Debt Settlement Market Infographics Description

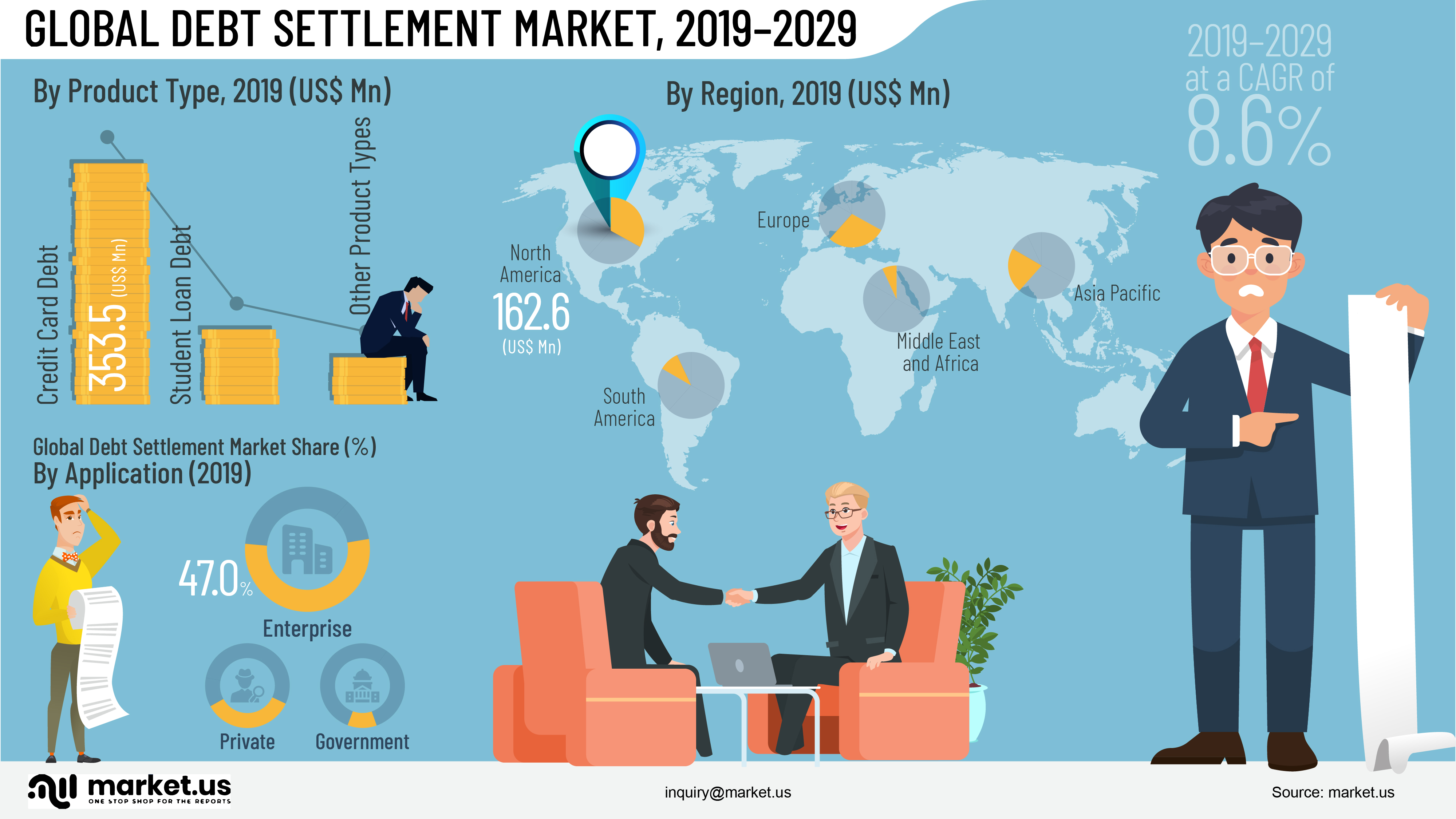

- The Global Debt Settlement Market was valued at US$ 491.8 Mn in 2019.

- Worldwide Debt Settlement Market is projected to reach US$ 1,116.3 Mn in 2029 at a CAGR of 8.6% from 2020 to 2029.

- Amongst product types the credit card type in the global debt settlement market is estimated to account for a majority revenue share of 71.9% in 2019 end, owing to increasing consumer awareness about the benefits of debt settlement.

- Among all the application segments, the private segment is expected to register highest CAGR of over 9.7%, owing to more companies educating their customers about budgeting and personal finance.

- North America market is expected to dominate the global debt settlement market and is expected to account for the largest market revenue share as compared to that of markets in other regions.

- Companies profiled in the report are Freedom Debt Relief, Pacific Debt Inc., Debtmerica, Accredited Debt Relief, CreditAssociates, Rescue One Financial, National Debt Relief, Clearone Advantage, New Era Debt Solutions, Guardian Debt Relief, and CuraDebt Debt

Debt Settlement Market Growth Drivers

- Increasing Consumer Debt Levels: The rising levels of consumer debt, driven by economic uncertainties and increasing credit card usage, have significantly contributed to the growth of the debt settlement market.

- Regulatory Support and Frameworks: Enhanced regulatory support for fair debt collection practices globally encourages more consumers to opt for debt settlement solutions, thereby fueling market growth.

- Technological Advancements: Innovations in fintech and digital payment systems enable more efficient and accessible debt settlement services, attracting a broader consumer base.

- Rising Financial Awareness: Greater consumer awareness about financial health and debt management options has led to an increased demand for debt settlement services.

- Economic Volatility: Economic downturns and volatility often increase the demand for debt relief services as consumers seek ways to manage their financial liabilities.

Strategic Developments in the Debt Settlement Market

- Partnerships and Collaborations: Companies in the debt settlement market are increasingly partnering with fintech firms to enhance their service offerings and expand their reach.

- Technological Integration: Many debt settlement companies are integrating AI and machine learning technologies to improve customer service and operational efficiency.

- Expansion of Services: Several key players are expanding their services to include not just debt settlement but also credit counseling and financial education, providing a more holistic approach to debt management.

- Global Expansion: Companies are expanding into new geographical markets, especially in emerging economies where consumer debt is growing rapidly.

- Focus on Compliance and Transparency: In response to regulatory scrutiny, companies are focusing more on compliance and transparency to build trust with consumers and regulators alike.