Tank Container Market Infographics Description:

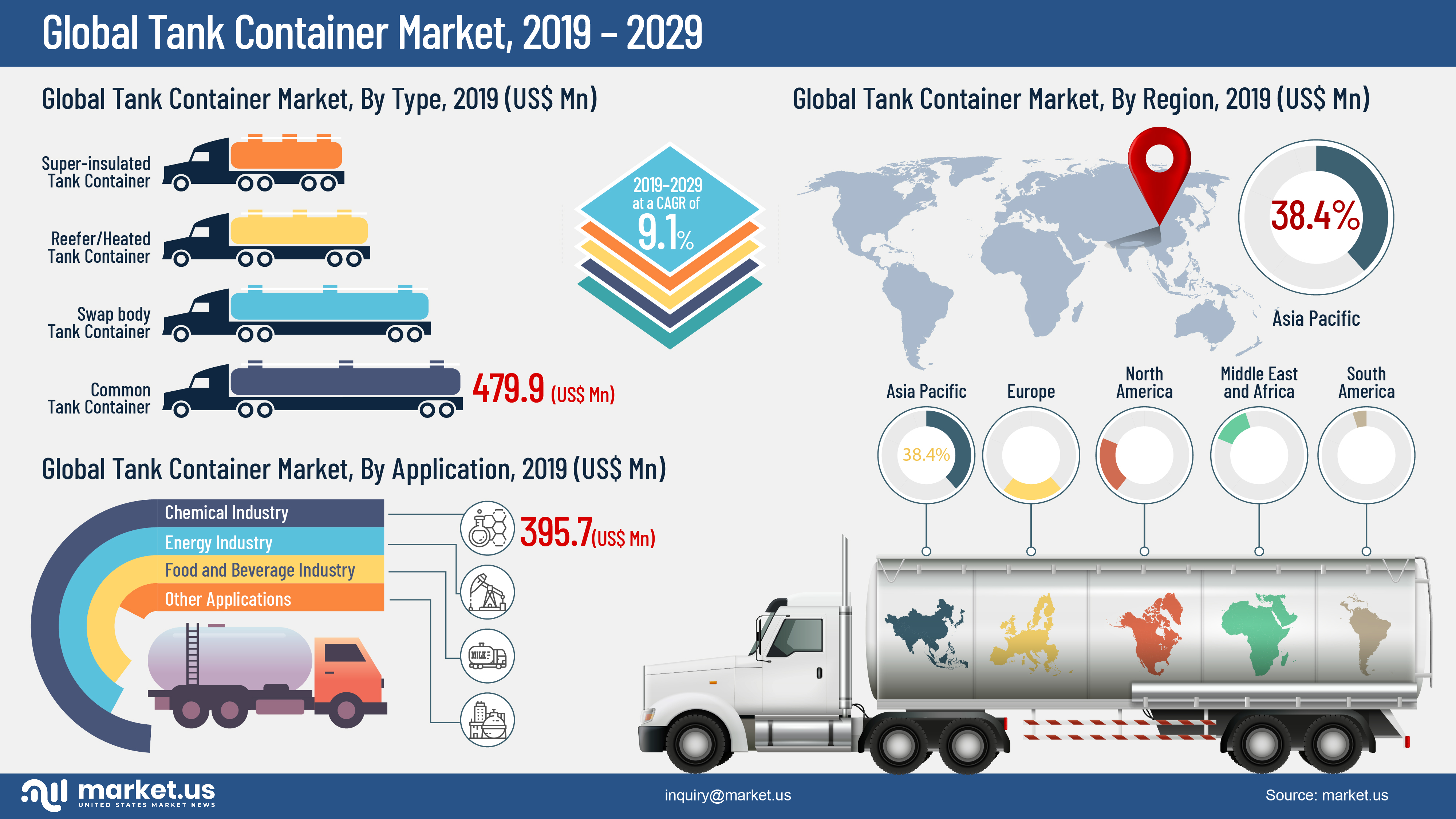

- The Global Tank Container Market is estimated at US$ 1,662.1 Mn in 2020.

- The Global Tank Container Market is projected to reach US$ 3,643.5 Mn in 2029 at a CAGR of 9.1% from 2021 to 2029.

- Among the type, the common tank container segment in the Global Tank Container Market is estimated to account for a majority revenue share of 31.3 % in 2020 end, owing to its useful properties such as it is made up of stainless steel that is surrounded by a layer of insulation and an outer protective layer of polyurethane or aluminum.

- Among the applications, the chemical industry segment in the global tank container market is estimated to account for a majority revenue share of 37.8% in 2020 end, owing to higher usage of tank containers for storage of various hazardous and non-hazardous chemicals.

- The Asia-Pacific market is expected to dominate the Global Tank Container Market. It is expected to account for the largest market revenue share than that of markets in other regions.

- Companies profiled in the report are CIMC Enric Holding Limited, Van Hool, Singamas Container Holdings Limited, Welfit Oddy (Pty) Ltd., CXIC Group Containers Company Limited, SureTank Group Ltd., Theilmann, Nantong Tank Container Co., Ltd., Meeberg Container Service B.V., and Danteco Industries B.V.

Tank Container Market Scope and Estimation (2023-2033)

- The global tank container market is poised for remarkable growth, expected to reach USD 4.6 billion by 2033, up from USD 2.1 billion in 2023, with a steady CAGR of 8.2% over the next decade. This growth underscores the rising demand for efficient transportation of bulk liquids and liquefied gases across the globe.

- According to ITCO, the global tank container fleet surged to 801,800 units by January 2023, reflecting an 8.65% growth compared to the previous year’s 7.3% rise. This increase highlights the industry’s resilience and the growing reliance on tank containers for global trade logistics. Furthermore, a total of 67,865 new tank containers were built in 2022, a significant jump from 53,285 units in 2021—an additional 14,580 units produced year-over-year.

- The industry is seeing concentrated leadership, with the top 10 operators controlling over 281,160 tanks, accounting for 49% of the operator fleet. In the leasing segment, the top firms dominate with 299,300 tanks, representing 83% of the market share.

- Non-Refrigerated Tank Containers hold a dominant 51% market share in 2023. Their versatility and cost-effectiveness make them a preferred choice for transporting a wide range of materials.

- The chemical and petrochemical sector leads the market, holding a 45% share due to robust growth in international chemical trade.

- Asia-Pacific remains at the forefront, capturing a 38% regional market share, driven by rapid industrialization and large-scale infrastructure investments.

- Siemens announced plans to invest over USD 500 million in U.S. manufacturing in 2023, fueling growth in critical sectors like data centers, EV charging, and rail transportation.

- This includes a USD 150 million AI infrastructure facility in Dallas-Fort Worth and a USD 220 million rail manufacturing plant, together creating 1,700 jobs. These initiatives align with Siemens’ global strategy to boost innovation and resilience, further supporting industries that rely on tank containers.

Report Overview

A tank container, often referred to as an ISO tank container, is a type of intermodal container designed for transporting liquids, gases, and powders as bulk cargo. These containers are made primarily of stainless steel and are known for their cylindrical shape, which is encased within a robust frame typically 20 or 40 feet in length. This design adheres to the International Organization for Standardization (ISO) regulations, ensuring they can be safely and efficiently used across different transport modes like ship, rail, and truck. Tank containers are particularly favored for transporting hazardous and non-hazardous materials due to their secure, leak-proof design and structural integrity.

The tank container market is a segment of the broader intermodal freight industry that has seen significant growth due to its efficiency and safety in transporting liquid bulk materials. The global market is driven by the increased demand for transporting chemicals, gases, and food products in bulk, which are crucial for various industrial and consumer applications. As of recent years, Asia, especially China, has been a prominent player in the production and use of ISO tank containers owing to its large scale manufacturing and export-oriented economy.

The primary drivers of the tank container market include the growing chemical industry, increased international trade, and the stringent regulations for transporting hazardous materials which necessitate the use of certified and reliable containers. The expansion of the food and beverage industry, which relies heavily on safe and efficient transport solutions for liquid products like oils, wines, and juices, also significantly contributes to market growth.

There is a robust demand for ISO tank containers driven by the need for safe, cost-effective, and environmentally friendly transportation of bulk liquids and gases. Industries such as chemicals, gases, and food and beverages rely on these containers to maintain the integrity and quality of their products during transit. The reusability and ability to transport large volumes reduce transportation costs and environmental impact, making ISO tanks a preferred choice over traditional barrels and drums.

The tank container market is ripe with opportunities, particularly in developing regions that are experiencing rapid industrialization and infrastructural development. There is also a growing trend toward the use of greener and more sustainable transportation methods. Tank containers align well with these initiatives due to their efficiency and reduced carbon footprint compared to other modes of bulk transport.

Technological advancements are shaping the future of the tank container market. Innovations in material science have led to the development of lighter, more durable tank containers that can withstand a wider range of temperatures and corrosive substances. Additionally, the integration of Internet of Things (IoT) technology allows for real-time tracking and monitoring of container conditions, ensuring the safety and integrity of the cargo.

Driver

Increasing Global Trade and Demand for Efficient Transport

The tank container market is poised for growth, driven by the escalating global trade and the necessity for efficient transportation solutions. This surge is particularly pronounced in the transportation of hazardous and non-hazardous chemicals, alongside a growing international trade in food-grade liquids like edible oils and wines.

The tank container offers a safer and more cost-effective mode of transportation, which not only ensures the integrity and quality of goods but also aligns with environmental sustainability standards by minimizing leakage and contamination risks. As global manufacturing and consumption patterns continue to expand, the demand for these containers is anticipated to rise, further propelled by the integration of advanced technologies ensuring safety and compliance with regulatory standards.

Restraint

High Initial Investment Costs

One significant restraint in the tank container market is the high initial investment required for procurement and maintenance. The cost associated with purchasing and retrofitting these containers to meet specific safety and environmental standards can be substantial. This financial barrier is particularly challenging for new entrants and smaller players in the market, who may struggle to allocate the necessary capital. Moreover, the specialized nature of certain tank containers, which are designed for specific types of cargo, adds another layer of expense, potentially limiting their widespread adoption across all industries.

Opportunity

Expansion in the Chemical and Energy Sectors

The tank container market is uniquely positioned to capitalize on the expansion of the chemical and energy sectors. As these industries continue to grow, driven by increasing industrial activities and energy needs worldwide, the demand for safe and compliant transportation solutions like tank containers is expected to escalate.

This is particularly relevant for the chemical industry, where the safe transport of potentially hazardous materials is critical. Additionally, the shift towards sustainable and clean energy solutions is increasing the need for specialized tank containers capable of handling new types of energy products and chemicals.

Challenge

Stringent Regulations and Environmental Concerns

Navigating the complex web of regulations and meeting increasing environmental standards pose significant challenges in the tank container market. Governments worldwide are tightening safety and environmental regulations, which impact the design, operation, and maintenance of tank containers. These regulations often require significant investment to ensure compliance, affecting operational costs and market entry for newer companies. Additionally, the heightened focus on sustainability demands adaptations in tank container operations to reduce environmental impact, further complicating logistics and increasing costs.

Top Key Players in the Market

- CIMC (China International Marine Containers)

- HOYER Group

- Welfit Oddy

- Suttons Group

- Stolt-Nielsen Limited

- Eurotainer

- EXSIF Worldwide

- TWS Tankcontainer-Leasing GmbH & Co. KG

- Tankformator

- Intermodal Tank Transport (ITT)

- Other Key Players