Quick Navigation

Introduction

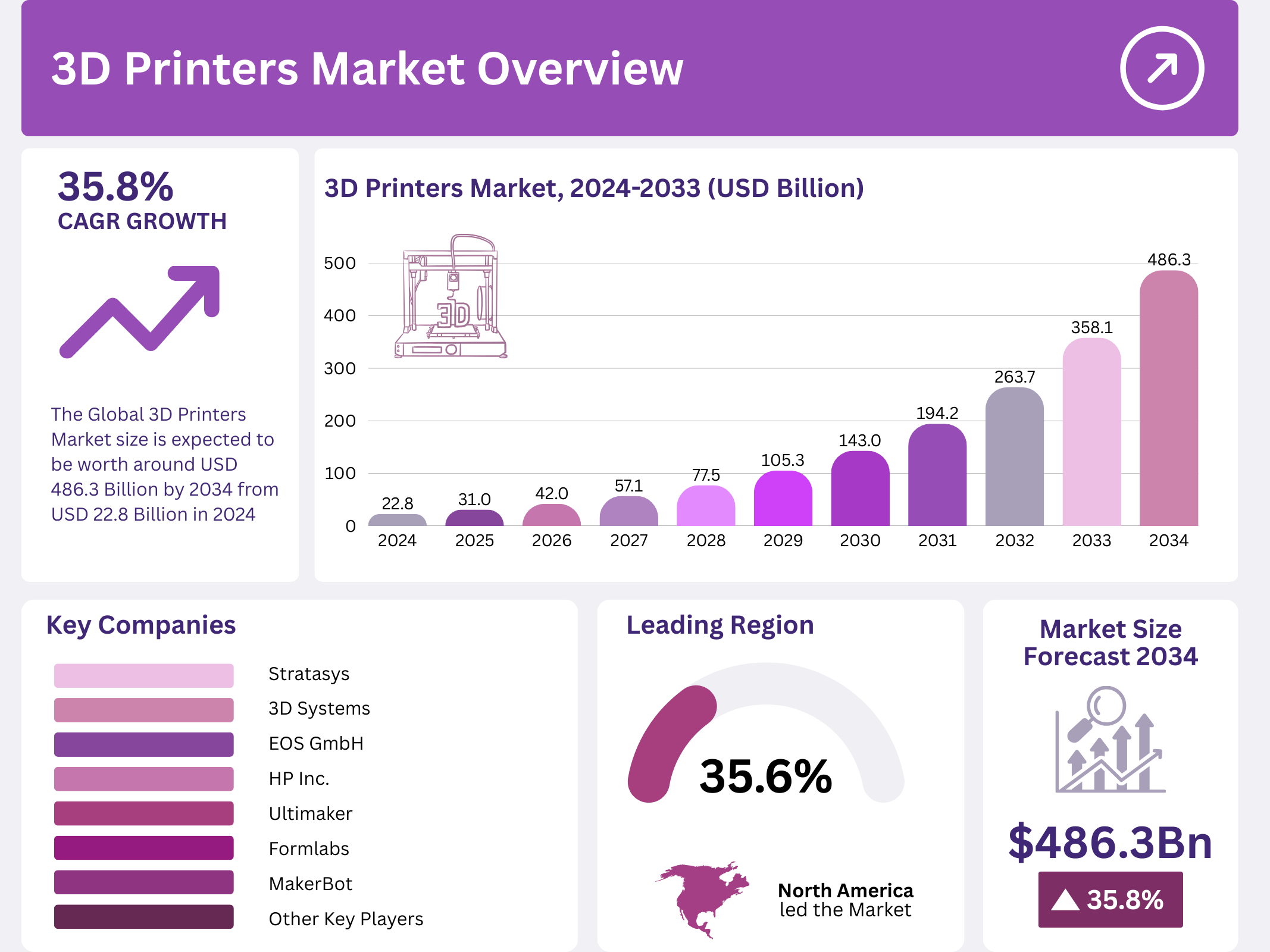

The global 3D printers market is poised for rapid expansion, with an estimated market value of USD 486.3 billion by 2034, up from USD 22.8 billion in 2024, growing at a CAGR of 35.8% during the forecast period from 2025 to 2034. Additive manufacturing, commonly known as 3D printing, is revolutionizing industries by enabling the creation of complex, customized parts with high precision. This innovation is transforming sectors ranging from healthcare to aerospace, automotive, and consumer goods, reducing material waste, accelerating prototyping, and driving cost efficiencies.

As 3D printing technology continues to evolve, it is expected to grow across various segments, including industrial, desktop, and material types. Emerging applications in bioprinting, construction, and personalized medical solutions are providing new revenue streams and opportunities for businesses. In this press release, we explore key takeaways, market segmentation, drivers, challenges, and recent developments impacting the global 3D printing industry.

Key Takeaways

- The global 3D printers market is projected to reach USD 486.3 billion by 2034, up from USD 22.8 billion in 2024, exhibiting a CAGR of 35.8% from 2025 to 2034.

- Industrial 3D printers represented the largest market segment in 2024, accounting for over 62.4% of the total market share.

- Fused Deposition Modeling (FDM) was the leading technology segment, capturing more than 44.8% of the global market share in 2024.

- Plastics were the most utilized material in 3D printing, holding a dominant market share of over 58.7% in 2024.

- Prototyping was identified as the primary application of 3D printing, accounting for over 36.8% of market share in 2024.

- The automotive industry emerged as the leading end-user sector, contributing more than 29.0% to the market share in 2024.

- North America dominated the global 3D printers market in 2024, holding a substantial 35.6% market share, valued at approximately USD 8.11 billion.

Market Segmentation Overview

By Type

In 2024, industrial 3D printers dominated the market, capturing more than 62.4% of the market share. Industrial-grade 3D printers are preferred for their high precision and scalability, essential for large-scale production and manufacturing applications across various industries such as aerospace, automotive, and healthcare. Desktop 3D printers, while growing steadily, are primarily used by small businesses, educational institutions, and hobbyists.

By Technology

Fused Deposition Modeling (FDM) technology led the market in 2024, accounting for 44.8% of the total market share. Known for its cost-effectiveness and ease of use, FDM is widely adopted across industries for prototyping and functional parts production. Other technologies, such as Selective Laser Sintering (SLS) and Direct Metal Laser Sintering (DMLS), are gaining traction in industries requiring high precision and material versatility, particularly in aerospace and medical applications.

By Material Type

Plastics dominated the 3D printing material market in 2024, with a market share of over 58.7%. The versatility, affordability, and ease of processing of plastic materials have made them the preferred choice for various applications, especially in automotive, healthcare, and consumer goods. Metals, ceramics, and composites are emerging as key materials for applications requiring high strength and durability, such as aerospace and healthcare.

By Application

Prototyping led the 3D printing market in 2024, with 36.8% of the market share. The ability of 3D printing to quickly and cost-effectively produce prototypes with high precision has made it indispensable for industries such as automotive, aerospace, and consumer electronics. The increasing adoption of 3D printing for tooling, end-use parts production, and personalization is expected to drive growth in the coming years.

By End-User

The automotive industry emerged as the leading end-user of 3D printing in 2024, contributing over 29.0% to the market share. The use of additive manufacturing for prototyping, tooling, and the production of lightweight components has been a driving force behind this growth. Other key sectors benefiting from 3D printing include aerospace, healthcare, and consumer goods, where the demand for customization and rapid production is rising.

Drivers

Advancements in Material Science

One of the key drivers fueling the growth of the 3D printing market is continuous advancements in material science. The development of high-performance polymers, metals, and composites has broadened the range of applications across industries. For instance, in aerospace, the use of lightweight yet durable materials is improving fuel efficiency and performance, while in healthcare, biocompatible materials are enabling the creation of personalized implants and prosthetics.

Integration of Artificial Intelligence (AI)

AI is playing a significant role in enhancing the capabilities of 3D printing. AI algorithms optimize design models for better structural integrity while reducing material usage. Predictive maintenance powered by AI also minimizes downtime and extends the lifespan of 3D printing equipment, ensuring cost savings and operational efficiency. As AI continues to evolve, its integration into 3D printing is expected to accelerate innovations and expand the technology’s applications.

Use Cases

Personalized Medical Solutions

3D printing’s ability to produce customized medical devices, such as implants and prosthetics, is transforming healthcare. Patient-specific solutions, including biocompatible implants, are enhancing treatment effectiveness and improving patient outcomes. The integration of 3D printing with imaging technologies is also advancing surgical planning, enabling more precise procedures and reducing operational risks.

Aerospace and Defense

The aerospace and defense industries are adopting 3D printing for the production of lightweight, durable, and complex components. The ability to produce customized parts on-demand helps reduce costs and enhance supply chain efficiency. This technology is particularly valuable for producing high-performance components in aircraft and defense equipment, where precision and material strength are critical.

Major Challenges

High Initial Capital Investment

Despite its advantages, the widespread adoption of 3D printing is hindered by the high initial investment required for industrial-grade equipment. The cost of acquiring and maintaining 3D printers, particularly for small and medium-sized enterprises (SMEs), remains a significant barrier. Additionally, the expense of specialized materials for 3D printing further compounds the financial challenges for many businesses.

Technological Obsolescence

The rapid pace of technological advancements in 3D printing can lead to equipment becoming obsolete quickly. Companies that invest in 3D printing technologies may face the risk of their machines becoming outdated, which could result in additional costs for upgrades or replacements. This factor may deter businesses from fully committing to 3D printing solutions.

Business Opportunities

Mass Customization

The ability of 3D printing to offer mass customization presents a significant business opportunity. Companies in sectors such as automotive, fashion, and healthcare are increasingly adopting 3D printing to create personalized products and components. This trend is expected to expand as demand for customized solutions grows, offering new revenue streams for businesses that can leverage this capability.

Sustainability and On-Demand Manufacturing

3D printing enables businesses to reduce material waste and lower carbon footprints by producing items on-demand and closer to the point of use. This model supports sustainable manufacturing practices and offers a competitive advantage in industries focused on reducing their environmental impact. Companies that embrace 3D printing for sustainable production are likely to attract consumers and investors prioritizing eco-friendly solutions.

Regional Analysis

North America

North America remains the dominant market for 3D printers, holding 35.6% of the global market share in 2024, valued at approximately USD 8.11 billion. The region’s strong technological advancements, high adoption rates across industries, and significant investments in additive manufacturing drive market growth. The integration of AI and high-performance materials further supports the expansion of the 3D printing industry in this region.

Asia Pacific

The Asia Pacific region is experiencing rapid growth in the 3D printing market, fueled by expanding industrialization and increasing investments in advanced manufacturing. Countries such as China, Japan, and South Korea are at the forefront of technological adoption, utilizing 3D printing for applications in healthcare, automotive, and consumer electronics. The cost advantages and material innovations driving growth in this region will likely continue to boost market demand.

Recent Developments

- In 2023, Stratasys ended its proposed $1.8 billion merger with Desktop Metal after shareholders voted against it.

- In 2024, Nano Dimension agreed to acquire Desktop Metal in an all-cash deal valued between $135 million and $183 million.

- In 2024, Hexagon acquired the Geomagic 3D software tools from 3D Systems to enhance its manufacturing software solutions.

- In September 2024, ICON, in collaboration with Liz Lambert, started building the world’s first large-scale 3D-printed hotel in Marfa, Texas.

Conclusion

The global 3D printing market is experiencing rapid growth, driven by advancements in material science, technological integration, and increasing demand across industries for customization, rapid prototyping, and sustainable manufacturing. The market’s expansion offers significant business opportunities in mass customization, healthcare, and aerospace. However, high initial investment costs and technological obsolescence remain key challenges. As technology continues to evolve, the 3D printing industry is expected to play a transformative role in modern manufacturing practices, with strong growth anticipated across all segments.