into their production processes to create low-carbon acetic acid, catering to the growing demand for sustainable chemical intermediates.

3. LyondellBasell Industries Holding B.V.

LyondellBasell is progressing with its new integrated acetyl complex in China. This strategic project will significantly increase their production capacity for acetic acid and other derivatives. The new facility is designed to leverage lower-carbon feedstocks and modern, efficient technology, strengthening their global supply position. This expansion underscores the company’s commitment to growth in the Asian market and its integrated acetyl chain strategy.

4. SABIC

SABIC is innovating in the sustainable production of acetic acid by exploring bio-based routes. The company is investigating the use of renewable feedstocks to produce key chemicals. This includes developing technologies for producing acetic acid with a lower carbon footprint compared to conventional methods. These initiatives are part of SABIC’s broader Chemistry that Matters strategy and long-term commitment to a circular carbon economy.

5. HELM AG

As a major marketer and distributor, HELM AG has secured a significant, long-term distribution agreement with Acetic Acid Anhydride, LLC (AAA) for the U.S. market. This agreement strengthens HELM’s global supply chain for acetic acid and its key derivatives, ensuring reliable access and distribution for customers. This move enhances their portfolio and solidifies their position as a key global supplier of acetyl intermediates.

Conclusion

Acetic Acid’s story is truly inspiring; it’s like the unsung supporter in a blockbuster film, quietly fueling everything from kitchen staples to shiny new cars. Its gentle strength touches food freshness, vibrant textiles, healing remedies, and eco-friendly homes, adapting seamlessly to green innovations and rising wellness vibes. This versatile gem promises even brighter days, weaving deeper into sustainable industries and everyday joys, proving that smart basics often lead the charge in a changing world.